At a Glance: What STP Means for Insurance Operations

Straight-through processing (STP) is redefining how insurance claims are handled. Traditionally, claims processing involved hours of back-and-forth, manual data entry, and multiple layers of review. With STP, that model is collapsing into something faster, smarter, and fully automated.

Enabled by AI-powered Intelligent Document Processing (IDP) systems like Nanonets, STP can transform a claim from submission to payout in minutes—especially for high-frequency, low-complexity scenarios like auto glass repairs or rental reimbursements.

- Cycle time reduction: From 72 hours to under 5 minutes (simple claims)

- Average case gains: 20+ minutes → ~8 minutes (using AI + RPA)

- Operational cost savings: Up to 70% via faster throughput, fewer manual tasks

- CX impact: One agency reported an 18-point NPS boost post-automation

- Reduction in human errors: 50–60% drop in data entry errors reported by carriers using IDP

- Claim routing efficiency: 90%+ of low-complexity claims triaged directly into STP workflows

STP is no longer aspirational. It’s operational—and increasingly necessary.

Why STP, Why Now?

Imagine this: A customer files a claim for a cracked windshield at 9 AM through their insurer’s app. By noon, the reimbursement hits their account. No manual checks. No paperwork. Just a fast, seamless experience.

This isn’t fiction—it’s the new baseline set by digital-first insurers like Lemonade, Root Insurance, Next Insurance, and Zego. These players are setting turnaround expectations in hours—not days—thanks to AI-driven claims automation.

As customer expectations evolve and operational costs climb, traditional insurers can no longer afford to rely on manual, paper-heavy processes.

Key drivers accelerating STP adoption:

- Consumer impatience: From Amazon’s same-day shipping to Uber’s one-tap rides, customers now expect services to be immediate. Insurance is no exception.

- Insurtech disruptors: Lemonade, Root, Zego, and others process claims in minutes

- Cost and efficiency pressure: Inflation and resource constraints are forcing optimization

- Manual bottlenecks: Human-centric claims processing limits scale and SLA performance

STP isn’t just for digital natives—it’s increasingly vital for legacy carriers and Tier-1 insurers navigating aging systems, rising costs, and competitive pressure. STP provides the modernization path without total system replacement.

What Is STP in Insurance?

Straight-through processing (STP) refers to the automation of the entire claims process—from document intake to payout—without any human intervention. It relies on a few key components:

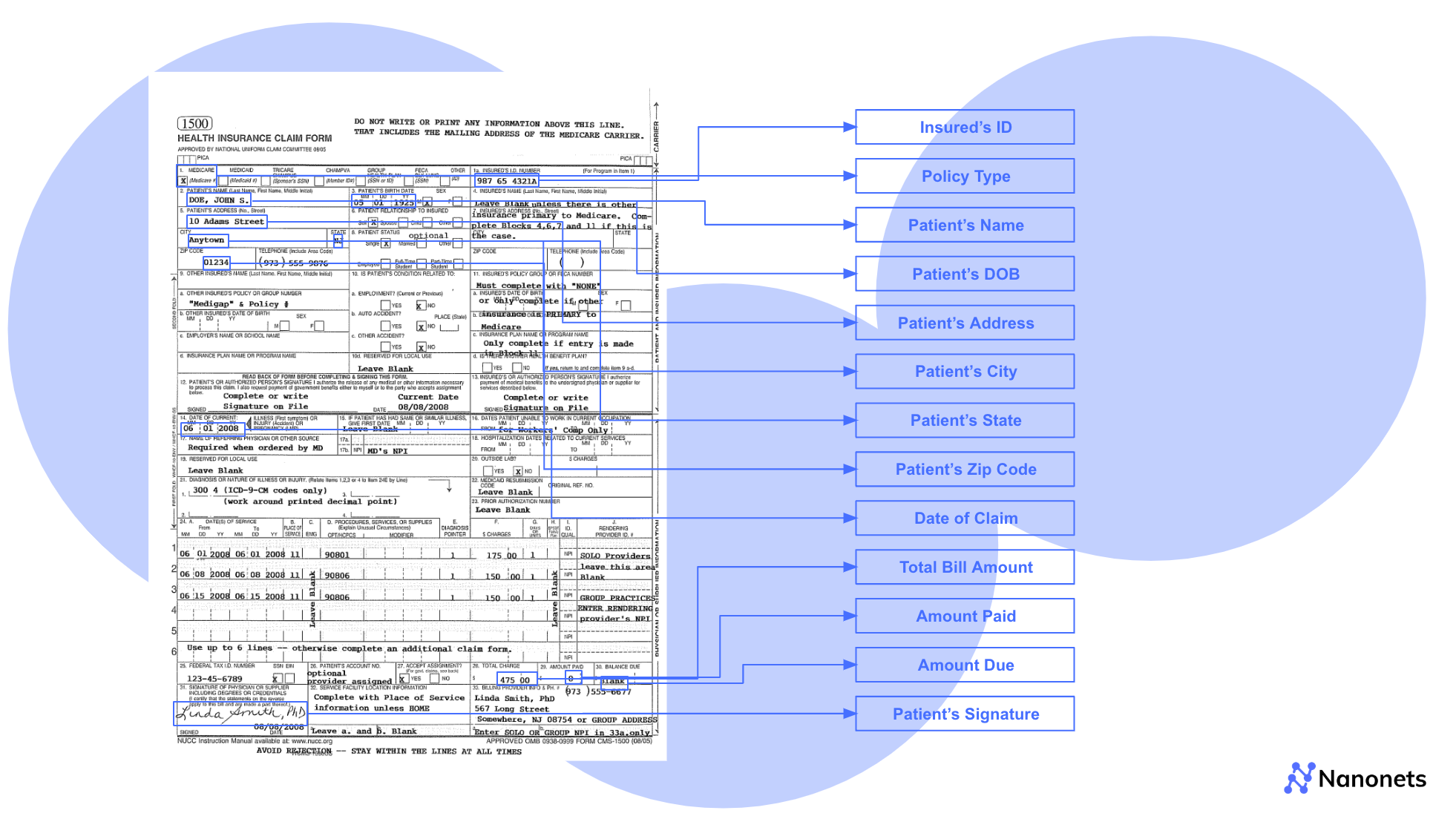

- Intelligent Document Processing (IDP): AI systems extract data from semi-structured and unstructured documents such as forms, repair estimates, EOBs, and FNOLs.

- Validation Engines: Business rules validate coverage, claim limits, and policy terms.

- Workflow Automation: Once approved, payments and updates are triggered automatically through connected systems.

Unlike semi-automated systems—such as traditional RPA bots or BPM tools—that rely on agents for exception handling or final approvals, STP executes the entire workflow end-to-end. These legacy solutions often require batch processing or rules hard-coded into outdated platforms, limiting flexibility and speed.

STP can also operate in hybrid models where exceptions—such as high-value claims, injury reports, or missing documents—are routed to human reviewers. This exception handling ensures safety without sacrificing speed.

The result? Lower costs, faster payouts, and happier policyholders.

STP is part of a broader automation shift in insurance, including underwriting workflows now powered by AI. Learn how AI is also transforming insurance underwriting →

Stakeholder Benefits of STP

Straight-through processing unlocks measurable gains across departments:

| Stakeholder | Key Benefit |

|---|---|

| Claims & Ops | 3–5x more claims handled per adjuster |

| IT & Systems | Seamless integration with core platforms & RPA tools |

| Risk & Compliance | Auditable, rules-based decisions reduce exposure |

| Customer Experience | Faster claims = Higher NPS, lower churn |

Claims & Operations:

STP significantly improves the efficiency of claims departments. Adjusters who once processed 10–15 claims a day can now handle 50 or more, thanks to automation handling the bulk of document intake and validation. Adjusters spend more time on complex cases, with routine claims handled entirely by STP. With pre-filled data and exception routing, they shift from data entry to decision-making, boosting productivity by 3–5×.

IT & Systems:

From a systems standpoint, STP can integrate with core insurance platforms like Guidewire, Duck Creek, and Insurity. It complements existing infrastructure through APIs and leverages RPA tools like UiPath and Blue Prism. Nanonets integrates as the IDP layer across DMS (like SharePoint or OnBase) and orchestrates backend workflows through RPA. This allows for modernization without needing to overhaul legacy systems.

Risk & Compliance:

STP reduces risk exposure by enforcing validation rules consistently and automatically applying audit-ready decision logic. Every document processed—be it an insurance form, police report, or EOB—is evaluated against predefined rulesets (e.g., coverage limits, date of loss vs. policy term, fraud patterns). All decisions are logged, timestamped, and traceable, ensuring transparency and facilitating compliance with NAIC, HIPAA, GDPR, and other regulatory standards.

Customer Experience (CX):

STP’s biggest win may be for customers. When claims are settled in hours, not days, satisfaction rises dramatically. With automated status updates and real-time resolution, some Nanonets customers have reported NPS improvements of 10–18 points.

Where STP Works Best

Not all claims are STP-ready—but many are. Focus on areas with:

- High claim volume

- Standardized document types

- Defined rule-based decisions

| Vertical | Claim Example | Key Documents | Turnaround Potential |

|---|---|---|---|

| Auto | Fender-bender, windshield damage | FNOL, repair quote, police report | 2–3 hours |

| Property | Storm or hail damage | Damage photos, contractor quote | Same-day |

| Health | Routine dental, flu shot | Itemized bill, provider note, EOB | Instant pre-approval |

These claim types follow consistent workflows, and document formats are well-understood—making them ripe for full or partial STP. In many cases, Nanonets users report achieving >90% document automation in these verticals.

Quantifying the Business Impact

Beyond the operational elegance of STP lies a measurable business case:

Common Documents by Vertical:

- Auto: FNOLs, police reports, and repair estimates

- Property: Damage photos, contractor quotes

- Health: EOBs, provider statements, itemized medical invoices — see our full health insurance claims automation guide for more.

- Cross-vertical: Other forms for additional remarks

IDP extracts and normalizes data across these documents—turning scanned PDFs into structured fields used by rule engines. This accelerates cycle times even before full STP is achieved.

Operational Metrics:

- ⏱️ Cycle time: 72+ hours → under 1 hour (simple claims)

- 💸 Cost per claim: ~$200 → ~$80 (with AI + RPA + STP)

- 📈 SLA performance: Up to 50% improvement

- 👤 Adjuster productivity: 3–5x more claims handled/day

- ❌ Error rate: Up to 60% fewer data entry mistakes

For a deeper look at how AI reshapes every phase of the claims journey—from intake to resolution—explore this breakdown of AI-powered claims processing →

Quick Takeaway

STP isn’t just a future-state ambition—it’s an available advantage for insurers today. With the right mix of document automation, validation logic, and orchestration, even legacy insurers can leapfrog their bottlenecks.

Start with low-complexity, high-volume claims. Apply IDP to documents like insurance forms and EOBs. Use business rules to validate, then trigger next steps via RPA.

Even partial STP adoption can dramatically accelerate claims, reduce overhead, and boost customer satisfaction.

CTA: Explore how Nanonets can help insurers deploy STP faster with fewer IT dependencies. Contact us →

FAQs

What types of insurance claims are best suited for straight-through processing?

Straight‑through processing (STP) is ideal for low-complexity, high-frequency claims that follow predictable rules. These include windshield repairs, minor property damage, outpatient medical reimbursements, or travel delay claims—scenarios where coverage is easy to validate, supporting documents are standardized, and fraud risk is low.

Consider a personal auto insurance claim for a cracked windshield. The customer uploads photos through the mobile app. The system validates policy status, checks the damage severity, fetches a pre-approved vendor quote, and auto-initiates payment. No adjuster touches the file.

Nanonets enables this kind of automation by extracting structured data from photos, inspection reports, or repair estimates—validating them against pre-configured rules and policy data. It pushes clean data into the insurer’s claims engine (like Duck Creek or Guidewire) and auto-triggers next steps—approval, vendor coordination, and payment.

This reduces cycle time from 2–3 days to less than an hour, slashes manual intervention by 50%, and improves Net Promoter Scores by up to 20%.

Can STP be applied to complex claims involving bodily injury or multiple parties?

While full STP is rarely feasible for highly complex claims, automation can still accelerate parts of the workflow. Multi-vehicle accidents, bodily injuries, or subrogation-heavy scenarios often require nuanced legal and medical judgment, which cannot be fully automated. However, automation can front-load these workflows with clean, structured data.

Take a three-car collision where one party is hospitalized. Determining liability, parsing medical invoices, and reconciling conflicting statements are manual processes—but data extraction doesn’t have to be. Nanonets captures key details from police reports, hospital forms, diagnostic codes, and witness statements. These inputs are structured and validated against claims rules and fraud detection patterns, then routed to adjusters with summaries prefilled—reducing clerical overhead.

This speeds up claim setup, shortens review time, and eliminates data errors. While final decisions remain with human experts, this hybrid approach can cut resolution time by 35% and significantly reduce backlogs in bodily injury teams.

Is STP feasible in health insurance claims, or only for P&C lines?

STP is very much possible in health insurance—especially for routine, rule-driven claims. Unlike complex inpatient cases or treatments needing prior authorization, simple outpatient procedures, pharmacy reimbursements, and diagnostic tests often follow standard billing codes and coverage guidelines, making them suitable for automation.

Picture a lab test claim under a group health plan: the provider submits an electronic claim with standard CPT codes and billing amounts. If the member is eligible, the procedure is covered, and pricing aligns with the negotiated rate, the claim is auto-processed and paid—no human review.

Nanonets automates this adjudication path by extracting key fields from electronic health claim forms (like CMS-1500), validating them against policy terms, and checking for anomalies. For flagged cases—like mismatched codes or expired coverage—it triggers human review. But for the rest, it pushes approvals in minutes.

Insurers using this model see up to 80% STP rates for low-complexity health claims, cutting processing costs by over 50% and accelerating payments to providers and members.