Let's face it: financial reporting is often a tedious, time-consuming nightmare. You're drowning in spreadsheets, chasing down data, and praying you didn't miss a decimal point somewhere. But what if there was a better way?

Yes—financial reporting automation! At its core, it leverages technology to streamline financial data collection, processing, and presentation. From automating data entry to generating complex reports at the click of a button, it's transforming how finance teams operate.

In this guide, we'll explore how financial reporting automation can transform your finance department. We'll cover the benefits, the challenges, and, most importantly, how you can get started today. Whether you're just beginning to explore automation or looking to optimize your existing processes, you'll find practical insights to help you navigate this rapidly evolving landscape.

What is financial reporting automation?

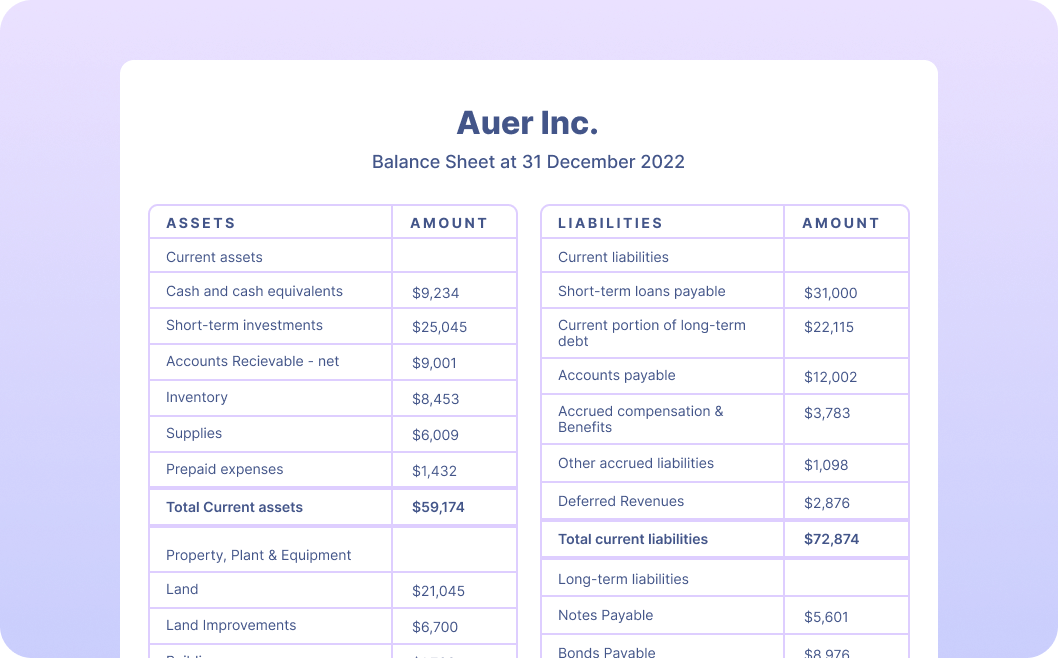

Financial reporting involves compiling and presenting a company's financial data to stakeholders through balance sheets, income statements, and cash flow statements. These reports offer crucial insights into a company's financial health and performance.

The traditional financial reporting process is inefficient and error-prone. It relies on manual data collection, account reconciliation, and calculations using basic tools like spreadsheets. This approach is time-consuming and prone to delays, leaving companies little time for financial data analysis and strategic planning.

This is where automation comes in. Financial reporting automation uses technology to streamline data collection, processing, and presentation.

How does it work

- Data capture: Automated workflows and advanced OCR combine to capture and extract data from various financial documents, such as invoices, receipts, and bank statements, from different sources, such as Gmail, Dropbox, vendor portals, etc.

- Data integration: The extracted data is automatically fed into your financial systems. APIs and integration tools like Zapier ensure seamless data flow between platforms, such as your ERP system and accounting software.

- Data validation: Automated validation rules check the data for accuracy and completeness. For instance, the system might flag discrepancies between invoice totals and line item sums or highlight unusual transactions based on historical patterns.

- Data processing: With clean, validated data in place, automated processes take over. This might involve currency conversions, categorizing transactions, or calculating financial metrics. RPA tools can handle repetitive calculations and data manipulations.

- Report generation: The system automatically generates financial reports using predefined templates. These could include balance sheets, income statements, cash flow statements, and custom management reports.

- Analysis and insights: AI-driven analytics tools can identify trends, anomalies, and potential areas of concern, providing valuable insights alongside the raw numbers.

- Distribution: Finally, the system automatically distributes reports to relevant stakeholders, whether through email, secure portals, or integration with other business intelligence tools.

Automating these processes enables finance teams to significantly reduce the time and effort required for financial reporting and focus more on analyzing data and providing strategic insights. McKinsey reports that finance leaders using automation spend 20% more time on value-added activities than typical departments.

This shift transforms finance teams from number crunchers to strategic partners. Automation tools enable professionals to interpret data, identify trends, and provide actionable insights for business growth. Additionally, automation enhances accuracy and consistency by eliminating manual data entry and calculation errors.

The benefits of automating financial reporting

Studies reveal that most businesses should be able to automate one-quarter of their processes within the next five years, and accounting and financial reporting are common targets for this type of automation. And it offers numerous benefits for businesses of all sizes.

- Enhanced accuracy: Automation minimizes human error in data entry and calculations, leading to more reliable financial statements.

- Time savings: Automating manual data entry, data transfer, and reconciliation frees up significant time for finance teams, potentially reducing the monthly close process by several days.

- Real-time insights: Automated systems can provide up-to-the-minute financial data, enabling quicker, more informed decision-making.

- Enhanced data integrity: Automated systems reduce the risk of data inconsistencies in financial reports by performing real-time data validation checks, ensuring accurate and reliable financial information.

- Improved compliance: Automated systems can be programmed to adhere to the latest regulatory requirements and internal controls, reducing compliance risks.

- Cost reduction: While there's an initial investment, automation can lead to long-term cost savings by reducing the need for manual labor and minimizing errors.

- Scalability: Automated systems will be able to handle increased data volumes without a proportional increase in effort or resources as your business grows.

- Enhanced collaboration: Cloud-based automation tools facilitate better collaboration among team members, even in remote work environments.

These benefits collectively contribute to improved financial performance and overall business productivity.

Financial reports and processes suitable for automation

Automation can revolutionize various aspects of financial reporting, from specific reports to underlying processes.

Let's dive into the areas where automation can make the most significant impact:

a. Key financial reports:

- Balance sheets: Automate real-time updates of assets, liabilities, and equity.

- Income statements (P&L): Streamline revenue and expense tracking for instant profitability insights.

- Cash flow statements: Automate cash inflow and outflow calculations for better liquidity management.

- Regulatory reports: Ensure compliance with automated SEC filings or tax reports.

- Management reports: Create customized dashboards with key performance indicators.

b. Financial processes:

- Accounts payable: Automate invoice processing, approval workflows, and payment scheduling.

- Accounts receivable: Streamline customer invoicing, payment reminders, and cash application.

- Expense management: Automate expense report submission, approval, and reimbursement.

- Budgeting and forecasting: Use AI to generate accurate financial projections based on historical data and market trends.

- Financial consolidation: Automate financial data aggregation from multiple entities or subsidiaries.

- Journal entries: Set up automated recurring journal entries for regular transactions.

- Bank reconciliations: Automatically match bank statements with internal records.

The impact of automation varies depending on your organization's size, industry, and specific needs. As you consider automating your financial reporting, prioritize areas with high volume, repetitive tasks, or those prone to human error. Start with processes that promise the highest ROI in terms of time saved and improved accuracy.

Best practices for successful financial statement automation

To maximize the benefits of financial reporting automation, consider these industry-leading practices:

1. Choose and integrate the right automation tools

- Evaluate tools based on your specific needs, considering factors like scalability, integration capabilities, and ease of use.

- Prioritize solutions like Nanonets that offer APIs and integrations with existing systems to ensure seamless data flow.

- Ensure the chosen tools can handle both structured and unstructured financial data.

- Look for solutions that offer pre-built connectors to popular financial software and ERPs.

2. Map and optimize your financial close process

- Pinpoint reconciliation bottlenecks and manual data entry points.

- Quantify time spent on each financial statement and supporting schedule – identify reports take the most time to prepare and why.

- Create a dynamic close calendar that adjusts tasks and deadlines based on real-time progress.

- Implement automated task dependencies to ensure the correct sequence of close activities.

- Set up automated reminders and escalations for overdue close tasks.

3. Standardize your chart of accounts and financial data structure

- Align your chart of accounts with both internal reporting needs and external reporting requirements (e.g., GAAP, IFRS).

- Create a standardized format for common financial data points across all subsidiaries or business units.

- Develop a consistent naming convention for all financial accounts, including those in foreign currencies.

4. Implement continuous accounting practices

- Set up daily or real-time feeds from transaction systems into your financial reporting tools.

- Automate routine journal entries, such as accruals and amortizations, throughout the month.

- Configure automated alerts for unusual transactions or balance fluctuations.

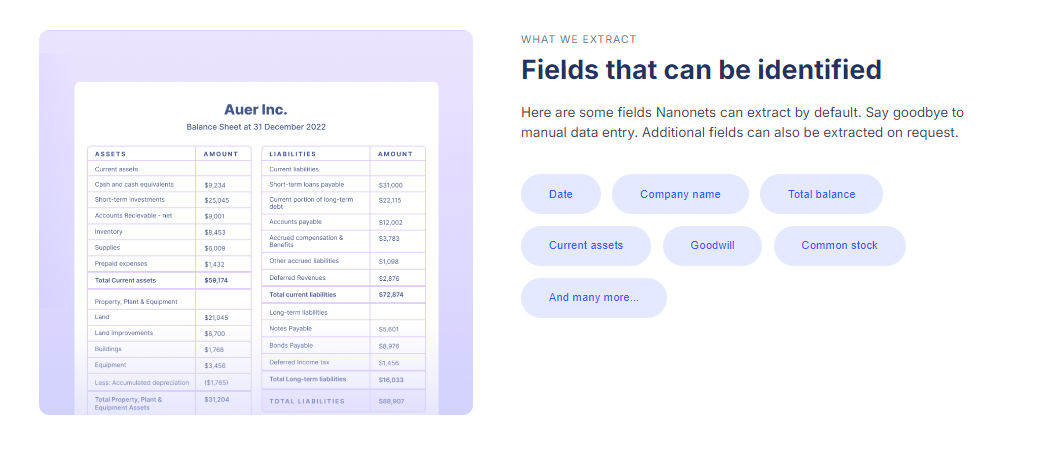

5. Leverage AI for complex financial document processing

- Use AI-powered OCR to extract data from diverse financial documents like invoices, bank statements, and receipts without templates.

- Categorize transactions automatically based on historical patterns.

- Extract relevant financial data from footnotes and management commentary.

- Set up reconciliation processes that match transactions across multiple systems and flag discrepancies.

- Set up validation rules to identify and flag unusual transactions or account balances.

6. Automate financial ratio calculations and trend analysis

- Configure your system to automatically calculate key financial ratios (e.g., current ratio, debt-to-equity, ROI) as part of the reporting process.

- Set up automated variance analysis to compare actual results against budgets and forecasts.

- Create automated alerts for when key financial indicators fall outside predetermined thresholds.

7. Design a comprehensive audit trail for financial reports

- Implement version control for all financial reports, tracking changes and approvals.

- Set up automated logging of all data sources used in each financial report.

- Create a system to document all manual adjustments made during the reporting process automatically.

- Configure your tools to generate audit-ready reports detailing the entire financial close process.

8. Automate regulatory reporting and compliance checks

- Encrypt financial data both at rest and in transit using industry-standard protocols.

- Implement role-based access controls to ensure data privacy and segregation of duties.

- Implement automated generation of regulatory reports (e.g., SEC filings, tax reports) using your financial data.

- Ensure compliance with relevant financial regulations (e.g., SOX, GDPR) through automated checks and reporting.

These best practices can help you create a robust and accurate financial reporting system that makes your finance department more efficient.

How to automate financial reporting

Selecting the right tool is difficult, but once you have settled on a tool, you can take a few steps to ensure a smooth transition.

The first step is to take stock of all the financial processes you have in your company. Figure out what manual tasks in your financial reporting process can be automated. Don’t forget to get inputs from your finance team so they can let you know what works and what doesn’t.

Once you have a list of the tasks that can be automated, design a workflow based on your needs. The first step in the workflow would be to digitize everything.

- Automate bank reconciliations: Use Nanonets' AI-powered OCR to automatically extract data from bank statements. Set up rules to match bank transactions with your general ledger entries. Configure automated alerts for unmatched items or discrepancies, allowing your team to focus only on exceptions that require human intervention.

- Streamline accounts payable processes: Implement automated invoice capture and data extraction using Nanonets to eliminate manual data entry. Set up automated three-way matching between purchase orders, invoices, and receipts to ensure accuracy and prevent overpayments. To speed up the approval process, create automated approval workflows based on predefined rules, such as amount thresholds or department codes.

- Automate data imports and integrations: Set up automated daily or real-time data feeds from your ERP, CRM, and other financial systems into your reporting tool. Use Nanonets' API to integrate extracted financial document data into your accounting software directly. Implement automated data validation checks to ensure the accuracy of imported data and flag any inconsistencies for review.

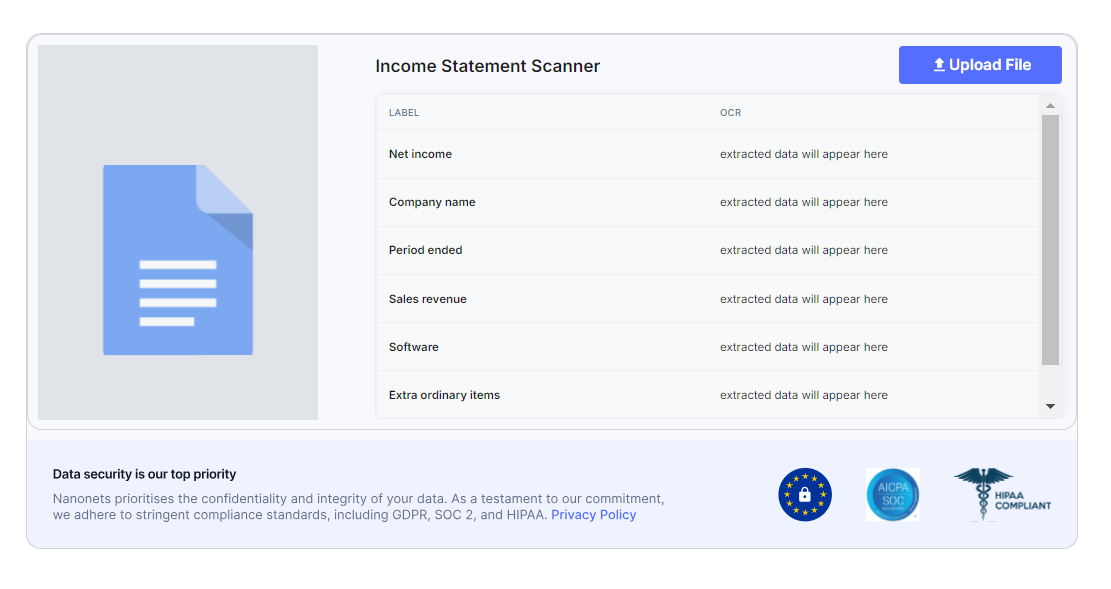

- Implement automated financial statement generation: Use Nanonets to auto-populate your balance sheet, income statement, and cash flow statement with data from your general ledger to ensure consistency and reduce manual effort. Implement checks for internal consistency across financial statements to catch any discrepancies before reports are finalized.

- Automate accounts receivable processes: Use Nanonets to extract data automatically from customer invoices and payments, reducing manual data entry and associated errors. Set up automated customer statements and payment reminders to improve cash flow and reduce Days of Sales Outstanding. Implement an automated cash application to match incoming payments with open invoices, streamlining the reconciliation process.

- Create automated dashboards for key financial metrics: Identify 5-10 key financial KPIs for your business. Set up automated data feeds to update these KPIs in real-time or daily, ensuring you always have the most current information. Create visually appealing dashboards automatically updated with the latest data, providing stakeholders easy access to critical financial insights.

Final thoughts

Financial reporting automation is a powerful tool that can help businesses to save time, improve accuracy, and comply with regulations. However, it is important to follow best practices to ensure that automation is successful.

Once you implement automation, ensure that you measure the ROI to get stakeholders' buy-in. Start by comparing the time spent on report generation before and after, error rates in financial statements, costs associated with manual reporting processes, and the speed of the financial close process.

Automate financial reporting: Save time, reduce errors!

Streamline your financial reporting process with AI-powered automation. Extract data from diverse financial statements, automate reconciliations, and generate reports in seconds. Schedule a personalized demo with Nanonets to learn how our solution can transform your financial reporting workflow.

FAQs

Can financial reporting be automated?

Yes, financial reporting can be automated using tools that streamline data collection, processing, and report generation. These tools connect data sources, extract relevant information, and generate reports based on predefined templates and rules. AI-powered solutions like Nanonets can accurately capture data from various financial statement formats, streamlining the process and reducing manual effort.

How to automate financial statements?

Identify statements to automate, choose a tool, set up data connections, configure templates and rules, implement workflows and controls, schedule report generation, and monitor the process. Automation streamlines the end-to-end financial reporting process.

What software is used for financial reporting?

ERP systems (SAP, Oracle), BI tools (Tableau, Power BI), specialized financial reporting software (Workiva, Prophix), and AI-powered OCR and automation solutions (Nanonets) are commonly used for financial reporting automation, providing data integration, analysis, and reporting capabilities.

What is the best tool for financial analysis?

The best tool depends on your needs and budget. Excel for spreadsheets, Tableau/Power BI for visualization, Python/R for statistical analysis, Nanonets for AI-powered data extraction from financial statements. Consider ease of use, integration, and scalability.