Fraud manifests in many ways. With financial transactions and digital verifications happening at the click of a button, a new trend has emerged - the rise of fake bank statements.

From forging bank statements in job and loan applications to issuing fake bank statements for visa processing and insurance claims, these fake documents seriously threaten individuals, businesses, and financial institutions.

In this article, we’ll explore the world of fake bank statements and learn how to spot them. We'll also discuss technology and cutting-edge artificial intelligence document processing solutions that can help businesses combat bank statement fraud effectively.

Understanding bank statements

A bank statement is an official document issued by a bank that provides balance and a detailed summary of all transactions in an account over a specific period, typically a month.

It records your financial activity and is widely accepted as proof of creditworthiness in different applications for loans, jobs, insurance claims, etc.

Key components of a bank statement

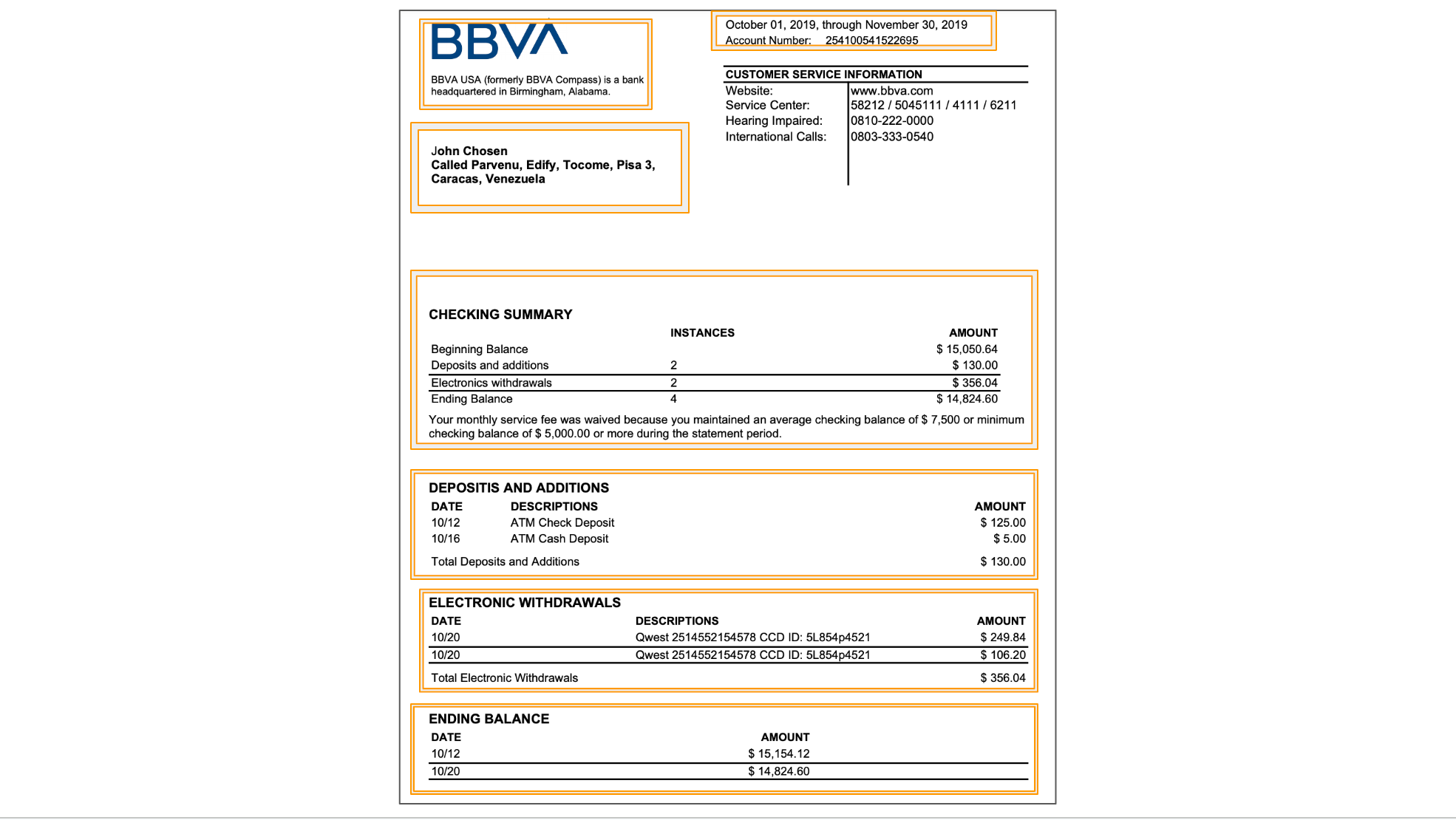

Understanding the components of a bank statement is crucial for detecting potential fraud. Here are the important fields on a legitimate bank statement:

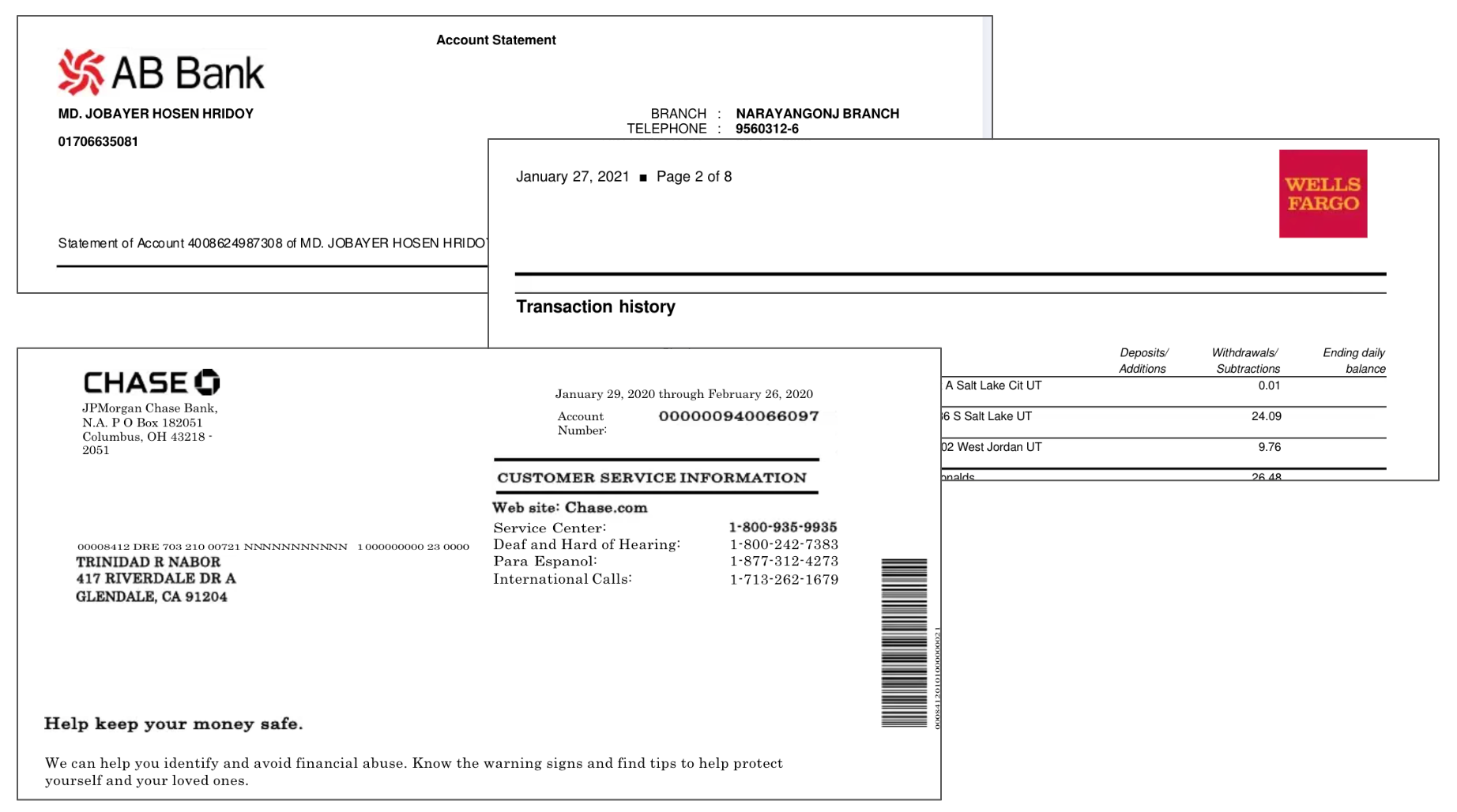

- Bank information: This includes the bank's official name and logo. It also contains the bank's contact information, the branch address, the address code, and other details.

- Account holder details: This includes the account holder's name and address. It also contains the account number (which is often partially masked for security, with only the last or first three to four digits visible).

- Statement period: It mentions the start and end dates of the period covered by the statement.

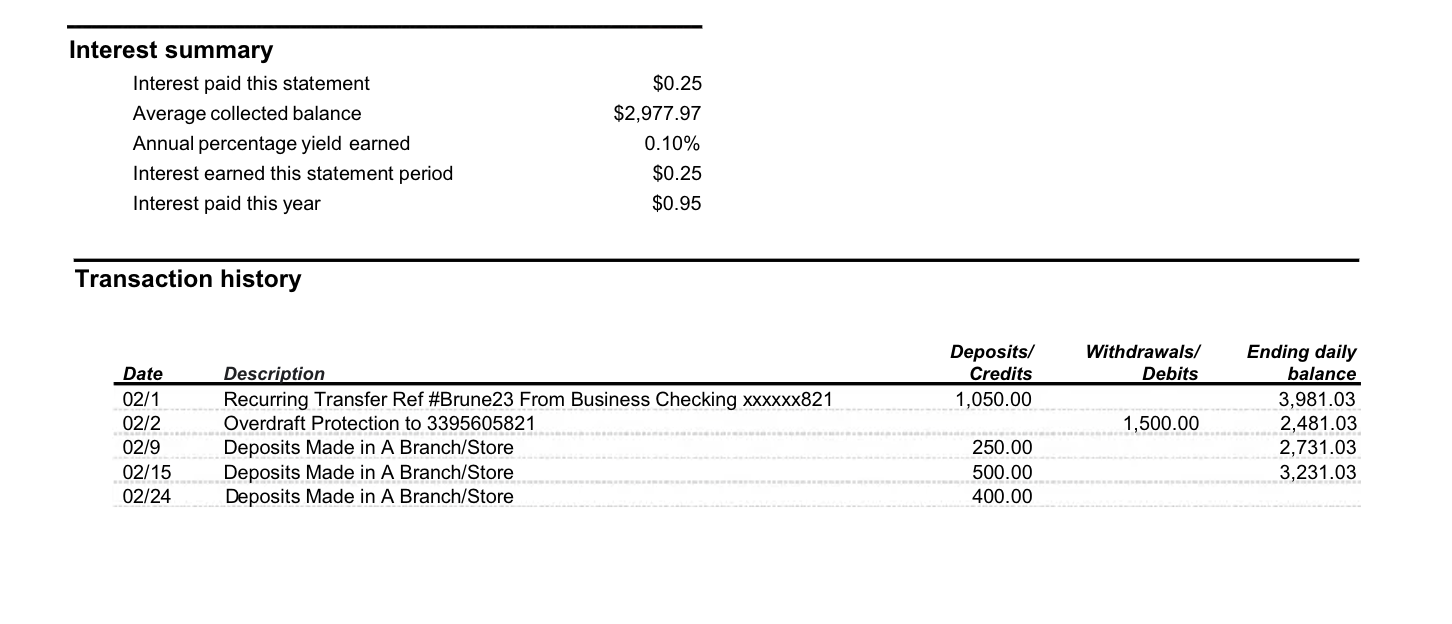

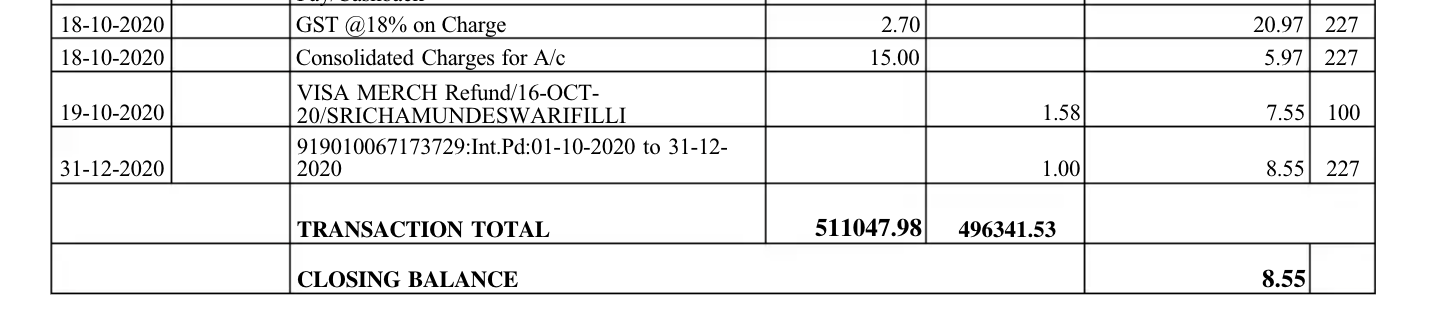

- Transaction details: The bank statement includes a table that contains information about all the transactions made during the period, such as:

- Date of each transaction,

- Description of the transaction (e.g., "ATM withdrawal", "Direct Deposit")

- Amount debited or credited (acronym as D or C sometimes)

- Running balance after each transaction

- Account summary: The bank statement also summarizes the following:

- Opening balance at the start of the statement period

- Closing balance at the end of the statement period

- Total deposits and withdrawals for the period

- Additional Information: This includes any miscellaneous information and can vary for different banks:

- Any fees charged by the bank

- Interest earned (for interest-bearing accounts)

Importance of bank statements in financial transactions

Bank statements play a crucial role in various financial transactions and processes:

- Proof of income: Bank statements are popularly asked by lenders, landlords, interviewing companies, and government agencies as proof of regular income or financial stability.

- Tax preparation: Bank statements are valuable for tracking deductible expenses and verifying income when preparing tax returns.

- Accounting: For companies, bank statements are crucial for reconciling accounts and ensuring accurate financial records.

- Fraud detection: A periodic review of bank statements can help financial institutions detect unauthorized transactions, fraud, and identity theft early.

- Visa applications: Many countries require bank statements to be included to ensure visitors have sufficient funds.

- Dispute resolution: In case of discrepancies or unauthorized transactions, bank statements serve as official records for resolving disputes.

Fake bank statements

Fake bank statements are fraudulent documents designed to look like genuine bank statements.

They can be of different types - forged documents created from scratch, altered statements that manipulate actual statements by making some changes, and, more recently - template fraud (a kind of document fraud), where ready-to-edit templates are used to create documents within seconds.

Are fake bank statements illegal?

Using fake bank statements can range from illegal to unethical and have severe and far-reaching legal and professional repercussions.

There’s no single reason why people forge or use fake bank statements.

For desperate individuals facing financial difficulties, falsifying financial documents is a way out of their situation to get a job, an apartment, or some financial aid.

On the other hand, there are professional fraudsters, who are organized criminals who specialize in creating and selling forged financial documents.

However, bank statement fraud has become prevalent and increasingly sophisticated in recent years due to the growing access to advanced technology.

How bank statement PDFs are manipulated

Bank and credit card statements are often downloaded and shared directly on the phone in PDF format. Inevitably, all PDF files are editable - even if the original PDF file is scanned as an image.

With advanced software that can crack open even password-protected file statements and intelligent OCR tools such as Adobe Acrobat, these bank statements can be easily manipulated to change amounts, dates, and transactions.

Misuse of bank statement generators

Bank statement generators are online software and tools to create documents that copy genuine bank statements. While some of these tools claim to be for "novelty" or "educational" purposes, they are often misused for fraudulent activities.

Most of these tools are freely available online as web-based tools, mobile apps, or downloadable software, thus giving everyone widespread access. Advanced users can also use programming languages to generate bank statements with higher customization than free tools offer.

These bank statement PDF generators allow you to create, edit, sign, and share bank statements with others.

As detection methods become more sophisticated, the risks of attempting such fraud continue to increase. Individuals and businesses must understand these risks and continuously operate within legal and ethical boundaries.

Spotting fake bank statements manually

Whether you're a landlord, a loan officer, or someone verifying financial documents, understanding ways to spot forgery can protect you from fraud. Let's dive into the key aspects of fraudulent bank statements:

Visual cues and red flags

A careful visual inspection of bank statements can help you notice red flags and spot fake ones early. Here are some early signs of tampering:

- Inconsistent fonts: Banks use specific, consistent fonts throughout their documents that are difficult for basic OCR software to match. Variations in font style or size within the statement can indicate tampering.

- Lack of security features: Many banks include watermarks or holograms in their statements as a sign of legitimacy. Their absence could indicate a fake. Banks even use password-protected statements to allow access only to bank account holders. Many users use free online tools to remove encryption and edit the content.

- Low resolution, blurred characters: Legitimate bank statements maintain clear resolution even when scanned. Blurry or pixelated areas might indicate digital manipulation.

- Misaligned elements: Look for text, numbers, lines, or logos that don't quite align correctly. Professional bank statements are meticulously formatted.

- Misspellings or grammatical errors: Banks have rigorous quality control. Poor grammar or multiple spelling mistakes, especially in standard text indicate a fake statement.

- Unusual file formats: While most bank statements are in PDF format, you should look for editable statements shared as Word or Excel files.

Key fields analysis

Analyzing bank statement content and key fields in bank statement analysis can reveal discrepancies.

- Reconciling bank statement: Ensure the account number and other bank details are consistent throughout the document and match any other records you have. Look for data entry errors on the bank statement.

- Incorrect totals: Calculate whether the running balance accurately reflects the transactions listed. In fraudulent bank statements, the line transactions often add up accurately. Such errors in these calculations are a clear sign of a tampered statement.

- Merchant details: Legitimate statements usually show specific merchant names. Vague descriptions like "Payment" or "Transfer" for every transaction and random transactions are a surefire telltale that something is fishy.

- Number formats: Date, number, and currency formats vary between countries. While in some countries, using decimals is the norm, in others, it's a red flag. Even a simple date inconsistency from DD/MM to MM/DD can give a fake statement away.

- Additional charges: Most banks charge additional fees. Look for missing or incorrect fees, a complete absence of those could be a sign of fabrication.

- Ending and starting balance: Match ending balances from previous statements to beginning balances of subsequent statements. It can be difficult to continue manipulating statements without error for an extended period.

Metadata analysis

Metadata, often described as "data about data," can help spot fake bank statements. Metadata in bank statements includes fields such as creation and modification date and time, author or creator name, software used to create or edit the document, and number of revisions.

- Inconsistencies between the statement date and the document's creation date can be a red flag.

- Genuine bank statements usually have minimal revisions. Even multiple modifications to the document indicate tampering.

- The bank's sophisticated software creates legitimate bank statements. Documents created or edited with ordinary office or image editing software may be suspicious.

While these techniques are good to know, with advanced software, editing metadata is possible. Metadata can be manipulated or stripped from documents, while canned documents may lose original metadata.

By familiarizing yourself with all the above indicators, you can be better equipped to spot potential fake bank statements. However, as detection methods improve, so do forgery techniques.

Challenges in detecting bank statement fraud

As detection methods improve, so do forgery techniques. Fraudsters continue to adapt to new security measures, which makes detection more difficult.

Standardization across the banking industry is limited, and different banks use diverse layouts and security features. In this scenario, relatively smaller newer local banks are at more risk of bank statement fraud. With more advanced editing software, highly convincing fakes are possible. Some forgeries are nearly indistinguishable from genuine statements.

Banks process a large volume of financial documents daily, which makes thorough verification challenging. Manual verification and time constraints often limit the depth of individual document checks.

Addressing these challenges requires a multifaceted approach by combining advanced technology and solutions with human expertise and industry-wide collaboration.

Technology in fake bank statement detection

While fake statement generation has become more prevalent and sophisticated, so has the technology for detecting them.

Document fraud detection software

With computer vision and AI advancements, deep learning models can detect minute alterations and subtle inconsistencies, such as layout changes and font usage, in digital documents with over 95% accuracy. They can analyze the visible content and hidden metadata to reveal any signs of document manipulation.

Aided by human oversight, fraud detection software uses AI and deep learning models to help financial institutions and companies fight document fraud.

OCR and AI-enabled data extraction tools

AI-driven data extraction tools use advanced OCR and NLP to recognize text, data, tables, and other elements in bank statements and extract them accurately. This simplifies the bank statement process and also helps reconcile them faster.

Bank statement extraction software can process large volumes of bank statements in different formats such as scanned PDFs, images, etc. With adaptive learning algorithms, the extraction accuracy increases significantly as the tool learns from new document formats.

These tools significantly reduce manual processing time and errors, providing a solid foundation for subsequent fraud analysis steps.

Looking for OCR for bank statement extraction? Try Nanonets AI OCR for bank statements. Convert PDF bank statements to Excel or CSV.

Knowledge graphs and AI

Knowledge graphs are enhancing AI-powered fraud detection in fake bank statements. By representing financial data as interconnected nodes and relationships, they provide crucial context that traditional databases lack.

This allows AI systems to understand complex patterns and inconsistencies in financial behavior by using diverse data sources. Knowledge graphs are highly adaptable and are rapidly updating fraud detection models as new fraudulent schemes emerge. Banks using this technology have reported up to 50% improvement in detecting sophisticated fraud attempts.

Blockchain for document verification

According to a 2023 report by McKinsey & Company, some banks are experimenting with blockchain to create tamper-proof records of financial documents, making it nearly impossible to alter statements without detection.

Blockchain enables a faster and more secure international bank statement verification process, which has traditionally been challenging and time-consuming.

Real-time cross verification

Banks are increasingly using a collaborative approach of shared databases of known fraudulent activities, allowing for real-time cross-checking of submitted documents. To aid this, fintech companies are developing APIs that allow instant verification of bank statements directly with the issuing banks, thus significantly reducing the window for fraud.