Does managing invoices and accounts payable in Xero feel like a never-ending task? Manual data entry, approval delays, and the ever-present risk of human error can make even the most robust accounting software feel limiting.

Here’s the good news: pairing Xero with OCR and invoice scanning software can change the game. By automating tedious AP tasks, you’ll not only save time but also improve accuracy and efficiency across your financial operations.

Tools like Nanonets take this a step further, seamlessly integrating with Xero to make invoice processing faster, smarter, and hassle-free. Ready to see how it works and how you can set it up for your team? Let’s dive in.

Manual AP Workflow in Xero

Let's walk through the typical manual AP process for a company using Xero:

Invoice Receipt

Invoices arrive in various formats, including paper and digital. Staff must manually collect and organize these documents.

Manual Sorting and GL Coding

Each invoice is then sorted based on criteria such as vendor, amount, or due date, requiring significant time and effort. Each invoice must then be coded to the appropriate General Ledger accounts.

Data Entry

Critical information from each invoice, such as vendor details, amounts, and dates, is manually entered into Xero.

Invoice Verification

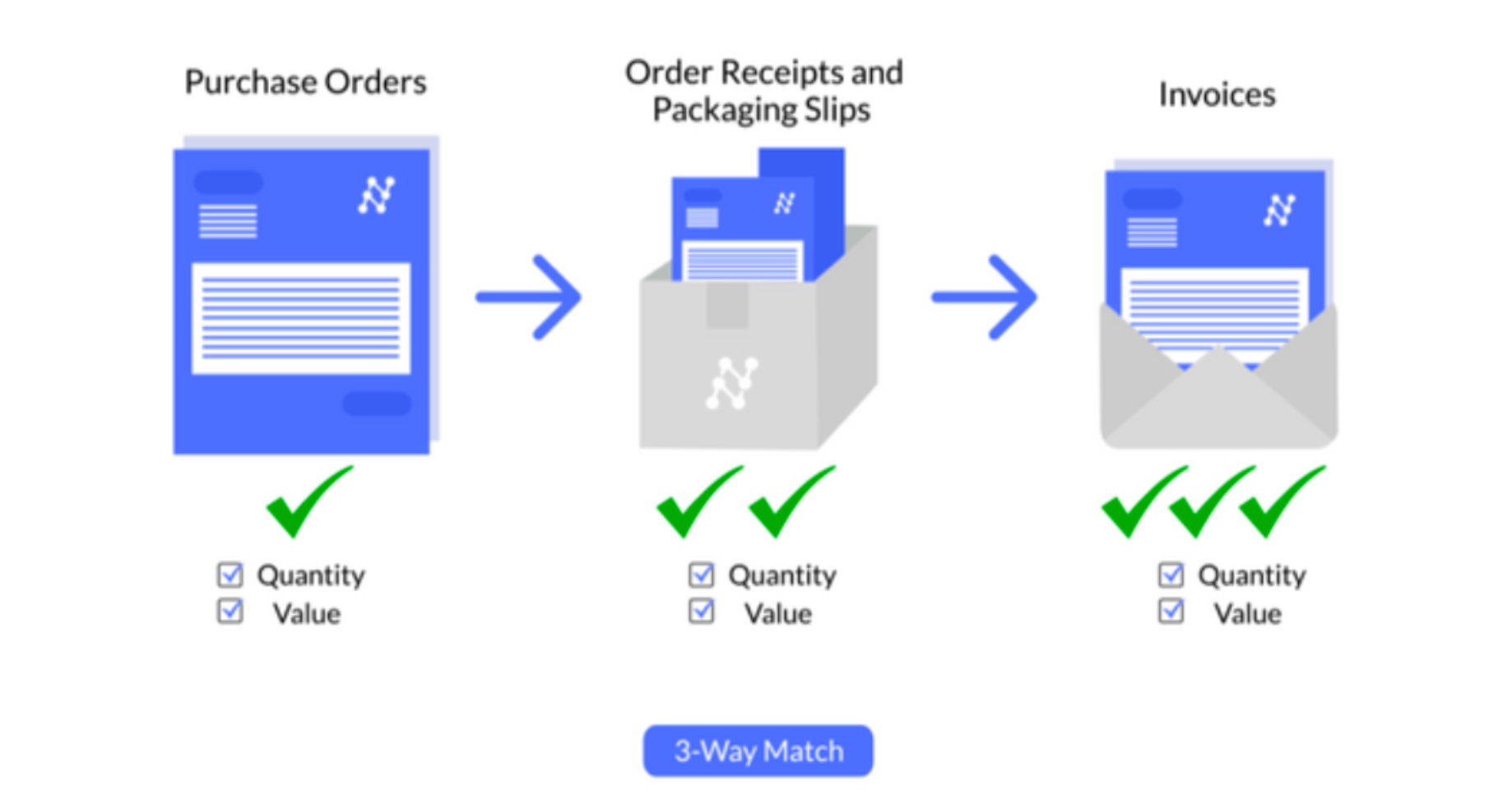

Depending on the company’s policies, invoices may undergo two-way (invoice and PO), three-way (invoice, PO, and receiving report), or four-way (invoice, PO, receiving report, and inspection report) matching to verify transactions.

Approval

Once verified, invoices are routed for approval, often involving multiple departments or levels of authority.

Payment Processing

Approved invoices are scheduled for payment based on terms and cash flow considerations.

Reconciliation

Finally, payments are reconciled in Xero, ensuring that all transactions are accurately reflected in financial records.

Nanonets for OCR and Invoice Scanning in Xero

For companies utilizing Xero for their accounting needs, the manual process of handling invoices is not just a test of patience but also a significant drain on resources. An OCR and Invoice Scanning Software for Xero transforms this critical yet cumbersome process into a streamlined, efficient workflow.

Let's take a look at how accounting teams can use an OCR-based AP automation software like Nanonets and integrate it with Xero to streamline their accounting workflow.

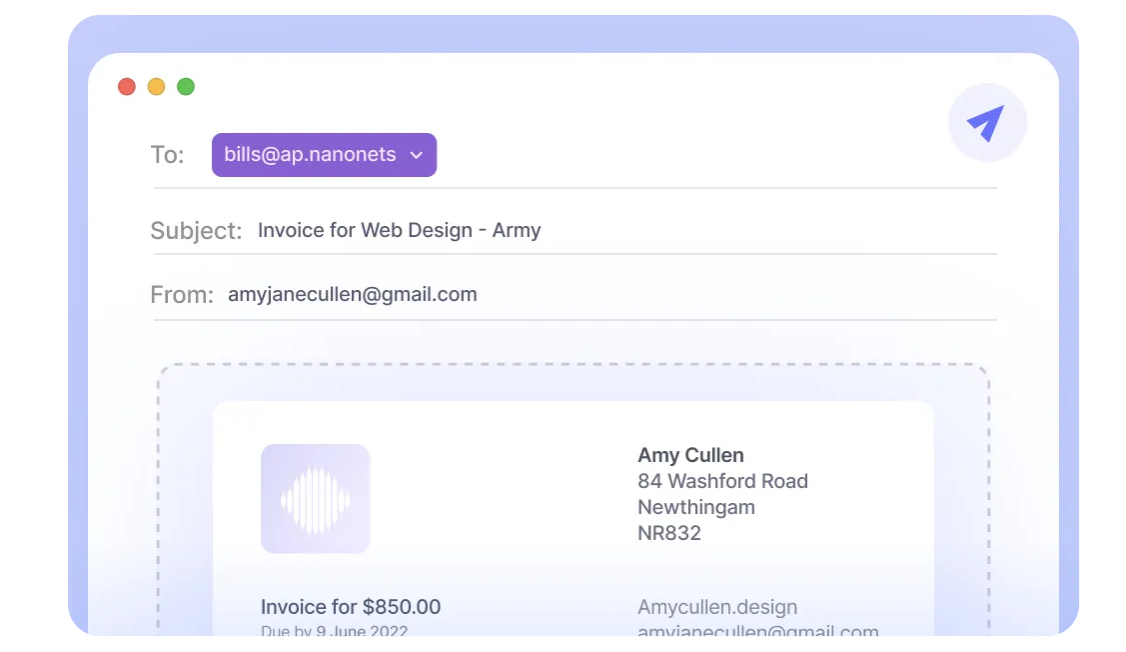

Automate invoices received

Picture this- every invoice your business receives, regardless of its source, lands neatly in one digital spot. Invoices are automatically imported from the mess of emails, drives, and databases as soon as they arrive, saving you time and reducing mistakes.

Nanonets automatically reads emailed invoices from email body and attachments.

Scan invoices into Xero

All handwritten and printed invoices can be easily scanned using a smartphone and directly uploaded to the platform.

Digital receipts can either be created and printed directly using the Nanonets platform, or imported into Nanonets from your mail, apps and databases.

This process ensures that every piece of data, regardless of its origin, finds its place in a centralized, digital repository, ready for further action.

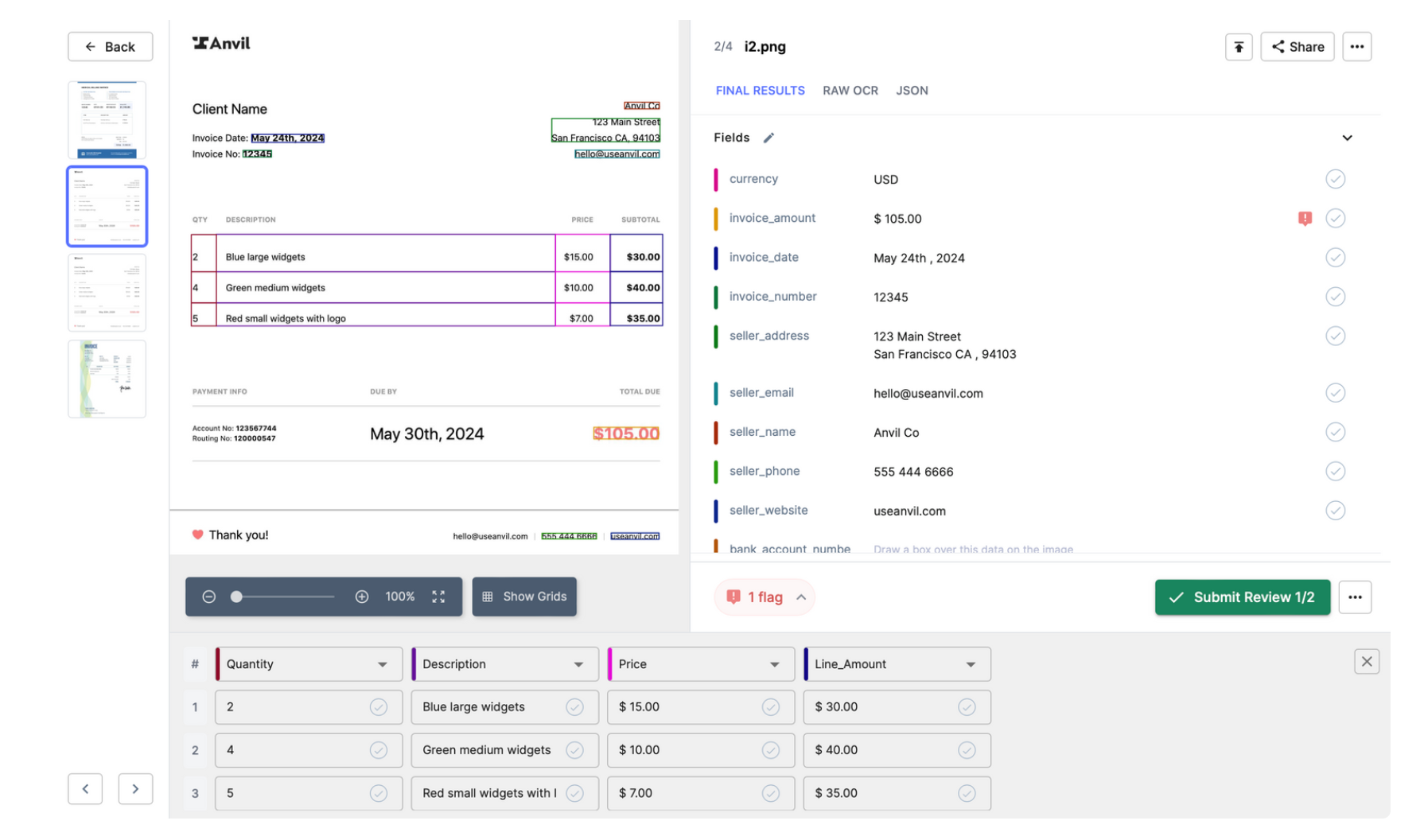

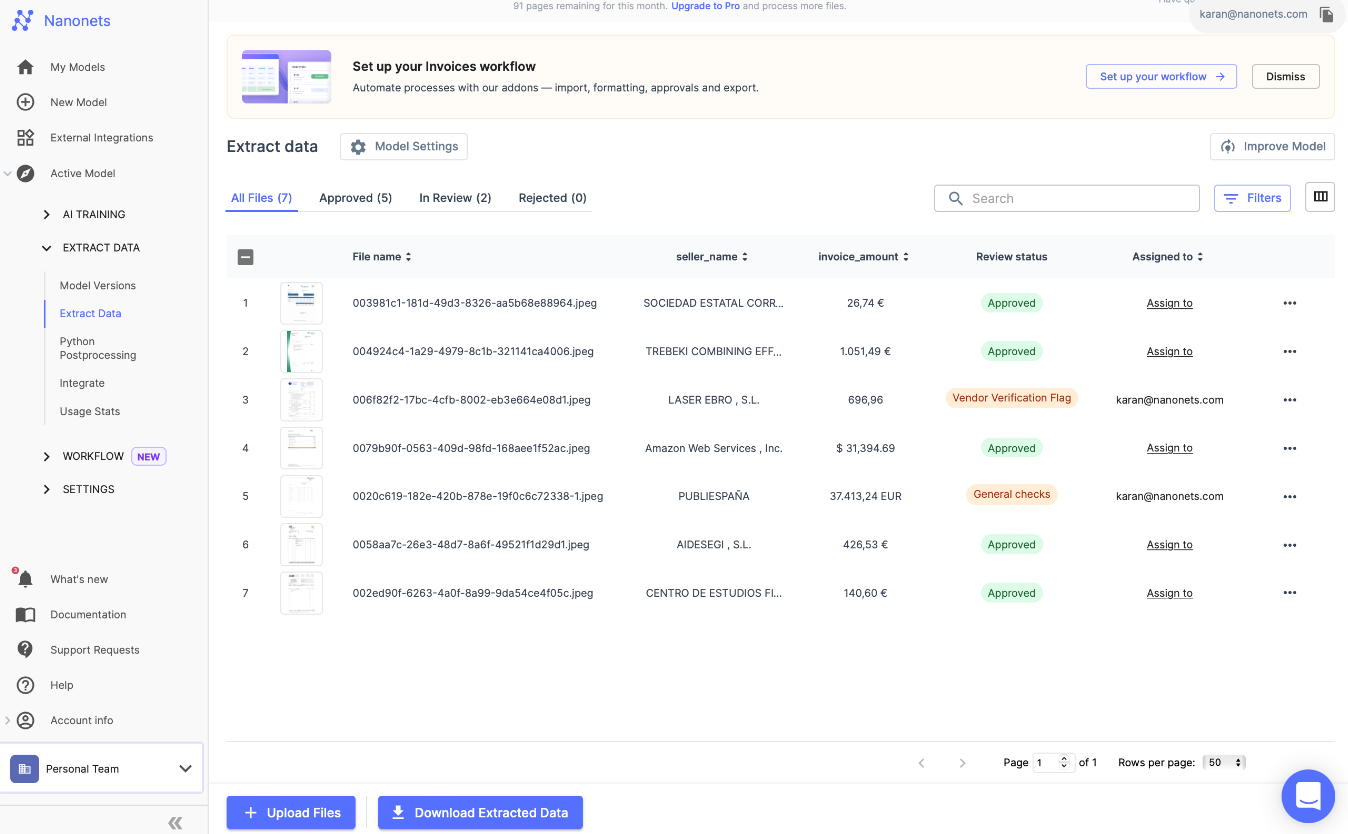

Automate Data Extraction from Invoices

Nanonets AI reads invoices with over 99% accuracy, cutting down the hours to mere moments. This change means your team can ditch the drudgery and dive into work that actually matters. Data is then extracted and directly inputted into Xero, with no manual data entry required.

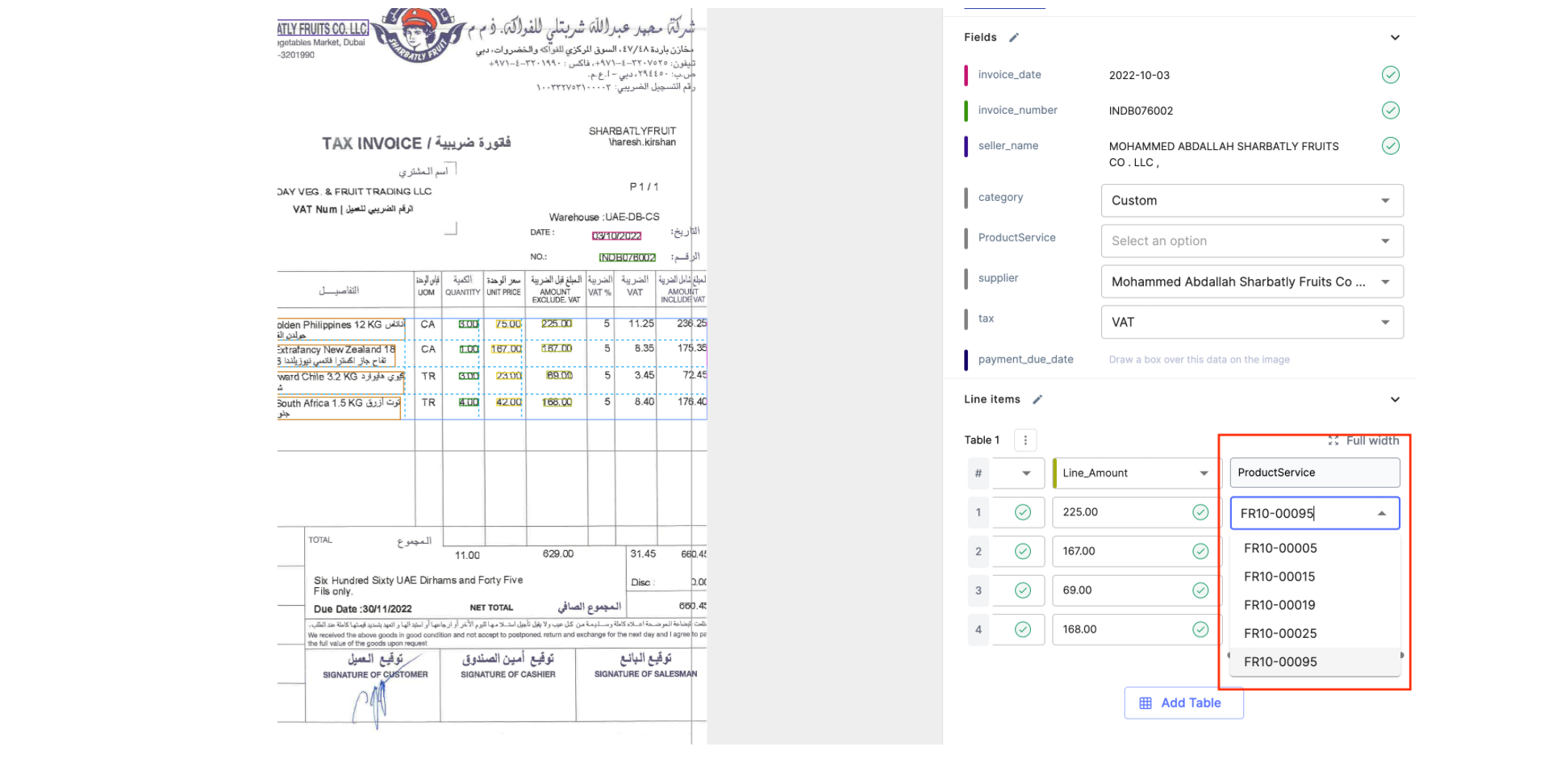

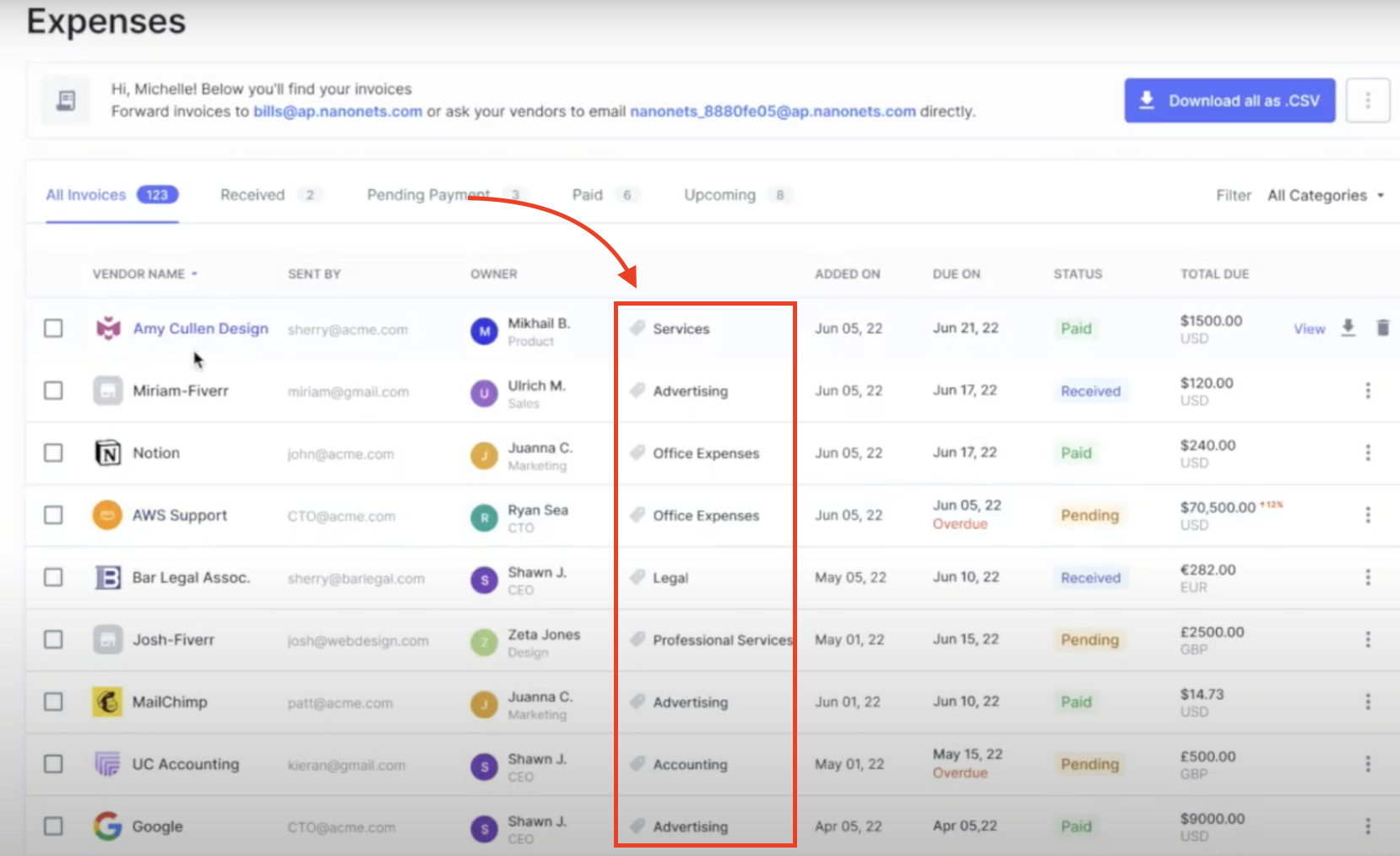

Automate Sorting and GL Coding

Nanonets uses OCR to automatically recognize and categorize invoices by vendor, date, amount, and other relevant criteria. GL code assignment can be automated by -

Training on past data

This involves uploading historical financial documents and transactions tagged with historically correct GL codes. The model learns from these examples to accurately predict GL codes for new transactions.

Out of the Box Gen AI

By using Nanonets GenAI, our software can interpret the text on financial documents in a way that mimics human understanding. This allows it to extract relevant information, context and semantics in order to apply complex reasoning to assign GL codes accurately, even in cases where transaction details are ambiguous or sparse.

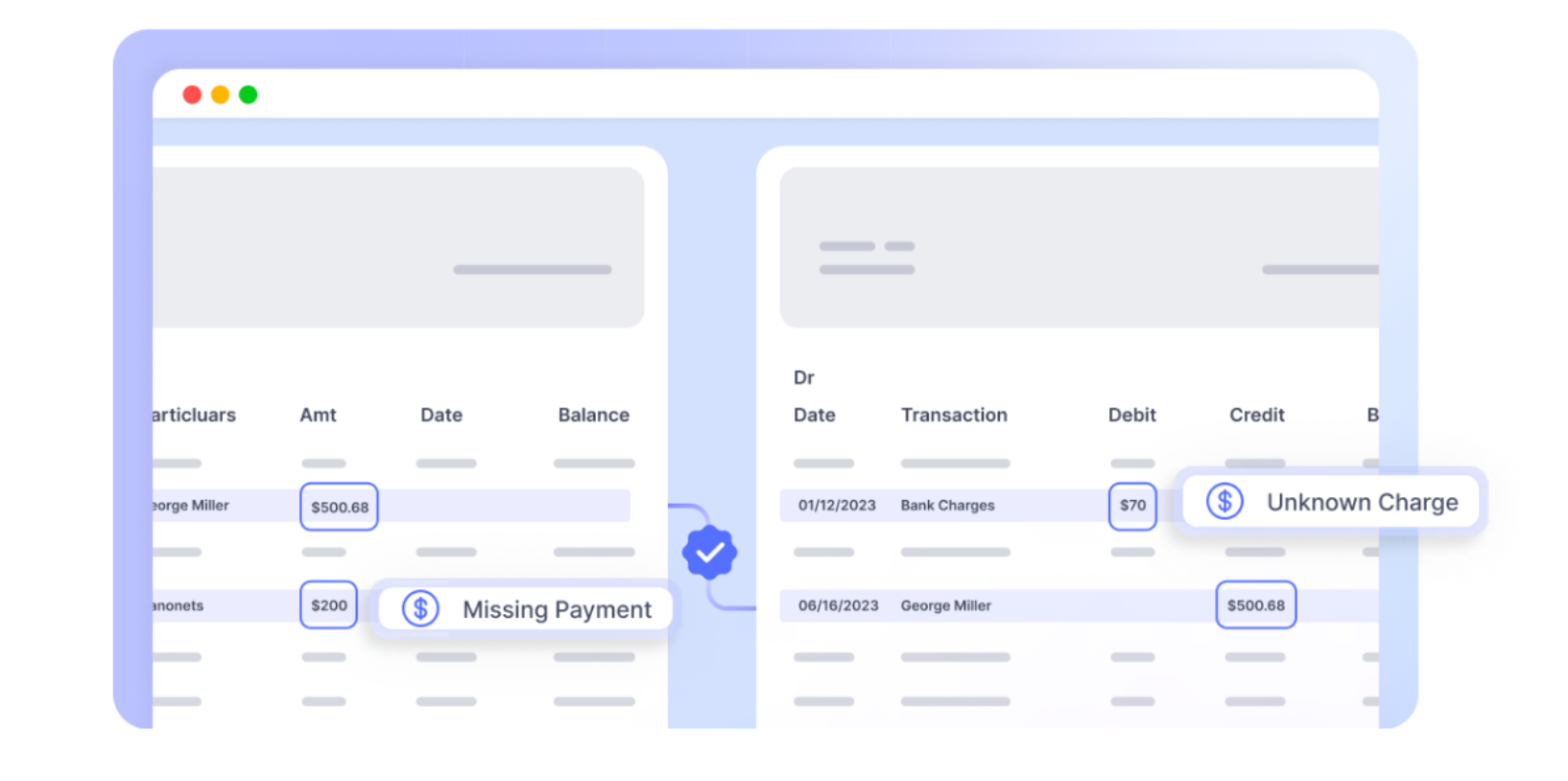

Intelligent Invoice Verification

Leveraging AI, Nanonets automatically performs two-way, three-way, or four-way matching by reading and cross-referencing the extracted invoice data with purchase orders, receiving reports, and inspection reports present in Xero.

Invoice validation

The system flags any discrepancies for human review, but otherwise, invoices that match company criteria are automatically routed for approval or directly approved based on pre-set rules.

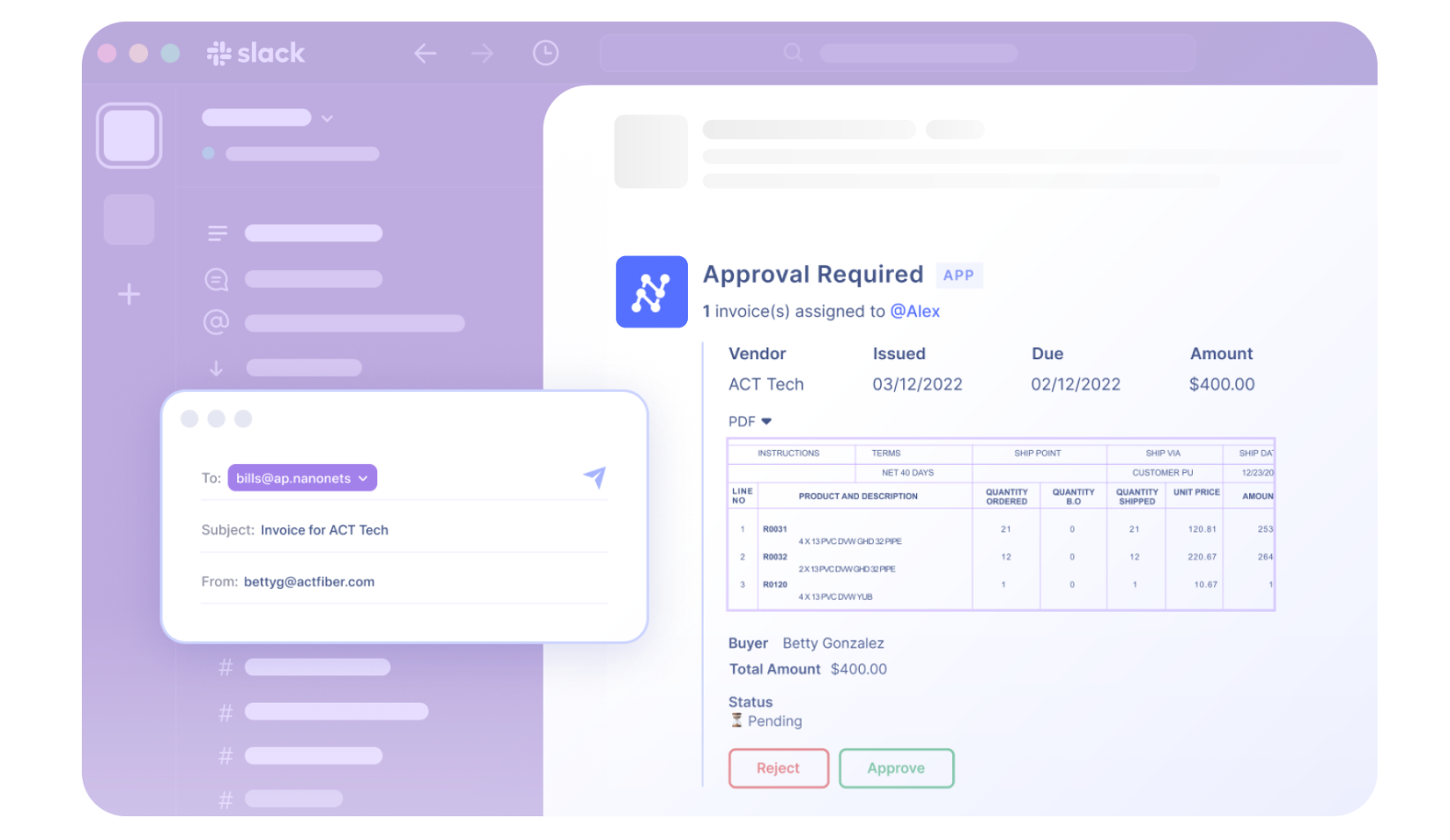

Automate Approvals

Approvals with Nanonets are no longer a bottleneck. They become flexible and live where your organization does—whether that's on email, Slack, or Teams. This eliminates the need for disruptive phone calls and the all-too-familiar barrage of reminders.

Automate Payment Processing

Approved invoices are automatically queued for payment according to their terms, optimizing cash flow management.

Reconciliation

You can import your bank statements, and Nanonets reconciles the payments automatically in Xero, ensuring that financial statements are up-to-date and accurate, and your books close 90% faster.

We discussed the tangible benefits of using OCR and Invoice Scanning Software for Xero earlier. But on top of that, the transition from a manual to an automated AP process represents not just a shift in how tasks are performed but a fundamental transformation in the role of the finance department. With tools like Nanonets, finance teams move from back-office functions to strategic contributors, leveraging real-time data and analytics to drive business decisions. This is the future of finance, and it's available now for Xero users through the power of automation with Nanonets.

Steps to Integrate Nanonets for Xero

You can integrate Nanonets with Xero, and start using the platform to automate your invoice processing and AP workflows. Her's how to get started -

- Sign up / Login on https://app.nanonets.com.

- Choose the Invoices pre-trained model.

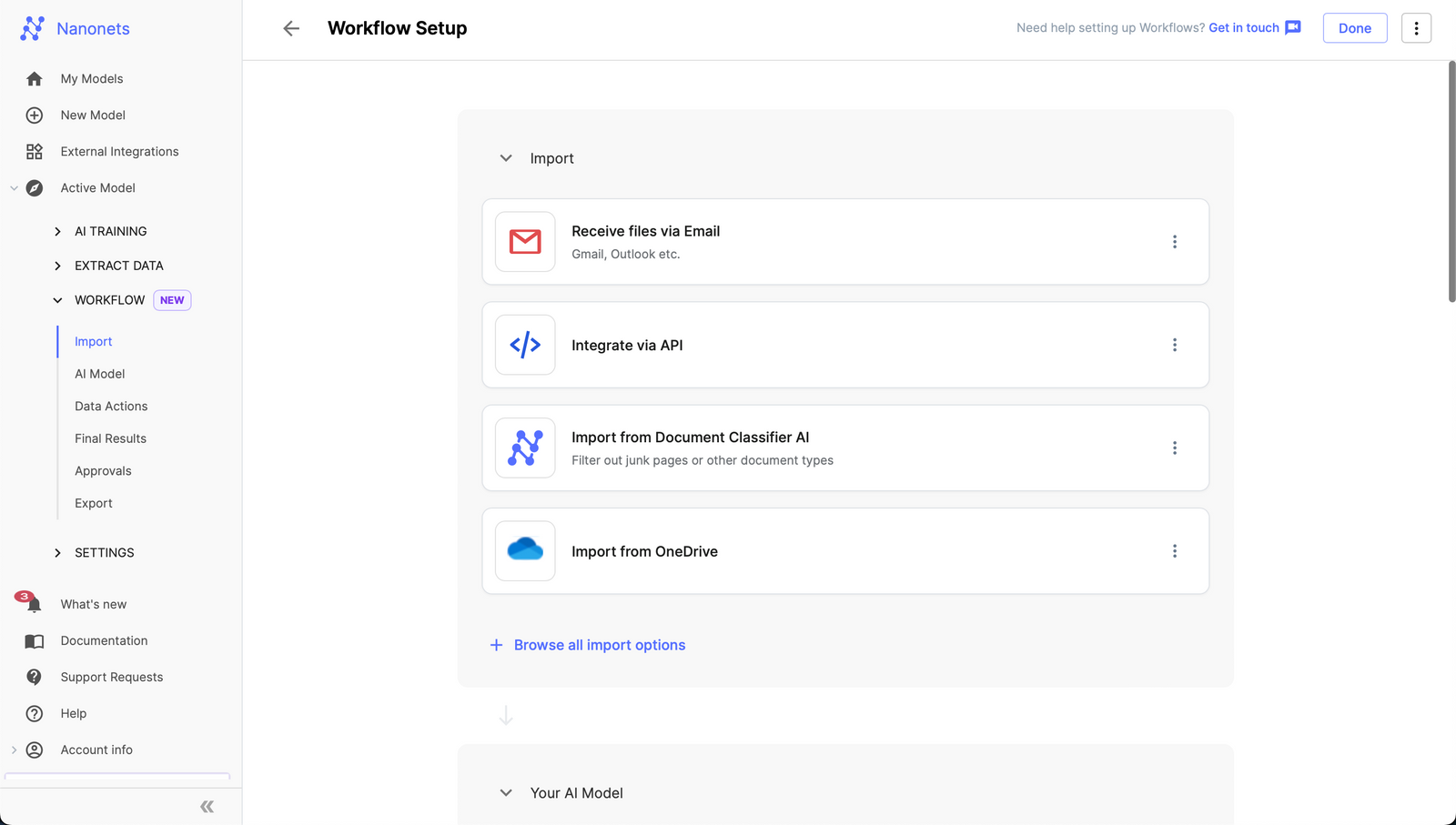

- Once you have created the model, navigate to the Workflow section in the left navigation pane.

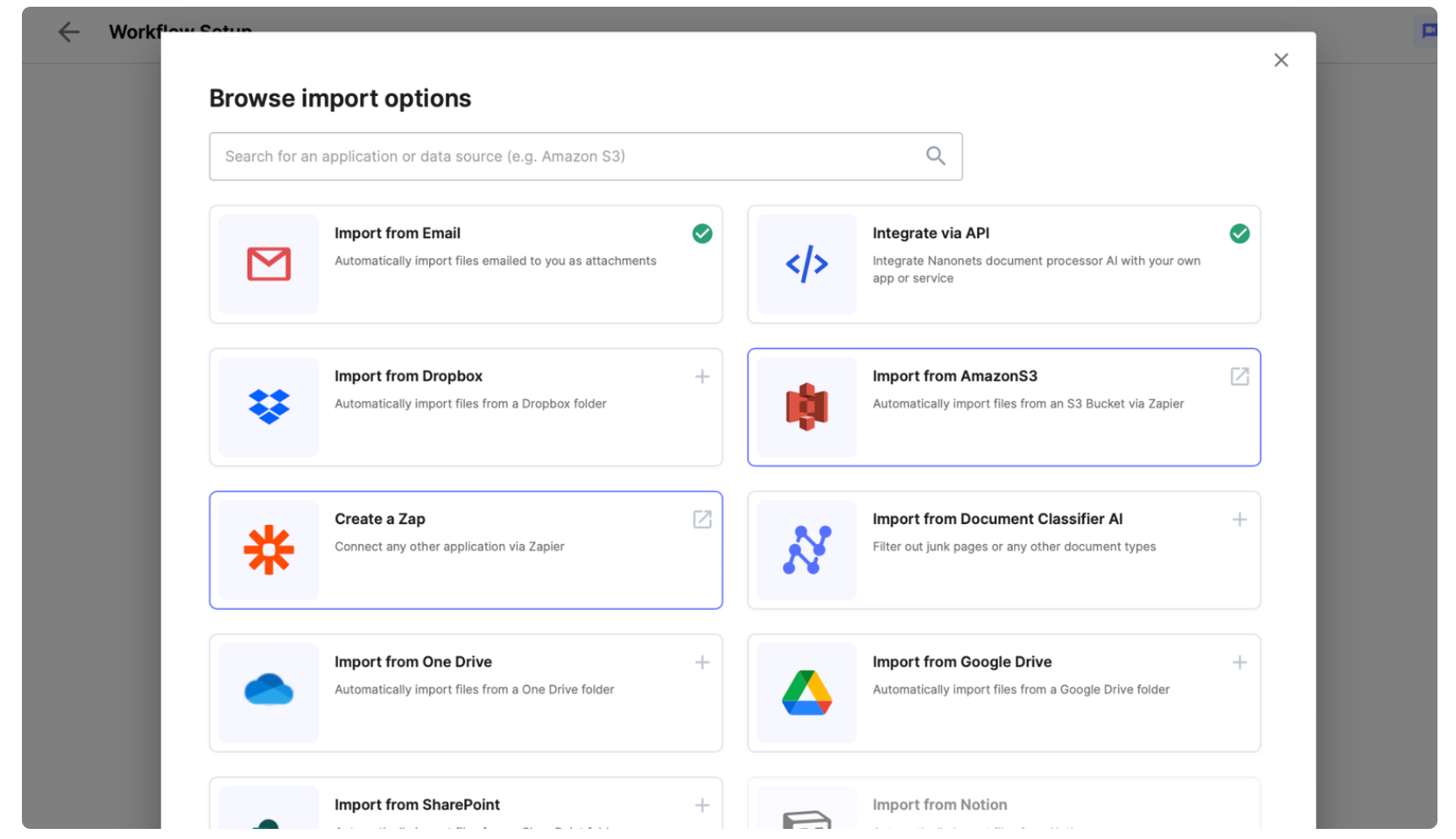

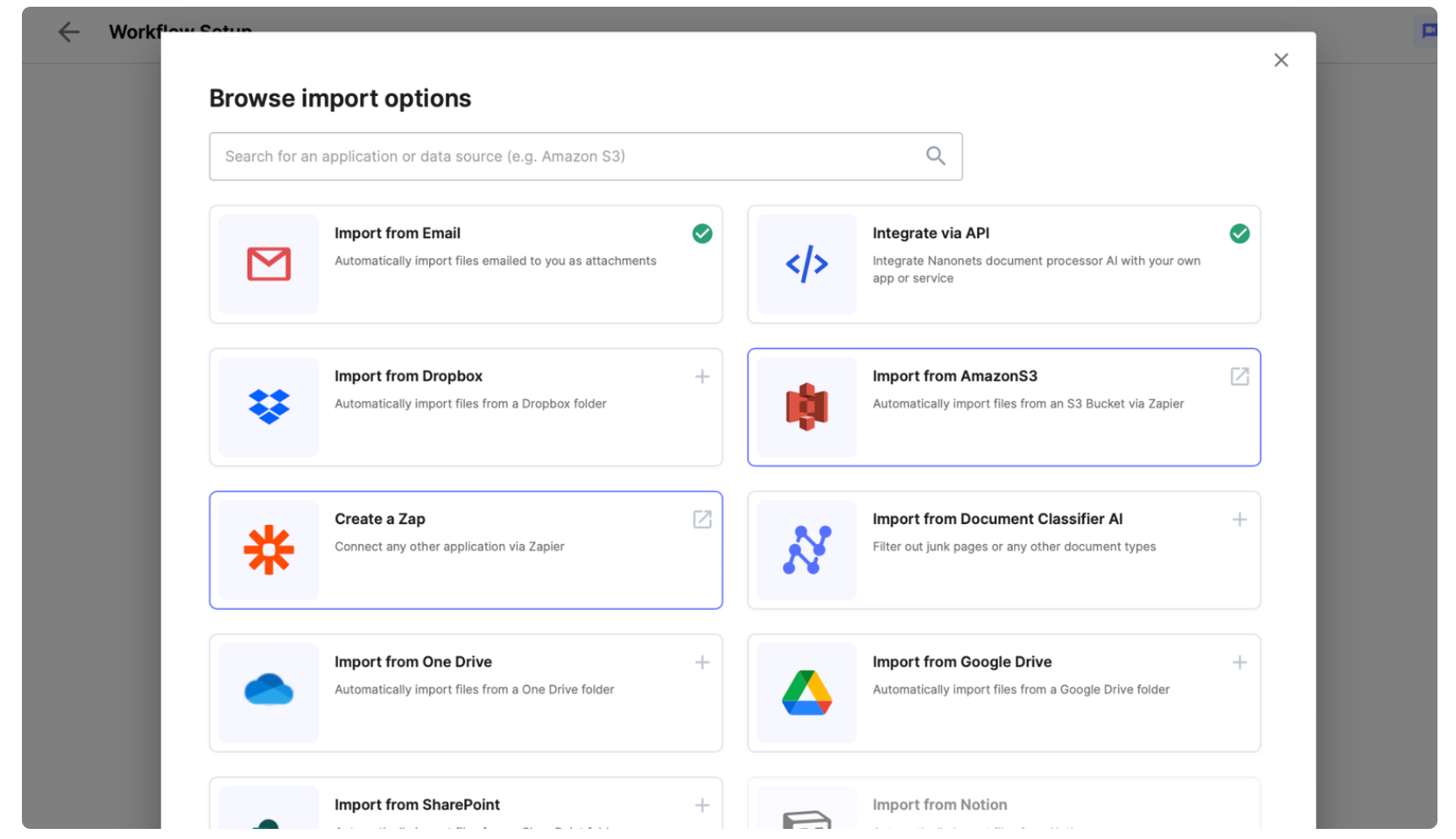

- Go to the import tab and configure your import options -

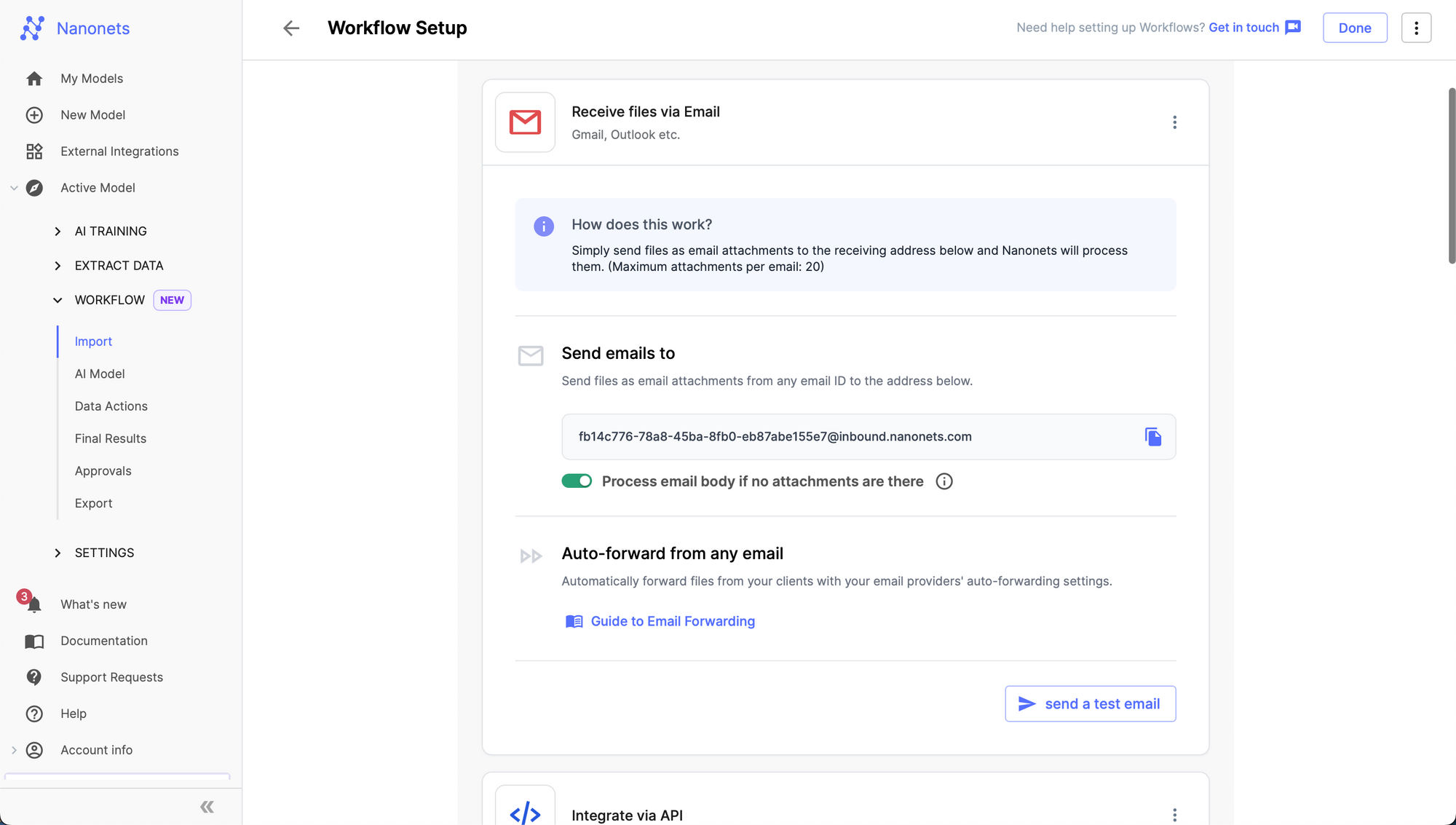

- 1. Email :

- Go to the import tab and click on "Receive files via Email".

- In the expanded view, you will be able to find an auto generated email address created by Nanonets.

- 1. Email :

- Any Email sent to this address will be ingested by the Nanonets model you created and structured data will be extracted from it. You can set up email forwarding to automatically forward incoming emails from any email address to the Nanonets email address to automate email ingestion and data extraction.

- 2. Automated Import from Apps and Databases

- Set up your imports from the "Browse all import options" modal.

- 3. Direct Upload

- You can also choose to directly take photos and upload invoices using the Nanonets platform or mobile app.

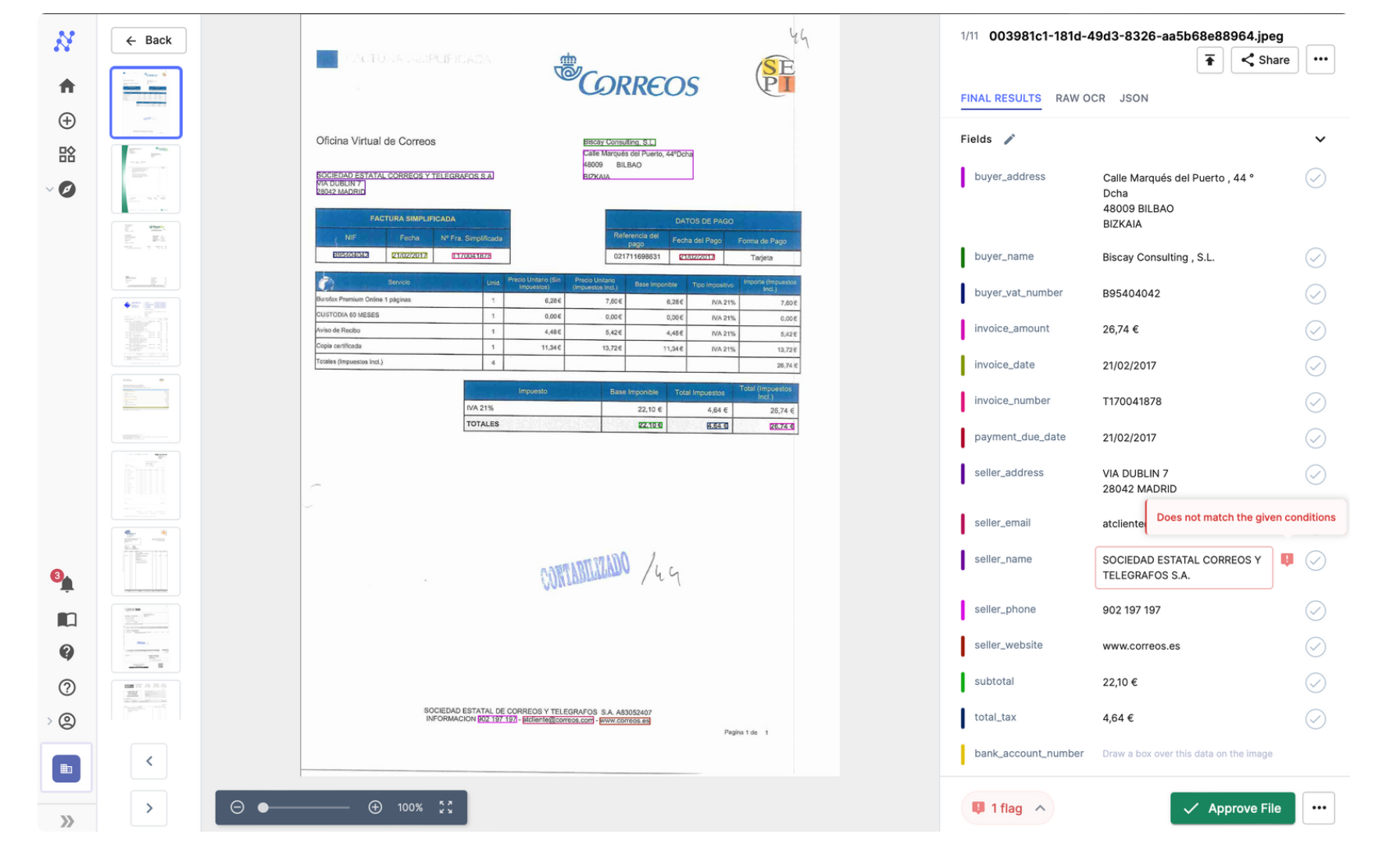

- Test Data Extraction: Upload an invoice and Nanonets works on the imported document and extracts fields, line items and tables.

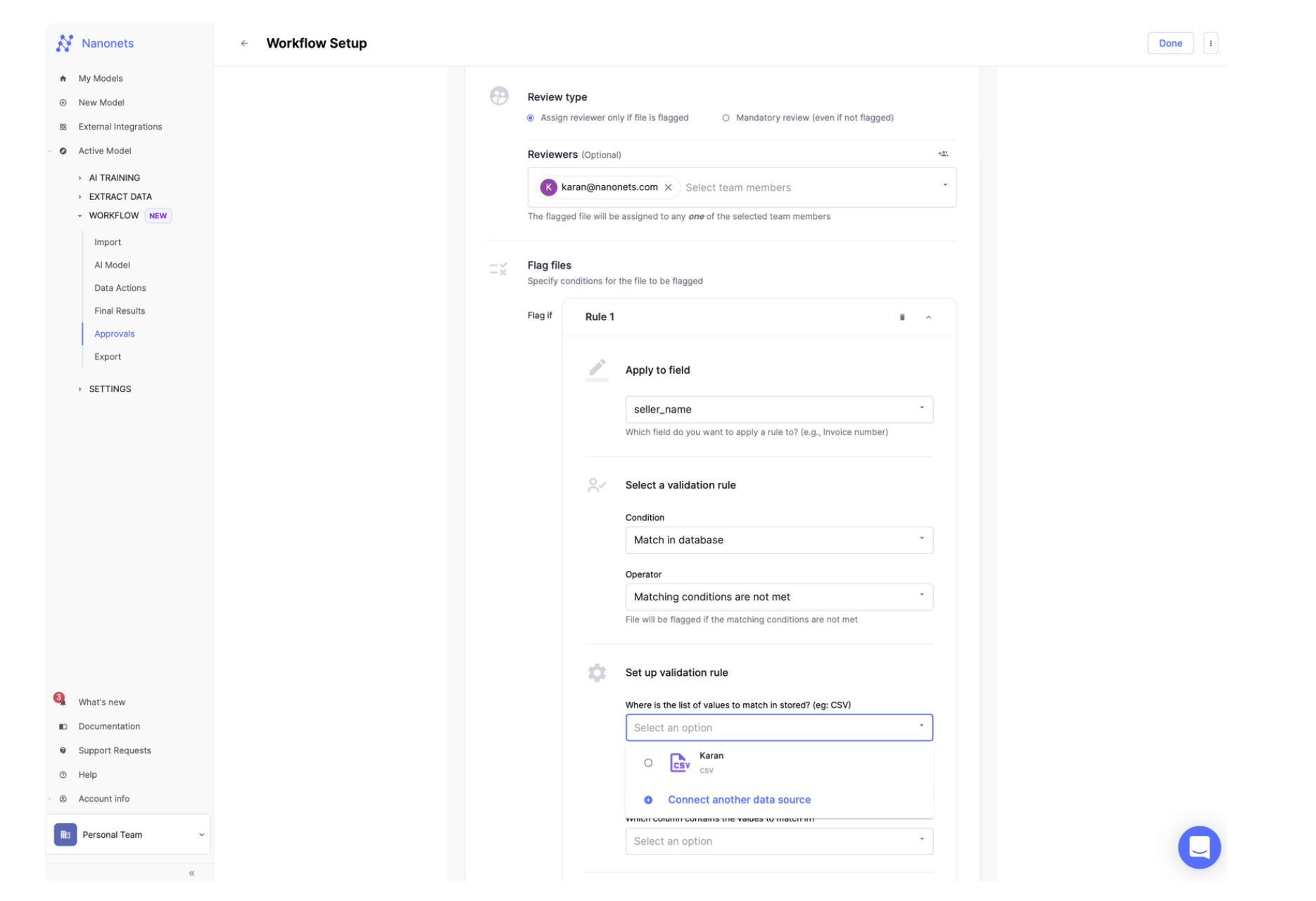

- Set up any Validation Rules and Approval Steps: You can perform postprocessing of data, set up conditional rules, assign manual approvers and set up automated approval based on validation rules. These rules can also be based on interacting with data located on external software / database through integrations.

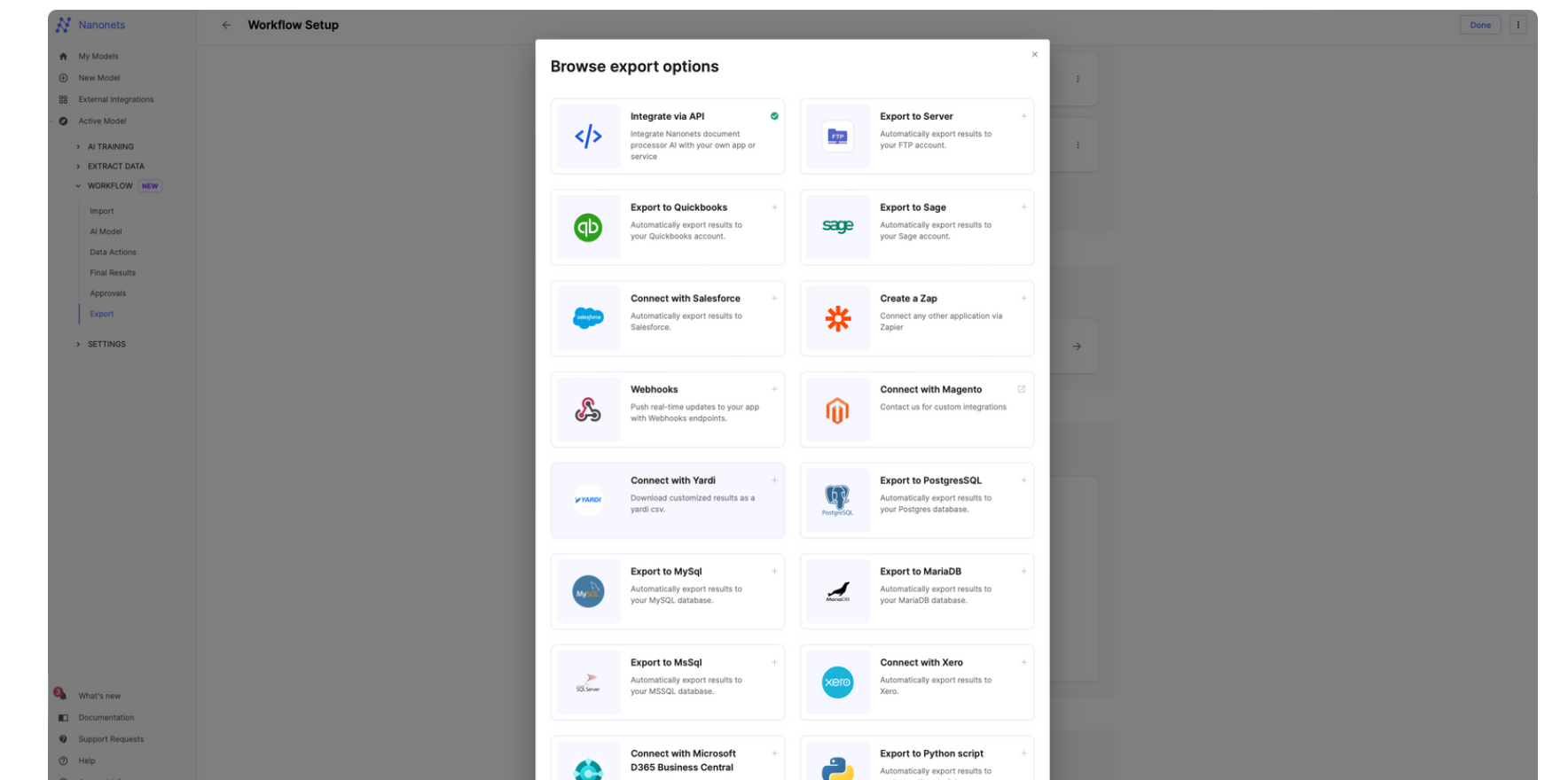

- Add the Xero Integration, Authenticate your Xero Account, and Set up the export into Xero Accounting Software.

This completes the basic set up. You can enhance the Nanonets workflow further and activate features such as GL coding and 2/3/4 way matching.

As we've explored, integrating Nanonets with Xero invoicing software is a game-changer for businesses bogged down by the inefficiencies of manual invoice processing.