In business, documents can provide information, request payments, establish relationships, and can be legally binding. A proforma invoice is unlike other invoices used in business with few distinct differences.

What is a proforma invoice?

A Proforma Invoice is a preliminary bill requesting payment from a committed buyer before supplying goods or services. It outlines the goods, total payable amount, and transaction details, serving as an estimated invoice to facilitate pre-payment arrangements.

It acts as a “good faith” agreement between seller and buyer. The terms stated, such as price, quantity, etc., are negotiable. Unlike sales invoices, it is visibly labeled “proforma invoice” and has no invoice number, which means it is not helpful for accounts payable.

However, some follow AP best practices and use a pro forma invoice number. The invoice should contain all the information a final sales invoice would typically have, thus giving the buyer all the information required to arrange the purchase from the seller.

Furthermore, it serves as an understanding between the buyer and seller that each side is committed to the sale/purchase of the required goods or services without any payment.

Sellers can be reassured that the buyer will complete the order and pay once the final sales invoice is issued. And buyers are protected from any sudden surcharges/overcharges that the seller might make.

A fashion boutique can use the prices quoted on a proforma invoice for the required fabric to confirm the order with the supplier. Once the fashion boutique receives the fabric necessary, payment can be made according to the sales invoice, which will closely reflect the previously issued proforma invoice, with minute differences, if any, such as taxes.

It is also used when exporting and importing goods internationally, as it contains all the information needed for customs clearance.

Procurement management teams may find proforma invoices especially handy in complex, international transactions. These documents help outline expectations and alleviate any potential misunderstandings about the product or service to be delivered.

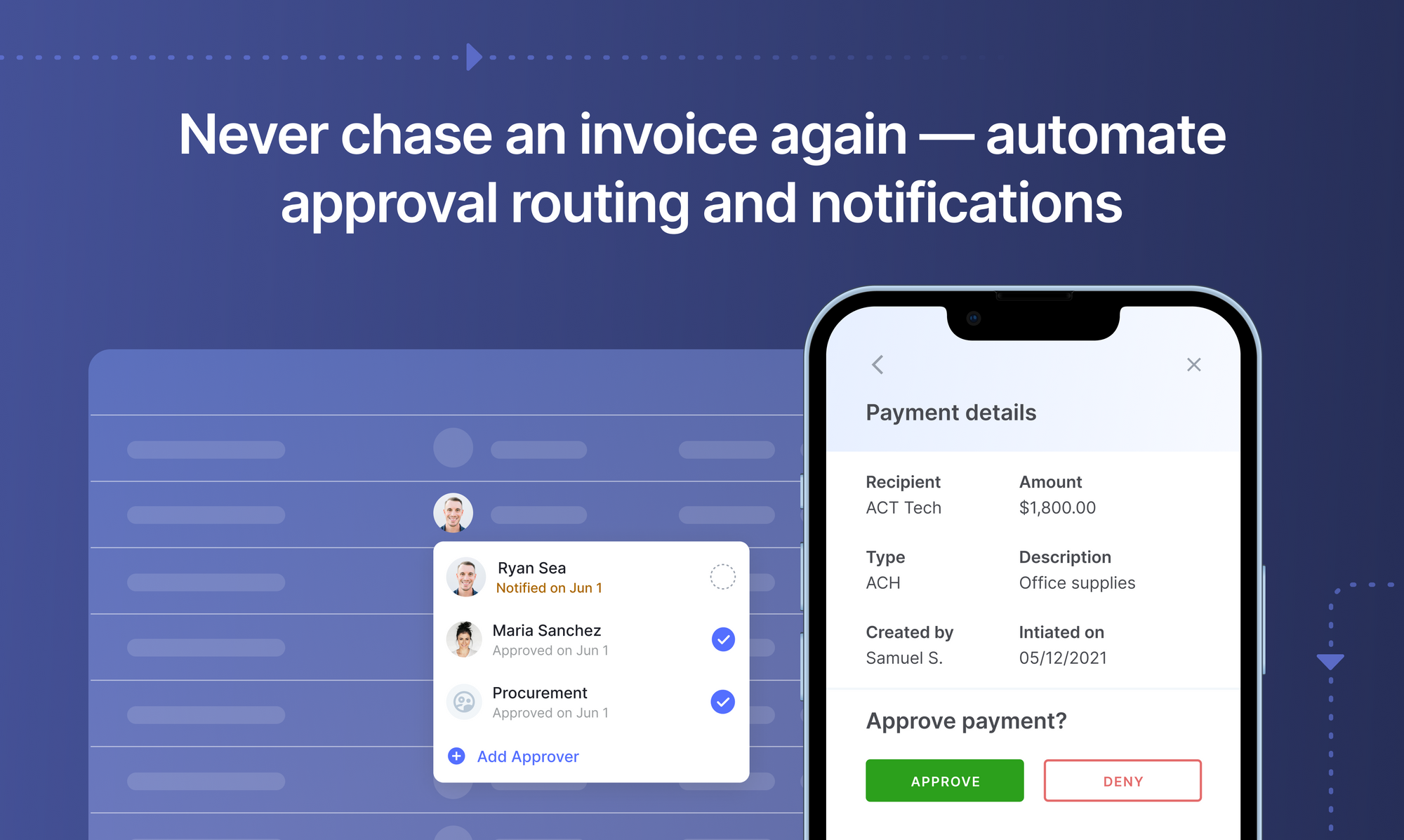

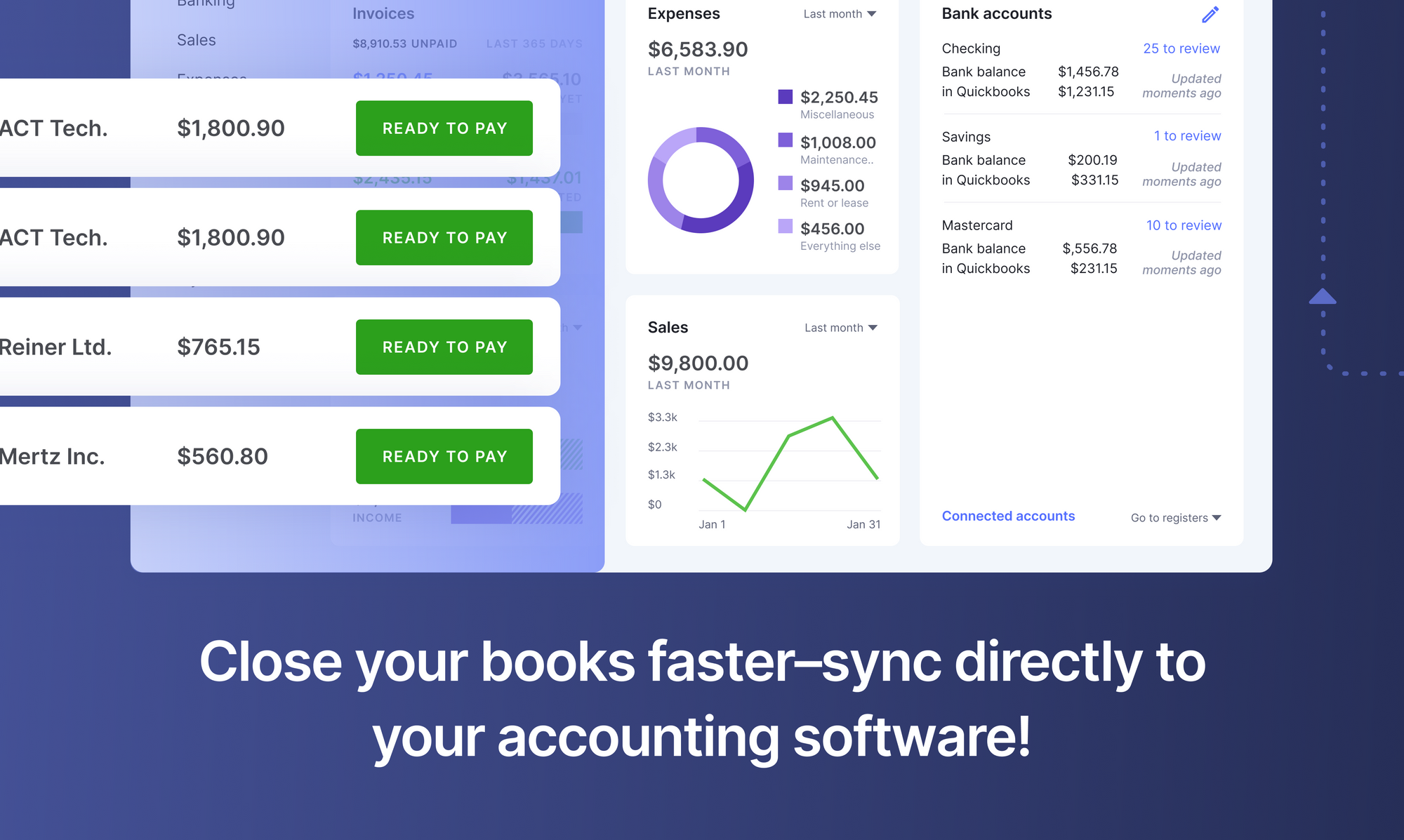

Looking to automate your manual AP Processes? Book a 30-minute live demo to see how Nanonets can help your team implement end-to-end AP automation.

When should a proforma invoice be sent?

As mentioned, a pro forma invoice is not the official final sales invoice. It is sent when the buyer is committed to purchasing from the seller, but an agreement is yet to be reached.

So, it serves as a document of commitment between buyers and sellers with respect to the final details, such as cost, quantity & specifications. It is also used to seek internal approval for buyers' purchase of goods/services.

Sellers shipping goods internationally also use them extensively. Customs laws at ports worldwide require details of the goods being sent to be easily accessible and visible. Therefore, to ensure a speedy customs clearance, proforma invoices come in handy to share details such as weight, value, taxes, shipping costs, delivery fees, etc.

Benefits of a proforma invoice

- Streamlines the sales process between the buyer and seller prior to confirming the purchase.

- Creates transparency by outlining all the agreed upon terms such as date of delivery, price, quantity, etc.

- It can serve as a purchase order or quotation. Buyers might need this for internal approval of the purchase.

- Since the invoice is not legally binding, both buyer and seller can use the invoice for negotiating better terms and making any changes to the order.

- Helps build better and longer client relationships since proforma invoices act as “good faith” agreements. It ensures that both the seller and buyer are committed to the sale/purchase of the goods/services

Set up touchless AP workflows and streamline the Accounts Payable process in seconds. Book a 30-minute live demo now.

Is a proforma invoice legally binding?

A proforma invoice is not the same as a final sales invoice and is not used for accounting purposes. The information stated in the invoice can be negotiated and changed, unlike a sales invoice, which is final and binding. It is more like a quotation and is not recorded in accounts payable processes. Hence, it is not legally binding.

Can a proforma invoice be canceled?

The answer is it doesn’t need to be. The reason is that it is not an invoice. It is the same as a quotation or estimate of what the buyer can expect from the seller to purchase the required goods/services. If the sale does not happen, then no action is needed.

What is the difference between an invoice and a proforma invoice?

The main difference between an invoice and a proforma invoice is their legal enforceability. An invoice is a legal document demanding payment for goods or services delivered. It serves as a legal proof of sale.

On the other hand, a proforma invoice is simply an estimate of what the final invoice will look like. It is sent before the delivery of goods or services and is not a legal demand for payment. Instead, it's used as a preliminary document to declare the value of the trade, especially in international trade.

Who uses a proforma invoice?

Proforma invoices are commonly used in international trade, where exporters provide them to buyers before shipping the goods. They are also used in situations where goods need to pass through customs. A proforma invoice helps declare the trade's value to customs authorities and can be used to secure a letter of credit.

Difference between proforma and other types of invoices

Now that we know what a proforma invoice is and why it is used, how does it differ from different types of invoices used by businesses?

Commercial Invoice

This invoice is issued after the goods have been delivered or shipped. A pro forma invoice is sent before the sale of the goods, and the details, such as quantity, have not been confirmed.

Commercial invoices are primarily used for international shipments and reflect the exact quantity shipped. It helps sellers ship the goods to the buyer with ease and efficiency. A commercial invoice is a shipping document used by customs at every port.

The invoice helps customs agencies levy the appropriate duties, import fees, and taxes. The details on the commercial invoice also ensure to customs officials that export compliance requirements have been met.

Sales Invoice

A sales invoice with an invoice number is issued when the goods/services have been delivered, and payment is due. It is a legally binding agreement and is recorded in accounts payable.

The proforma invoice is like a quotation, is not legally binding, and is sent before the sale and details have been confirmed. A sales invoice can also be a tax invoice since it includes VAT/GST and other taxes. The final sales invoice can be used to reclaim VAT/GST.

Credit Memo

When the goods received are damaged, or some error has been made in the purchase, a seller can issue a credit memo to the buyer. A credit memo issues a refund for the original value or part of, it that can be used for orders in the future.

The difference is that a pro forma invoice is sent before goods have been ordered, and a credit memo is issued post-delivery of damaged goods.

Purchase Order

A purchase order (PO) is a commercial document confirming the purchase of goods. It is sent to the seller through the buyer’s purchasing department. A purchase order is legally binding, as the terms are final and cannot be negotiated.

Although a purchase order and a proforma invoice are both sent before the goods have been delivered, the key difference is that a pro forma invoice is a quotation sent from the seller to the buyer. In contrast, the PO process confirms the order shipped from the buyer to the seller.

Book this 30-minute live demo to make this the last time you'll have to manually key in data from invoices or receipts into ERP software.

Proforma invoices and taxes

Since proforma invoices are not final sales invoices, they cannot be used for tax purposes or treated as VAT/GST invoices. This is because it doesn’t fit the “tax point”, which is the time of supply. The final sales invoice, with the transaction date, is the actual time of supply and, therefore, the tax point for claiming VAT/GST.

Additionally, proforma invoices should mention all applicable taxes (VAT, GST, etc.), especially if the business is VAT/GST registered. If mandated, the buyer and supplier's VAT/GST registration number should be visible on the invoice.

If the supplier is not VAT/GST registered, then there is no need to mention tax details. Additionally, if the goods are VAT/GST exempt, then there is no need to include taxes.

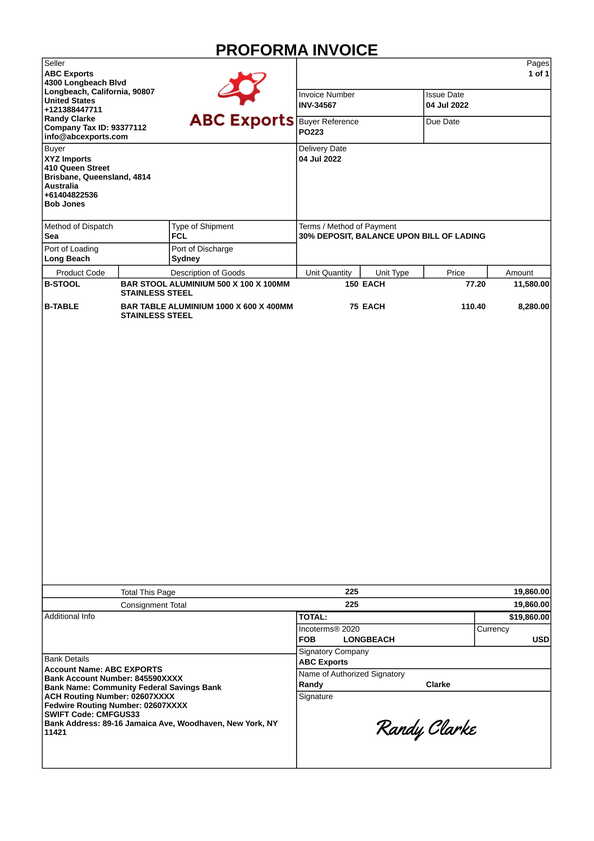

How to create a proforma invoice

A proforma invoice is quite similar to the final sales invoice and contains all the same details. They can be easily created using accounting or word processing software.

What to include on a proforma invoice?

The invoice should contain all the information the buyer needs to confirm or seek approval for placing the order. The details to include are:

- Date of Issue

- Seller and Buyer Details (Address, contact, etc)

- Details of goods/services

- Price of Goods

- Validity of offered price

- Payment Terms/method

- Applicable taxes if any

- Shipping costs if any

- Proforma invoice number if applicable

- Labeled Proforma Invoice

- Labeled Not a Tax Invoice

Automate manual processes using Nanonets AI-based OCR software. Capture data from documents instantly. Reduce turnaround times and eliminate manual effort.

Conclusion

A proforma invoice is essential because it ensures seamless business transactions while purchasing goods/services. It aids in creating transparency between buyers and sellers.

Furthermore, it is not only a helpful negotiating tool and essential for shipping globally, but it also helps build stronger relationships between buyers and sellers.

Proforma invoice FAQS

What is the main difference between a regular invoice and a proforma invoice?

The main difference between a regular invoice and a proforma invoice is that an invoice is a legal document obliging a buyer to pay the seller for goods or services. In contrast, a proforma invoice is more of a preliminary document used as a quotation or estimate before the final sale details are confirmed. An invoice is recorded in the accounts payable and has a legal standing, while a proforma invoice does not. Moreover, a final sales invoice can be used for tax purposes, unlike a proforma invoice.

What is the difference between a draft invoice and a proforma invoice?

A draft invoice and a proforma invoice serve as preliminary documents in a sales transaction, but their purposes differ. A draft invoice is an initial version of the final sales invoice. It is often used for review and approval within a business before it is sent to the customer. On the other hand, a proforma invoice is sent to the buyer before the goods or services have been delivered, serving as an estimate or quotation, and is not legally binding.

Should you pay a proforma invoice?

While a proforma invoice estimates the cost, it is not a demand for payment. It is a negotiation tool between the buyer and seller before issuing the final invoice. Therefore, typically, you should not pay a proforma invoice as it is not a final bill. However, some businesses may ask for payment based on a proforma invoice, especially in international trade, to secure the goods or services.

What is the difference between a tax invoice and a pro forma invoice?

Tax and proforma invoices differ primarily in their legal and tax implications. A tax invoice is a legal document that serves as proof of a sales transaction and is necessary for the buyer to claim input tax credits. A proforma invoice, however, is an initial bill sent before the delivery of goods or services and cannot be used for tax purposes as it does not constitute an actual sale transaction. Hence, while a tax invoice is used for tax filing and auditing purposes, a proforma invoice is a preliminary document detailing the expected cost of goods or services.

Can a proforma invoice be canceled?

Yes, a proforma invoice can be canceled as it is not a legally binding document. It is a quotation or estimate the seller provides the buyer before the final transaction occurs. Since it does not represent a completed sale, the terms and conditions, including prices and quantities, can be altered, or the invoice can be canceled without legal implications.

Is a proforma invoice legally binding?

A proforma invoice is not legally binding. It is a preliminary document sellers use to estimate or quote potential buyers. It details the expected cost of goods or services, but it doesn't represent a completed sale or an obligation to pay. Hence, changes or cancellations can be made without any legal consequences. However, once the final invoice is issued and agreed upon, it becomes legally binding, and the buyer is obligated to pay as per the terms mentioned in the invoice.

Why do businesses use proforma invoices?

A proforma invoice is used as a preliminary document in a sales transaction to provide an estimate or quotation to the buyer. It helps establish the terms of the deal before the actual goods or services are delivered. This allows both parties to agree on the transaction's price, quantity, and other details, thus reducing the risk of disputes. It is handy in international trade, where the final details may take time due to shipping, customs, and other factors.

When should proforma invoices be sent?

Proforma invoices should be sent before the delivery of goods or services, typically during the negotiation phase of a sales transaction. They are often used in international trade, where they can provide detailed information about the transaction to allow for necessary arrangements such as shipping and customs clearance. They can also be used in domestic transactions to provide an estimate or quotation to the buyer, helping to establish clear expectations and reduce the risk of disputes. However, it's important to note that a proforma invoice is not a final bill and does not require payment.

What information should be included in a proforma invoice?

A proforma invoice should include essential details such as the seller's name and contact information, the buyer's name and contact information, a unique invoice number, the date, a detailed description of the goods or services being offered, the quantity, the unit price, and the total amount due. It may also include payment terms, delivery details, and any other terms and conditions of the sale. However, it should clearly state that it is a proforma invoice to avoid confusion with a final sales invoice.

How does a proforma invoice differ from a regular invoice or quote?

A proforma invoice is not legally binding and provides an estimate before final sale details are confirmed. On the other hand, a quote is generally more formal and may be legally binding. While a proforma invoice and a quote serve to establish the terms of a potential transaction, they differ in their level of formality, detail, and legal implications.

What are the advantages of using a proforma invoice?

There are several advantages of using a proforma invoice:

- It allows the seller to provide a detailed breakdown of the goods or services, including the price, quantity, and other terms of sale. This helps the buyer to understand the cost structure and make informed decisions.

- It gives both parties a clear understanding of the transaction details before the final sale, reducing the risk of misunderstandings and disputes.

- It can be used as a negotiation tool to finalize the terms of sale before delivering goods or services.

- In international trade, it helps make necessary arrangements, such as shipping and customs clearance, by providing detailed information about the transaction.

- It can be used to secure payment or a letter of credit in advance, especially in international trade where there may be a high level of risk involved.

How should a proforma invoice be presented?

A proforma invoice must be presented professionally, clearly stating that it is not a regular invoice. It should have all the necessary information about the transaction, including the seller's and buyer's details, a unique invoice number, a detailed description of the goods or services offered, the quantity, the unit price, and the total amount due. It may also include payment terms, delivery details, and other relevant terms and conditions. Despite being non-binding, it should be treated with the same importance and professionalism as a regular invoice because it can significantly influence the buyer's decision and the overall sales process.