Growing businesses often struggle to deal with sudden increases in invoices. Throw in manual invoice processing and siloed data and systems, and you've got a recipe for inefficiency and frustration. The cost of manually processing invoices can climb from $15 to $40 per invoice, not to mention the countless hours spent on data entry.

In sharp contrast, AI invoice automation and accounts payable automation could reduce the cost to $1.42 per invoice, leading to significant cost savings. In addition to that, automation can help mitigate fraud risks and provide increased visibility into cash flow trends.

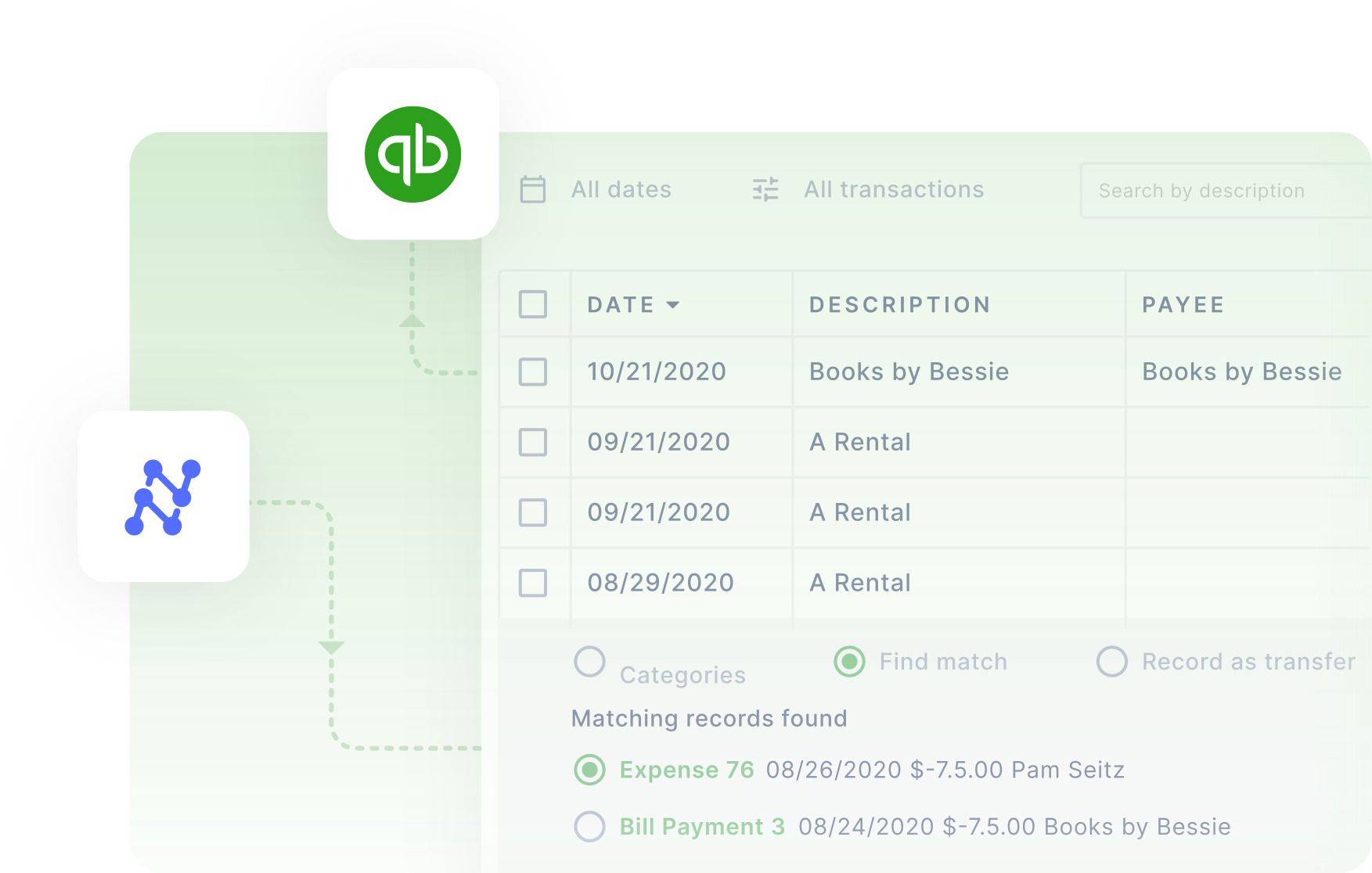

At Nanonets, we've been helping businesses worldwide streamline their accounts payable (AP) processes with our QuickBooks invoice automation integration.

It is designed to drastically reduce manual data entry, validation, and processing, allowing accounts payable teams to focus on more strategic tasks. Our accounts payable automation can improve the speed and accuracy of invoice processing and simplify compliance.

This blog post will explore how an SME improved operational efficiency and saved resources using Nanonets' QuickBooks invoice automation. Also, get a step-by-step overview of how to set up the automation workflow for your business.

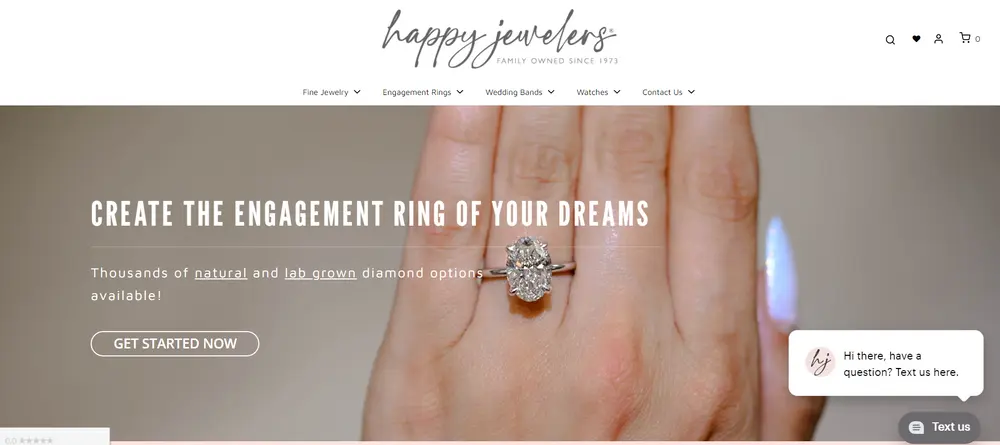

The business

Happy Jewelers is a small-sized business specializing in handcrafted jewelry. They aim to provide the finest quality handmade jewelry. Based in California, their reputation for innovation, professionalism, and customer satisfaction has been built over 40 years.

The challenges

Because of growth and expansion to new cities, Happy Jewelers had to juggle a hefty influx of invoices. Manual accounts payable management was not just a colossal time-sink but also riddled with inaccuracies. They needed a system to streamline their accounting tasks, delivering precision and efficiency.

How Nanonets helped Happy Jewelers boost AP efficiency

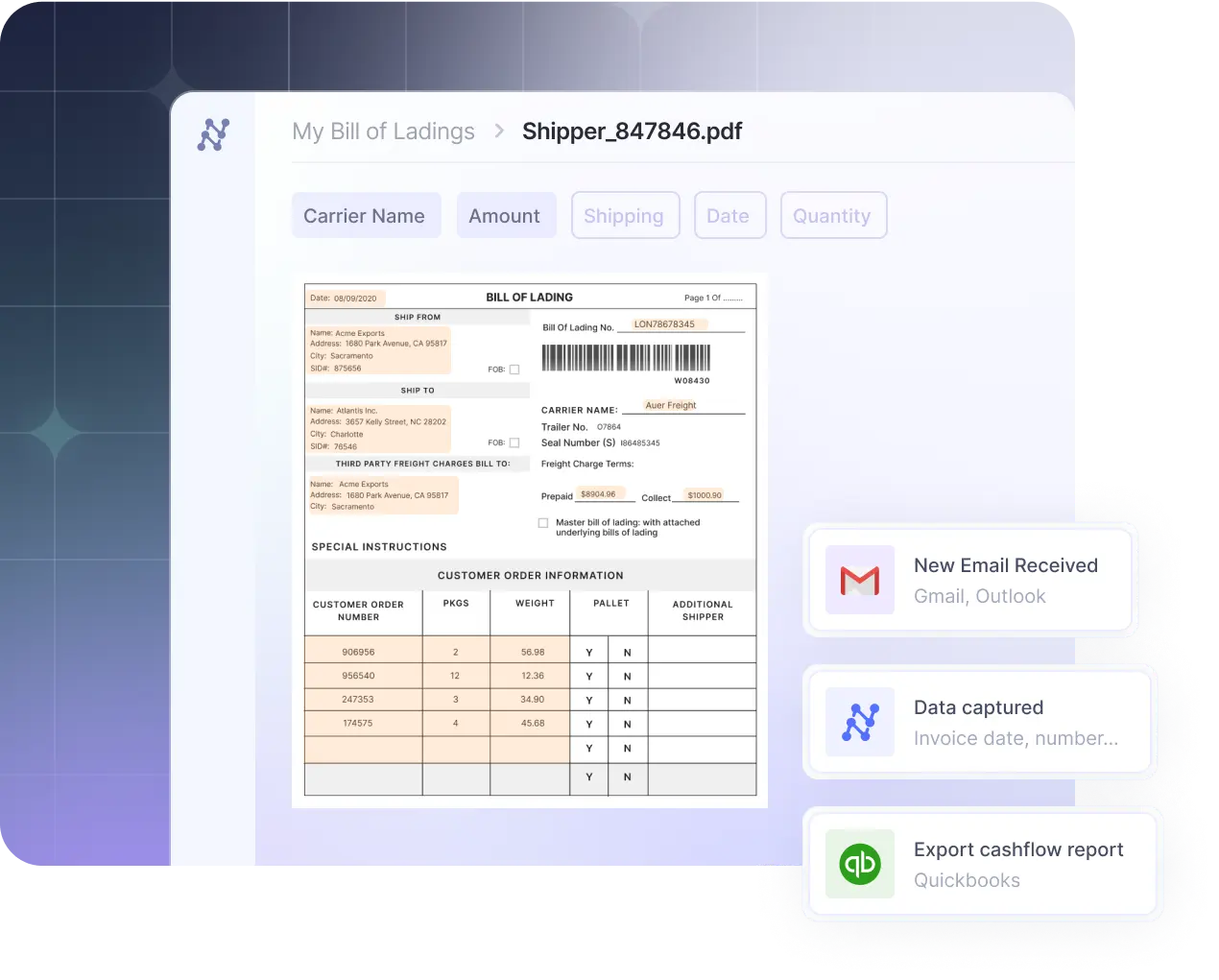

Using Nanonets for QuickBooks invoice automation, Happy Jewelers could extract invoices from emails automatically, process them efficiently, and store them in a structured manner on the cloud.

This automation for QuickBooks drastically reduced the time spent on manual data entry and invoice management. The SMEs could also integrate this data directly into QuickBooks, streamlining their accounts payable process.

Let's examine how Happy Jewelers benefited from Nanonets' QuickBooks invoice automation integration:

1. Cut down on manual data processing

Business expansions to New York and Chicago meant Happy Jewelers had an increase in the volume of invoices. The Accounts Payable Team at Happy Jewelers wanted to ensure they could handle the influx without sacrificing accuracy or efficiency.

However, the existing manual process meant the team spent valuable hours manually extracting, categorizing, and processing invoices before uploading them to QuickBooks Online or Desktop. Aside from being a time drain, manual invoice processing left them vulnerable to late payments, strained vendor ties, and unbalanced financial statements.

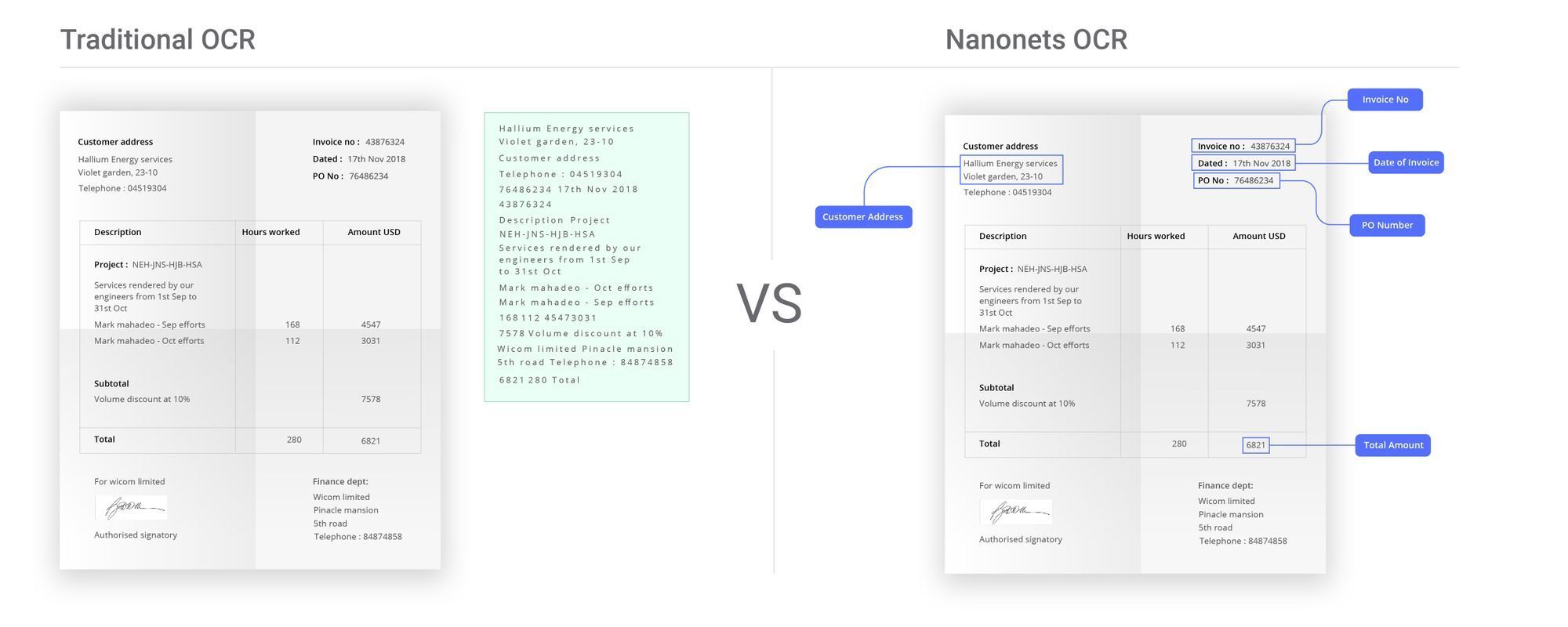

Realizing the need for accounts payable automation, their AP team and the management decided to deploy Nanonets. By combining OCR software and AI capabilities, Nanonets could read, classify, and extract data from invoices.

It also ensured invoice details were synced with QuickBooks' vendor and account data in real-time. So when invoices from new vendors land in the inbox, Nanonets automatically creates new vendor profiles in QuickBooks. This ensures that the vendor list is always up-to-date.

Overall, the integration ensured that extracted data could be easily uploaded into QuickBooks Online or Desktop, reducing the need for manual data entry.

This automation for QuickBooks allowed their Accounts Payable team to process 50% more invoices in the same time without hiring additional resources.

2. Scaling up with business growth

As Happy Jewelers expanded, they faced the challenge of managing an increased volume of invoices from multiple sources. New invoice layouts and structures, different compliance requirements, and varying payment terms posed a significant challenge to the AP team. The manual invoice processing was proving to be a bottleneck.

The growing business demanded a more flexible solution than manual invoice processing. So, instead of expanding their AP team or hiring engineers to build basic workflow automation tools, they turned to Nanonets.

With Nanonets' pre-built workflows and AI models, they could adapt to different business needs. Moreover, the AI model learns from manual interventions and the data it processes — improving its accuracy over time and enabling businesses to process structured and unstructured invoices seamlessly.

Once set up, the system could automatically identify and classify the invoices, extract the necessary information, verify and validate the data, assign the invoices for approval, and synchronize the data with QuickBooks — making the invoices payment-ready faster than ever.

Each step would have taken hours if done manually. And their AP team would have had to double their workforce. Instead, they deployed the new workflow with Nanonets in less than 7 days from the signing date.

The flexible and scalable automation for QuickBooks reduced their document processing time by 90% and helped the team handle the expansion without increasing costs or resources, thus enhancing operational efficiency.

3. Integrated into QuickBooks without disturbing existing workflow

Happy Jewelers has been using QuickBooks for accounting for quite some time. They valued the convenience and familiarity of the software but were frustrated with the time-consuming process of manually entering invoice data. Ensuring seamless integration with QuickBooks' existing workflow was crucial for any new system they considered purchasing.

Nanonets, with its ability to integrate with QuickBooks, was a perfect fit. Happy Jewelers' AP Team streamlined the workflow to achieve 50% efficiency improvement. No matter where an invoice originates — be it email, Google Drive, or elsewhere — it's swiftly validated, categorized, and exported to QuickBooks. They could quickly transform raw data into a tidy Excel sheet that could be uploaded to the accounting software.

Once the two accounts are connected, Nanonets can automatically add SKU-level information in QuickBooks within seconds and match supplier and GL codes automatically. This can save the AP team from manually entering and matching the data, reducing errors and speeding up invoice processing.

Moreover, any changes made to the extracted data in Nanonets are reflected in QuickBooks in real-time without manual intervention.

The integration was seamless and didn’t significantly change their existing workflow. Instead, it enhanced the workflow by automating the time-consuming parts of the process.

4. Improved the team morale

Happy Jewelers is committed to ensuring the satisfaction of their employees. They believe it contributes to a more robust organization, resulting in better products for customers and better vendor relationships. However, the manual processing of invoices was a significant source of frustration for the team. It was a cumbersome process that left little time for more strategic tasks.

Understanding the need to improve employee morale and productivity, they implemented Nanonets. The AI-powered solution automated the clerical work associated with invoice management, like data entry, validation, categorization, matching, data synchronization, and more.

It could also eliminate the more tiresome aspects of the job, such as chasing down colleagues for approvals, detecting duplicate invoices, or updating suppliers on delayed payments.

The AP team immediately noticed a significant decrease in their workload. This not only improved their productivity but also boosted their morale. They could devote their time and energy to more meaningful and rewarding tasks.

The reduction of manual tasks and the improved efficiency led to a more satisfied and motivated team, contributing to Happy Jewelers' overall growth and success.

5. Enhanced compliance and audit readiness

The AP Team at Happy Jewelers spent significant time ensuring compliance and audit readiness. The manual processing of invoices, payment records, and other financial documents was time-consuming and prone to human error. This could open businesses up to potential penalties during audits and could negatively impact their reputation.

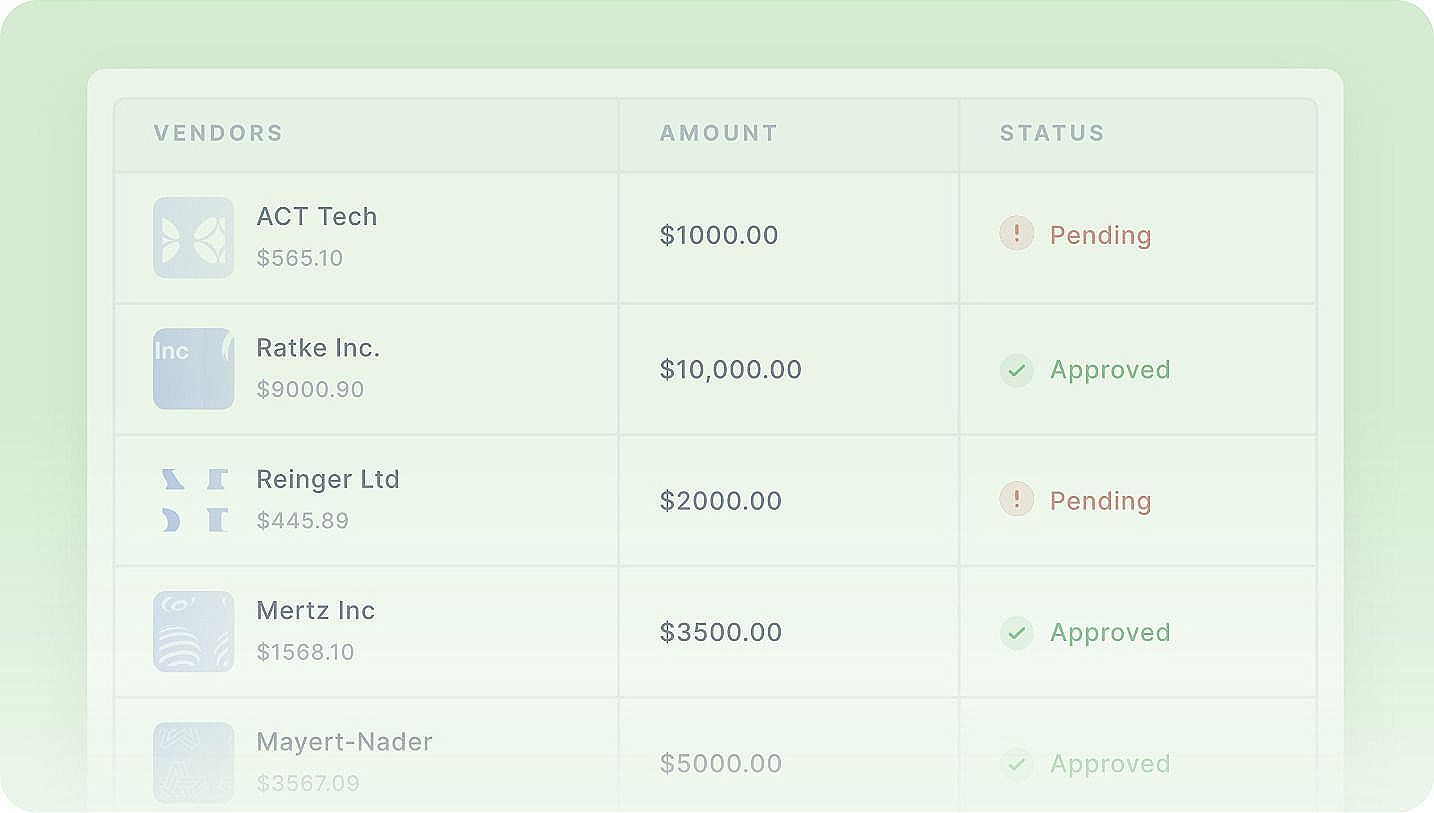

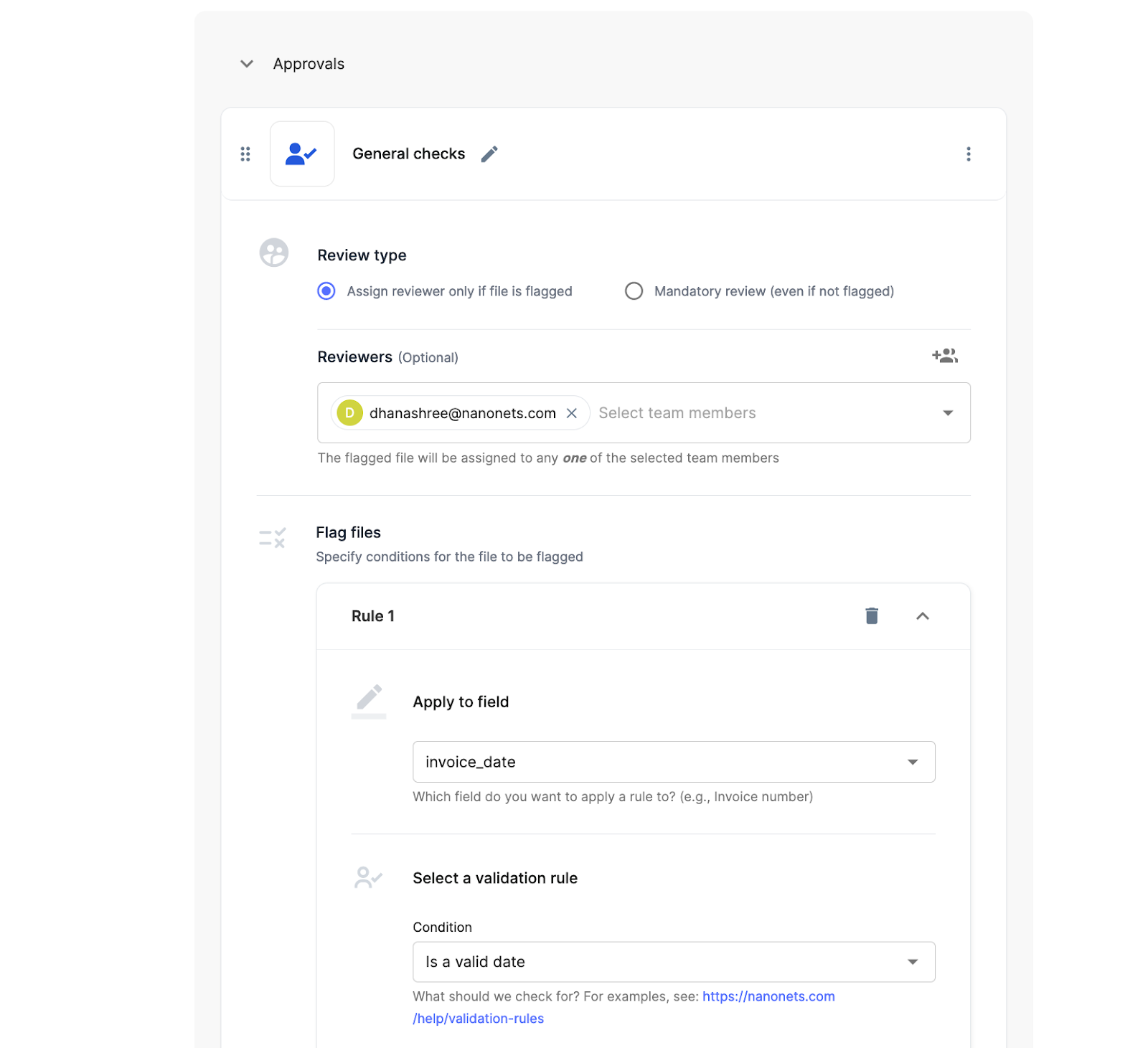

With Nanonets, the process of maintaining compliance became significantly more straightforward. The system automatically validates the data extracted from invoices against the company's internal policies and external regulations. If the invoice values do not match the purchase order or if other discrepancies pop up, the system flags these invoices for manual review.

Moreover, the inbuilt approval workflow feature of Nanonets ensures transparency and accountability in invoice processing. It reduces the chances of fraudulent activities and helps maintain a clear audit trail. This feature also allows supervisors to set up a custom approval hierarchy, ensuring all invoices are reviewed thoroughly before they are paid.

This helps to maintain accurate financial records and reduces the risk of compliance issues or audit failures.

Additionally, Nanonets' integration with QuickBooks allowed Happy Jewelers to sync payment records and other financial documents directly from the system into their accounting software. Once the invoices are reviewed and approved in Nanonets, the integration will automatically generate bills ready to send for payment.

This eliminated the need for manual data entry and significantly reduced the time spent on payment and maintenance.

This elevated level of compliance and audit readiness saved the team countless hours and brought peace of mind, knowing that their financial documents were accurate and easily accessible.

Nanonets' QuickBooks invoice automation integration: An implementation guide

Want to know how Happy Jewelers integrated Nanonets with QuickBooks so seamlessly? Here's a step-by-step guide to help you get started:

1. Access the Nanonets platform

You can visit our website and create a new account or log in to your existing account. You can either sign up using your Gmail account or manually enter your email and create a password.

2. Connect to QuickBooks

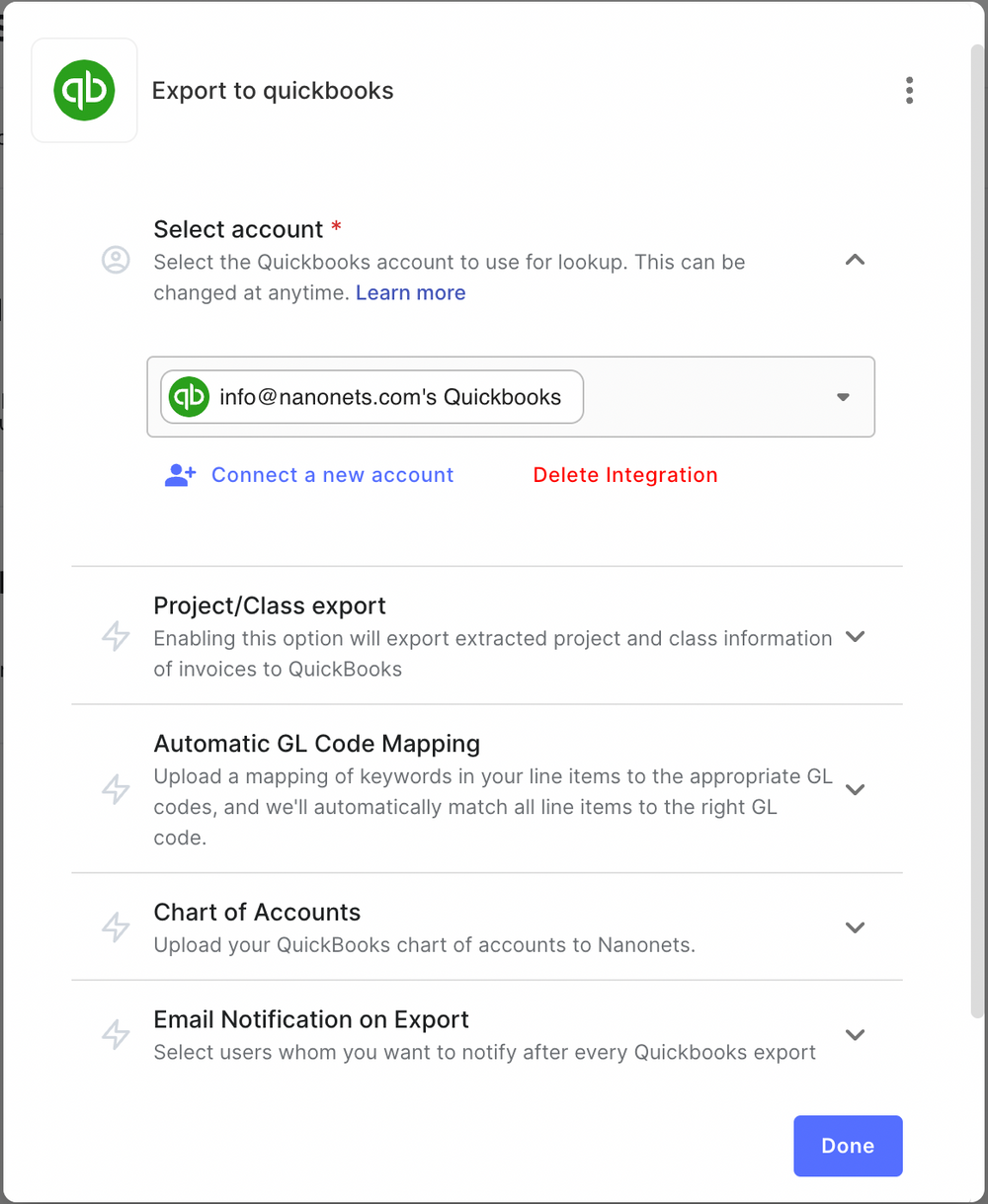

On the dashboard, navigate to Integrations -> QuickBooks. With a single click, you can connect your QuickBooks account to Nanonets.

3. Import your QuickBooks data

After connecting, your Chart of Accounts and General Ledger (GL) Codes from QuickBooks are automatically imported to Nanonets. If you use Classes and Projects, those are read and made available for your invoices as well.

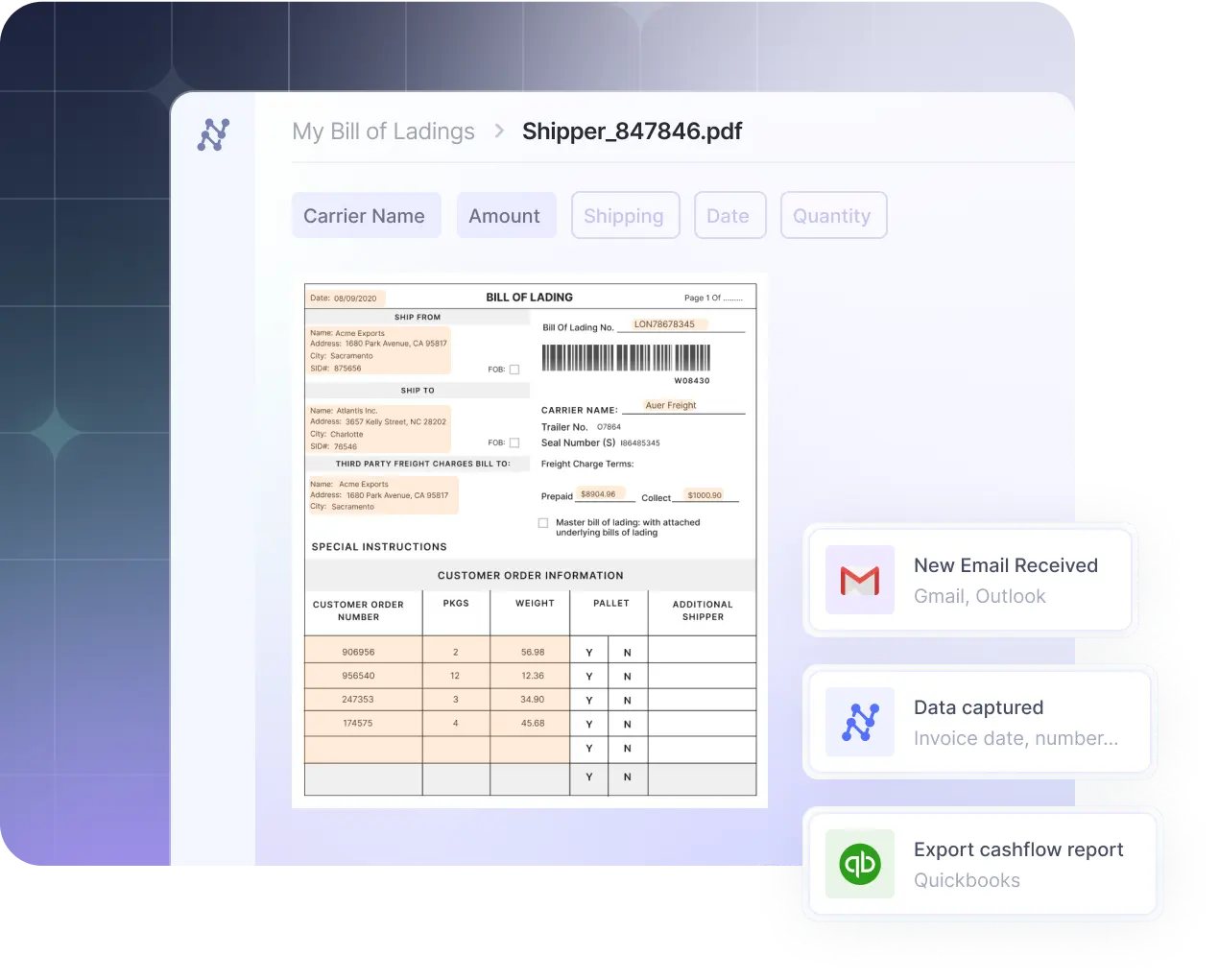

4. Upload or import invoices

Select the ‘Invoices’ model from ‘Document types’, configure the fields you need from the invoice, and the formatting. You can easily add invoices by uploading them manually or set up an automatic import from your email or other sources like Dropbox, Google Drive, or even your scanner.

5. Data extraction and review

Nanonets can capture 20 unique pieces of information, including table data, from invoices. Once the data is extracted, it is verified for accuracy. You will get notified and can manually review and correct the information if there are any errors or discrepancies.

6. Verify and validate data

Nanonets ensure the data is validated against set standards. For example, Nanonets checks if a given GL code exists in your database and is only valid if found there.

7. Set up approval workflows

You can add as many reviewers as you like for the approval process. Set up rules for each stage of review. For instance, you might want to trigger a review if the invoice amount exceeds $1000.

8. Perform matching

The Nanonets platform allows you to perform 2-way matching, 3-way matching, or GL code matching. You can add documents for matching (like blanket purchase orders) and verify if specific values, such as the grand total corresponding to a given purchase order number, match the value in the database.

9. Export to QuickBooks

Go to the invoice detail screen. You can download the data in various formats, including CSV and XLSX, or export it to a CRM or AP Automation software like QuickBooks.

10. Monitor and optimize

Finally, you can monitor the workflow's performance and make necessary adjustments. Nanonets provides comprehensive analytics on the dashboard, enabling you to track accuracy, processing time, and other vital metrics. This will help you identify any areas that might require further optimization.

Final thoughts

Embracing automation in invoice management, as Happy Jewelers did with Nanonets, can significantly enhance your business operations. It not only reduces the time and effort spent on mundane tasks but also ensures a high level of accuracy, compliance, and audit readiness. The seamless integration with QuickBooks further streamlines the process, making your financial management more efficient and reliable.

Remember, the key to successful digital transformation lies in choosing the right tools and implementing them effectively in your workflow. Doing so can free up your team's time, boost their morale, and ultimately contribute to your business's overall growth and success.

Can QuickBooks automate invoices?

Yes, QuickBooks can automate invoices. QuickBooks Online has a feature that automates recurring invoices, particularly useful for businesses offering services or products regularly. Other automation features include integrating other apps, such as Shopify and Stripe, to automatically generate invoices based on orders from these platforms. Additionally, by integrating with Nanonets, businesses can further enhance automation by seamlessly exporting approved invoices directly to QuickBooks.

Does QuickBooks have automation?

Yes, QuickBooks has several automation features. It can automate recurring invoices, schedule and automate billing, and export data from various platforms. With Nanonets integration, QuickBooks can automate data import such as Chart of Accounts and General Ledger (GL) codes, automatic approval workflows, and even the export of invoices.

Is there a way to automate invoices?

Yes, there is a way to automate invoices. QuickBooks Online provides a feature to automate recurring invoices. Additionally, it allows users to schedule and automate billing. For businesses using Nanonets, the automation process can be further improved. They can automatically import invoices, extract necessary data, validate this data, set up approval workflows, and directly export approved invoices to QuickBooks.

Can you automatically bill in QuickBooks?

Yes, you can automatically bill in QuickBooks. QuickBooks Online allows you to set up recurring invoices and enable Autopay, making it easier for your customers to pay. This feature is available for both card and ACH transactions. However, to allow Autopay to, a QuickBooks Payments account is required. Moreover, QuickBooks Online lets you create a recurring bill template and specify the frequency interval and start date, helping you better manage your billing tasks.

Can QuickBooks automatically generate invoice numbers?

Yes, QuickBooks can automatically generate invoice numbers. Whenever you create a new invoice in QuickBooks, it automatically assigns a unique number starting from 1001. However, QuickBooks also allows you to customize the invoice numbers according to your company's invoicing practices. You can turn on the 'Custom transaction numbers' feature, which introduces an 'Invoice no.' field in the sales form, allowing you to input custom numbers or letters. QuickBooks will then sequence your invoices based on the number you entered in this field.

How to automate invoice processing for received payments in QuickBooks?

To automate invoice processing for received payments in QuickBooks, you should take advantage of the following features and steps:

Autopay: Set up automatic payments for recurring invoices. This requires a QuickBooks Payments account and works for card and ACH transactions. By enabling Autopay, you can ensure fast and consistent payments from customers.

Integration with Nanonets: By integrating QuickBooks with Nanonets, you can automate the import of invoices, extract necessary data, set up automatic approval workflows, and directly export approved invoices to QuickBooks. This integration significantly reduces manual intervention and enhances the overall efficiency of your invoice processing.

Integration with other apps: Integrate QuickBooks with Shopify, Stripe, and Invoiced apps. This allows the automatic generation of invoices based on orders or transactions made on these platforms and the automation of Accounts Receivable (A/R) processes, such as sending invoice reminders, adding late fees, and sending paid notifications.