Download the expert's guide to Online Identity Document Verification

“May I see my ID card?”

Have you wondered why ID verification is necessary?

Personal identity is essential when describing individuals. Each individual has a specific identity. The attributes of a person’s identity are identical to others.

From taking admission to a school to opening a bank account, it requires a personal identity verification of the user. It has become a necessary part of our daily lives. Identity verification is necessary to ensure that the person is who they claim to be in real life and to eliminate the risk of data breaches.

However, online ID verification is also making its way into the digital world, with everything being digital.

Around 3.4 million identities were compromised in a breach in 2019. That’s huge!

Therefore, it has become more critical to manage identity risk online as cybercriminals are always looking for ways to temper people’s identities.

Read the article below to have an in-depth knowledge of online identity document verifications, their processes, different methods, and their future.

What is online ID verification?

Identity is a set of variables issued against a person and can be used to describe a person. These variables can be permanent characteristics such as names, dates of birth, fingerprints, etc. These variables can also include home addresses and phone numbers, which are not likely to change more often.

Online identity document verification is a digital process to verify a person’s identity over the internet.

With the growth of all-digital businesses, online ID verification has become a thing. There can be a threat of service misuse, identity personation, and money laundering. ID verification is necessary.

Read more: ID Card Digitization

Why is online identity document verification necessary?

Identity Fraud Cases increased to around 45% in 2020!

In 2021, Americans incurred a total loss of $56 Billion because of cyber identity theft cases.

Identity verification has gained importance due to the enormous losses incurred by taxpayers and companies. However, due to the risks involved, many companies or businesses still consider in-person ID verification, such as face-to-face identity verification or real-time checking of a person’s identity card. For example, this type of verification is required while opening a bank account or applying for a loan.

With increasing digitization, these document verifications need to shift online as in-person ID verification is not scalable and standardized. Due to this, organizations are open to trying online identity document verification methods. Online identity document verification speeds up the process, makes it error-free, and removes geographical boundaries. Though, it may come with its risks and challenges.

Read more: Ultimate Guide to document verification.

Automate the document verification process with intelligent document workflows in 15 minutes! Try a no-code workflow-based document automation platform,

Why do organizations need online identity document verification?

The number of smartphone subscriptions surpasses 6 Billion and is forecast to grow by several hundred million in the next few years.

With this increase in smartphones, people are connected to services over the internet 24/7. Customers can do international transfers, P2P payments, shopping, banking, and more conveniently and effectively with their smartphones.

More online services lead to more consumer data – thus increasing the need to protect that data from cybercriminals and people looking for identity theft. Therefore, organizations need online identity document verification.

Some of the main reasons to adopt online identity verification are listed below:

Data breaches & Fraud prevention

Increased data breaches and frauds have forced organizations to have online identity document verification processes with the highest security measures. However, the in-person verification might be non-standardized, leaving room for human error, whereas online ID verification methods can eliminate these errors.

Read more: 5 ways to stop vendor fraud

Growth in Online Channels

Consumers have moved dramatically toward online channels during the pandemic, and companies and industries have responded.

- 90% of consumers expect an online portal for customer service.

- 66% of consumers have used at least three communication channels to contact customer service.

With such a boom in digitization, organizations need to adopt digital channels to conduct various business activities like shopping, onboarding, payments, and more.

Compliance

Another reason is to comply with the regulatory framework.

Online Identity Verification systems like Nanonets maintain a log of all document activities and is GDPR compliant and SOC2 compliant, which helps make the organization ready for audit.

Frictionless customer onboarding

Organizations need online identity verification to help save customers a load of paperwork for identity verification and provide an experience of frictionless automated customer onboarding.

Read more: Deep dive into automated onboarding.

Authenticate identity documents & verify your customers or employees online with automated workflows. Set up your ID verification process in 15 minutes with Nanonets now.

No Code. No Hassle. No Credit Card is Required.

What are the benefits of online identity document verification for organizations?

Quick Turnaround Time

Online identity document verification provides a quick turnaround not only for organizations but also for consumers. Despite physically dropping the documents for verification and waiting for them to get authenticated, organizations and customers can have this verification done electronically in less time than required.

Improved customer experience

Customer experience has become the most exciting business opportunity for organizations. Today, customers want a customer-centric user experience and a great consumer experience that strives to eliminate all the barriers to give the consumer frictionless access to its services.

The term “frictionless” refers to organizations' simple and easy-to-access verification method. Consequently, providing an improved customer experience to their consumers.

Read more: 5 ways to implement RPA in Customer Service

Avoid fraud and money laundering concerns

Applying an effective identity document verification process can help organizations reduce or eliminate fraud and money laundering concerns. In this regard, businesses use two-factor authentication methods for the ID verification of their consumers.

As more and more transactions happen online, having authentic ID verification processes will help businesses eliminate data breaches in their organization.

Easy to use

If you use a document verification solution, then verification of identity documents can be done more efficiently and effortlessly.

Improve and Maintain Reputation

It is essential to improve and maintain a reputation for businesses. With several online options, it is effortless for customers to hop from one brand to another.

Having an authentic identity document verification process makes customers believe in your business and that you care for your customer’s security and privacy. This improves and maintains the reputation of your business and makes customers trust your brand.

What is the online identity verification process?

A person must undergo an identity document process to verify their identity. A typical Identity verification process includes the following.

A User

A user is a person who wants to verify himself over the internet to use the services of the business. In this regard, he will provide his identity claims. Also, he will present trusted credentials to get verified by the platform.

Account grantor

An account grantor is a person who uses the user resource data to confirm identity claims provided by the user. A third-party verifier does this. Once the credentials provided by the user are verified, the account grantor determines the probability of impersonation or credential fraud. After that, the user is granted access to the account.

Third-party verifier

A third-party verifier is a database present against the user credentials. It can be an ID card issued by the government or online records in the government's database.

In the case of online identity document verification, this process is done through Artificial Intelligence (AI) and Machine Learning (ML). The user provides credentials online, and the account grantor is the AI of the website that will verify the user's credentials online through a third-party verifier, an online database against that user's identity.

There are many methods and solutions to verify identity documents online. We will discuss those methods later in the article.

Want to automate repetitive manual tasks? Check out Nanonets. Use workflows to verify invoices, identity cards, or any document on autopilot!

What are the different approaches to ID verification?

A risk-based approach to identity document verification is what businesses need to adapt to nowadays. When taking this approach, the methods you use must match the risk level. The risk level will likely change with the constantly evolving technology, regulations, and consumer behavior. To have a risk-based approach for ID verification, it is essential to think about the following different things for an ID verification.

Flexibility

A risk-based approach requires an agile, agile identity verification method that can adjust with your process as business needs change.

Reliability

It must be reliable enough to evaluate previous attacks or historical breaches to ensure future safety through identity document verification.

User experience

Customers who face too much friction in the signup process are more likely to drop off. Providing an easy-to-use ID verification process enhances the user experience.

Cost

Keep in mind the costs you incur when ensuring user security over the internet.

Pervasiveness

To check and balance the widespread coverage of the approach you are trying to verify. For example, many businesses are global, but having a local system won’t work.

What are the different methods to verify online identity documents?

There are many different methods to verify identity documents online, and they all work differently. Let’s have a look at these methods.

Two-Factor Authentication

This is a standard type of verification method. However, it requires you to add your username and password. In addition to this, it asks for another step for verification and adds something that can belong only to you. Thus, making it almost impossible for hackers to steal your data.

Knowledge Authentication

Knowledge-based authentication is also known as KBA. It is generally used by a financial institution or website whose services you want to access. This authentication process requires the user to provide personal information to prove that the person is the owner of the identity. It consists of two types of KBA; static KBA and dynamic KBA.

Biometric Verification

Every person has some unique traits which can’t be attributed to someone else.

These unique traits include fingerprints, retina scans, facial characteristics, and voice patterns. Biometric verification is the verification of these unique traits recorded against a person’s identity.

It must be noted that these traits can be verified only if they are previously captured or recorded by a trusted authority. Therefore, biometrics can not be claimed as an initial identity verification method. Instead, they are used as a second step for identity verification for a returning user to authenticate other identity credentials.

One-Time Password (OTP) Verification

One-time Password verification is a well-vetted way of online identity document verification. This method sends an OTP to your mobile phone or email address to verify your identity before accessing an account.

It is great as anyone cannot access your mobile phone. Also, the OTP will not work later once it is used. However, OTP verification will not work if you don’t have your mobile phone or your email address was hacked.

Credit Bureau Authentication

In this authentication method, a credit bureau is responsible for verifying your identity on your behalf. This is a secure way to verify your ID but it can take longer.

Database Authentication

Database authentication is a process that validates that the person trying to log in to an account is the owner of that account. It generally includes the data taken from your social media handles, such as Facebook or Google.

ID Document Verification

ID document verification is a way to check whether a person’s identity document, for example, an ID card, passport, or driving license, is valid and authentic. This helps differentiate between real and fraudulent.

Zero-knowledge Proof

Zero-knowledge proof is one of the advanced ways to verify identity documents. This method uses a cryptographic approach to authenticate a person's identity without providing additional information to the verifier.

Let's explain this with the help of an example. For example, a bartender wants to know your age before serving you. In most situations, a person will provide his ID card or driving license to prove his age is above 21. And doing this will also reveal their additional information, such as name, address, etc. However, zero-knowledge proof lets the person prove their age to the bartender without revealing any further information.

This is how Zero-knowledge Proof works. It lets you verify your identity without revealing the actual information.

Automate identity document verification in 15 minutes with Nanonets. Try it yourself. Start your free trial.

When & where is online identity verification mandatory?

Users expect you to protect their privacy and security and protect their identity while they use your services. They hold you responsible for this. Consumers will abandon an organization or business that cannot protect their identity and can easily fall prey to losing their consumer data.

To ensure a relationship of trust among users and protect their identity in this era of data and security breaches, it is mandatory to find a modern solution that provides both security and less friction for users. Some identity verification use cases are listed below.

Banking and Finance

It includes banking procedures, such as bank account opening and financial procedures for online sales and purchases.

Government and Public Administration

For the renewal or issuance of

- electronic certificates

- identity documents

- identification to create accounts on government websites

- Documentation for medical applications, etc

These are a few use cases of ID verification in Govt and public sectors

Telecommunication Industries

It includes sales and purchases of products and services and other online operations.

Retail

Online identity document verification can be used in retail outlets to verify customers and provide appropriate loyalty rewards as required.

Financial Services

Identity theft plays a crucial role in the financial services industry. In order to process claims, credit underwriting, pricing, and other factors, financial services organizations need to identify the customers, their previous habits, and other variables in order to provide better services.

Healthcare

Healthcare is a largely paper-based industry. Digitizing patient identity document verification can accelerate patient treatment. Automated and digitized ID verification can reduce patient wait time, enhance patient experience and reduce care staff workload.

Looking to document verification software?

Try Nanonets and verify 10,000+ documents daily with no-code workflow automation. Trusted by 500+ enterprises.

What are the different use cases for Online ID Verification?

Online identity document verification can be used at multiple customer lifecycle stages. These use cases include:

Account opening

Customers are willing to work with banks and other service providers that are not within their physical range. It provides them with a wide range of offerings. Banks and other consumer marketers can take advantage if they have a quick, easy, and secure online account opening experience.

Customer onboarding

Nowadays, retailers and other consumer marketers have an online digital presence for their businesses. Connectivity with customers is increasing rapidly so is the field of competitive offerings. Having a verified and well-managed customer onboarding plan is the key to cross-selling and up-selling strategies.

Employee onboarding

Employee onboarding is also a typical phase of ID verification. A sleek ID verification method helps in efficient employee onboarding and registering existing employees to give them access to apps, networks, and administration.

Want to automate identity document verification? Use Nanonets document management software to Save Time, Effort & Money while enhancing efficiency! See how it works!

What is the future of Identity Document Verification?

Identity document verification plays an essential role in the digital economy. With the increase in the products and services offered online, consumers want seamless connectivity to those services and products. Moreover, they want all this without compromising their identity and security.

On the other hand, businesses, too, want to know who they are letting in through the door means using their products and services. This freedom of privacy and security can be achieved through digital identity. This trend will continue, and Digital identity document verification will be the future – the key to more convenient and quick access over the internet while not compromising on privacy and security.

In this regard, a decentralized approach will help protect identity over the internet. By doing this, consumers will get privacy, security, and quick access to digital products & services. Alternatively, businesses benefit from this while gaining access to more people.

Developments in identity verification will profoundly impact how we see digital identity today. The new approaches will allow us to fight with bad actors and provide security and make our lives more convenient. Let’s have a look at some of these innovations.

The rise of digital IDs

The traditional methods of identity document verification will become outdated in the digital world. ID documents (such as ID cards, driving licenses, passports, etc.) are currently issued in a physical format. A centralized system delivers these documents and follows strict measures to ensure security and privacy.

Today, many experiments are shifting physical identity cards to digital IDs as more services are delivered online. For example, the Digital Identification and Authentication Council of Canada (DIACC) is doing many experiments to develop Canada's system for digital identification.

However, when it comes to digital IDs, maintaining high levels of security is a big challenge, as they can be easily forged or counterfeit if not secured properly. There might not be a perfect solution for this right now, but it will find its way in the future.

Decentralized models will replace Centralized ones.

Centralized databases limit user control and create security issues. For example, in a centralized database, such as a credit bureau, the data of all the users are stored in one place. So, if one person's data is hacked, other users' data will also be at risk.

Alternatively, decentralized databases will allow users to control their identity with no third party involved. Due to decentralized models, consumers will be able to have control over all their legal activities. Also, there will be no need to share your information every time you sign up.

Biometrics

There have already been some developments when it comes to biometrics. However, biometrics are here to stay for longer than expected. Their use will only increase in the future with some latest developments. With an increase in the usage of biometrics, pins and passwords are more likely to become a thing only in the past.

Biometrics are hard to temper. It will be hard to carry out fraudster attacks due to biometrics. Behavioral biometrics is also making its way in the future of using biometrics. Behavioral biometrics is the study of analyzing a person’s unique cognitive behavior. It will help distinguish between criminal activities and legitimate customers.

Artificial Intelligence (AI)

Artificial Intelligence (AI) and Machine Learning (ML) will play a key role and will be the future of identity verification and fraud prevention. By using AI and ML, businesses can protect their user identities. An increase in the use of AI will not only make customer onboarding faster and more secure but also reduce fraudulent attacks.

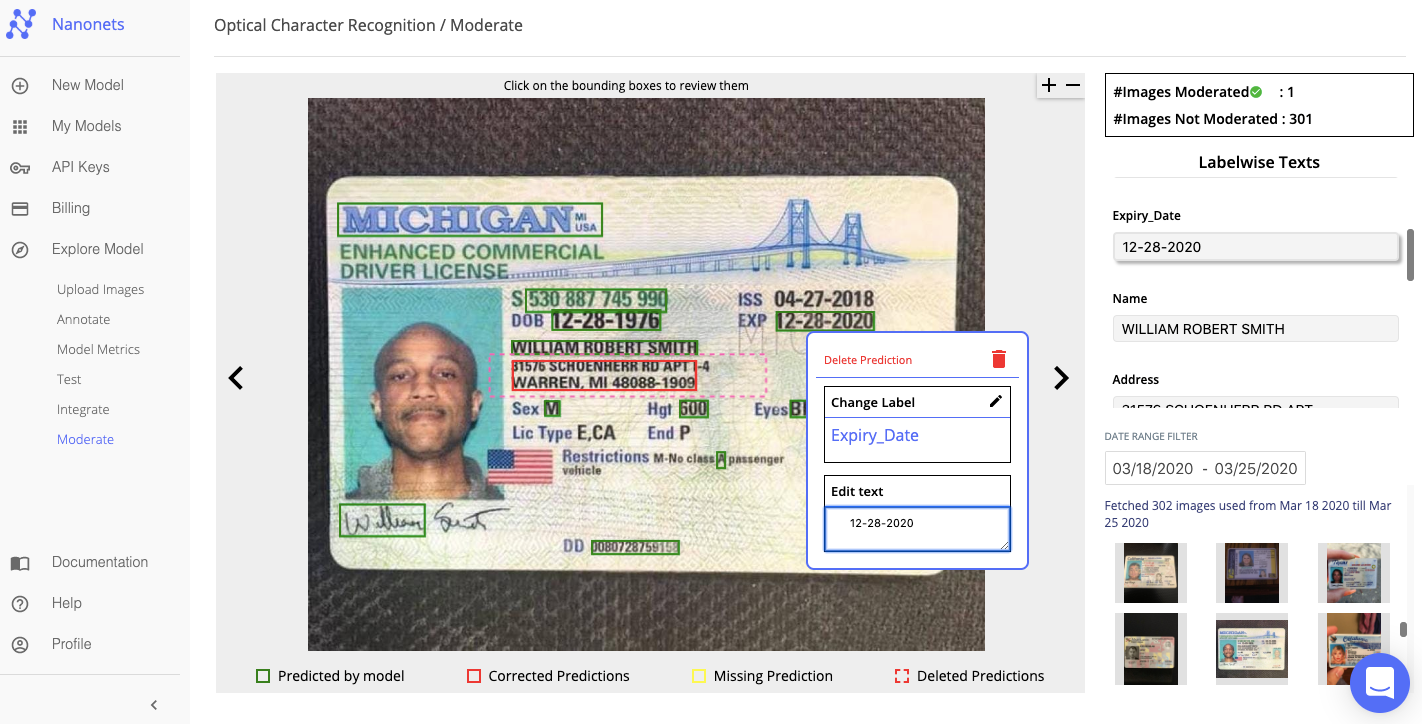

Nanonets for Online Identity Document Verification

Nanonets is a no-code workflow base intelligent document processing platform. Nanonets can digitize identity documents like passports, driver's licenses, Aadhar cards, or any other KYC documents. Over 500+ organizations use Nanonets to process documents online.

Nanonets are best suited for online identity document verification for various reasons:

- No code platform

- Modern User Interface

- 1 Day Setup

- 24x7 Support

- 200+ Languages supported

- Identifies multi-lingual documents

- Create document workflows with no coding

- SOC2 and GDPR compliant

- Role-based access

- Document Storage

- Classifies documents automatically

- Easy workflow management

- End-to-end document management

- 5000+ integrations

- Transparent Pricing Plans

Intuitive UI

Nanonets have a very intuitive interface with almost zero learning curve, making it easier for your employees to learn.

On-premises solution

Nanonets models could be configured to run on-premises using docker containers so that user data never leaves their infrastructure. Nanonets also support integrations with the internal stack so that ID cards can be processed in real-time.

Nanonets is an easy-to-use platform. Get started with a free trial or let our automation experts give you a free product tour!

Conclusion

It's time that you start thinking about managing and leveraging these digital identities. Make sure to have the technology to cope with this. Moreover, design your digital identity methods while keeping your customer in mind. Consumer experience is everything. Lastly, stay in touch with the latest industry news and research so that you don’t stay outdated regarding digital identity document verification.

The time is not far from when we will see the rise of digital identity, biometrics, AI, and the shift from a centralized model to decentralized frameworks to benefit consumers, businesses, and regulators equally.

Want to automate identity document verification? Use Nanonets document management software to Save Time, Effort & Money while enhancing efficiency! See how it works!

20 September 2022: This blog was originally published in May 2022 and was updated in September 2022 with updated content.