One thing scientists do is to find order among a large number of facts, and one way to do that across fields as diverse as biology, geology, physics and astronomy is through classification.

- Alan Stern

Classification and categorization are important, not only in the sciences but in business administration and accounting as well. The categorization of related accounting records in a financial statement is called line item classification and helps confer clarity to the statement.

Let us learn more about line item accounting in the following sections.

Learn how account reconciliation plays a pivotal role in enhancing the accuracy of line item classification by reading our insightful post at What is Account Reconciliation?.

Line item Accounting

The formal definition of a line item in the context of the International Accounting Standards (IASs) and International Financial Reporting Standards (IFRSs) is “a category on the face of financial statements and in notes in the financial statements”. The line item is, in fact, a piece of information that carries meaning in itself and must be presented as a separate line in the financial document.

In an invoice, a line item is most often the detail that carries meaning to the invoice, such as the product details. In balance sheets, line item is the separation of each category of income, expense, and other financial terms in separate lines. Each line item is a distinct type of entry that affects the value of the document and may include sales items, price, quantity, revenue, expense, asset, liability and equity.

Line item accounting or line item processing is a simple accounting method that uses line item categorization to track transactions through independent single entries.

Line item accounting is often used by freelance professionals, contractors, and small businesses to consolidate data from invoices and bills, and on a larger scale to track the income and expenditure of a company.

Business documents amenable to line item processing

All categories of revenue and expenses relevant to the business can be processed using in line item accounting. The day-to-day transaction of any business involves dealing with invoices, bills, and receipts, most of which are in line item form. At a more extended level, balance sheets and company financial statements can be as line items and are important in the annual accounting reconciliation processes.

Invoice and receipts

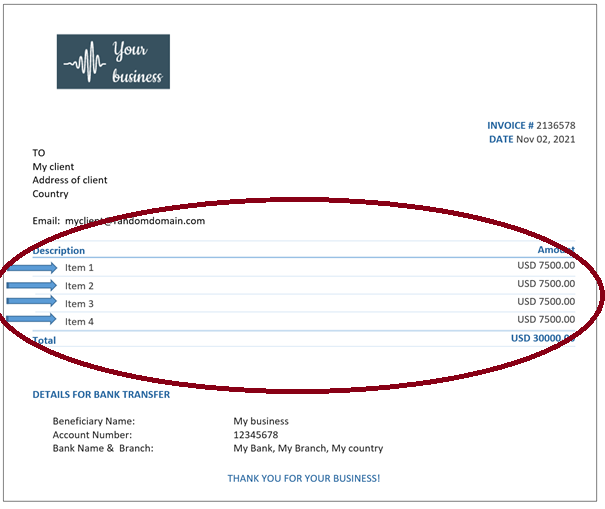

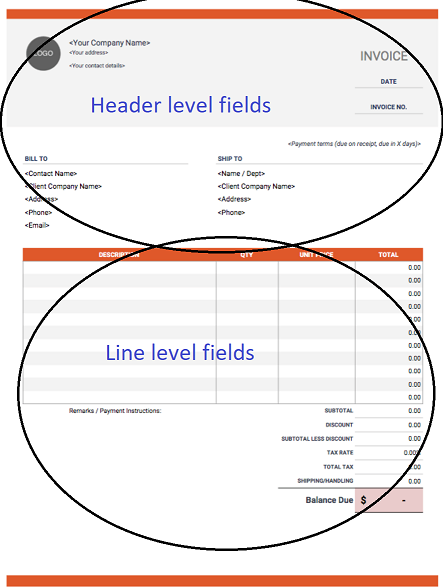

Invoices are typically made of two parts: the header-level fields and line-level fields. The header level usually contains such information as client name, address, invoice numbers, date etc. The available fields depend on what actions are performed at the header level, and what invoicing rules have been applied. Buyers can also specify custom fields to appear on invoices. Line items in invoices refer to any item – product or service – that is billed in an invoice, along with information on quantity, rates, price etc. an invoice can be made of one or more invoice line items.

The line items in invoices are often in the form of a table, as seen in the example above. Processing of the invoice involves accurate extraction of data from each of the lines in the invoice.

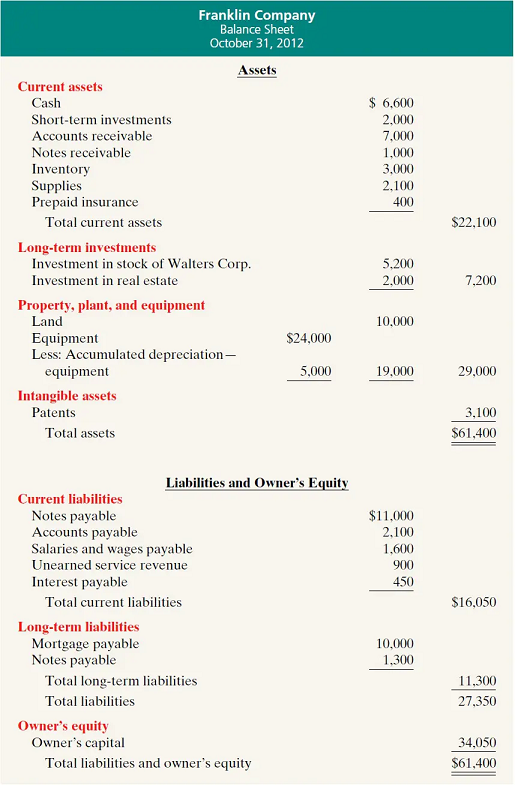

Company balance sheets

The balance sheet of any company contains the following categories, that are present as separate lines in the line item statement:

- Income

- Operating revenue: the income received by a company from its operations such as sale of goods or the provision of services.

- Non-operating revenue: income received by a company from a side activity that is unrelated to the main activities of the company, such as dividend income or profits from investments.

- Gross revenue: Gross revenue is the total amount of money a business earns from all sources before any deductions.

- Expenditure

- Capital expenditure: any payment made by the company to an external source in order to acquire an asset, the benefit of which would be spread over several years.

- Administrative expenditure: recurring expenses associated with the normal course of the business, the benefits of which are usually received within the same accounting year.

- Deferred revenue expenditure: an advance payment for goods or services, the benefit of which is to be received only in the future.

- Depreciation expense: depreciation calculated for a long-term asset for each accounting period

- Tax payments: The amount a company pays in state and federal taxes

- Assets: Items/money the company owns that provide future benefits

- Liabilities: Items/money the company owes to other entities

- Equity: Stocks, securities and other equity items owned by the stakeholders of the business.

Benefits of line item processing

- Line item processing helps in the methodical organization of transactional data from documents such as invoices and balance sheets.

- An accurate and detailed representation of a business's finances and other transactions can be gleaned through line item accounting practices.

- Line item accounting separates categories clearly and helps in easy visualization of the transaction.

- The line-by-line breakdown of transactions can help in analyses of the health of the organization, which in turn can help stakeholders plan future actions and paths for the business to sustain or improve bottom-line.

- The use of line items and sub-line items can enable quick identification of various fields for comparison purposes. The segmented picture of money allocation can help with prediction and forecast activities in financial planning.

Manual line item processing of invoices and day-to-day accounting documents

Line items are the most important parts of an invoice, bill, or receipt in that they contain the details of the product/service bought or ordered by the company, the quantity and the cost price of that item. Most companies have some form of data extraction procedure by which the data from these lines are extracted into a centralized location, either a physical ledger or a digital database for storage, subsequent processing, and accounting purposes. In small companies, an employee manually copies these entries into the target repository. A breakdown of the manual line item data extraction process is as follows:

- Receive paper or digital documents such as invoices, bills or receipts – we will use “invoice” as the generic name for all such documents, henceforth.

- Open the target repository – either the manual ledger or accounting software.

- Look at the invoice. Copy the header level fields such as PO number, vendor details etc., into the repository.

- Copy each line item into the appropriate column/field of the repository. Repeat the process until all line items have been copied.

With an increase in the number of invoices and the number of line items in each invoice, manual data entry becomes a tedious energy-draining task. The mundanity of the task results in a plethora of problems including:

- Productivity loss: Time “wasted” on the mundane tasks of data copy and entry can be better spent on tasks that contribute to enterprise value.

- Loss of employee morale and enthusiasm: 60% of accounting personnel detest the repetitiveness and boredom of the action line item data transfer. This leads to loss of morale and enthusiasm among workers, which in turn results in rapid employee turnover.

- Errors in data entry: Manual data extraction of line items is prone to errors that arise from fatigue or oversight. Such errors can cause losses, delays and accrued liabilities over time, escalating pressure at audit periods, and non-compliance.

- Obstacles to scaling up: As the company grows, manual bill processing becomes unwieldy. Thus, continuing to hold on to what presumably works for a small setup hinders expansion and potential to scale. The ultimate aim of any business is not to maintain status quo but to grow.

Automating the line item classification of invoices

Automation of the line item classification can help overcome the drawbacks associated with manual line item extraction from invoices and other documents. When invoices are in the form of hard copy, the first step is scanning them to convert them to a digital format. Traditionally, computer vision and image processing of line detection involved the use of a sliding window of pixels (kernels) and convoluting (multiply) with patches of images such that only the lines and edges are left. This, however, is not good with content extraction.

Line item extraction can be automated through the use of Optical Character Recognition, OCR, a software that can convert printed letters from scanned documents into digital text. Line item extraction using OCR first involves identifying the table rows that constitute the line item and then applying OCR to extract data from the table’s cells. In a typical OCR, line item extraction as tables could be brought about by the following steps:

- Detection of the line segments through the application of horizontal and vertical contours.

- Detecting the line intersections as a function of the intensity of the pixels of all lines.

- Determination of the edges of the tables again through the intensity of pixels of intersected lines at the boundaries.

- Translation of the image analyses into PDF coordinates to determine the cells, followed by assignment of the text to the cell based on the geometric coordinates

- Application of OCR to extract text from the coordinates

- Exporting the extracted text into a data frame based on the position of the table.

OCRs are not fail-proof, especially when the line item containing documents such as invoices are of different formats. Artificial Intelligence (AI) and Machine Learning (ML) technology can overcome the shortcomings of OCRs. AI-based line item readers can intelligently capture relevant data with minimal errors due to the continuous learning processes of the AI tool. The feature of continuous learning in AI systems allows the reading software to adjust to all formats of line item documents and gives it a universality across the company’s platforms.

Nanonets for automated line item classification

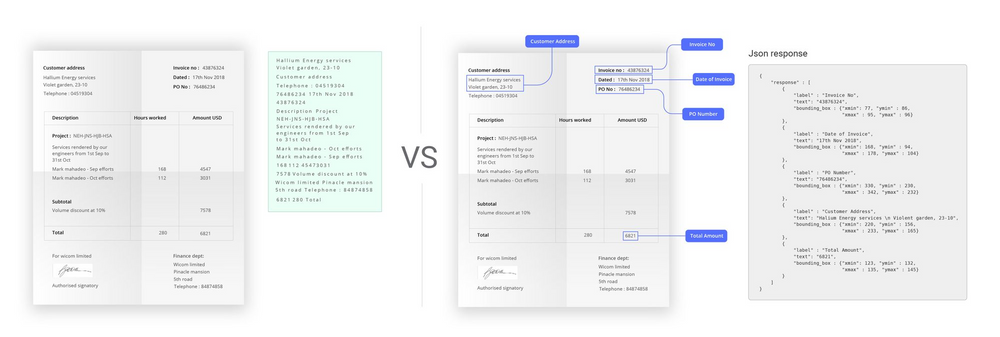

Nanonets is an OCR app that leverages AI & ML capabilities to automatically extract line item text from PDF documents, images, and scanned files. Unlike traditional OCR tools, Nanonets doesn’t require separate rules and templates for each new document type.

The Nanonets API provides high speeds and great accuracy in line item extraction of data, enables fraud detection, and drives automation for line item management. The Nanonets API can perform the following tasks:

- Accurate detection of the table structure of a line item containing documents like invoices and the titles and fields in it for better line item detection.

- All the line item entries that are present in the invoice like name, product, price, total sum, discounts, etc.

- The line item fields can be extracted as JSON output that can enable the building of customized apps and platforms.

Take-away

Automating line item processing can help companies spend less time on mundane activities such as manual data extraction and instead focus on their core competencies of customer care, innovation, expansion, and productivity.