Month-end close refers to the accounting process undertaken by companies at the end of each month to close their financial books.

For the layman who lives from pay-check to pay-check, the oft asked question is “why is there so much month left at the end of the money?” For an accountant, it’s quite the reverse – “why is there so much money to reconcile at the end of the month?”

Many businesses perform a month-end close of their accounts to organize their financial data. Due to the amount of work involved, the month-end close process is never a one-day-in-a-month activity, and may even take a week off every month.

Thus, an accountant must not only manage the day-to-day and end-of-year accounting activities, but also perform the month-end close process. Naturally, accountants are overworked throughout the year, and accountancy has become a job that is never at rest.

While the month-end close can be stressful for accountants of small businesses, it can be overwhelming for those in large companies with significant financial activity.

There are ways in which the overwhelm can be tackled. Having a month-end close checklist can enable systematic management of the process. Automation can also take the edge off the accounting close process, and allow for better and faster monthly closing of books.

This article explores the month-end close process in depth and how automation can help optimize the process.

What is the month-end close?

The month-end accounting close process in any enterprise is the process of “closing the books”. It involves the consolidation, review and reconciliation of all financial information at the end of every month.

The accounting close process is important because it provides insight into the financial health of the company. This process also facilitates financial and operational planning and provides the basis for strategic business decision-making.

The steps of the month-end close process

The month-end close process involves the recording, review, and reporting of the financial transactions that have happened in the period since the last close in the previous month. It provides a quick overview of the company’s financial health over the period and serves as a cutoff point for transactions so that the following month starts afresh.

The details and steps of the month-end close process largely depend on the size of the company and the quantum of financial transactions executed per month.

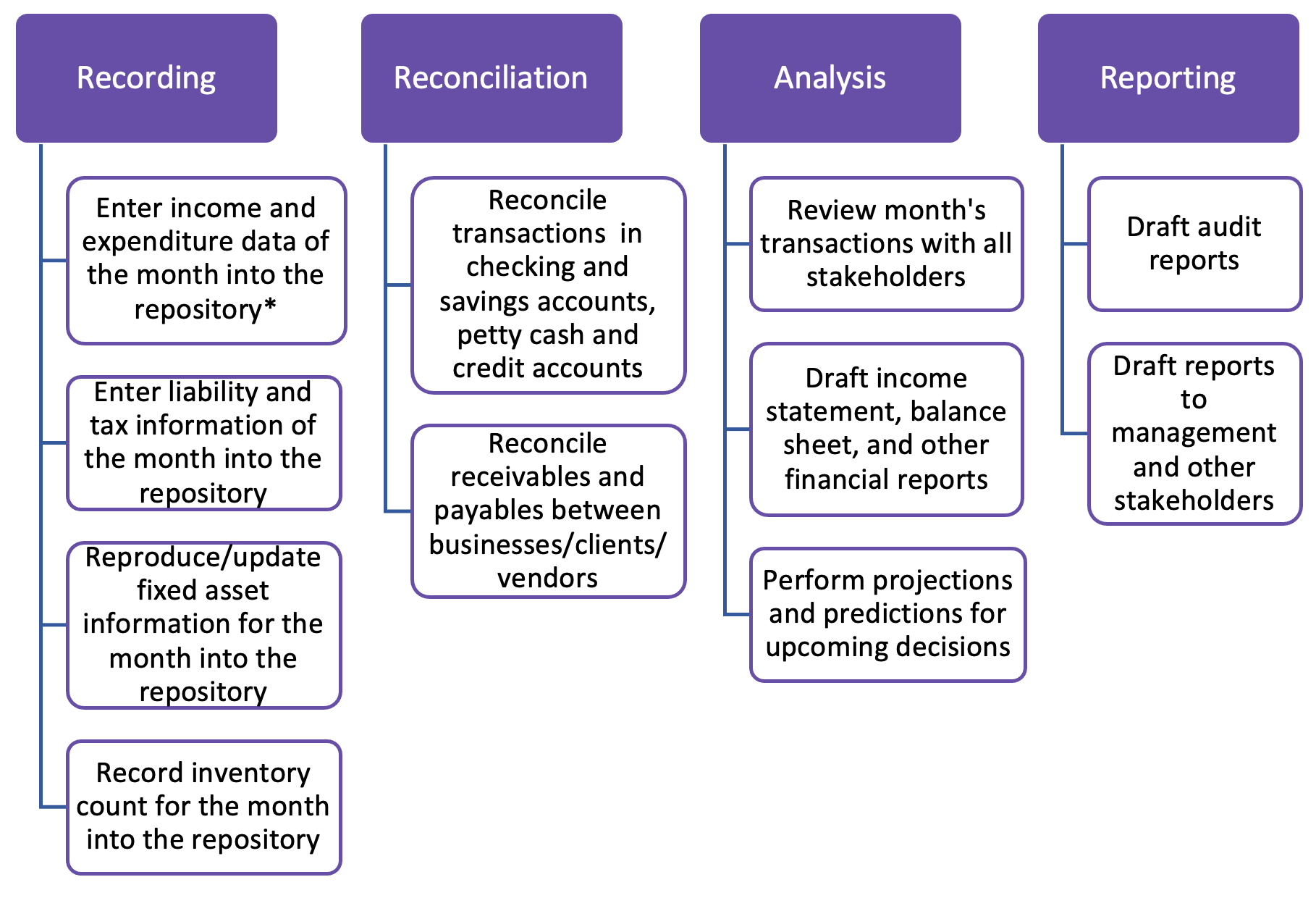

However, all accounting close processes are made of four activities:

- Recording the cash flow* - The recording process involves the entry of income, expenditure, liability, fixed assets and tax data into the repository of choice.

- Reconciling the income and expense accounts - The [reconciliation process] reconciles bank statements and petty cash holdings with transactions and payments between businesses.

- Analyzing the balance sheet - Analysis makes use of the data from the recording and reconciliations steps to analyze patterns and provide predictions.

- Reporting/archiving - The final step produces all the reports and statements for stakeholders, and archive all the data.

The accounts closing process is sometimes referred to as the “Record to Report (R2R)” process.

*The entry of income and expenditure data into the repository in itself is made of four steps:

- Transfer all balances in the revenue account into the Income Summary.

- Transfer balances in the expense account into the Income Summary

- Given that Income Summary is a temporary account, the balance is transferred to Retained Earnings

- Cash distributions or dividends paid out to owners is entered into Retained Earnings

The process of month-end accounting close is indeed complicated because it involves various types of information and data that must be consolidated, verified and reconciled.

It can become overwhelming unless the accounting team has a well-designed SOP that can be followed. Many efficient accountants have a comprehensive checklist for account closing processes.

The month-end close checklist

Checklists serve as reminders of the essential steps, enable verification, and enhance discipline, all of which lead to seamless and efficient operations.

The month-end close checklist is specific to the company, but may be something like this:

Recording Tasks

- ✅ Time sheets submitted

- ✅ All accounts payable bills included in the system

- ✅ All accounts receivable invoices included in the system

- ✅ All expense reports included and approved

- ✅ All payments recorded

Review Tasks

- ✅ Review revenue and ensure inclusion

- ✅ Review deferrals, accruals, and reversals and ensure inclusion

- ✅ Verify all entries are entered

- ✅ Check for deferred/delayed transactions, failed transactions, and transactions awaiting approval

Reconciliation

- ✅ Reconcile all bank accounts with bank statements

- ✅ Reconcile AP data with sub-ledger and/or General Ledger

- ✅ Reconcile AR data with sub-ledger and/or General Ledger

- ✅ Reconcile assets and deferred activities

- ✅ Reconcile actual inventory with the General Ledger

Reporting

- ✅ Audit trail report

- ✅ Stakeholder report

Such a checklist ensures a smooth and effective month-end close. An effective month-end accounting close process has the following benefits:

- Provides a reliable and accurate accounting system

- Provides a picture of the financial health of the enterprise

- Streamlines end-of-year financial auditing

- Simplifies tax filing

- Helps make financial plans and decisions for the near and far future

Challenges associated with manual month-end close processes

The month-end close can be strenuous and time-consuming, especially in large companies with significant monthly financial transactions.

According to a survey by Ventana Research, in 2014, 58% of companies reported taking seven or more days to close their books. Adding to the stress and work levels is the deadline-oriented nature of the activity; the accounts must necessarily be closed by the last day of the month.

Excerpt from Season 1, episode 22 of Friends – “Bossman” Bing setting deadlines

The quantum of work, its tedious nature, and deadlines can be stressful for accountants and financial professionals. The demands on attention and time are increased further by the need to perform regular responsibilities in addition to the close reconciliations.

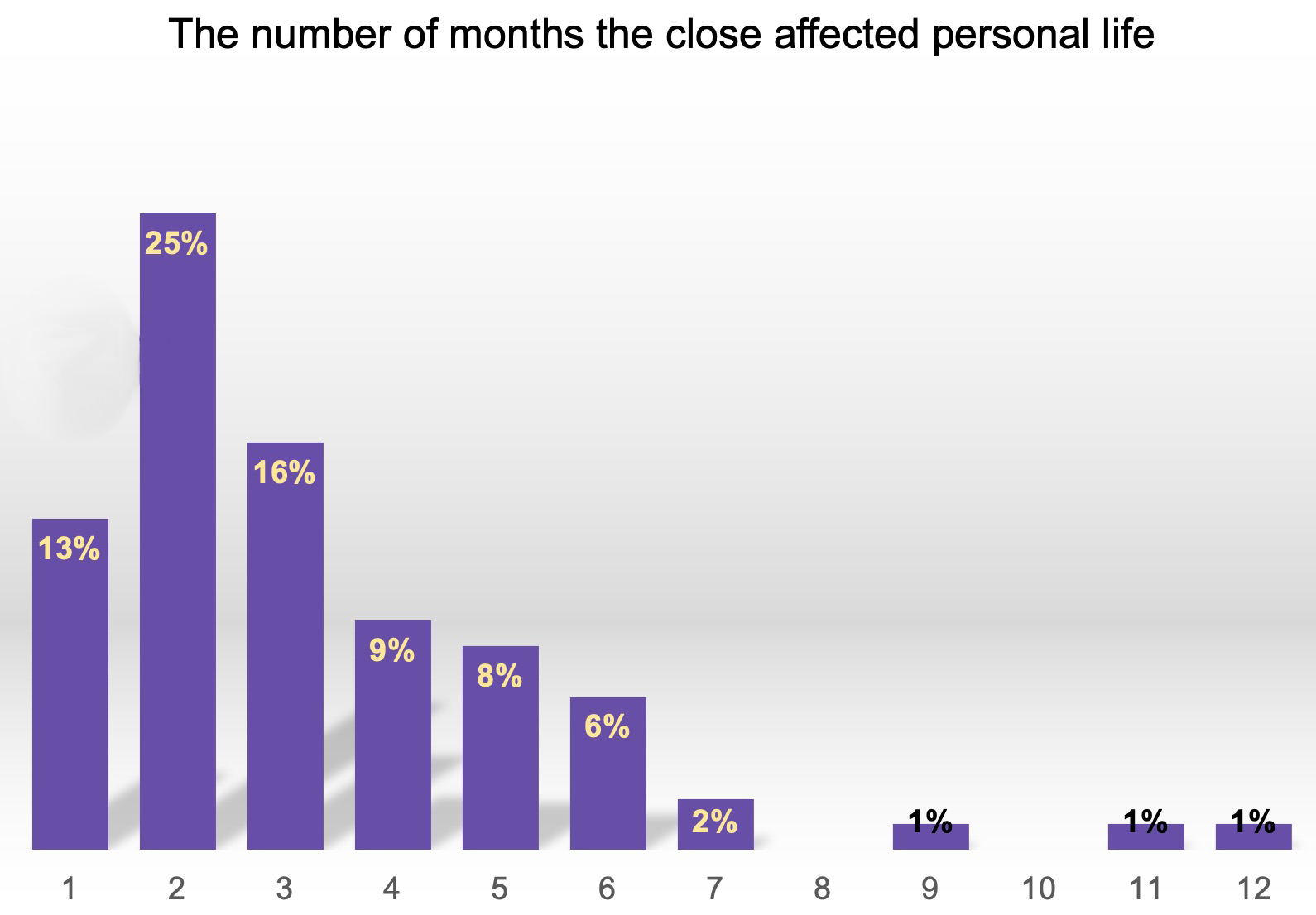

An online survey conducted among accounting and finance professionals by the University of Georgia’s Consumer Analytics program in March 2022, immediately after a month-end close, found that the accounting close busy-ness disrupted the personal lives of at least 81% of accountants during at least one month in the past year.

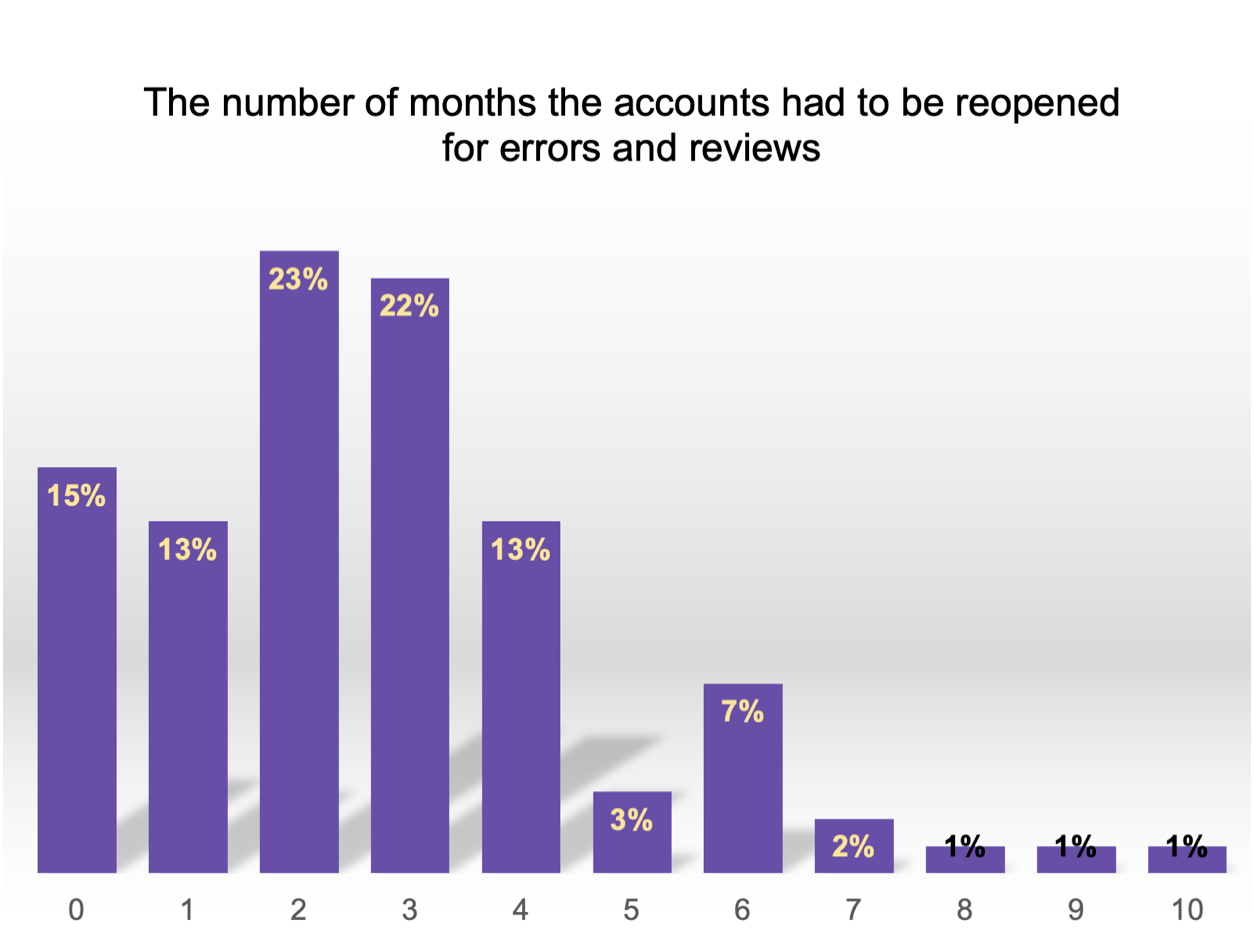

Any accounting close activity cannot be expedited because of the possibility of errors, which are unacceptable in the accounting field. The above survey also found that 85% of participants reported having to re-open the books in at least one month during the past year to fix errors.

Many of the challenges of the accounting close process may be traced back to one or more of the following reasons:

- Team members are not clear of the tasks that need to be done

- Supervisors have limited visibility over the tasks and their status

- Disorganized accounting sources – invoices and other accounting documents are in various formats and in various repositories, which makes consolidation complex. Fragmentation, operations across multiple geographic locations, and high interdependencies of financial data further complicate the close process.

- Errors in account reconciliations are not caught early on and snowball into complicated mistakes that are harder and time consuming to fix.

Best practices for the month-end close process

There are some common-sense steps to avoid errors/lapses and overcome the stress commonly associated with the accounting close process.

- The first step to a seamless closing process is a well-designed SOP that considers all tasks and steps in accordance with the company’s work. Meticulous planning and a boilerplate for the closing process can prevent unnecessary steps and poor coordination among stakeholders.

- Extensive training of all professionals involved in the closing process can ensure clarity in roles and responsibilities.

- Realistic estimation of the time required for monthly closing must not neglect the non-closing responsibilities of the accountant and financial professional. Pre-close meetings are useful in discussing the schedule and timeline, and will help in rescheduling tasks to meet the month-end deadline. It helps to fix specific deadlines for specific activities such as assembling data, adjusting the ledger, report preparation, etc.

- Consolidation of all the data sources required for the closing operation. These may include bank statements, financial statements and balance sheets, fixed assets and inventory, Accounts Receivable and Accounts Payable documents, Petty cash fund and General Ledger data.

- A month-end closing checklist such as the one shown above can help in seamless operations of the accounting process.

Automation for month-end closing

Accounting software can ease many of the difficulties of month-end closing operations. Automation can help in consolidating all relevant data under a single platform, and help in classifying and organizing the data into fields that help in reconciliation and report generation.

The benefits of month-end closing automation include:

Time savings

Manual monthly closing is time consuming. For example, low-level, automatable tasks have been reported to consume 47% of the AP department’s time, and 75% of the time of HR and Payroll department staff. This naturally leads to delays and associated stress. Automation of some or all tasks of the monthly closing process can help avoid delays and bottlenecks.

Cost savings

Manual accounting closure requires considerable human capital. McKinsey showed that 45% of current paid activities that cost an equivalent of $2 trillion in total annual wages, can potentially be automated. Furthermore, manual performance of redundant, potentially automatable tasks decreases the productivity of the company and low productivity can cost employers around USD 1.8 billion dollars annually.

Error reduction

Manual accounting tasks, when performed under time crunch and stress, can become error-prone. A human being is likely to make 10 errors in every 100 steps when performing redundant work.

Increased focus on strategic tasks

A global study on automating processes found that an average worker spends more than 3 hours per day on mundane, repetitive tasks, which reduces focus on higher-value tasks that involve human strategizing and planning for the betterment of the organization. The productivity and satisfaction of employees increase when they spend time on interesting and rewarding aspects of their jobs, and this reduces employee turnover and enhances employee retention.

Collaborative processing

An automation tool for month-end closing builds a unified platform where all stakeholders can work in tandem and complete the month-end close checklist developed by the company. Such software tools are provided with dashboards and notifications to keep track of the closing process in real-time, which ensures that everyone involved is aware of the status of the process and issues can be identified and addressed in time.

Audit-readiness

Perhaps the most compelling advantage to automated month-end close is audit readiness. Automated business processes not only allow standardization of operations but also ensure maintenance of records throughout the year, thereby creating an audit trail.

Scalable

As the client base and financial portfolio of an enterprise expand, manual monthly account closure can become unwieldy and impossible without automation.

Not surprisingly, more and more companies are using some sort of automation tool in their account closing process.

Verona research showed that 83% of companies now apply at least some automation compared to 60 percent in 2015. In consequence, 61 percent of participants indicated that their company completes its monthly close within six business days, with nearly half (46%) finishing within four business days. Compare that with the 7 or more days reported earlier, without the use of automation.

Nanonets for the month-end closing process

Accounting tools are not single entities but a collection of workflows that serve various purposes, activities and departments. There may be workflows specific to the accounts payable process, accounts receivable process, payroll and so on. The closing process combines the output or content of all these components for reconciliation. At its core, data collection is the fundamental task of any account closing process

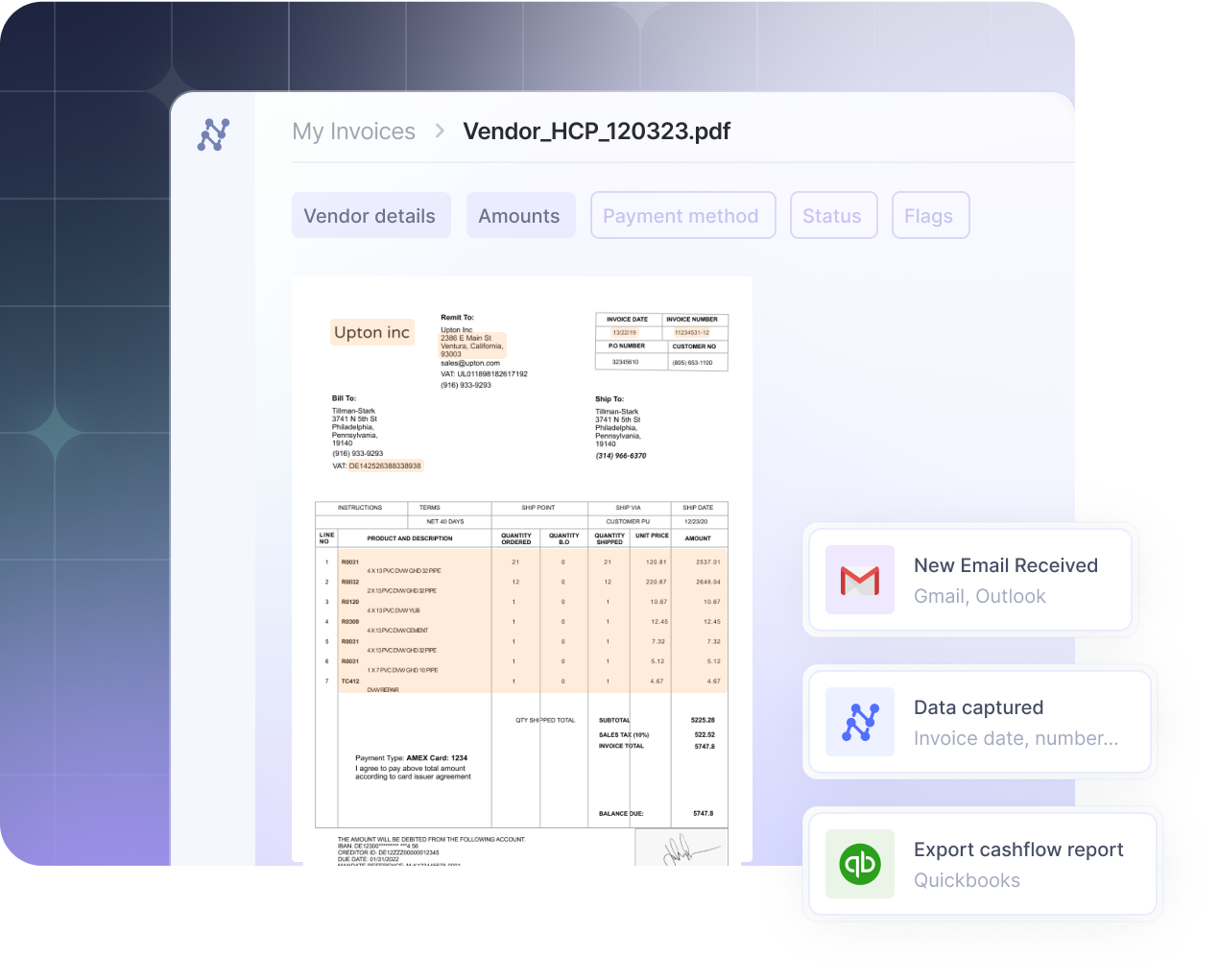

Integrate your existing tools with Nanonets and automate data collection, exports storage and bookkeeping.

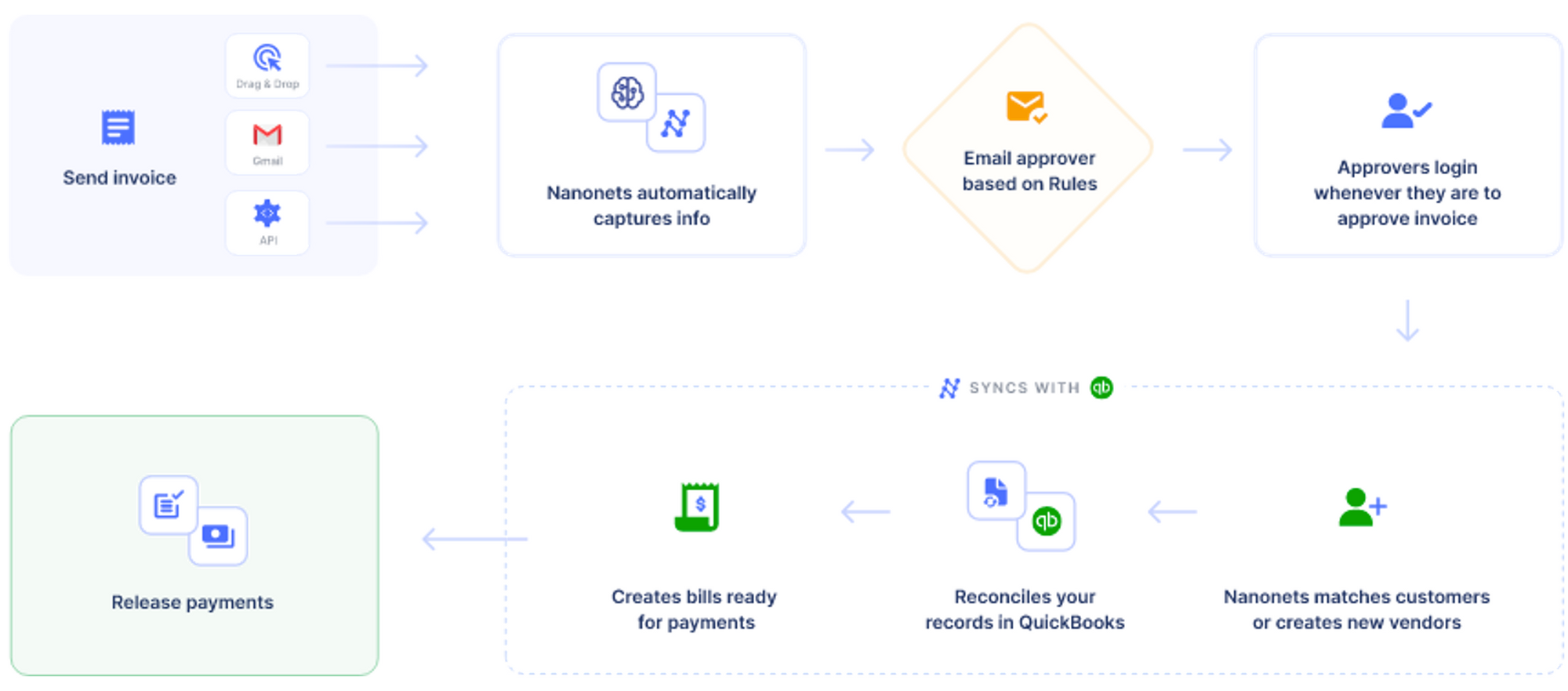

Nanonets can also help in automating the month-end close process by:

- Importing and consolidating data from multiple sources - email, scanned documents, digital files/images, cloud storage, ERP, API etc.

- Capturing and extracting data intelligently from invoices, receipts, bills, and other financial documents.

- Categorizing and coding transactions based on [business rules].

- Setting up automated approval workflows to get internal approvals and manage exceptions.

- Reconciling all transactions.

- Integrating seamlessly with ERPs or accounting software such as Quickbooks, Sage, Xero, Netsuite and more.

All these features of Nanonets allow for fast and accurate closing of the books and efficient management of resources.

Take away

An accountant’s job is never a single entity with a beginning and an end. It can, at best, be broken down into bite-sized pieces of monthly reconciliations so that the account close process does not become overwhelming at the end of the financial year.

Automation of the monthly accounts close process can ease much of the strain associated with the activity, and can help any enterprise not only be on top of its current situation but also prepared for the future.