Introduction to Stripe Reconciliation

Every digital purchase is a complex interplay of entities—Customers, Merchants, Acquirers, and Issuing Banks—that orchestrate the flow of funds. A Payment Service Provider (PSP) acts as an intermediary between merchants and the financial institutions involved in processing online transactions. Stripe is a PSP that offers a suite of services to streamline payment processing and enhance the online shopping experience.

Stripe not only facilitates seamless payment processing but also simplifies the reconciliation process by providing detailed transaction records and integrations with accounting software, ensuring accuracy and efficiency in financial management. In this overview, we shall look into the core principles of Stripe Reconciliation, discuss its importance and understand its complexities to equip businesses with the tools they need for enhanced financial transparency and operational efficiency.

What is Stripe Reconciliation?

Stripe Reconciliation refers to the use of Stripe for the systematic process of matching and verifying transactions processed through the Stripe payment gateway with corresponding entries in your accounting records. It ensuresthat the money flowing through the Stripe account matches what your business expects, leaving no room for discrepancies or errors.

Stripe can be used to automate the comparison of internal records like invoices with external data such as settlement files and bank statements, reducing manual effort and errors. Daily cash tracking provides real-time insights into cash positions, vital for effective financial management. Swift identification of discrepancies prevents revenue leaks, while transaction life cycle visibility ensures thorough monitoring. Strong financial controls are implemented through automated reconciliation and detailed transaction tracking, safeguarding against errors and fraud. Stripe's scalable solutions accommodate growing transaction volumes and complexities, making it invaluable for businesses with dynamic financial needs.

How are transactions processed through Stripe?

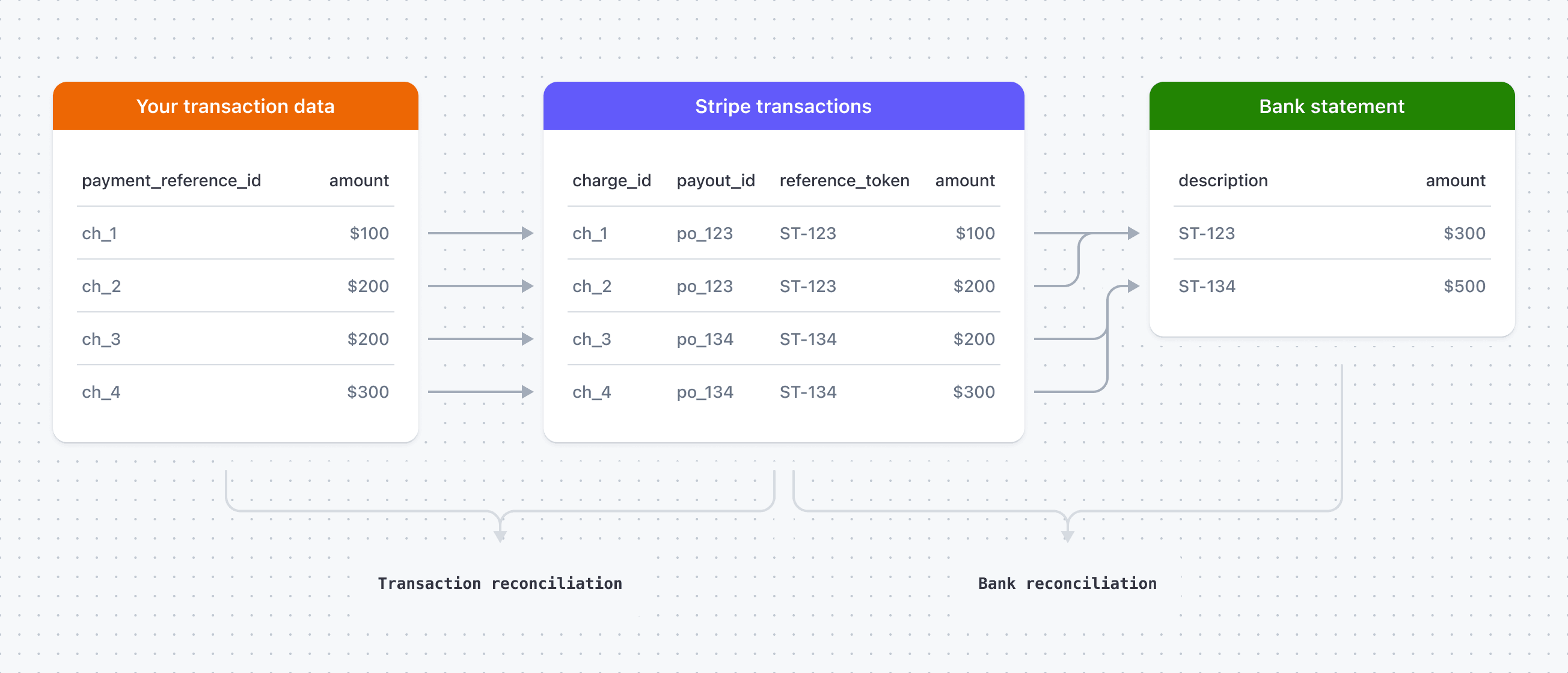

Stripe harnesses three primary datasets in its reconciliation efforts:

- The company’s transaction data: This encompasses internal records of payments, such as sales records or invoices, reflecting the gross amount for each transaction stored within your system. Stripe uses this data to estimate expected gross amounts for transactions and to create payment expectations.

- Stripe transactions: These are confirmations of money movement generated by Stripe, encompassing charges, refunds, or payouts processed through the platform. This data is automatically fetched into the reconciliation workspace every 12 hours, providing real-time insights into transactional activity.

- Bank statements: These statements validate the money movement claimed by Stripe in your bank account. Stripe directly fetches this data through Financial Connections on a daily basis, ensuring alignment between Stripe's records and actual bank deposits.

Stripe reconciliation facilitates three types of reconciliations:

- Bank reconciliation: Aligns payouts made by Stripe with cash deposits in your bank account, requiring access to your bank statement through Financial Connections.

- Transaction reconciliation: Enables reconciliation of individual Stripe transactions with internal records, ensuring consistency and identifying any discrepancies between the two datasets.

- Combination of transaction and bank reconciliation: Tracks the complete lifecycle of transactions from initiation to bank deposit, providing a comprehensive overview of financial operations.

By establishing this three-way reconciliation process, businesses can meticulously track information across systems, validate data accuracy, and ensure financial integrity before updating their books, empowering them with enhanced transparency and efficiency in managing online transactions.

Types of transactions supported by Stripe

From traditional card payments to emerging payment methods, Stripe's versatility enables businesses to streamline revenue streams, automate financial processes, and embrace unified commerce models.

- Card Payments: Stripe supports a wide range of card payments, including credit and debit cards, allowing businesses to accept payments from customers worldwide securely.

- ACH Debits: Ideal for recurring payments or subscription-based models, ACH debits enable businesses to withdraw funds directly from customers' bank accounts.

- Bank Transfers: Stripe facilitates Euro bank transfers, providing customers with the flexibility to pay directly from their bank accounts, enhancing convenience and reducing transaction costs.

- Alternative Payment Methods: Stripe integrates with a plethora of alternative payment methods such as Alipay, Apple Pay, and Blik, catering to the preferences of diverse customer demographics and enhancing checkout experiences.

- Clearpay and Affirm: With Clearpay for buy now pay later options and Affirm for flexible financing solutions, Stripe empowers businesses to offer flexible payment terms, driving conversion rates and customer satisfaction.

- Dispute Handling: Stripe provides robust dispute handling mechanisms, enabling businesses to efficiently manage and resolve payment disputes, safeguarding revenue and maintaining customer trust.

- Revenue and Finance Automation: Stripe's suite of revenue and finance automation tools streamlines processes such as invoicing, billing, and revenue recognition, empowering businesses to optimize cash flow and financial operations.

- Unified Commerce: Whether for professional services, SaaS, or subscription-based businesses, Stripe offers unified commerce solutions that seamlessly integrate with existing workflows, enabling businesses to manage all aspects of their operations from a single platform.

How to Set up Stripe Reconciliation?

Setting up of the Stripe Reconciliation process typically involves the following steps:

- Upload Transaction Data:

- Go to the Stripe Dashboard's reconciliation overview page.

- Click on "Import data".

- Select your file

- Click "Import CSV".

- Track Progress:

- Monitor the progress of the import by clicking "View data management".

- Understand Reconciliation Data Schema:

- Ensure that the transaction data meets Stripe's required fields to convert it to the canonical reconciliation schema.

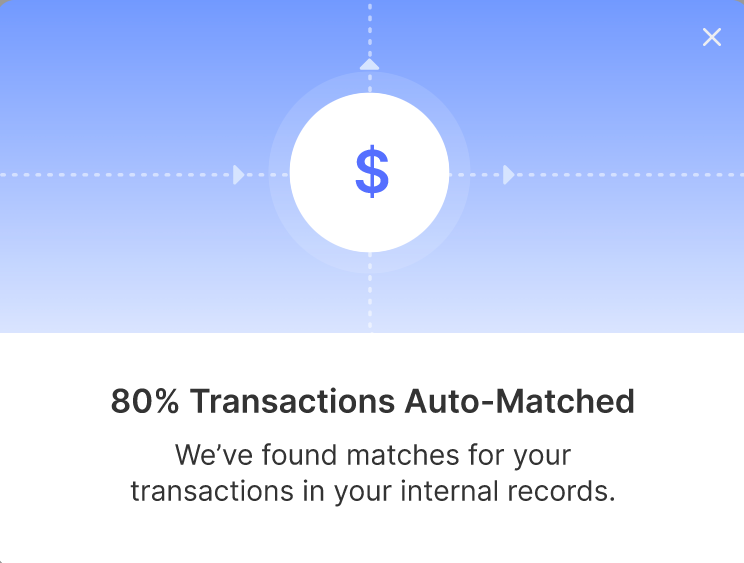

- Automated Reconciliation:

- Once data is imported, reconciliation starts automatically.

- Each transaction receives a reconciliation status based on its alignment with Stripe records and bank statements.

- Configure Thresholds:

- Configure reconciliation thresholds for settlement and transaction reconciliation according to your specific requirements.

- Monitor Reconciliation Statuses:

- Regularly check reconciliation statuses for both settlement and transaction reconciliation.

- Understand the implications of different reconciliation statuses, such as "Completely matched", "Partially matched", "Unmatched", "Settled", "In process", "Open", and "Foreign".

- View Analytics:

- Utilize the reconciliation analytics page to gain high-level insights into your business's money movement.

- Analyze charts for reconciliation status and aging summaries to track fund disbursement and adherence to service level agreements (SLAs).

- Generate Reports:

- Access standard reports from the Stripe Dashboard, including reconciliation result reports, settlement level reports, and transaction-level search reports.

- Customize report types and filters to obtain specific insights into transaction reconciliation, pay-in reconciliation, and settlement reconciliation.

- Download Reports:

- Generate and download reports to review transaction reconciliation statuses, pay-in reconciliation results, and settlement details.

- Use these reports to validate financial transactions, identify discrepancies, and optimize financial processes.

Best Practices for Stripe Reconciliation

To harness the full potential of Stripe Reconciliation, businesses should adhere to a set of best practices aimed at optimizing efficiency and mitigating risks.

- Consistent Reconciliation: Routine payment reconciliation ensures a regular cadence. This proactive approach empowers businesses to swiftly identify and rectify errors or inconsistencies, maintaining the integrity of financial data.

- Division of duties: Errors and fraud can be mitigated by dividing responsibilities. Transaction recording and account reconciliation can be segregatedd to establish a robust system of checks and balances within the organizational framework.

- Standardize Operations: The design of standardized procedures for reconciliation fosters uniformity and precision. It helps to document these protocols and ensure adherence across the organizational spectrum.

- Thorough Documentation: Complete records of the reconciliation process provide comprehensive insights and facilitate audits. These detailed accounts serve as invaluable references, offering historical context and aiding in error resolution.

- Swift Response to Discrepancies: Discrepancies must be promptly addressed, errors rectified and funds recuperated when necessary. Rapid intervention is key to upholding financial accuracy and trustworthiness.

- Employee Empowerment: All stakeholders must be trained to use the system. Familiarizing them with accounting principles, regulations, and the operation of Stripe, ensures proficiency and efficacy in their roles.

- Implement Oversight Mechanisms: A robust review and approval process is essential for reconciliation reports, instilling an additional layer of scrutiny and ensuring thoroughness.

- Fortify Security Measures: Financial records and systems must be secured by restricting access to authorized personnel and instituting stringent security protocols. Sensitive information must be protected from unauthorized access.

- Continuous evaluation and testing: Continuous evaluation and refinement of the reconciliation process, benchmarking against industry standards and seeking avenues for improvement fosters continual growth and operational excellence.

- Open Channels of Communication: Transparent communication channels must be maintained with pertinent stakeholders, including banks and vendors. This facilitates seamless issue resolution and ensures access to essential information for informed decision-making.

Automate Reconciliation with Stripe and Nanonets

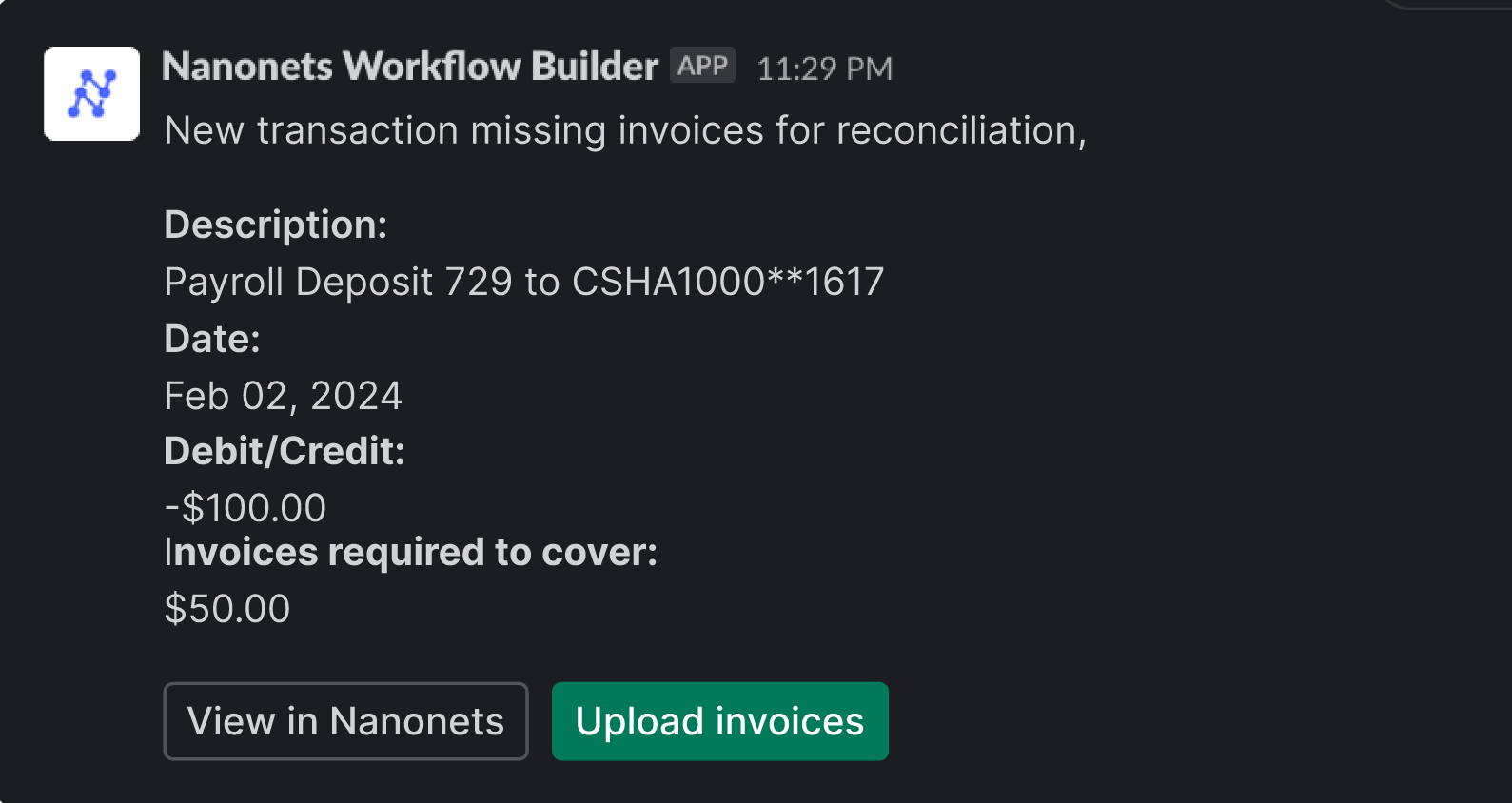

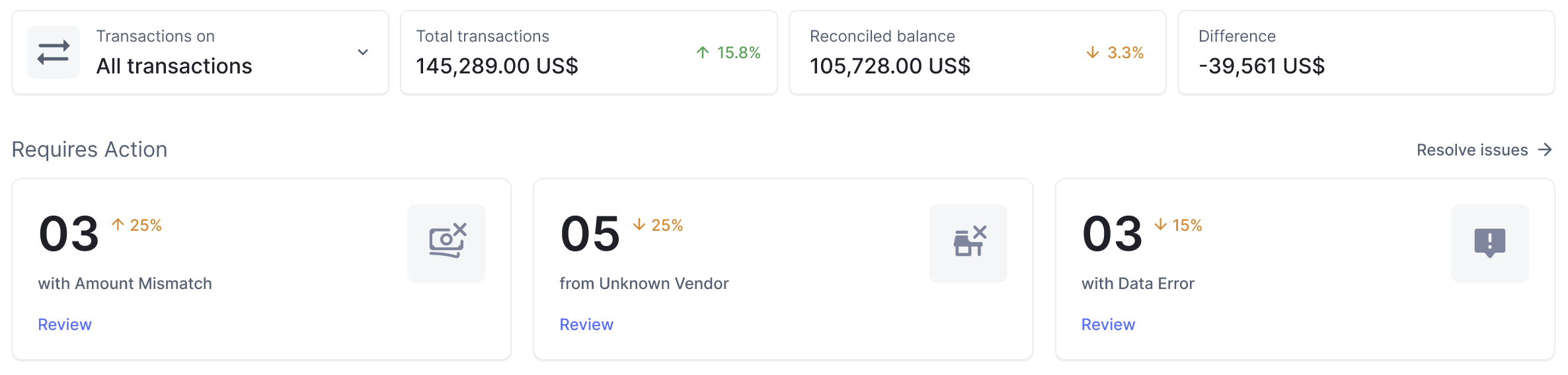

Nanonets (as mentioned above) offers AI-powered solutions for automating account reconciliation processes, enabling businesses to streamline operations, reduce manual effort, and improve accuracy. Additionally, Nanonets integrates seamlessly with Stripe, providing businesses with a comprehensive solution for financial management and account reconciliation.

Key benefits of Nanonets for automated account reconciliation:

- Automated Data Extraction: Nanonets leverages advanced Optical Character Recognition (OCR) technology to automatically extract relevant data from invoices, bank statements, receipts, and other financial documents. This eliminates the need for manual data entry and reduces the risk of errors, ensuring accurate reconciliation.

- Intelligent Data Matching: With Nanonets' AI algorithms, you can match transactions across different systems and identify discrepancies with precision. The system intelligently analyses transaction data, identifies patterns, and reconciles accounts efficiently, saving valuable time and resources.

- Seamless Integration: Nanonets easily integrates with Stripe and other accounting software, allowing for seamless data exchange and synchronisation. This integration streamlines the reconciliation process, enhances data accuracy, and ensures consistency across financial systems.

- Customizable Workflows: Nanonets offers customizable workflows that can be tailored to your specific reconciliation requirements. Whether you need to reconcile large volumes of transactions or manage complex accounts, Nanonets' flexible workflow automation capabilities can adapt to your unique business needs.

- Real-Time Reporting: Nanonets provides real-time visibility into the reconciliation process, allowing you to monitor progress, track discrepancies, and generate comprehensive reports. This real-time insight enables proactive decision-making, improves financial transparency, and enhances compliance.

With Nanonets, businesses can achieve greater efficiency, accuracy, and compliance in their reconciliation processes.

Conclusion

Leveraging Stripe reconciliation empowers businesses to maintain a firm grip on their financial operations. With this tool, businesses can track daily cash flows, swiftly identify and rectify discrepancies to prevent revenue leakages, and gain comprehensive visibility into the entire lifecycle of each transaction. Stripe reconciliation facilitates the implementation of robust financial controls, safeguarding businesses against errors and fraud. Its scalability ensures that businesses can establish processes that grow with their expanding operations, offering flexibility and adaptability to meet evolving needs. Stripe reconciliation can provide businesses with the tools they need to optimize efficiency, accuracy, and resilience in their financial operations.