Let's face it, invoice processing has changed. The mountain of paperwork and endless data entry that once ate up your accounts payable team's time is becoming obsolete, thanks to invoice imaging.

With recent advancements in AI, ML, and AI invoice automation, invoice imaging software has become even more robust, enabling AP teams to automate many tedious parts of the paperless accounts payable process.

In this guide, we dive into what invoice imaging is, how it transforms your accounts payable process, and why your business can't afford to ignore it. With real success stories and expert insights, we'll show the tangible benefits of automating invoice imaging and how it can significantly reduce processing times, increase accuracy, and save costs.

What is invoice imaging?

Imagine trading the tedious shuffle of paper for a few effortless clicks. That's what invoice imaging does — digitizes invoices and extracts data from them for further processing. These digital files are easier to store and access, making file cabinets a thing of the past.

The invoice imaging feature is now built into invoice automation tools. These tools use OCR to detect and recognize text, numbers, and other information from invoices and can send the extracted data to accounting systems or ERP software for further processing.

The transformation it brings is clear: less manual labor, fewer errors, and a faster path from invoice to pay. Most importantly, you will be more likely to get discounts from suppliers for timely payments.

How does invoice imaging work?

Let's be honest — nobody loves processing invoices manually. It's time-consuming, repetitive, and often the least favorite part of an AP clerk's job. Now, imagine having to process 600-800 invoices a month. Manual data entry would gobble up so much time, leaving room for little else.

This is where invoice processing software helps. The software generally follows a logical sequence of steps to complete the task.

- Digitization of invoices: The process begins when a physical invoice is scanned, creating an accurate digital version. This step converts tangible paper documents into digital files that can be easily accessed, edited, and stored.

- Data extraction and interpretation: Once digitized, the software analyzes the electronic invoice. Using predefined rules, it precisely extracts critical data elements such as vendor details, dates, line item descriptions, and monetary amounts. The extracted data is then validated to ensure completeness and accuracy.

- Review and ERP integration: After successful validation, the information is forwarded for requisite approvals and sent to the organization's Enterprise Resource Planning (ERP) system. This integration facilitates advanced processing, such as financial analysis and strategic planning.

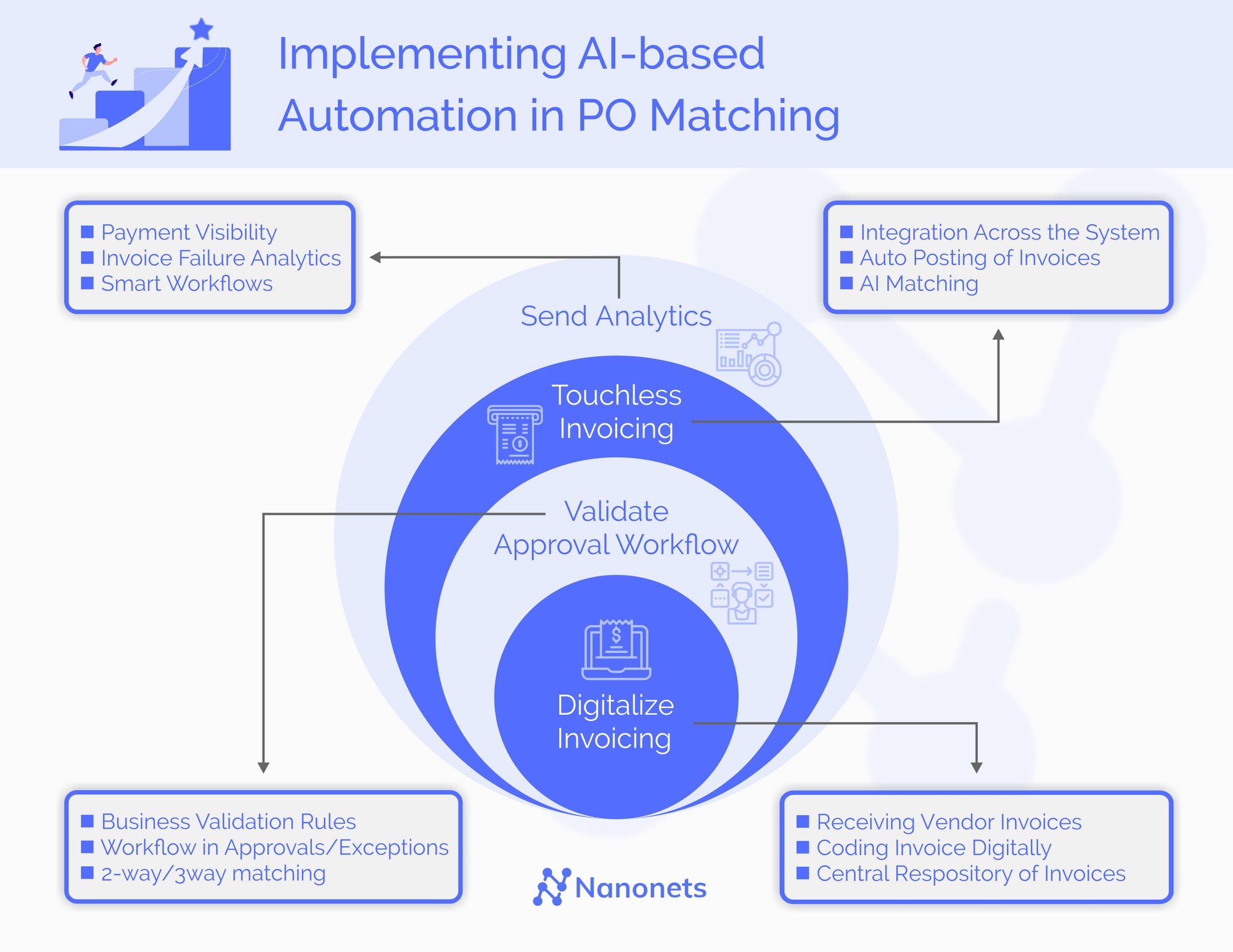

There are two types of invoice processing tools available in the market: rule-based systems and AI-based systems. Rule-based systems process invoices using a pre-programmed set of criteria and are best suited for invoices that adhere to a uniform structure. However, they may falter when handling invoices that deviate from conventional formats.

AI-based systems have machine learning capabilities to intuitively adapt to and process various invoice layouts. These systems continuously refine their data extraction techniques through ongoing learning, leading to increased adaptability and accuracy. While rule-based tools may require less initial setup, AI-based systems, despite requiring more training, offer a flexible and dynamic solution for invoice processing.

When should Invoice Imaging be Adopted?

Invoices imaging is most suitable for companies as well as other organizations that deal with many invoices frequently. This includes:

Small to Medium Sized Business (SMBs)

Invoice imaging can be useful for SMEs as it automates the processes connected with issuing invoices and decreases the amounts of mistakes in data entry.

Large Corporations

Invoice imaging can be helpful to companies of different scales, especially those performing many operations that require paperwork; however, complex corporations are especially likely to benefit from the technology since it simplifies the management of numerous documents and helps avoid potential issues connected to the failure of compliance with financial rules and regulations.

Accounting and Finance Departments

Such departments can also apply the method of invoice imaging to increase the efficiency, as well as the credibility of the invoices that they process for management and report generation purposes.

Accounts Payable Teams

Invoice imaging enables the accounts payable teams to work on the automation of processing of the invoices, and reduction of the processing time.

E-commerce Businesses

Invoice imaging is quite beneficial to e-commerce companies that process several transactions and invoices daily or within a single month.

Healthcare Providers

There are various advantages that may prove helpful for the healthcare providers through invoice imaging and these are related to medical billing and timely and accurate payment systems.

Government Agencies

Business departments such as government bodies can benefit from invoice imaging since it can enhance transparency while at the same time cutting the workload, in addition to ensuring that the organization complies with financial laws.

Non-Profit Organizations

Invoice imaging is beneficial to non-profit organizations because it enables the organizations to take control of their financial processes especially when it comes to issuance and allocation of funds.

Automated invoice processing ROI calculator

Notes and assumptions (click to expand)

- The manual processing cost per invoice ranges from $15 to $40

- According to salary data, an AP clerk's average annual salary varies between $40,766 and $50,080.

- Nanonets' PRO Plan is offered at a fixed rate of $999 per month for each model, which includes processing up to 10,000 pages.

- There is an additional charge of $0.10 for each page processed beyond the initial 10,000 pages included in the PRO Plan.

- According to feedback from our customers, the solution can reduce the turnaround time for manual invoice processing by up to 90%. This significant reduction in processing time is not included in the cost savings calculation to keep the computation straightforward.

- Employing a dedicated AP clerk to manage the Nanonets system is optional, depending on the company's size, policies, and volume of invoices.

- The cost savings we've calculated are only based on the differences in processing costs between the manual method and Nanonets AP automation. And it doesn't consider any potential decrease in turnaround time or clerical work hours.

- Nanonets also offers a pay-as-you-go model where the first 500 pages are free, then $0.3/page afterward. This model can be more cost-effective for smaller businesses or those with lower document processing volumes.

Reasons to adopt invoice imaging and automation into your AP workflow

As the business processes evolve, companies are increasingly turning to invoice imaging technology to streamline their accounts payable (AP) workflows.

Beyond the apparent efficiencies, this technology serves as a springboard for a multitude of operational improvements and strategic opportunities.

1. Prevent fraud

Since each invoice goes through a 2-way, 3-way, or 4-way matching of purchase orders and sales receipts to invoices (facilitated by OCR technology), fraudulent vendors won't be able to take advantage of your business. It also prevents fraudulent payments from being processed, including those resulting from incorrect data entry, false billing, or fraudulent cheques.

Additionally, automated invoice approvals and an audit trail for the accounting team and auditors can be set up to add another layer of protection against fraudulent activities.

2. Reduce human errors

Manual data entry is prone to errors, leading to incorrect payments, penalties, and strained relationships with vendors. With invoice imaging and automation, these errors are significantly reduced as the software accurately captures and processes invoice data.

This also ensures that no invoices are lost or forgotten, further improving the reliability and efficiency of your AP process. You can correctly estimate your cash flow and take the necessary steps to maintain a healthy cash flow balance.

3. Ensure compliance

Audits become less daunting as all necessary documentation is readily available, accessible in a central location, and traceable. Moreover, the integrations with the ERP system ensure that all transactions are recorded and tracked in real time.

The reviewal and approval routing processes ensure that every invoice is verified as per company and regulatory policies. Moreover, you can set up taxation rules and regulations in the software to automatically calculate and apply the correct tax rates to invoices, ensuring compliance with local and international tax laws.

4. Maintain better vendor relationships

Vendors appreciate prompt responses and accurate payments. Automated invoice processing ensures that all invoices are paid on time. Moreover, since the system keeps them in the loop with automatic notifications, they feel more secure about their transactions with your business — and this reduces the need for follow-ups.

This level of transparency can lead to better negotiation of terms, discounts, and possibly even exclusive deals. This also makes it easier to resolve any disputes or issues that may arise, leading to more robust, more collaborative relationships.

5. Monitor vendor performance better

With all vendor information centralized, monitoring their performance and making data-driven decisions becomes more manageable. Unexpected delays in stock replenishment can be avoided as the system can predict and notify when a restock is necessary based on the vendor's historical data.

This level of foresight ensures a smooth supply chain and reduces the risk of overstocking or understocking, thus optimizing inventory management.

6. Enhance the AP team's morale and productivity

Imagine telling an AP team member that they won't have to chase their colleagues or teammates from other departments for approvals. Or that they won't have to manually process invoices ever again. That's precisely what invoice imaging and automation can provide.

Eliminating tedious and repetitive tasks can increase job satisfaction and higher productivity levels. Plus, with the quick and accurate processing of invoices, the team can avoid the stress of last-minute rushes and achieve a better work-life balance.

7. Improved financial forecasting

With real-time updates on invoice payments, AP teams can get a clear picture of the company's cash flow. This enables better financial forecasting and planning. For instance, knowing when a large payment is due can help adjust the budget and avoid any potential cash flow issues.

8. Improve profitability

By automating the invoice process, companies can significantly reduce the cost of processing each invoice. This, coupled with taking advantage of early payment discounts and avoiding late payment fines or compliance-related penalties, can lead to a noticeable improvement in the company's bottom line.

Furthermore, the ability to accurately forecast cash flow and budget effectively can contribute to increased profitability. By clearly understanding the company's financial situation, better decisions can be made to positively affect the business's profitability.

How do Nanonets seamlessly automate invoice imaging and processing?

Nanonets AP automation software comes with built-in invoice imaging. You can scan and upload invoices in bulk, completely automate data extraction, route invoices to the right approvals, assign them to team members, and pay vendors with just a few clicks.

A brief comparison of invoice processing with Nanonets and traditional methods

| Feature | Traditional Software | Nanonets AP Automation | Advantages of Nanonets |

|---|---|---|---|

| Data Extraction | Rule-based, manual intervention. | AI-powered, continuous learning. | Adapts to formats, reduces manual tasks. |

| Bulk Processing | Limited batch capabilities. | High-volume processing. | Efficient for large invoice quantities. |

| Integration | Basic, manual ERP setup. | Seamless ERP integration. | Quick, adaptable integration with ERPs. |

| Error Reduction | Higher human error potential. | AI highlights errors and learns from manual intervention. | Consistent accuracy, less risk of mistakes. |

| User Training | Extensive training required. | Intuitive, minimal training needed. | Easy onboarding, user-friendly interface. |

| Scalability | Limited by fixed algorithms. | Adapts and scales with growth. | Handles increased volumes effectively. |

| Approval Workflow | Rigid, IT-dependent changes. | Flexible, automated adjustments. | Adapts to organizational changes smoothly. |

| Reporting | Standard reporting tools. | Advanced real-time analytics. | Informs decisions with detailed insights. |

| Cost Savings | Efficiency bound by manual processes. | Substantial savings from AI efficiency. | Greater ROI through lower processing costs. |

| Vendor Relations | Manual updates may strain ties. | Automated, transparent communications. | Enhances trust and negotiation leverage. |

| Compliance | Time-consuming manual checks. | Automated regulatory adherence. | Simplifies audits, reduces non-compliance risk. |

| Forecasting | Inaccurate manual forecasting. | Real-time data for precise forecasting. | Better strategic planning, financial management. |

| Invoice Matching | Time-intensive manual matching. | Intelligent automated matching. | Streamlines reconciliation, saves time. |

| Payment Scheduling | Manual scheduling risk errors. | Automated scheduling. | Avoids late fees, maximizes early discounts. |

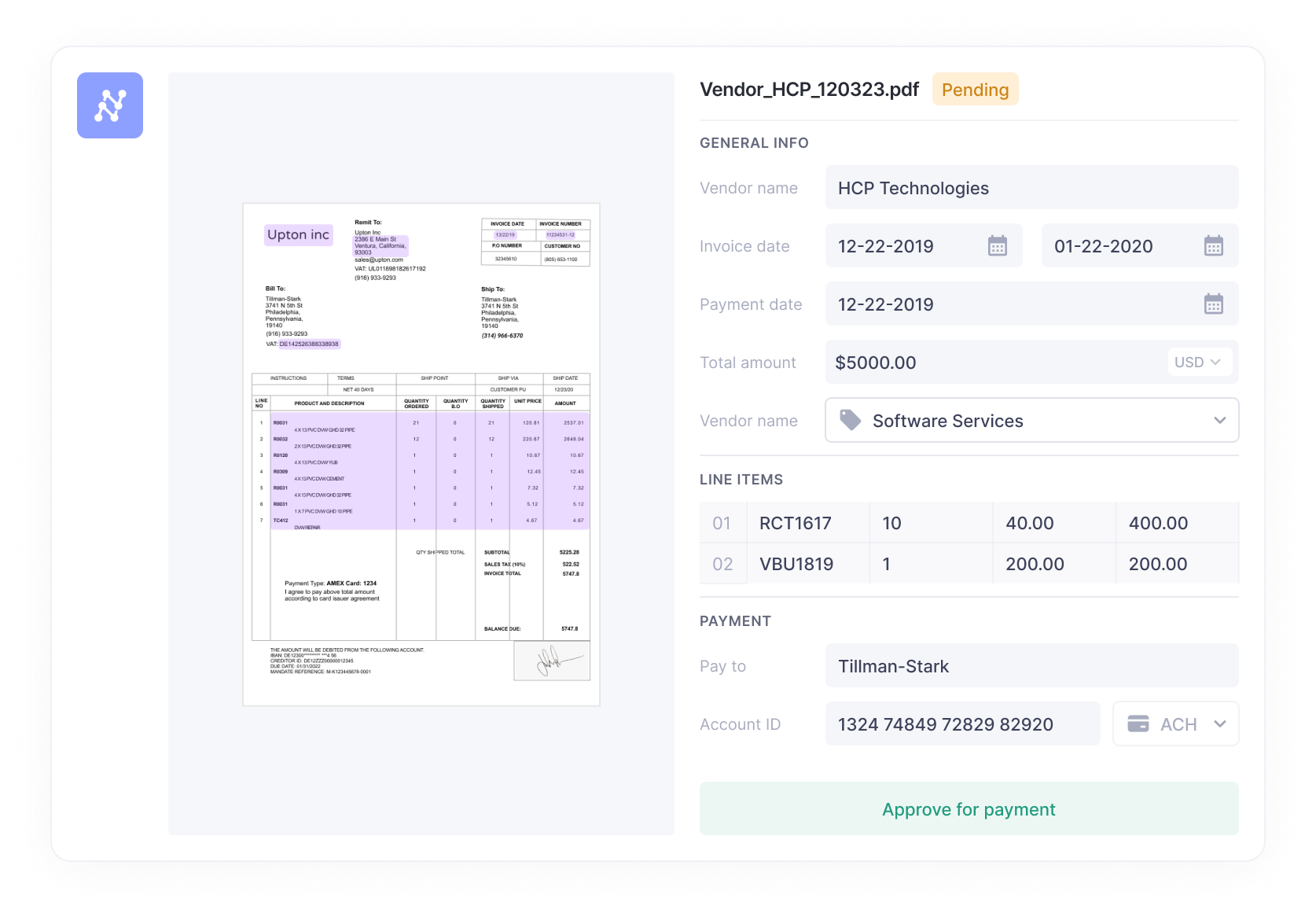

Here's a quick step-by-step guide on how Nanonets AP automation software can transform your invoice imaging and processing:

1. Upload or import scanned invoices

Nanonets can scan or import any invoice, whether it's received via email or Google Drive. You can even set up a Zapier integration to directly import and extract text from each new invoice in QuickBooks.

Speak to your vendors about how they'd like to send invoices. For example, they might send paper invoices that need scanning or email images directly. It is essential to provide them with clear specifications, such as the preferred image format and minimum resolution required. Nanonets can support a variety of formats, including PDFs, Docs, TIFFs, and most image formats.

2. Train the AI model and adjust the settings

Upload a few sample invoices to train the AI model. This will help the model understand the structure of your invoices and how to extract data accurately. It also learns from manual interventions to improve future extraction accuracy. You can also use the pre-trained invoice model to expedite this process.

Adjust the table fields and headers to match your invoice structure. Set which PDF pages to extract data from or whether to process emails without attachments. Also, look at the workflow settings — the import and export options, the approval process, when to flag files, and more.

3. Process and review invoices

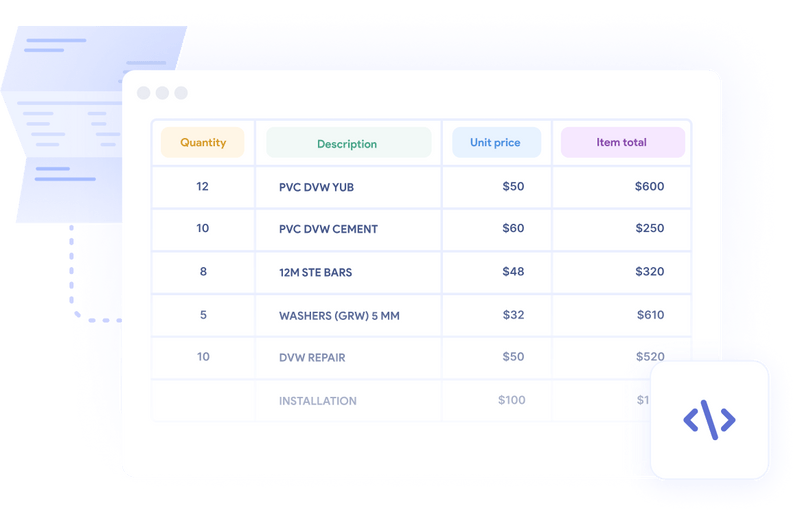

Manually upload or automatically import invoices into the system. Nanonets will then use the trained AI model to extract data, such as vendor details, PO number, invoice number, date, line item details, and total amount.

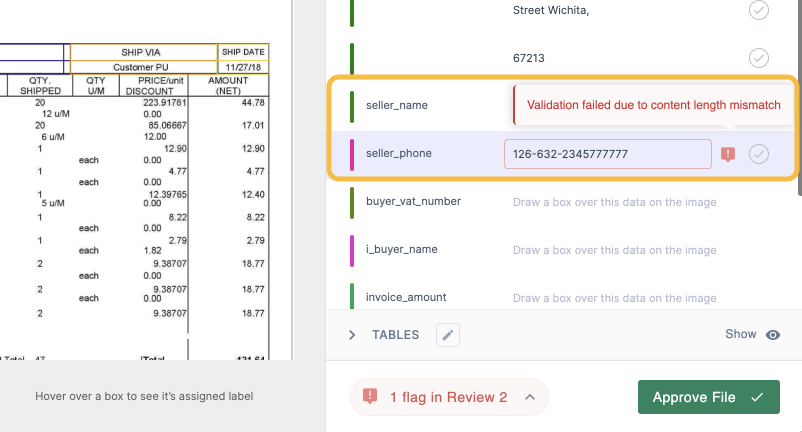

Review the extracted data. The AI highlights fields that it is less confident about. Correct any inaccuracies and approve the data extraction. This ensures the current invoice is processed correctly and helps the AI model learn and improve over time.

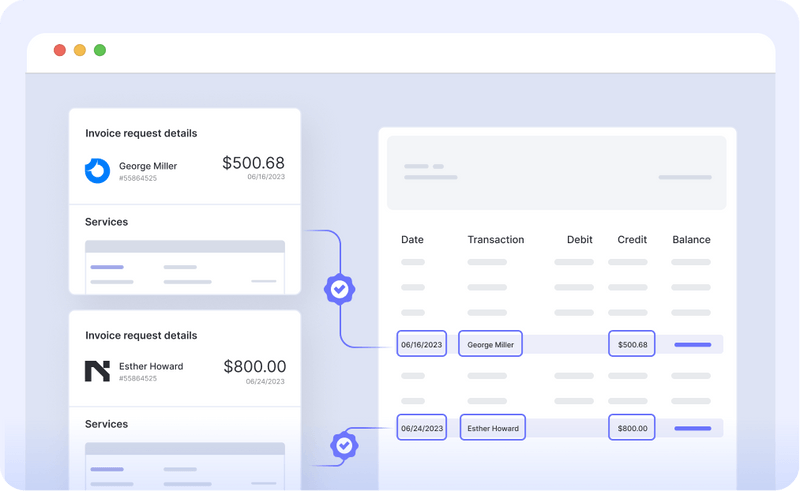

4. Match POs and approve invoices

3-way matching is automated in Nanonets. The software will automatically retrieve the corresponding PO based on the extracted PO number from the invoice. It matches the invoice details against the PO and any associated delivery receipts. Any discrepancies are automatically flagged and sent to an AP clerk for resolution.

Once the data is validated, the system will route the invoices to the appropriate approvers based on your predefined rules. They will get notified in their email inbox and can approve the invoices from their email or directly in the Nanonets system. If the invoice requires multiple approvals, Nanonets handles that, too, sending notifications in the correct order to each approver. This ensures a smooth and efficient approval process. The approver can approve or reject the invoice with just a click, and if needed, they can also add comments for further clarification.

The system ensures transparency as everyone knows what stage the invoice is at — be it in review, pending approval, or ready for payment. Team members won't have to chase each other for updates or approvals, thereby eliminating unnecessary delays and improving overall productivity.

5. Pay and reconcile invoices

Once approved, you can initiate the payments from within Nanonets. Select the payment mode, enter the details, and click pay. You can also schedule payments to avoid late fees and take advantage of early payment discounts.

The reconciliation process is also made easy. Nanonets integrates with Xero, QuickBooks, and other popular accounting systems. This allows you to reconcile paid invoices with your financial records seamlessly. This eliminates the need for manual data entry, reduces the risk of errors, and ensures your financial data is accurate and up-to-date.

Automating invoice imaging boosts AP efficiency

Automating invoice imaging and processing has proved to be a game-changer for our clients, resulting in significant cost and time savings.

| Client | Original Challenge | Solution with Nanonets | Resulted Outcome |

|---|---|---|---|

| ACM Services | 20-hour weekly invoice processing workload. | Nanonets OCR automated data extraction. | Reduced processing time by 90%, completed in 2 hrs. |

| Ascend Properties | 5 full-time employees processing invoices. | Nanonets automated invoice imaging system. | Saved 80% on processing costs, reduced to 1 employee. |

Maryland-based full-service environment remediation contractor ACM Services is a prime example of this transformation. They integrated the Nanonets OCR solution into their operations, and the results were brilliant — a whopping 90% cut in their invoice processing time.

What used to be a 20-hour weekly chore turned into a task that could be wrapped up in a single day. Not only did this speed up the invoice extraction process, but it also led to a happier work environment. The cost of processing an invoices plummeted for ACM Services. Plus, by settling their invoices promptly, they were able to grab early payment discounts from their vendors.

Ascend Properties, a UK-based property management company, saved 80% in invoice processing costs after implementing an automated invoice imaging system. They had five full-time employees dedicated to manual invoice processing. After automation, they needed only one, freeing the rest of the team to focus on more strategic tasks.

Final thoughts

If you're considering implementing an automated invoice imaging system, choosing a solution that fits your business needs is essential. Look for a system that offers real-time tracking, integration with your ERP system, and customizable approval workflows.

Remember, the goal is to streamline your AP process, reduce manual tasks, and improve your bottom line. With the right solution, you can achieve these objectives and more.

Check out Nanonets OCR and AP automation solution for a comprehensive, easy-to-use, and efficient way to automate your invoice imaging process. With our advanced AI technology, you can drastically reduce invoice processing time, improve accuracy, and enhance your team's productivity.

Frequently asked questions on invoice imaging

1. What is invoice imaging?

Invoice imaging is the conversion of paper invoices into digital format through scanning. It's often part of a broader automated invoice processing system, which uses Optical Character Recognition (OCR) and Artificial Intelligence (AI) to extract, validate, and process invoice data.

2. What is a scanned invoice?

A scanned invoice is a digital copy of a physical invoice obtained through scanning. It is a paper invoice converted into an electronic format, which can be stored, managed, and retrieved digitally. This eliminates the need for physical storage and manual retrieval.

3. What are the benefits of invoice scanning?

Automated invoice scanning is a process that makes accounts payable (AP) processing more transparent and audit-friendly. It enables accurate capture and extraction of invoice data, including line items, which improves productivity and frees up AP teams for more significant tasks. With the ability to process large volumes of invoices quickly and accurately, automated invoice scanning reduces the risk of errors and late payments. Additionally, it enables real-time tracking of invoice payments, resulting in better financial forecasting and improved profitability.

4. What is invoice scanning software?

Invoice scanning software is a tool that uses technologies like OCR and AI to scan, interpret, and process invoice data. This software can automate the entire invoice management process, from scanning the invoice to extracting relevant data, validating it, and integrating it into an ERP system. It's a key component in a company's accounts payable automation strategy, significantly reducing manual tasks, errors, and processing time while improving accuracy and efficiency.