Efficient management of accounts payable (AP) is crucial for maintaining a healthy cash flow. Managing invoices - the key financial document in these workflows - is an essential part of this. Invoice processing are critical steps in these processes.

Oracle NetSuite's invoice management system offers a powerful solution to automate your AP invoice process, boosting efficiency and improving your bottom line.

What is NetSuite Invoice Management?

NetSuite Invoice Management is made of the following facets:

- Data Capture from Invoices

- Review and Validation

- Matching to POs and Receipts

- Invoice Approval Routing

- Invoice Payment

- Payment Reconciliation

If you are familiar with some of these processes, you can skip to the section on how to automate and improve the efficiencies of Accounts Payable.

This comprehensive guide dives deep into the capabilities of Oracle NetSuite Invoice Management for Accounts Payable, empowering you to take control of your financial operations. We will also discuss NetSuite and AI-enabled automation to simplify some of the manual processes in AP.

The NetSuite Invoice Automation Workflow

For many businesses, managing accounts payable involves a mountain of paperwork and tedious data entry. Imagine that you're the CFO of a mid-market e-commerce company with 500+ employees and $30m in annual revenue - you probably have 100s of not thousands of invoices to deal with every month.

NetSuite allows you to set up a comprehensive vendor invoice management system, that includes PO-linked and standalone invoices, as well as capabilities for 2-way and 3-way matching.

Once your invoice verification and matching workflows are completed, you are able to route invoices for approval to various stakeholders automatically, and then send out the invoice payments (whether individually or in bulk) to your vendors.

Vendor Invoice Data Capture

Converting a paper or PDF invoice to a Vendor Bill in NetSuite requires near-perfect data extraction - that should be agnostic of template, layout or document type.

There are multiple ways to input vendor invoices into NetSuite. For digital invoices, vendors can email them to a designated central email, or AP staff can conveniently upload bills directly through File Explorer or use drag-and-drop in NetSuite Bill Capture. NetSuite's OCR functionality scans, digitizes, and uploads paper invoices seamlessly.

After an invoice is uploaded, NetSuite automatically scans the document, generates a bill record, and links this record to the corresponding purchase order. Once processed, the scanned invoice is accessible on the Scanned Vendor Bills screen.

Review and Validation

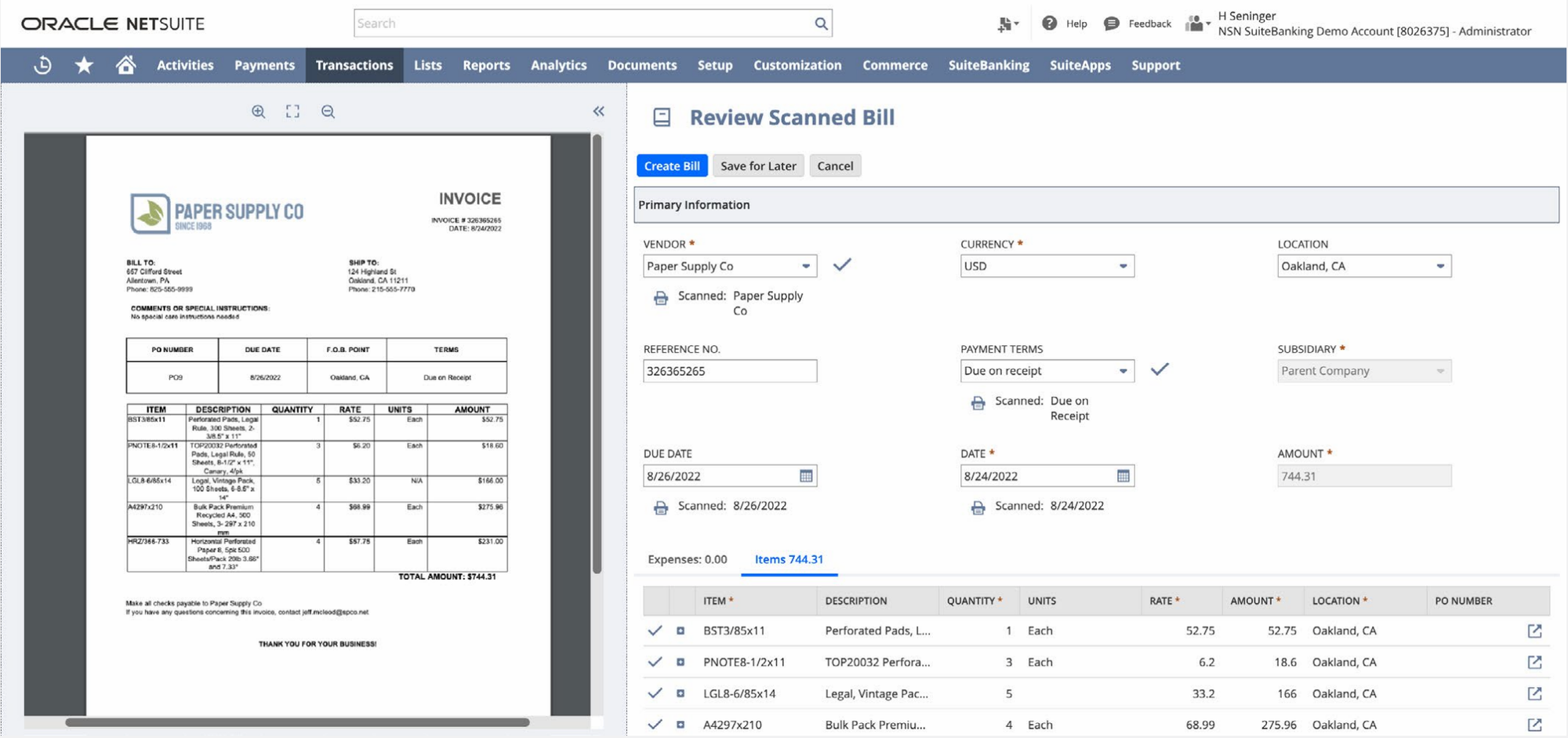

The Review Scanned Bill screen displays the scanned invoice on the left side and the vendor bill on the right. NetSuite automatically populates key details—such as vendor name, invoice number, and line items—directly into the vendor bill.

At this step, the AP team reviews the invoice details, making any required adjustments to the vendor bill. If the invoice includes an item not listed on the PO, the AP team can manually add this item to the vendor bill as needed.

2-way and 3-way PO Matching

A vendor bill can also be matched to an existing Purchase Order, by going to Purchase Order -> List POs, where you can 'Receive' a bill and then 'Bill' the PO by matching a vendor bill to it.

Matching a bill to a PO results in the Purchase Order changing status from "Pending Bill" to "Fully Billed". You can also carry out partial PO match, by updating only the required line items on the PO - however, this can turn into a tedious process to do manually for every single vendor bill.

This function on NetSuite also ties into payment requests—a vendor bill can also be approved as a bill paid. However, this is also a fairly manual process that is prone to error. This is where the need for automation and AI-driven processes comes in, such as Netsuite 3 way match, which automates the process of comparing POs, receipts, and invoices to ensure that everything matches accurately.

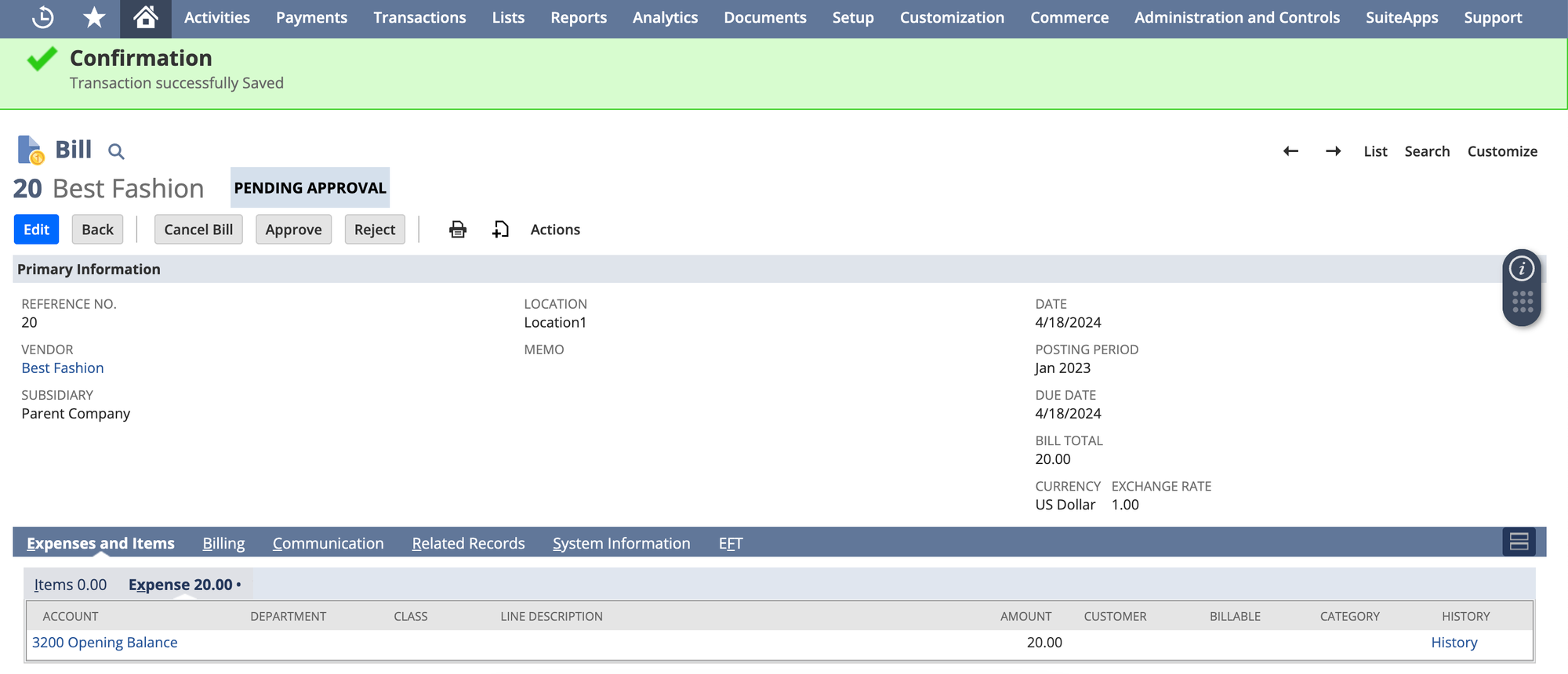

Invoice Approval

Once the vendor bill is posted, it moves to the approval stage. In the standard Invoice Management setup, approvers can navigate to the bill list, select the bill needing approval, and then set the invoice approval status to “Approved.”

To streamline this process, you can use a NetSuite SuiteApp or a tool like Nanonets, enabling automated NetSuite Approval Workflow with custom routing and rules. This allows us to configure multiple approvers, set up batch approvals, and add specific conditions to the approval process."

Payment of Invoices

With NetSuite’s SuiteBanking feature, you can efficiently handle vendor bill payments directly within the software. Once a bill is approved, the finance team can access it in NetSuite, verify payment details, and proceed with payment. SuiteBanking supports various payment methods, including ACH transfers, paper checks, and HSBC virtual credit cards.

Payment Reconciliation

NetSuite enables you to streamline vendor payment reconciliation through SuiteBanking, ensuring a clear AP audit trail. Each day, NetSuite retrieves payment details from HSBC, along with monthly statements at the end of each month. The platform automatically matches virtual credit card transactions, flagging any discrepancies for the AP team to review and resolve as needed.

AI-based Invoice Management Automation on NetSuite

While NetSuite's Invoice Management module will definitely help speed up your invoice processing, it is always worth considering advanced AI-based Invoice Automation tools as well.

The AP tasks most likely to benefit from automation are those where you can cut processing time or increase accuracy, hence saving money. Compared with manual processing, Invoice automation can significantly improve the following steps:

- Data entry. Automating data capture of invoices and other source documents is faster and less prone to error than entering data manually.

- Invoice matching. Invoices can be automatically matched to supporting documents, like purchase orders and receiving documents (three-way matching in Netsuite). This automatic matching is faster and more accurate than manual matching, especially for businesses that otherwise might have to match documents stored at different locations.

- Coding invoices. You can establish rules that automatically set the correct general ledger code for each invoice, eliminating the time and inconsistencies inherent in manual coding.

- Approval routing. Electronic routing to all the necessary approvers is faster than manually sending documents to each of them, and it also provides better tracking throughout the workflow.

The Payment Automation SuiteApp lets you automate vendor payments and manage your A/P and reconciliation workflows efficiently. Payment Automation is a part of the NetSuite AP Automation paid module. This SuiteApp comes with its limitations, and that's where third-party integrations and other SuiteApps come into foreplay and give added benefits:

This SuiteApp comes with its limitations, and that's where third-party integrations and other SuiteApps come into foreplay and give added benefits:

- Integrate and pull in invoices, POs, etc., from more sources. No more drag-and-drop, email, or connecting your Google Drive, etc.

- Complex approval settings with reminders for approval and tracking

- AI to match invoices, PO, and all various designs they come in.

- More payment options and integrations with Stripe, Wise, Revolut, and ACH.

Nanonets: Your Invoice Management Champion

Nanonets is a powerful AP automation solution that leverages the magic of Artificial Intelligence (AI) to streamline invoice processing and integrates seamlessly with NetSuite in real-time.

Trusted by over 10,000+ enterprises, Nanonets comes with best-in-class invoice recognition, matching and AI workflows for accurate recognition and processing of AP.

Here's a glimpse into how Nanonets automates the NetSuite Workflow for AP processes:

- Automated Invoice Receipts: Importing invoices into Nanonets from multiple sources is the best in class for accuracy and integrations coverage.

- Automated Data Entry: Nanonets extracts structured data from your invoices, irrespective of the invoice format and whether the invoice is scanned or digital.

- Automated Verification: Two-way matching and beyond. Match invoice information against open Purchase Orders, Delivery Notes, and other AP documents. Avoid NetSuite's tedious matching process completely.

- Multi-stage Approval routing: Send automated notifications to the right person in the organization to review invoices before approval. Users don't need to pay for NetSuite licenses to approve invoices.

- Automated Payment Scheduling and Processing: Pay invoices using any payment method

- Real-time syncing: Import your NetSuite chart of accounts and create rules to code documents from your Vendors.

By automating these critical tasks, Nanonets significantly reduces manual effort, minimizes errors, and expedites the AP process, allowing your team to focus on more strategic endeavors.

Unleashing the Power of AI-based Invoice Management

Integrating Nanonets with NetSuite unlocks many benefits for businesses of all sizes. Here are some of the most compelling advantages:

- Reduced Effort: Nanonets automates invoice processing, freeing up your AP team.

- Enhanced Accuracy: Integration reduces errors and ensures data integrity.

- Faster Processing: Automate tasks for quicker approvals and payments.

- Increased Visibility: Gain insights with real-time dashboards.

- Improved Compliance: Ensures a streamlined and auditable AP process.

Integrating Nanonets with NetSuite can automate and optimize accounts payable operations. This combination can streamline the AP process, reduce costs, and empower the team to focus on more strategic initiatives.

Taking the First Step Towards AP Automation

Nanonets automates accounts payable, driving efficiency, accuracy, and a robust financial process. Leverage AI and machine learning to lead in financial management. Eliminate errors, automate tasks, and seamlessly integrate AP. See how Nanonets tailors solutions with a free demo. Step into the future of finance with Nanonets.