When I first heard about AI's potential in auditing, I was both excited and skeptical. How could a technology that started in software development make its way into the meticulous world of audits?

The truth is, we’re seeing a transformation. Just like agile methods reshaped how we develop software, AI is now pushing auditors to rethink traditional practices and improve their approach. With the rapid pace of innovation, embracing these changes isn't just a choice anymore — it's becoming a necessity.

In this blog, I’ll take you through the audit lifecycle and share how AI can disrupt and enhance each step, based on my own experiences and observations in the field.

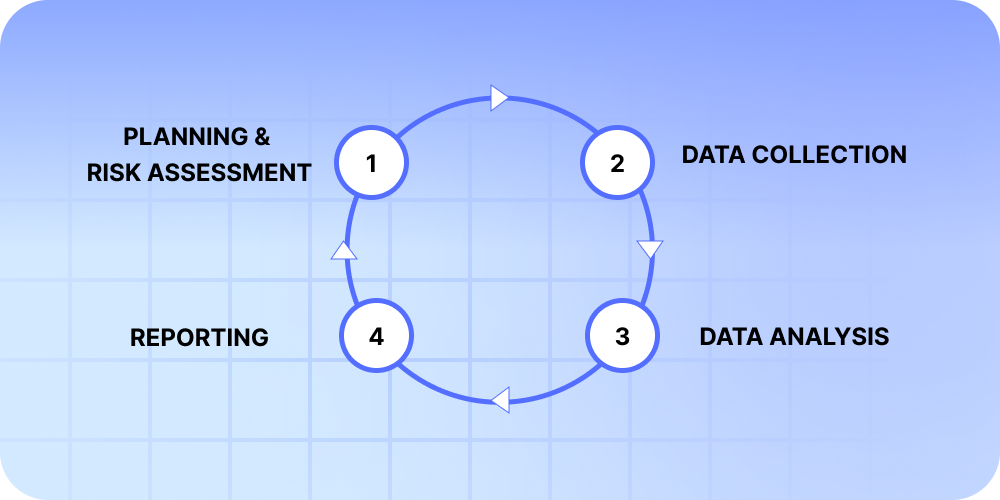

Audit Lifecycle Process

Auditing is crucial for ensuring the accuracy, transparency, and integrity of financial reporting. It provides stakeholders with confidence in an organization's financial statements. As a mandatory process, auditing helps detect and prevent fraud, ensures compliance with regulatory requirements, and upholds the overall accountability of financial practices.

The audit lifecycle process has four steps:

- Planning & Risk Assessment

- Data Collection

- Data Analysis

- Reporting

Each step of the audit lifecycle is interconnected and vital for ensuring a comprehensive and effective audit. Proper planning sets the stage for a focused and efficient audit; accurate data collection provides the foundation for reliable analysis, and thorough data analysis leads to well-informed conclusions. Finally, clear and actionable reporting ensures that audit findings are communicated effectively to stakeholders.

We will examine the four steps in-depth, understand the current process, and see how AI can improve it.

Planning & Risk Assessment

In the planning stage, Auditors develop an audit plan and identify potential risks that may arise.

Identifying risks is usually time-consuming, and there is usually a subjective opinion. Risks could be of various types, ranging from Fraud and compliance to overall strategic business risk.

Role of AI: AI can help analyze historical and real-time data. Leveraging ML algorithms to identify patterns and predict potential risks allows for better audit planning.

First, auditors can prompt natural language processing (NLP) tools to provide a list of risks to expect in an area. Many will leverage this option when approaching a process for the first time. Next, auditors can use AI to analyze large datasets to identify patterns, trends, and anomalies that may indicate potential risks to help prioritize their focus areas.

Artificial intelligence could produce a potential audit schedule, taking the workload off the audit leadership team.

Data Collection

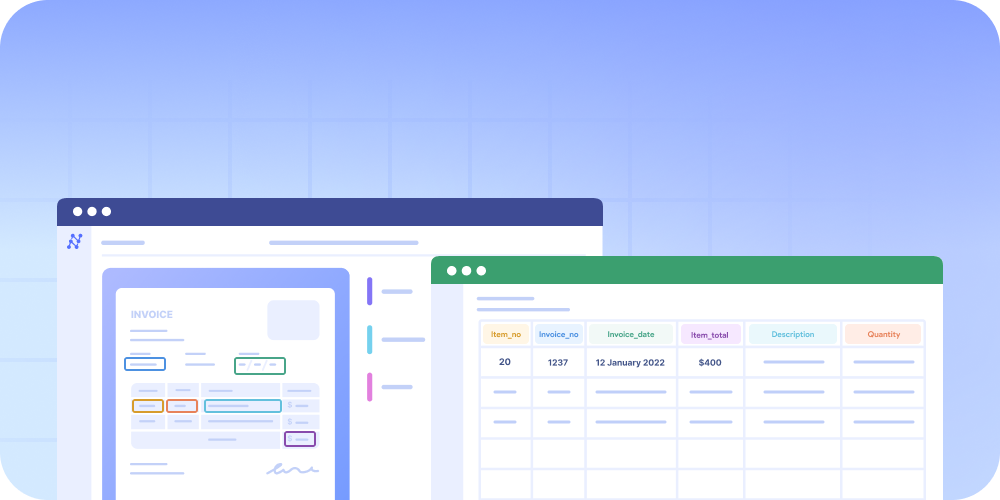

The next step in Data collection involves reviewing every financial document related to the company.

These include financial statements, receipts, invoices, purchase orders, and bank statements. This stage could have industry-specific documents like Bills of lading and insurance claim documents.

This stage is usually labor-intensive, with hours spent reviewing the documents and digitizing them for further analysis. The manual effort involved is expensive and can lead to mistakes as the volume of documents increases.

Role of AI: AI, with Optical Character Recognition (OCR), can scan and interpret documents. It can categorize documents accurately, such as invoices, bank statements, etc. With newer technologies like Natural Language Processing (NLP), AI can scan documents to organize and even point out any potential discrepancies or mismatches, which could reveal any potential compliance risk or detect Fraud.

Data can originate from various sources, including the ERP, point-of-sale, expense reports, and payment approval systems. Traditionally, auditors request specific components or, in some cases, all data from these systems. However, with the advent of AI technology, auditors can now ask for the entire dataset. AI tools can then extract and analyze the necessary sub-datasets, alleviating concerns about handling and analyzing comprehensive data.

AI has the potential to reduce costs. Shortened audit times, made possible by AI-driven efficiencies, reduce overall audit expenses.

Data Analysis

After bringing in all the required documents and data, the next step is to analyze the data. Going through the papers and trying to match and verify data is challenging. The more complex transactions are present, the riskier it gets to analyze and ensure there are no compliance issues.

Role of AI: While traditional algorithms can help with the first bit of matching, advanced algorithms must analyze the data across various documents to detect anomalies and present insights. AI with advanced algorithms can help with real-time insights, flagging issues, and intervention in these cases.

AI assists auditors in assessing risks by analyzing historical data, industry trends, and financial ratios. This data-driven approach helps auditors identify high-risk areas that require closer scrutiny during the audit.

Journal entries can be performed early in risk assessment with full-population testing with AI. Journal entry testing involves identifying unusual transactions among a large pool of unstructured data and analyzing those transactions for patterns and anomalies.

AI can identify unusual transactions or patterns that might indicate errors or fraudulent activities, allowing auditors to investigate further.

Reporting

It is time to report after data has been analyzed and potential risks have been neutralized. When it comes to reporting, it could be error-prone with manual processes. This could directly put the audit at compliance risk.

In addition to errors with manual processes, reports are no longer 50-page documents faxed or couriered to stakeholders; they could be an online dashboard with notifications and approvals smartly managed via emails and other communication tools.

Role of AI: An essential part of such dashboards is visualization and highlighting critical findings and recommendations; this is where AI, with the latest large language models (LLMs), can help comprehend complex information and present intelligent insights. These AI-first insights can complement human insight to make more effective recommendations.

In the future, audit committee reporting could leverage AI to create predictive models that estimate the likelihood of future risks based on current data. This would enable more in-depth discussions between audit leaders and the audit committee, enhancing risk management and strategic decision-making.

Risks to keep in mind

Adopting new processes or technologies comes with its risks. It's also essential to keep in mind the risks of adopting AI within auditing processes.

Key AI risks include:

- Accuracy and Reliability: Ensuring AI models provide accurate and reliable results by validating data and addressing biases.

- Transparency and Explainability: Making AI algorithms transparent and their decision-making processes understandable to build trust and facilitate issue resolution.

- Security: Implementing strong security measures to protect AI systems from unauthorized alterations and cyber threats.

- Data Protection: Comply with privacy regulations and ensure robust data protection to safeguard user information and maintain compliance.

What can auditors do to get in the game?

Across firm sizes and industries, auditors must realize the value of AI technology, the various possibilities it unlocks, and the potential downsides of not adopting it and committing to transforming processes.

The barrier to adopting technology is usually being made aware of the technology and its benefits. Educate yourself on the potential of AI to be leveraged across audit stages. To convince the leadership of the importance of AI, one can start by adopting it for a specific stage of the audit process or a minor audit, like an R&D audit. The value is usually apparent once it's put into action.

If you are an auditing firm that performs audits across industries, the tool to be leveraged must be versatile across industries and various documents. There may be better choices than using niche tools to test out AI for audits. A tool like Nanonets, which is versatile across documents, is better for such versatile use cases. It is even capable of niche industry-specific use cases with its always-learning AI models.

Here are a few concrete steps you could take as an auditor to get into the game:

- Invest in education and training. Learn as much as possible about the potential use of AI and technologies in auditing and other day-to-day business activities.

- Collaborate & Learn—If you are part of a larger organization with dedicated data science teams and analysts, you can contact them to learn about potential uses and likely tools that could help your use case.

- Leverage AI tools - Get started with an AI tool relevant to automating and enhancing the stage of your audit process. You can get started with tools in your day-to-day and see what AI is all about

- Maintain Data Quality—Establish data policies within your organization and guide your clients to ensure documents are accurate by AI analysis and compliance.

- Privacy - It's essential to make yourself aware of data privacy laws and enforce them to ensure compliance and safer audits