The demand for online services and products is increasing at an unprecedented rate. With this shift to adopting online platforms, it becomes vital for businesses to confirm the identity of their customers via an online portal.

Online Document Verification is imperative for businesses to ensure safety, eliminate misuse of services and render better customer experiences.

For example, ride-sharing apps need online document verification to ensure both the rider and driver are identified as real individuals. Online document verification is important to fight online identity theft and make online experiences safer.

Let’s dive into the guide to document verification and learn more about it with illustrative examples.

What is document verification?

Document verification is the process of verifying the authenticity of a document. Be it a bank statement, employment record, business document, etc. This process typically involves four key steps: document collection, data extraction, document validation, and manual verification.

Document verification is used to check the originality of submitted documents, extract information using OCR tool like Nanonets, and match genuine microprint text to match identities.

There are many official documents that can be verified by using a document verification software like Nanonets:

- ID card

- Passport

- Driver’s License

- Bank Statement

- Utility Bill

- Tax bill

- Insurance Agreement

- Employment documents

- Educational Documents

- Employee Letters & many more

The verification process checks document features, such as stamps, watermarks, holograms, fonts, or other security features, and automatically approves the document. This automation saves time and effort for the organization and frees up employees’ time to provide better services.

Why do we need Document verification?

Online identity theft is a massive problem for all online businesses.

The losses from identity theft cases cost $502.5 billion in 2019 and increased by 42% to $712.4 billion in 2020. Losses are forecast to rise again in 2021 to $721.3 billion.

Document verification is an integral tool in verifying a customer’s identity. Online document verification is needed, whether for complying with KYC regulations or for account opening.

Document verification software can help organizations verify new customers quickly and securely during the customer onboarding process with efficient online ID verification.

Online document verification software, like Nanonets, makes it easier for organizations to reduce their customer onboarding time to minutes. With the help of AI-enhanced OCR software, teams can selectively extract data from ID documents and combine it with their existing CRM software to build rich customer profiles.

Enhance your customer onboarding journey with an effortless document verification process. Onboard 10,000+ customers every day with automated document workflows.

What are the different types of Document Verification?

Different businesses require different types of document verification.

For example, banks would need passports, whereas a ride-sharing app might just need a driver's license too. Banks might need multiple documents, whereas an app might need just one document. Based on requirements, there are different types of document verification, as shown below:

Education Certificate Verification

In this class, the credentials and information about the educational qualification claimed by an individual are verified. Education credential verification includes:

- Degree passing certificate copy verification

- Degree mark sheet copy verification

- Year of graduation

- Registration number/Roll number

Professional License/Certificate Verification

The date on which the professional license/certificate was awarded is verified, and the license status is checked.

Address Verification

The candidate’s place of residence is checked. The following points are taken into consideration:

- Residence address

- Duration of stay

- Residential status

- Type of Accommodation

Database Verification

The database information is used to check the applicant’s relevant information. The following points about the applicant are checked:

- Criminal Record Database check

- Civil Litigation Database check

- Credit & Reputational Database check

- Regulatory Authorities Database check

- Serious & Organized Crimes Database check

- Compliance Authorities Database check

- Web & Media searches

Driving License Verification

Individuals need to provide a driver’s license to identify an individual. A driving license is issued by the government, meaning the individuals' credentials are thoroughly checked.

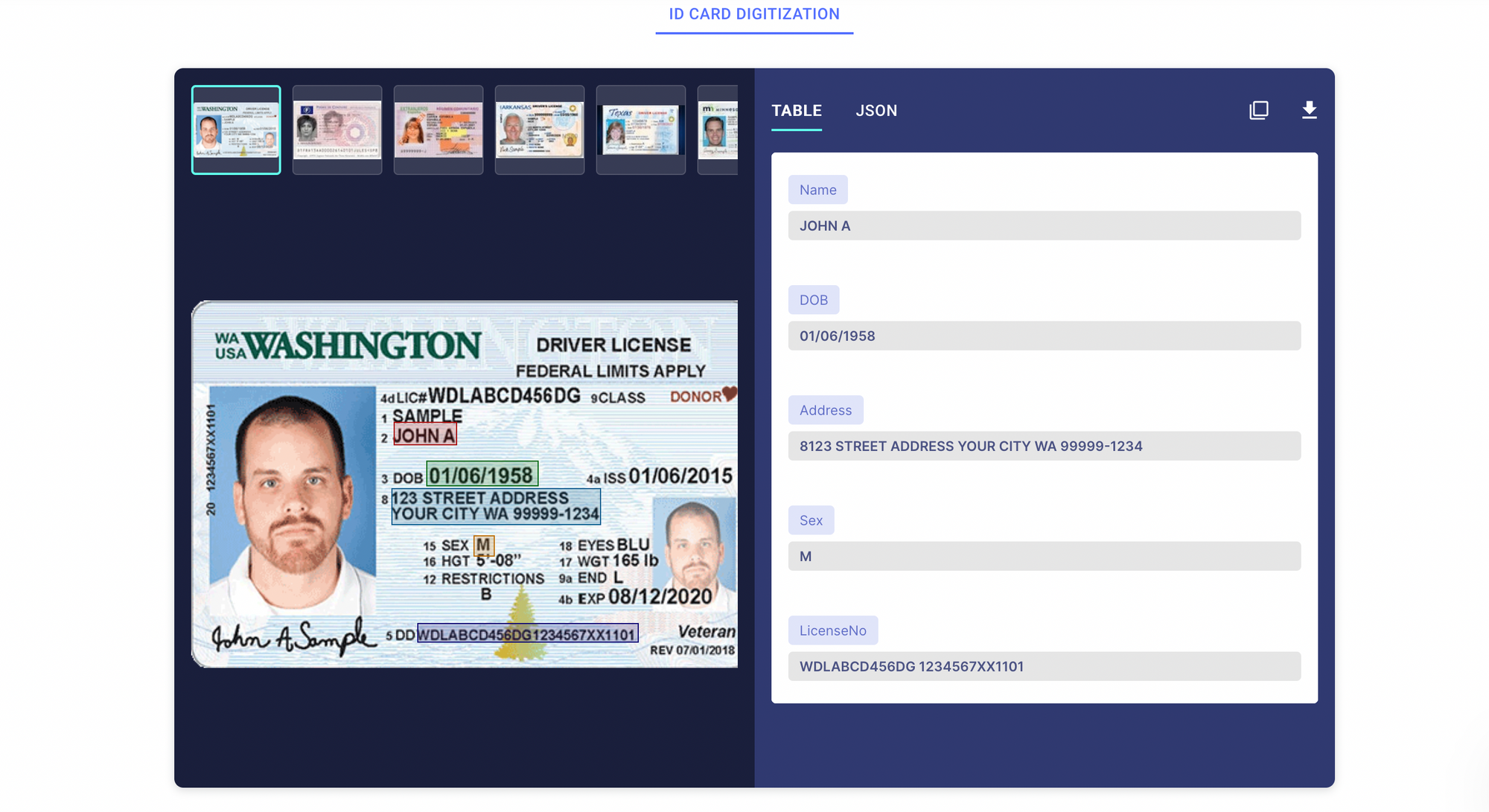

Here's how driver's license data is extracted on Nanonets.

Birth Certificate Verification

The date of birth of the applicant is verified from central records.

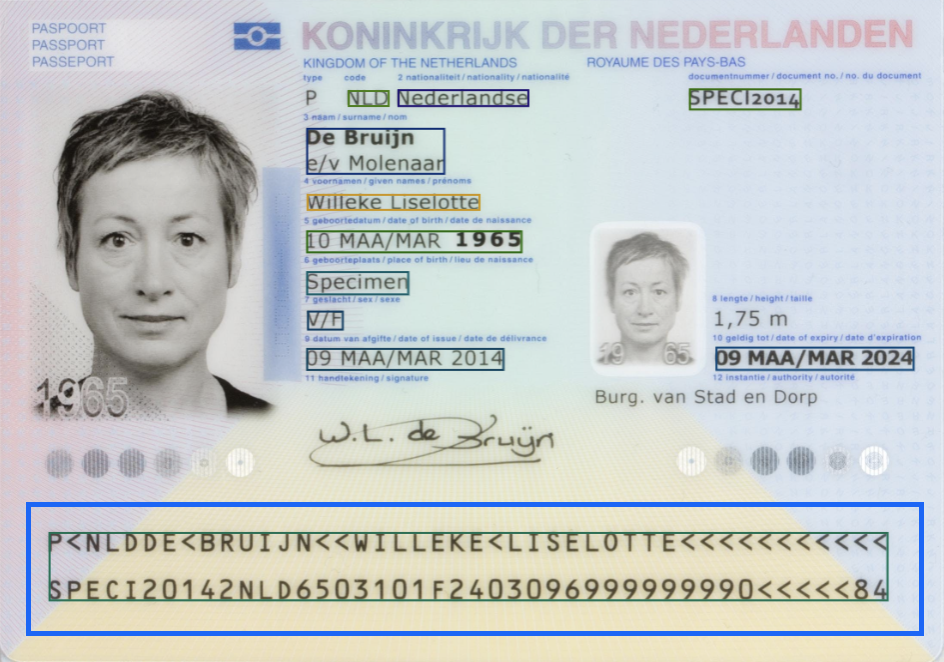

Passport Verification

Government passport issuing authorities verify the details of the passport. Here's how passport OCR looks on Nanonets. You can then use no-code workflows to verify the user's identity.

Manual Document Verification

Anyone in a professional occupation can verify your documents. They could be a:

- Doctor

- Solicitor

- Teacher

- Police Officer

- Commission of oaths

- Company Manager or Director

- A chartered accountant

You can show the originals to the person who is verifying your copies. The person verifying your documents will sign it with their name & include their job title and the verification date.

Components of Document Verification

1. Identity Verification

Identity confirmation mostly entails a process that seeks to determine the real identity of a person by presenting some legal documents like passports, driver’s license, or national ID cards among others. This step implies affirming that the person who presents a document is the real holder of the document.

2. Document Authentication

Document authentication is a process through which the authenticity of the submitted documents is determined. It involves verifying some features such as holographic water mark or barcodes in order to ensure that the document has not been altered or was produced fraudulently.

3. Data Extraction

The first process is extraction of data using OCR commonly known as Optical Character Recognition which extracts information from the documents. This step assists in entering the information in digital form, which enhances storage and manipulation of the information as well as relating it with other information from other databases.

4. Cross-Referencing

Verification refers to the steps of comparing the data extracted for with other records or databases. This assists in determining any gaps or anything that is out of the ordinary in relation to the other activities observed that might denote fraud.

5. Compliance Checks

These are used to make sure that the verification of documents being used follow the laid down laws, regulations, and standards in the country. Companies in highly regulated industries must pay special attention to this step, particularly businesses that belong to the finance and healthcare industries.

6. Risk Assessment

Risk assessment considers the odds that are attached to the ascertained documents and the person who presents them. Besides, the identified level of risk put organizations in a better position to endorse necessary decision based on its outcomes.

What are the different ways to verify identity documents?

Check that the security features are in the right place

Every ID document has unique security features, such as watermarks, logos, holograms, and microprint. Checking that these security features are where they are supposed to be is a solid first step in verifying the document is real. All that is needed is a clear image of the document to be able to verify its security features.

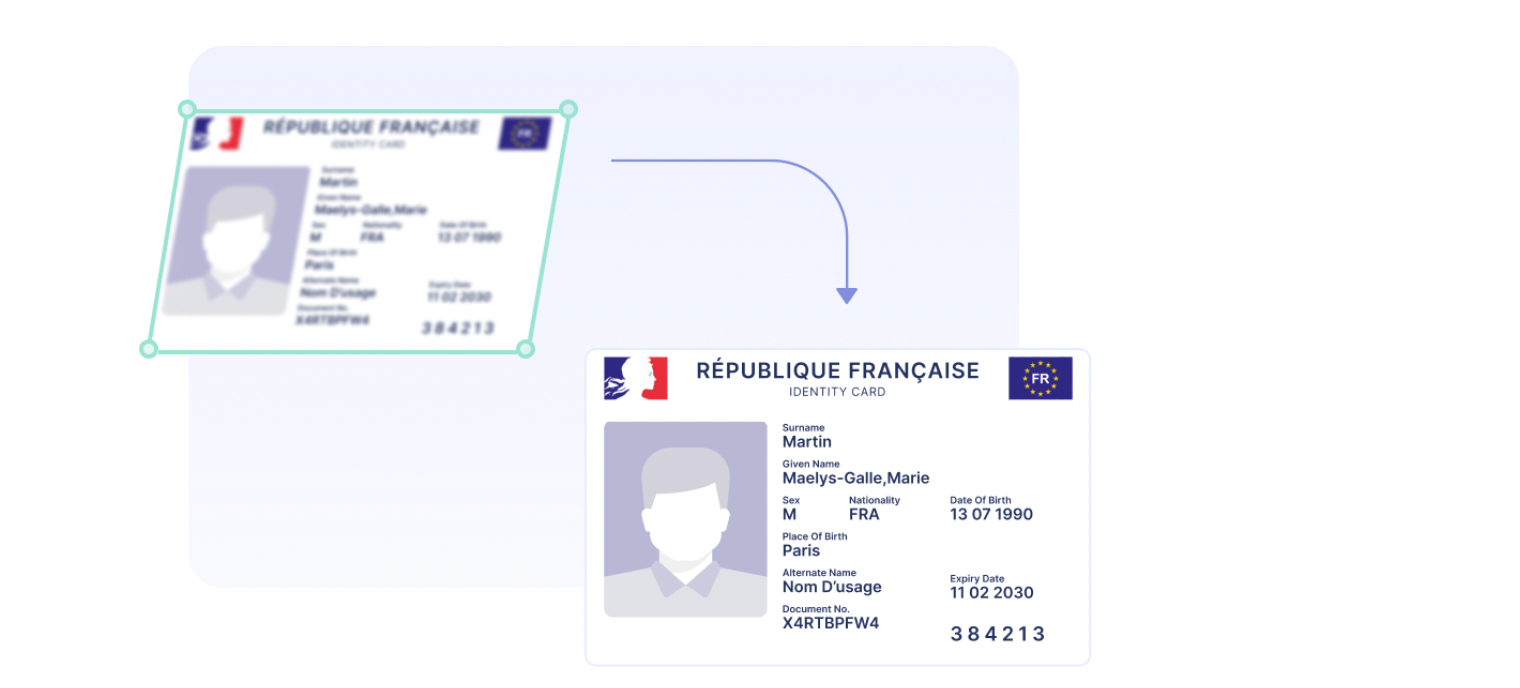

The result should be a clear, horizontally aligned document image.

Compare the ID data for consistency.

Every ID has the document holder’s data encoded in some way - whether in a barcode or a Machine Readable Zone (MRZ). Any mismatch between this data and the data printed on the rest of the document ( its so-called Visual Inspection Zone, or VIZ) indicates tampering.

Match the user’s face with the portrait on the document

Another way to verify a document is to compare the ID photo and the uploaded selfie of the customer. If the characteristics of these two images match, the user is the genuine owner of the submitted document.

Reduce fraud, improve customer turnaround time and ensure compliance with smart document verification workflows.

What is the Document Verification Process?

Now, the next question is, how do you verify documents? Let's deep dive into 4 steps of document verification and see how we can automate it.

Step 1: Document Data Capture

This is the step where you collect documents to verify. You can ask the end users (customers, employees, vendors, or more). Here, you also make documents ready for the next step. The pre-processing document includes checking the borders of the papers, de-skewing the images, and improving the color and brightness of the image to ensure better data extraction at the next step.

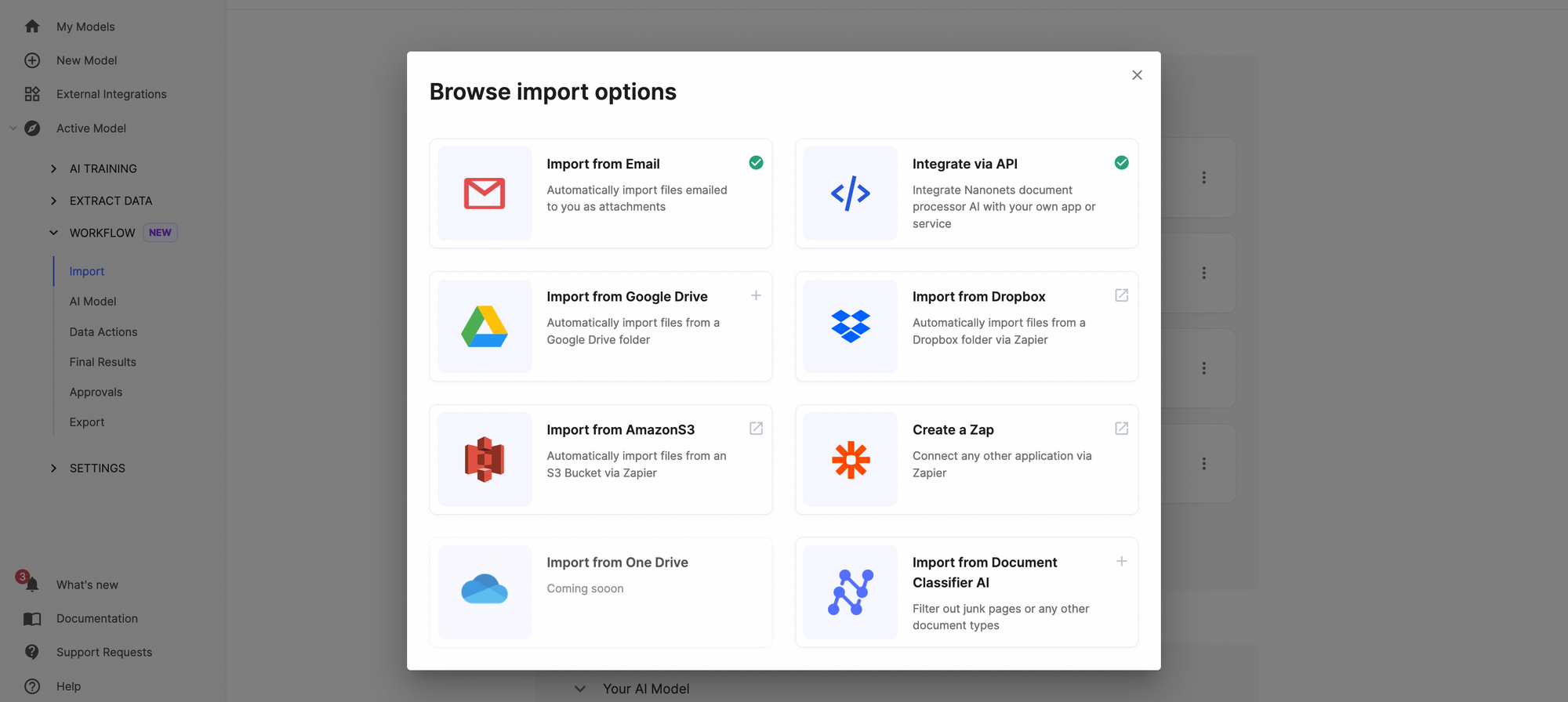

You can use Nanonets to collect documents automatically using multiple document import options.

Also, Nanonets can deskew, enhance contrast, and automatically check for blurry images, text, and more.

Step 2: Data Extraction

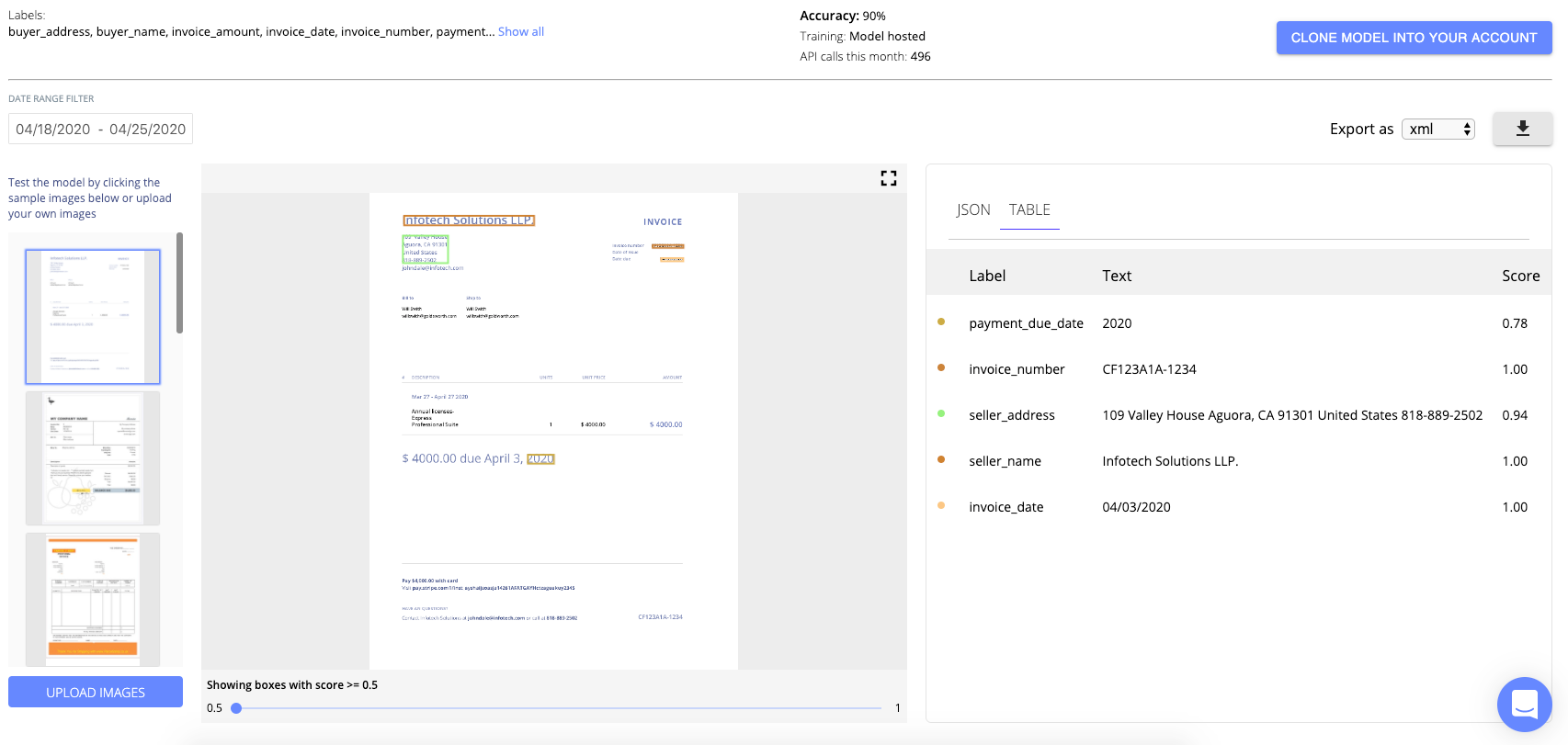

We must extract data from documents to verify it in the next step. You can use OCR software, like Nanonets, to remove relevant information and discard the rest.

Instead of a simple OCR software, it is better to use Nanonets as it converts your entire document into a structured document.

At this step, you can also classify the document based on its document structure. Check out the document classification model on Nanonets.

Step 3: Document Validation

Now, you need to validate the data. You can use database matching to perform this action. You match data from documents with data from a trusted database.

For example, the loan processing department might want to check if the person applying for a loan has any present loans in the same bank.

Document validation is imperative to reduce identity theft and fraud.

Step 4: Verify documents with a manual check

As a final step, any flagged documents can be sent for manual review through approval workflows. This is a human-in-the-loop document verification process. This ensures there are no errors.

After checking for everything, the documents are then verified.

You can automate this entire process on Nanonets using approval workflows.

Benefits of Document Verification Process

1. Enhanced Security

Document verification is useful in preventing and combating fraud since it allows a business to reject any document the business deems not genuine. This helps to minimize on cases of identity theft and other illogical incidences such as fraudulent activities.

2. Improved Compliance

Such automated document verification methods enable the organization to meet organizational legal and regulatory obligations. This is particularly important in fields like finance, health, and any field that deals with clients’ sensitive data.

3. Increased Efficiency

Automated document verification helps in verification where it could have taken a lot of time for a person to verify the documents on their own. This enhances the ability to process transaction in a shorter time hence increasing efficiency in operations.

4. Cost Savings

Overall, the implementation of automatic document verification has other capabilities, such as elimination of expenses on the manual work for documents verification, and, of course, additional financial risks due to fraud.

5. Better Customer Experience

A smooth method of verification of documents will lead to satisfaction of the customers due to reduced time of on-boarding. Thus, there can be enhanced customers’ satisfaction and, consequently, their loyalty.

6. Data Accuracy

Due to its automation, verification means minimize errors inherent to the work of employees, which implies higher accuracy. This makes the quality of data collected and used in decision making to be much improved.

7. Scalability

Document verification systems keep on automating; therefore, they don’t pose a challenge regarding the number of documents that can be processed at a given instance, which makes them ideal for use in small and big firms.

Nanonets - The best Document Verification Software

Nanonets is an AI-enhanced intelligent document processing platform that helps organizations of all sizes digitize, classify, and selectively extract essential information from their documents. Organizations use Nanonets as an end-to-end document management system.

Nanonets are used extensively by enterprise clients to verify documents on a secure online platform to conduct Passport Verification, ID Verification, Driver's License Verification, Invoice Verification, Vendor Verification, Accounts Payable Automation, and more.

Also, Nanonets is known for being an easy-to-use, no-code workflow-based platform that delivers much faster ROI.

Nanonets can

- automatically source documents from emails, desktop, Sharepoint & more

- classify and index the document type based on document content

- route the document to the correct OCR model without supervision

- extract data from document with 99% accuracy

- [match the document data] with your any data set

- flag the documents in case of any anomalies

- export the extracted data to your required database (5000+ integrations)

Here's a snapshot of the performance expected from Nanonets.

Nanonets is highly rated on peer-to-peer customer review websites as shown below.

What are different document verification use cases?

Different industries use document verification for varied use cases. We will discuss some of the prominent document verification use cases below to give you a basic idea of the use cases.

1. Account Opening or Customer Onboarding

During account openings, businesses have to verify the identity of the customer. Many institutions like banks, educational institutions, healthcare, and more have to undergo an extensive verification process to ensure the authenticity of the submitted documents.

2. Invoice Processing

Every business has invoices. Employees sometimes manually fill in the details to track company expenses which takes up a lot of your employee time while also leaving room for error.

Automating invoice processing using Nanonets will ensure that all your invoices are processed with an error-free standardized process. You can automatically collect invoices from sources like email, drive, or dropbox, collect selected data from the invoices, and then send them to the database of your choice like CRM, Tableau, or Excel.

3. Fraud Detection

Document verification protects your business from different parameters of document fraud, such as forged documents, compromised documents, counterfeit documents, pseudo documents, photoshop detection, fake documents, or stolen records from entering your onboarding workflow.

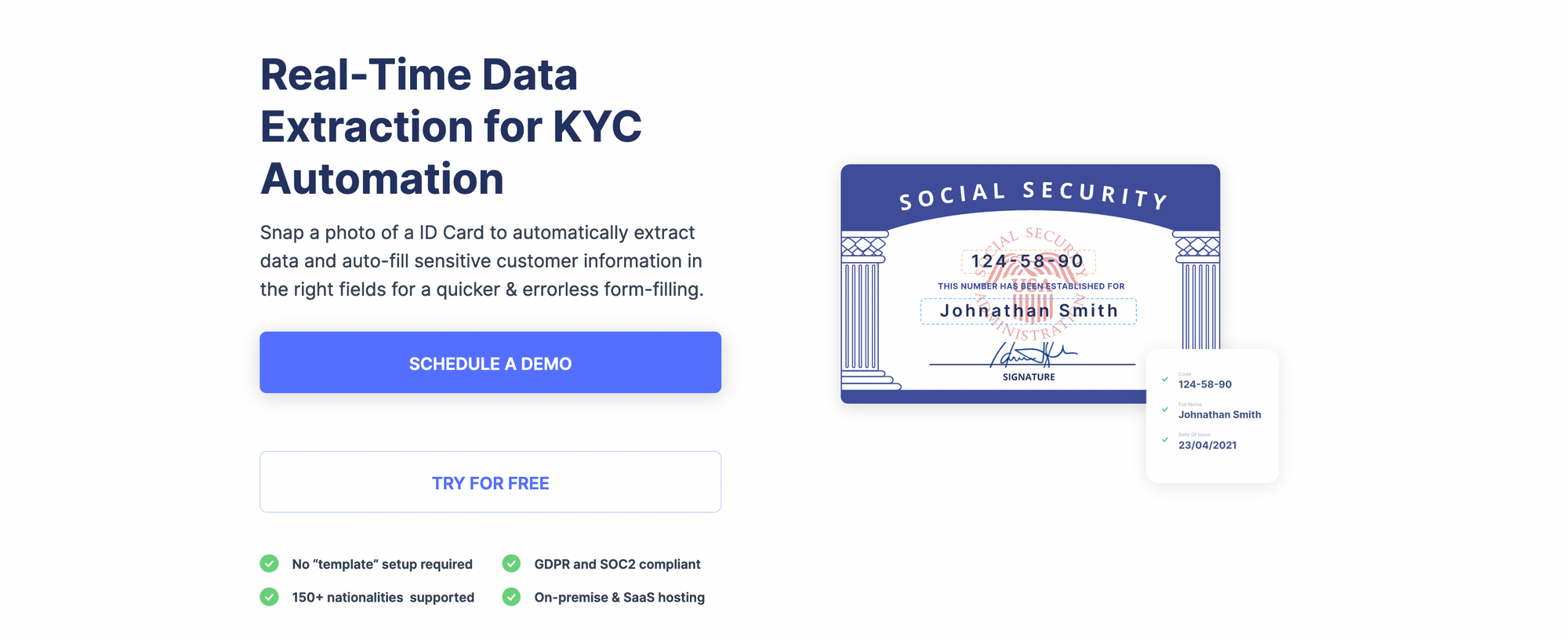

4. KYC/AML Compliance

KYC and AML compliance is necessary for banks, insurance, and other financial services institutions. Due to the rising identity theft cases, KYC compliance is a must. An online document verification software like Nanonets ensures a smooth, hassle-free process for your employees and customers.

5. Vendor Verification

Businesses work with multiple vendors over the course of their financial year. Retail businesses work with multiple suppliers and vendors. Verifying the vendors' identity is imperative to ensure you work with the right people during the vendor onboarding process.

Future for document verification

The document verification market is growing at a rate of 14.4% CAGR, and there is a reason for that. Businesses are moving their processes online, which includes document verification too. Additionally, there is a sharp increase in the databases where customer data is stored.

To ensure that only "real" customers access the online data, businesses must regularly verify identity. Using manual methods will not only slow the process but will also make the process error-prone, costly, and insecure.

This is where AI for document processing comes in, streamlining document verification automation and helping businesses ensure secure access to data, services, and products. Nanonets help businesses automate manual document processes. We have helped many organizations like Toyota, P&G, and EY digitize their manual processes with no-code workflows, resulting in cost and time savings.

Onboard customers, employees, or patients in minutes with automated document verification workflows. Just upload the documents and let Nanonets do the rest. Book a demo, where we will show you how you can automate your document verification process with no-code workflows.

FAQs

What is the role of the document verification executive?

The Document verification executive steps in the fourth step of the document verification process. These are the tasks that they carry out on a daily basis:

- Collecting documents from the selected candidates

- Maintenance of employee files and other documents

- Responsible for employee verification

- Understanding the requirement on manpower from the business and sourcing candidates

- Conduct background verification for all new hiring (need to be done before joining)

- Responsible to maintain recruitment and employee master data

What are the challenges of using online document verification?

Here are some of the disadvantages of using online document verification.

Accuracy

Document verification software is a powerful tool to verify fraudulent documents but it is not exactly foolproof. Human in-the-loop verification is a must for all regulatory institutions to prevent mistakes.

Inefficient & Expensive Identity Verification Solution

There are many ID verification solutions available in the market. Each has its own advantages and disadvantages. Also, each has its own protections against fraud, but some are more easily forged or tempered with than others. Companies are constantly updating techniques in order to meet growing data privacy needs across countries and industries. It is crucial to look at their security certifications.

Evolving Biometry Forgery

The rise of technology has given birth to the problem of online identity verification. For every advance in identity verification, there is an advance in identity fraud techniques. Detection techniques for each type of biometric forgery are required, as well as proactive monitoring of the involving fraud techniques.

Hurdles in Determining the real identity

Document verification software checks for the authenticity of the document and forged documents. But if the fake ID passes all the verification filters, it would be difficult to identify the person without manual verification processes.

What are the benefits of using online document verification?

Businesses reaping a fair share of success due to their growth and appeal of ideas need to tackle the complex web of fraudsters who’re ever-present at their cyber portals. Employing AI in ID verification increases the security of commercial portals ten-fold, along with providing businesses with an edge over those who’re on the lookout to commit fraud. When used in conjunction with human intelligence, AI increases the human ability to process data, thereby enabling businesses to process information intelligently and prevent being scammed. Some of the benefits that machine learning brings to document verification are:

Faster return on investment

Automation document processing tools can be set up and trained in days or weeks rather than months or years. With a lower total cost of ownership, enterprises can apply automated document processing to a wide range of documents to realize ROI faster compared to traditional tools. Softwares like Nanonets can provide up to 3-5x ROI in less than 3 months.

Improved operational flexibility

AI with deep learning enables rapid document modeling and training so that new, never-processed documents can be quickly added to the document processing system. And, with reduced lead times, enterprises can respond quickly to new opportunities by creating new document processing applications without increasing staffing.

Faster operational responsiveness and compliance transparency

AI-led automation can support “human-in-the-loop” validation that delivers document classification and extraction results to the person submitting the document. This enables fast and responsive information verification and correction in near-real-time. Front-line workers can quickly make corrections or request additional information while collaborating with customers, partners, or other external stakeholders. This saves time and ensures better data accuracy and transparency for everyone involved in a business process.

Enhanced Fraud Detection

AI-enabled document processing software can detect fake documents by using photoshop, EXIF or forgery detection. It keeps a check for any anomaly in the documents which can indicate tampering of any sort.

Scalable processes

Document verification software automates the entire document verification process, making it standardized and scalable across geographies without any differences.

Faster onboarding

With an automated onboarding process, it is possible to reduce the customer onboarding process from days to minutes. Nanonets can help enhance the customer onboarding process with fewer waiting times and almost 99% accuracy.

Hyper-accurate

Document verification software like Nanonets uses AI-enhanced OCR technology to extract information from customer documents. It can identify images, over 200+ languages, and handwriting with over 99% accuracy. Also, with no human intervention except for flagged cases, the accuracy of the entire process increases to over 99%.

Simplified Experience

Remote ID verification is done from anywhere in the world, anytime, for a seamless customer experience

Instant Online Document Verification

This is the perfect solution for banks and non-bank financial institutions to reduce cost, effort, and mistakes, while simultaneously enhancing the overall customer experience. User verification within 30-60 seconds to optimize conversion rates and reduce drop-offs. This technology provides instantaneous and real-time verification of documents, including bank account verification, bank statement verification, proof of address documents, tax return verification, identity verification, and more.

Enhanced KYC, KYB, and AML compliance

You can enhance your KYC, KYB, and AML compliance and at the same time, improve the user experience by cutting down the onboarding time.

Digital Process

Fully-automated digital process for increased productivity and reduced manual labor. This technology provides instantaneous and real-time verification anytime, anywhere, and globally.

Which industries use online document verification?

Organizations are overwhelmed by documents. And most have paper-heavy processes. Document automation software can extract and organize data across industries and business functions right out of the box.

Apart from the document overload, many organizations are heavily regulated and required to follow strict rules for KYC and AML compliance in financial services, banks, and insurance institutions. Using document verification software can alleviate the pressure of reducing customer turnaround time and enhance customer satisfaction.

Here are some industries that need document verification:

- Financial services - loan and claims processing, bank account openings, mortgage processing, underwriting, fraud checks and audit trails.

- Healthcare - verify medical forms, billing, patient onboarding and patient records.

- Aviation - improve contactless check-in and boarding of passengers with ticket verification

- Telecommunication - verifying bills, payments & customer requests

- Travel - invoices, identity verification

- Gaming- identity verification

- IT firm - employee records and service records.

- Logistics - delivery slips, invoices, purchase orders

- Retail - customer identity verification, invoices, customer order

- Government - public records, invoices, approval systems

- Banking - application, customer onboarding

- Software Apps - ID verification