"Let's just ensure that going forward, all the invoices are forwarded to Mr. X for validation before processing."

If only invoice validation were that simple.

In reality, it requires systematic checks and balances, not just one person's oversight. Studies show that 25% of invoice errors slip through accounts payable processes undetected despite internal correction efforts.

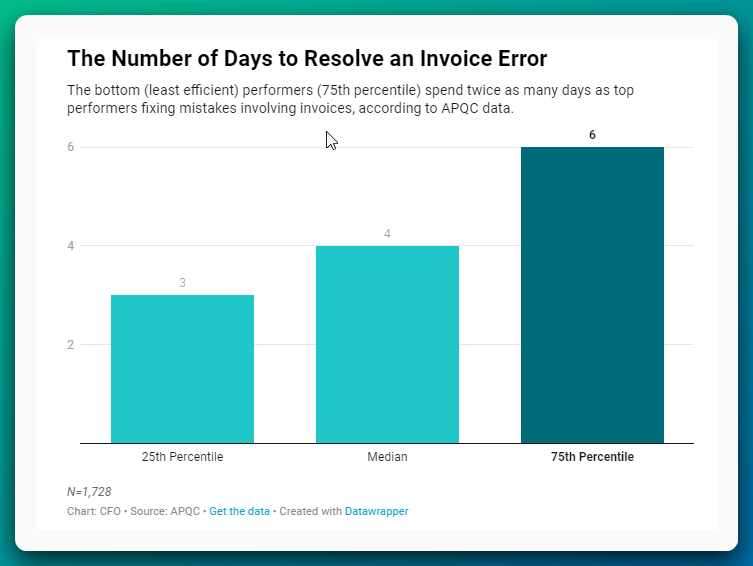

Even top-performing companies take 3 days to resolve invoice errors, while others take twice as long. This leads to payment delays and strained vendor relationships.

How do we break this cycle? That’s what we’ll explore in this post. We'll walk you through the invoice validation process, explore common challenges faced by AP teams, and provide practical strategies to streamline your workflow. We'll also delve into how automation can help you move closer to that 3-day benchmark.

The invoice validation process

Invoice validation is the process of verifying and authenticating vendor information, invoice number, due date, goods billed, tax application, prices, quantities, and other fields of an invoice.

It typically involves checking these fields, matching them against supporting documents like purchase orders, vendor contracts, and receiving reports.

The aim is to ensure accuracy and prevent errors or fraud before payment processing. It is crucial for:

⁍ Preventing unauthorized, duplicate, or inflated payments

⁍ Maintaining accurate financial records

⁍ Adhering to tax regulations by verifying correct tax applications

⁍ Ensuring proper documentation for audit trails

⁍ Following industry-specific regulations (e.g., GAAP, IFRS)

⁍ Catching and resolving discrepancies before they impact cash flow

⁍ Identifying and stopping potential fraudulent activities

Typically, it is the AP clerks or specialists who handle the majority of the validation tasks. Through the process, they deal with the purchasing department to verify purchase orders, the receiving department to confirm receipts of goods, and the finance department to approve payments. And, of course, vendors who provide invoices in the first place. They may be contacted for clarifications, too.

1. Invoice: The primary document detailing the amount owed and for what

2. Purchase Order (PO): Confirms what was ordered by the company

3. Receiving Report: Verifies that goods or services were delivered as expected

4. Vendor Contracts: Provide agreed-upon terms and pricing

5. Company Policies: Guide internal procedures for invoice processing

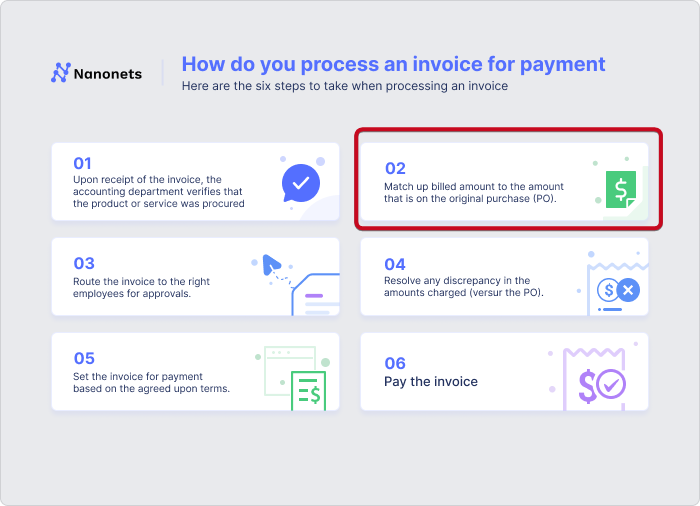

Now, let’s put them all together to understand the validation process:

1. Receipt and initial review

Invoices are received through various channels — email, mail, or physical documents. Then, AP specialists begin by checking for completeness of essential information in the incoming invoice.

They look for vendor name and contact details, invoice number and date, due date, item descriptions, quantities, unit prices, total amount due, and tax breakdown (if applicable). If any information is missing, they typically contact the vendor for the missing details and hold the invoice in a pending status.

2. Three-way matching

This crucial step involves comparing the invoice against the purchase order (PO) and receiving report. AP specialists will check item descriptions and part numbers, quantities ordered vs. received vs. billed, unit prices and extended amounts, payment terms, and delivery dates. Any discrepancies found here are flagged for further investigation.

3. Compliance check

AP specialists verify adherence to company policies and regulatory requirements. This includes checking purchase approval limits, preferred vendor lists, contract terms (e.g., agreed discounts, payment schedules), correct tax rates, documentation needed for specific industries, or compliance with international trade regulations for foreign vendors.

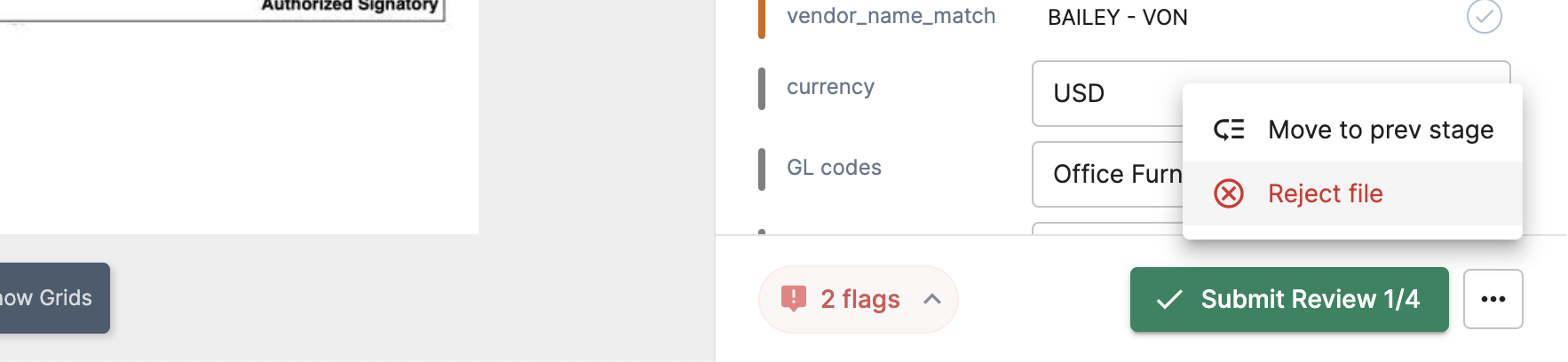

4. Approval routing

Based on predefined rules, invoices are routed to the appropriate approver(s). This routing typically considers invoice amount (e.g., invoices over $10,000 require senior management approval), department (e.g., IT purchases approved by IT manager), or project codes (e.g., specific project managers approve related expenses).

5. Discrepancy resolution

Say the order quantities in the invoice don't match the receiving report. Then AP specialist might review the packing slips or shipping documents to verify the actual quantities received and also to determine the actual source of the error.

To resolve the situation, they may need to negotiate with the vendor for a credit note or revised invoice.

6. Final verification

AP specialists ensure all approvals are in place, and check that any discrepancies have been resolved. The invoice is then entered into the accounting system with proper coding for general ledger accounts, cost centers, and project codes.

The expense is recognized, typically by debiting the appropriate expense account and crediting accounts payable.

Finally, the payment is scheduled according to terms, with the appropriate payment method (e.g., check, ACH, wire transfer) selected. The invoice is then filed for future reference or audits, completing the validation process.

The challenges that AP teams often face with invoice validation

According to a recent industry report, roughly one in five invoices is tagged as an exception today. These exceptions can significantly reduce the percentage of invoices processed straight-through. This leads to an increase in the cost and time to process a single invoice.

Invoice validation is a complex process that can be hindered by various challenges. These include:

1. Manual receiving of invoices

Nearly 49.7% of invoices are received manually. This means AP teams manually sort, categorize, and input data from paper invoices or PDFs into their systems. This introduces the risk of human error. It could be typos, wrong decimal placements, or misread information.

AP Specialist: "Sure, I'm pulling it up now... You're right. Must have transposed the numbers on one of the line items. It should be $1,823.50, not $1,283.50."

Your AP team ends up spending more time on validation and error correction, reducing overall efficiency. Manual data entry also slows the process, potentially leading to late payments and strained vendor relationships.

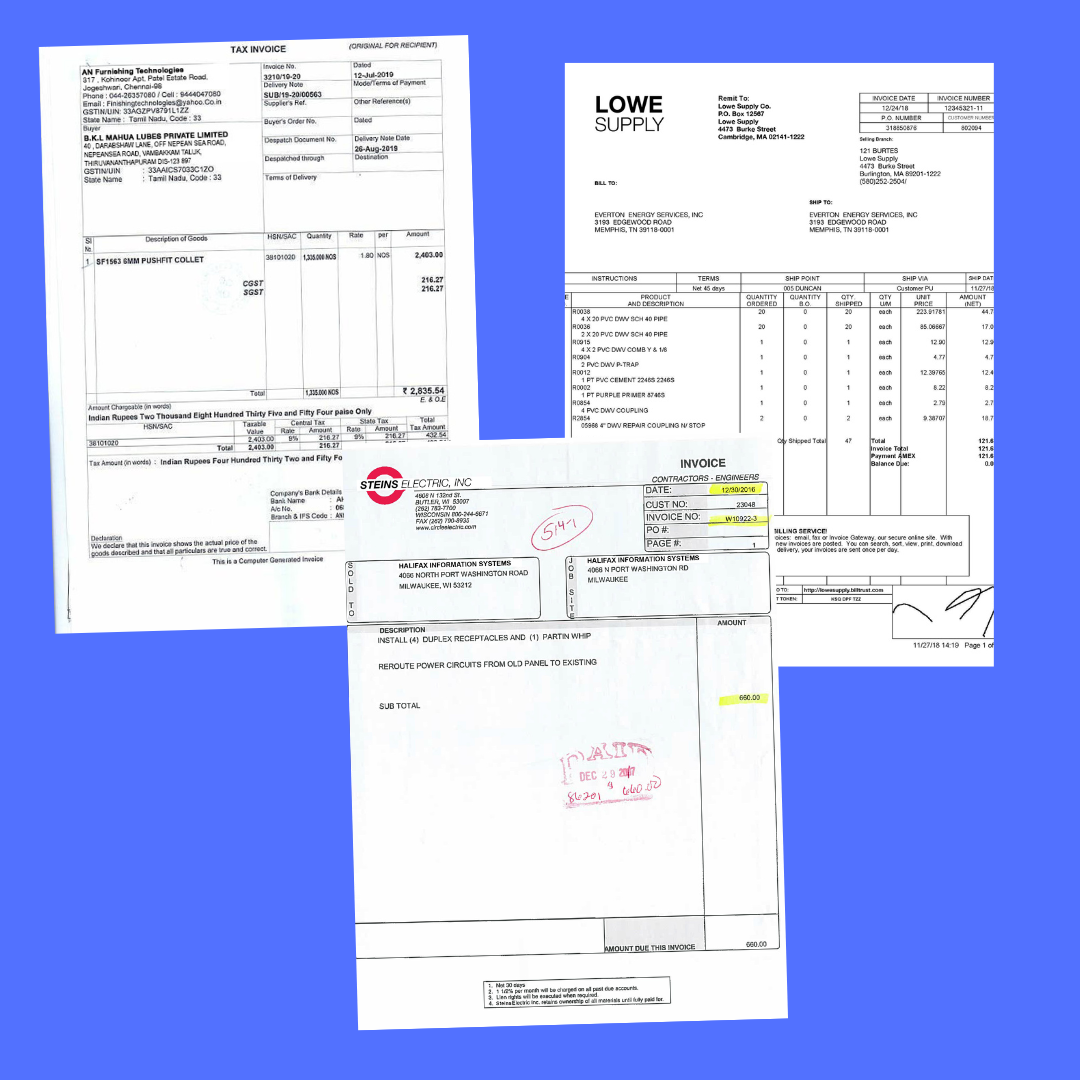

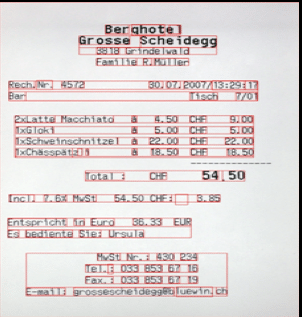

2. Inconsistent invoice layouts

The invoice structure and layout can vary between vendors. For instance, some may include detailed item descriptions, while others provide minimal information. Locating key details each time manually will become a significant time sink over time.

This inconsistency not only slows down processing but also increases the likelihood of errors. AP teams must constantly adapt to different layouts, which can be mentally taxing and time-consuming.

3. Disconnected systems and data silos

Many organizations use multiple systems for purchasing, receiving, and accounts payable. So, at the time of validation, looking up matching information across these systems can be challenging and time-consuming.

Such disconnected systems increase the risk of errors and make it difficult to maintain a comprehensive audit trail. They also hinder real-time visibility into the invoice status, making it challenging to respond to vendor inquiries promptly.

4. Complex and unclear approval hierarchies

Convoluted approval processes with multiple layers and unclear responsibilities often cause bottlenecks in the validation workflow.

These complex hierarchies lead to delays in validation, frustrated vendors, and missed opportunities for early payment discounts. They also make it difficult to track the status of invoices and identify bottlenecks in the process.

5. Inadequate exception management processes

Some AP staff may not know or have the necessary authority to handle exceptions effectively. This happens due to a lack of clear guidelines or training.

Poor exception management leads to backlogs, delayed payments, and increased processing costs. It also increases the risk of errors as AP staff may rush to clear exceptions without thoroughly investigating the root causes.

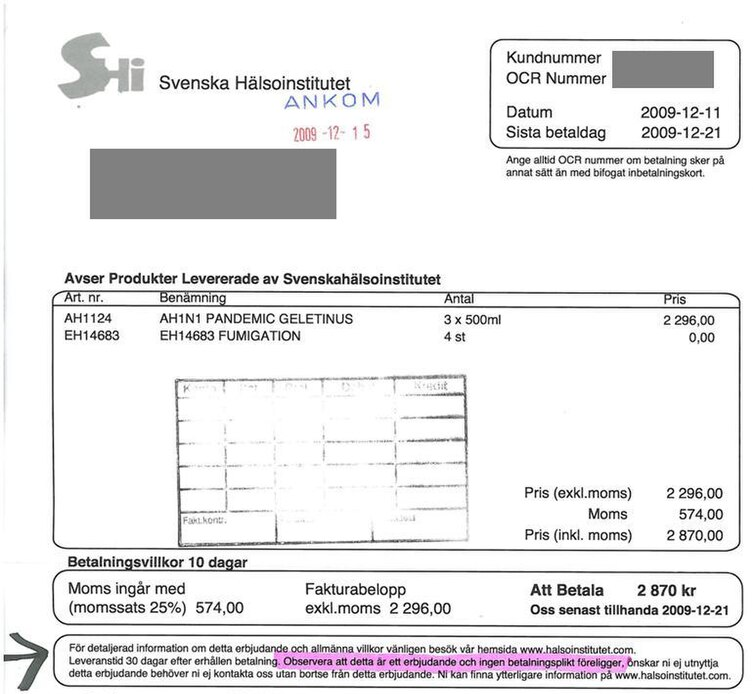

6. Difficulty in validating tax compliance

Each country and jurisdiction has its own tax regulations. And they change often. So, manual processing requires your AP staff to stay updated on these complex and ever-changing rules. Otherwise, they may fail to identify incorrect tax rates or miss required tax documentation.

AP Specialist: "Oh, I didn't update the recent rate changes. I'll need to review all the Japanese invoices again to ensure compliance."

If these exceptions are not identified on time, it could lead to compliance issues and potential penalties. Furthermore, currency conversions and fluctuating exchange rates add another layer of complexity to invoice validation. AP teams must ensure that the correct exchange rates are applied and that any currency-related fees are accurately calculated and accounted for.

7. Detecting sophisticated fraud schemes

As invoice fraud schemes become more sophisticated, spotting red flags during the validation process becomes increasingly difficult. Manual validation processes often lack the systematic checks needed to identify subtle signs of fraud.

Manual validation processes may miss these subtle changes, especially when dealing with high volumes of invoices. This oversight can lead to significant financial losses and damage the company's reputation. Additionally, manual processes often lack the ability to cross-reference historical data and patterns, which could help identify potential fraud indicators.

8. Handling high invoice volumes and scalability

Manual validation processes often buckle under pressure when invoice volumes surge due to business growth, seasonal peaks, or acquisitions. They don't scale easily, forcing AP departments to hire more staff or borrow resources from other teams.

This inability to scale invoice validation efficiently can lead to increased error rates, late payment penalties, lost early payment discounts, and strained vendor relationships. The lack of cash flow visibility due to delayed processing can also hinder strategic financial decision-making.

Moreover, the increased workload and stress on AP staff can lead to burnout and higher turnover rates, further exacerbating the problem.

How to improve your invoice validation workflow

The good news is there are several ways to streamline your invoice validation process. Whether you're dealing with a handful of invoices or thousands, these approaches can help you save time, reduce errors, and keep your vendors happy.

Let's explore some of them.

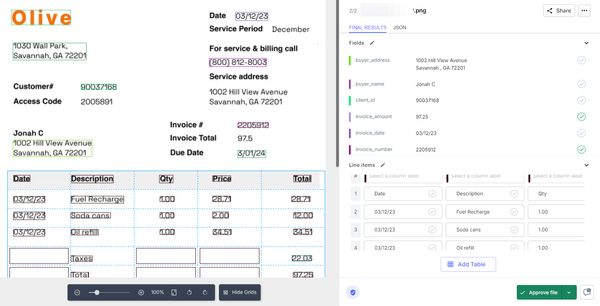

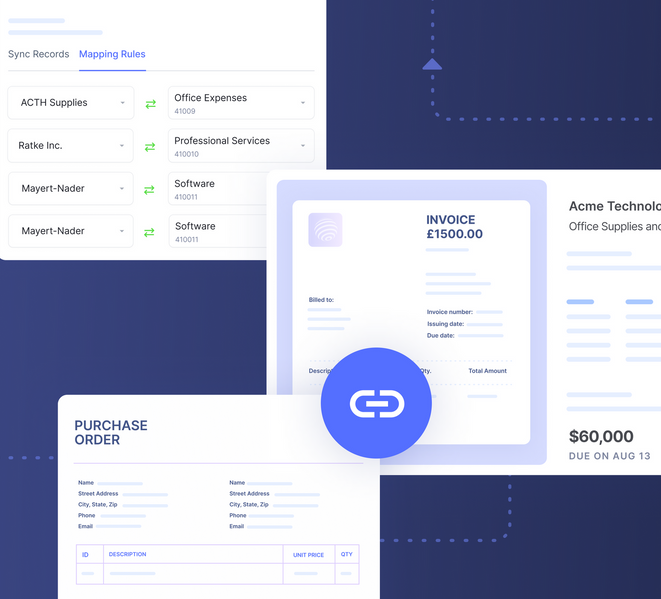

1. Use AI to capture and extract invoice data

With an AI-powered intelligent document processing (IDP) solution, you can automatically extract data from invoices in any format - PDF, scanned images, or even photos of paper invoices. This eliminates the need for manual data entry or tedious file conversions.

These systems use advanced OCR and AI to accurately capture all crucial invoice information from a single source. They can handle invoices with different layouts and structures, including standard invoices, international formats and languages, and even handwritten notes.

The AI adapts to various invoice structures without needing pre-set templates. It can identify and extract key fields like invoice numbers, dates, line items, taxes, and totals, even when their positions change between invoices.

You can pull out vital information from scanned invoices, including vendor details, item descriptions, quantities, and prices. The system then exports this as structured data compatible with your accounting software or ERP system.

This technology significantly speeds up the initial stages of invoice validation. It reduces errors from manual data entry and frees up your AP team to focus on more complex validation tasks.

2. Automate three-way matching

An AI-powered document processing system can perform automatic three-way matching between invoices, purchase orders, and receiving documents. This process is faster and more accurate than manual matching.

The system compares key details like item descriptions, quantities, prices, total amounts, dates, and delivery information across all three documents.

When everything matches, the invoice can be automatically approved for payment. If there are discrepancies, the system flags them for review, pointing out exactly where the mismatch occurs.

This automation speeds up the validation process, allowing you to process more invoices straight through. It reduces errors and frees up your AP team to focus on resolving exceptions and other high-value tasks.

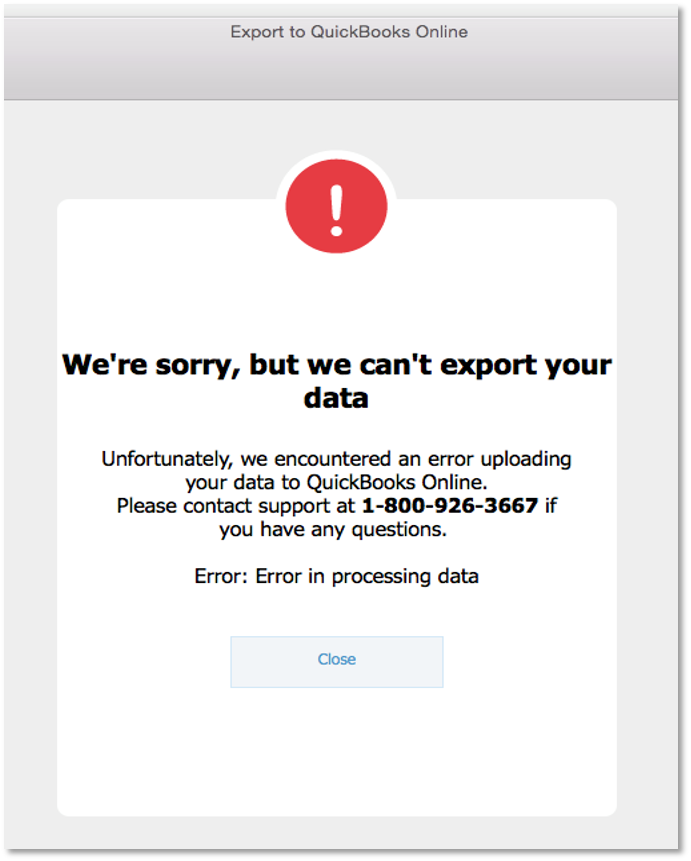

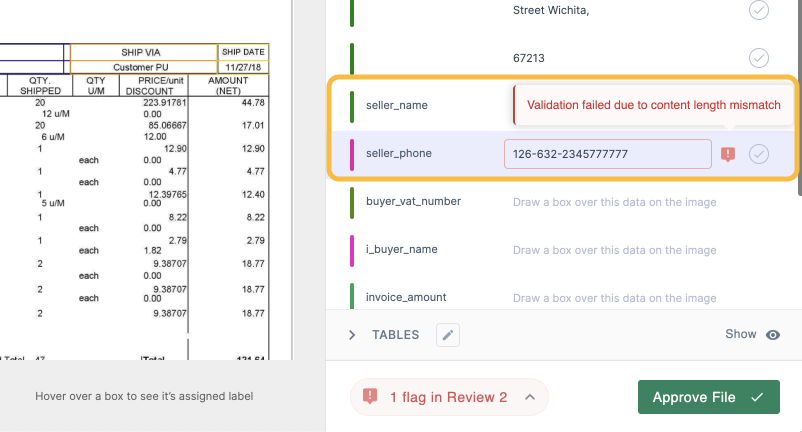

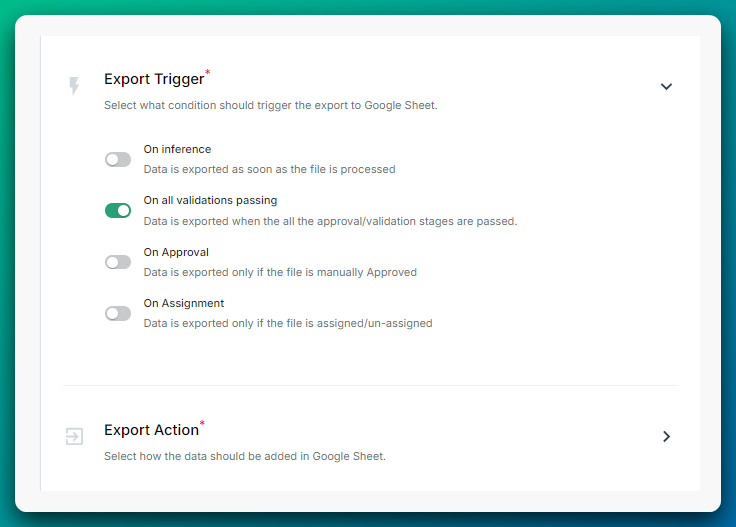

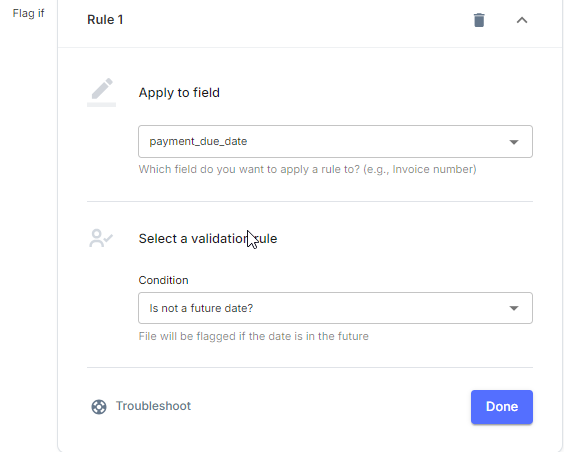

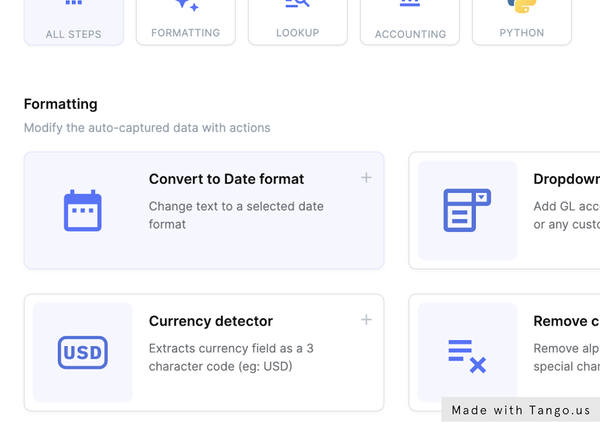

3. Set up automated validation rules

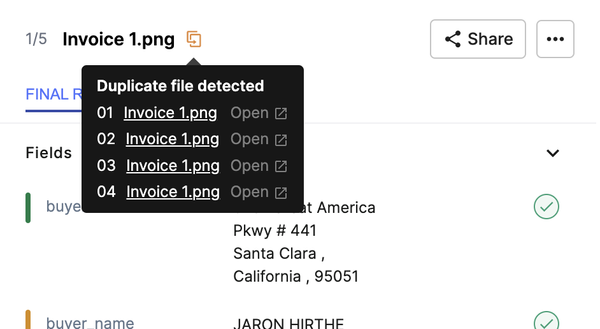

Intelligent document processing solutions allow you to configure predefined validation rules. These can include checks for missing fields, mismatched amounts, duplicate invoices, incorrect tax calculations, and invalid vendor information.

These automated checks catch the most common errors before they reach human reviewers. The flagged invoices are then routed to the appropriate team members for review and resolution. This streamlines the validation process, ensuring that only genuine exceptions require human intervention.

With these validation rules, your team won’t be wasting time on basic math checks anymore. You can even verify and potentially correct tax calculations based on subtotals and known tax rates.

The system catches those errors, and they can focus on the trickier issues that need expertise. It also helps ensure consistency in how invoices are validated across your AP team.

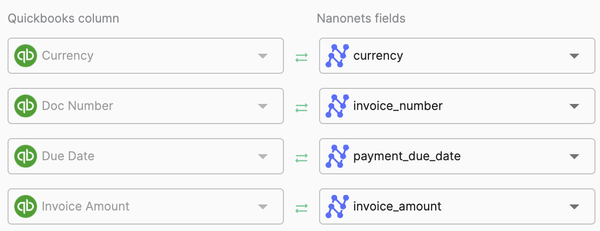

4. Integrate systems for seamless data flow

Connect your invoice processing solution with your ERP, accounting software, and other business systems. This integration enables real-time data sync and reduces manual data transfer.

It ensures automatic updates of invoice status across all systems. This eliminates double data entry and reduces errors. Moreover, you can easily access purchase orders and receipt information for matching. You don’t have to manually contact different departments or dig through multiple systems for information.

Additionally, it ensures improved accuracy in vendor data and payment information, allowing for better cash flow management and reporting. Finance teams can make more informed decisions about when to pay vendors.

5. Use AI to detect fraud

IDP tools can analyze invoice patterns and flag potential fraudulent activity. This adds an extra layer of security to your validation process.

AI can spot subtle patterns humans might miss, such as invoices just below approval thresholds, slight changes in vendor bank details, unusual spikes in invoice frequency or amounts, and duplicate invoices with minor alterations.

It protects your company from financial losses and strengthens your overall control environment. It allows your team to focus on strategic tasks while the AI continuously monitors for potential risks.

6. Implement a supplier portal

Set up a self-service portal where suppliers can submit invoices electronically and check payment status. This will reduce manual data entry and help catch errors at the source.

It encourages electronic invoice submission. Suppliers can upload invoices directly, reducing errors and ensuring data accuracy. In case of exceptions, the system will alert suppliers, allowing them to quickly address issues, speeding up resolution times.

Moreover, it ensures transparency because they can track invoice status and payment information without contacting your AP team. This reduces inquiries and frees up your staff's time. Also leads to better supplier relationships.

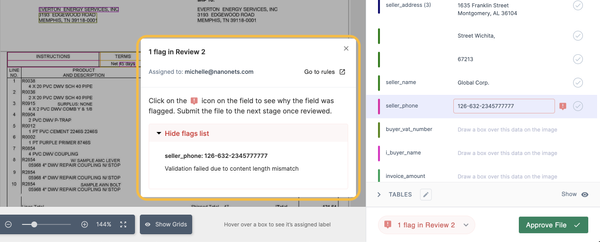

7. Implement exception-handling workflows

Set up automated workflows in your IDP tool to manage invoices that fail initial validation checks. For instance, a mismatch in pricing could trigger a notification to the purchasing department for review. This context-based routing ensures that exceptions are handled efficiently by the right people.

Plus, when exception types are clearly categorized (e.g., price mismatch, quantity discrepancy), it becomes easier to track and analyze common issues. This data can be used to identify recurring problems and implement preventive measures.

When your AP team knows exactly which issues they need to handle, and they can easily collaborate with other departments to resolve them quickly. You won’t be taking weeks or months to resolve exceptions anymore. This streamlined process reduces invoice processing time and improves overall efficiency.

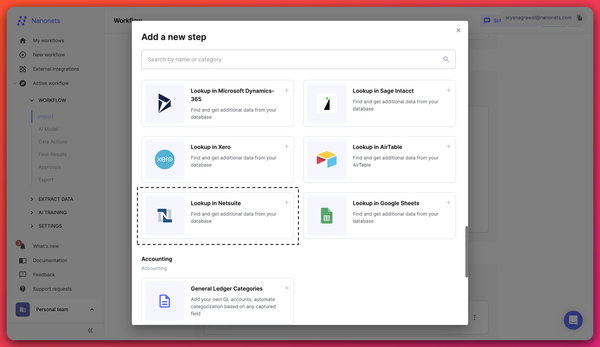

8. Enriching invoice data from external sources

Missing or incomplete invoice data often prevents them from being validated quickly. IDPs can help overcome this challenge by enriching invoice data from external sources.

These tools allow you to look up vendor information from databases or from your Netsuite, Xero, QuickBooks, or other accounting systems. This ensures that critical information like tax IDs, payment terms, and addresses are accurate and up-to-date. You can automatically fill in missing details, reduce the manual back-and-forth

Moreover, IDPs can cross-reference invoice line items with product catalogs or price lists to verify pricing accuracy. This feature is particularly useful for organizations with complex pricing structures or frequent price changes.

9. Simplify international invoice validation

Imagine being able to apply country-specific validation rules (e.g., VAT calculations for European invoices) automatically. Many of these IDP tools come with multi-language support, currency detection and conversion, and built-in compliance checks for different regions. This eliminates the need for manual intervention at so many different levels.

Additionally, these tools can standardize various date and number formats. So, if you're dealing with invoices from different countries, the system can automatically convert them to a standardized format for easier processing.

Final thoughts

There’s a lot you can do to streamline your invoice validation process. However, it is important that you don’t disrupt your existing workflows while implementing these changes.

A recent Forrester study found that the Risk of disruption to current processes is the highest barrier to adopting new invoice processing technologies. So, you must prioritize technology that can seamlessly integrate with your legacy systems and workflows.

This is where IDP solutions shine. Unlike general AI tools like LLMs, IDP platforms are built specifically for tasks like document processing, offering a more predictable and accurate approach. They're designed to handle all types of invoices — from simple to complex, typed to handwritten – with high accuracy.

What sets IDP solutions apart is their ability to deliver consistent results time after time, regardless of the invoice format or complexity. They work methodically, following set rules and patterns while also learning from each document they process. This means they can adapt to new invoice formats over time, but in a controlled, predictable way.

Moreover, they can work with your existing systems seamlessly, be it traditional solutions like NetSuite or SAP or modern cloud-based platforms like Xero or QuickBooks. This integration capability ensures that your existing workflows remain intact while benefiting from enhanced automation. This ensures a smooth transition and minimal disruption to your current processes.

Nanonets stands out as an industry leader in the IDP space, addressing every AP challenge you face. It offers a comprehensive solution for invoice validation:

- Intelligent document sorting

- Automated line item and field validation

- Smart three-way matching

- Database matching

- Multi-stage approval workflows

- Automated import and export workflows

- Multi-language support and currency detection

- Duplicate detection, tax verification, and much more

With Nanonets, you get the efficiency of full automation without the hassle of complex setup or maintenance. It's designed to streamline your entire invoice validation process, from when an invoice is received to its final approval and payment.