Dext (formerly Receipt Bank) is a cloud-based financial automation tool that helps businesses capture, process, and manage receipts, invoices, and financial documents. Businesses worldwide rely on Dext to automate their bookkeeping and expense management processes.

While Dext excels at receipt processing and management and document organization capabilities, users often report challenges with:

2. Customer support response times

3. Complex initial setup requirements

4. Limited customization options

5. Higher costs for growing businesses

This comprehensive guide will examine the top 9 Dext alternatives, comparing their features, pricing, and real-world performance. Whether you're a small business owner looking for a cost-effective solution or an accounting firm serving multiple clients, you'll find detailed insights to help you make an informed decision.

A quick comparison of Dext Alternatives

| Product | Key Strength | G2 Rating | Free Trial | Starting Price | Total Score* |

|---|---|---|---|---|---|

| Dext | Receipt processing | 4.5/5 | Yes | $24/month | 46.1 |

| Nanonets | End-to-end automation | 4.8/5 | Yes | First 500 pages free | 46.5 |

| Hubdoc | Xero integration | 4.3/5 | Yes | $12/month | 44.6 |

| AutoEntry | Credit-based pricing | 4.4/5 | Yes | £12/month | 39.7 |

| Ramp | Corporate cards + expense | 4.8/5 | Yes | Free | 47.1 |

| Expensify | Expense management | 4.4/5 | Yes | $5/user/month | 45.2 |

| SAP Concur | Enterprise integration | 4.0/5 | No | $9/report | 41.6 |

| Zoho Expense | Part of Zoho suite | 4.5/5 | Yes | $15/month | 44.5 |

| BILL | AP automation | 4.5/5 | Yes | Free | 45.8 |

| Emburse | Travel & expense management | 4.7/5 | Yes | $3,000/year | 44.8 |

*Total Score calculated as sum of G2 ratings for: Ease of Use, Ease of Setup, Quality of Support, Meets Requirements, and Product Direction (% positive). All scores based on verified G2 ratings as of November 2024.

Let's examine each alternative in detail to understand how they measure up against these criteria.

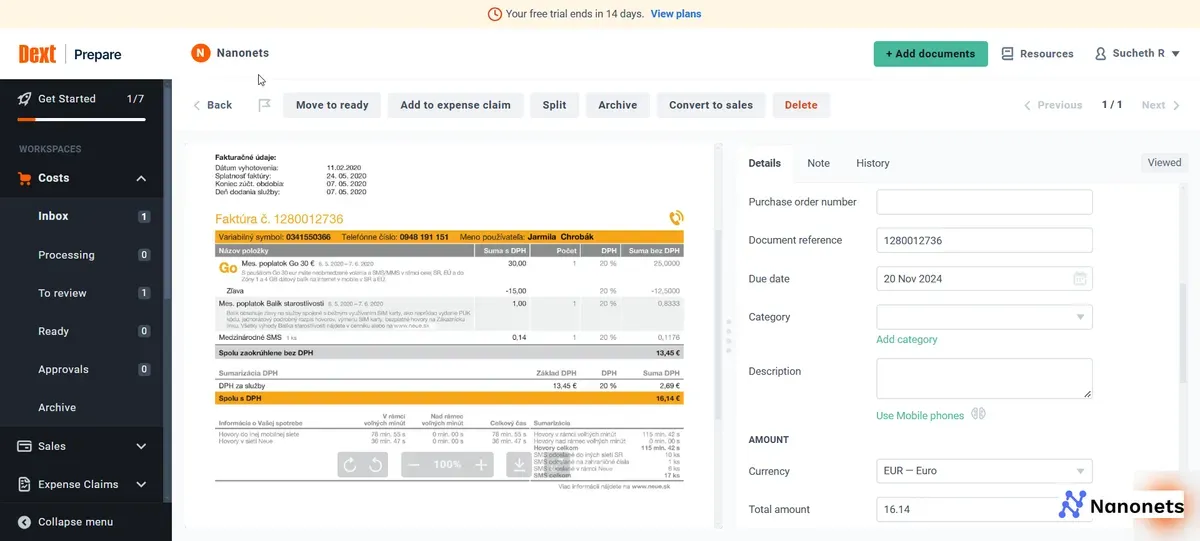

1. Nanonets

Nanonets is an intelligent document processing platform designed to streamline and automate various aspects of the accounting process. It offers features such as document capture, data extraction, approval workflows, integration with accounting software, and more. It aims to improve efficiency, accuracy, and control within the traditional document-upload-and-approval workflow for businesses and the wider procure-to-pay lifecycle.

1. AI-powered document classification and routing

2. Automated data validation and error-checking

3. Custom model training with minimal sample documents

4. Pre-built models for common documents like invoices and receipts

5. Multi-stage approval workflows

6. Seamless integration with existing business systems

7. Supports 40+ languages

8. Database matching to ensure data accuracy

9. Extensive API access for custom integrations

Pros of Nanonets | Cons of Nanonets |

|---|---|

Template-free processing with self-learning models | Not affordable for low volumes |

Extensive integration capabilities | UI could be more intuitive |

Strong workflow automation | Lack of mobile support |

Built-in human verification tools | |

Robust customer support | |

High accuracy in data extraction | |

Handles invoices in various formats |

Pricing: Nanonets offers a free tier for the first 500 pages, with the Pro plan starting at $999/month for 10,000 pages.

Best suited for: Businesses in finance, healthcare, and logistics that require a flexible, automated solution for diverse, high volume of invoices in various formats from multiple vendors.

How does Nanonets compare to Dext?

Parameter | Nanonets | Dext |

|---|---|---|

Ease of Use | 9.3 | 9.4 |

Ease of Setup | 9.1 | 9.2 |

Quality of Support | 9.4 | 8.9 |

Meets Requirements | 9.1 | 9.2 |

Product Direction (% positive) | 9.6 | 9.4 |

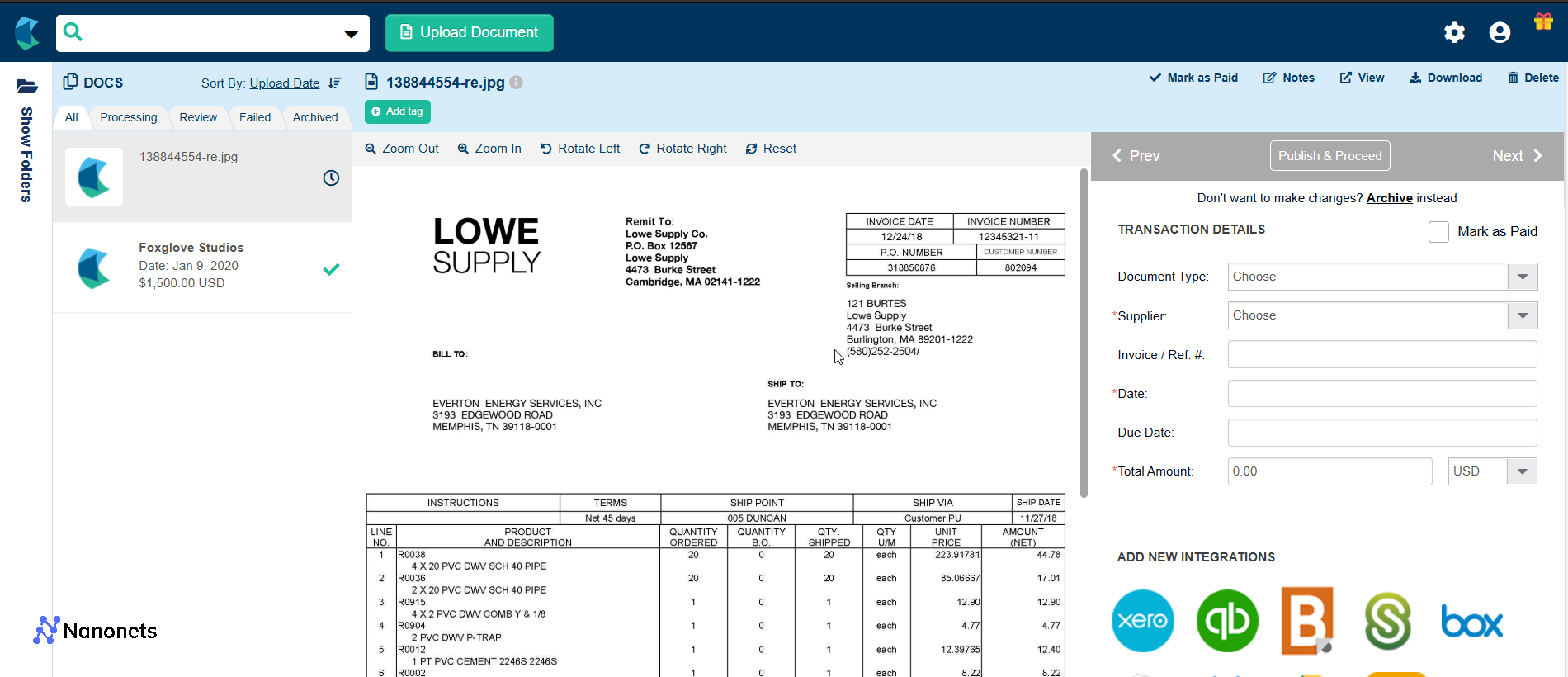

2. Hubdoc

Hubdoc is a document management platform that simplifies the collection and organization of financial documents for businesses. It automates the process of capturing receipts, invoices, and bills, allowing users to focus on more strategic tasks.

1. Automatic fetching of bills and receipts from various suppliers

2. Secure document storage and organization

3. Integration with popular accounting software like Xero and QuickBooks

4. Mobile app for easy document capture on the go

5. Receipt and invoice categorization for streamlined tracking

Pros of Hubdoc | Cons of Hubdoc |

|---|---|

Reduces manual data entry | Limited functionalities outside of Xero |

User-friendly interface | Some users report syncing issues |

Automates document collection | Requires a subscription for full features |

Strong integration capabilities | Not suitable for complex document types |

Pricing: Offers a flat rate of $12 per month per client, providing access to all features without limits on documents.

Best suited for: Ideal for small businesses and accountants using Xero or QuickBooks, looking for efficient document management.

How does Hubdoc compare to Dext?

| Parameter | Hubdoc | Dext |

|---|---|---|

| Ease of Use | 8.8 | 9.4 |

| Ease of Setup | 8.5 | 9.2 |

| Quality of Support | 8.9 | 8.9 |

| Meets Requirements | 8.6 | 9.2 |

| Product Direction (% positive) | 8.8 | 9.4 |

3. AutoEntry

AutoEntry is an automation tool that simplifies data entry and document management for businesses. It uses advanced OCR technology to capture and input data from various financial documents like invoices, receipts, and bank statements.

1. Automated document capture through scanning and uploading

2. Data extraction from various document types

3. Seamless integration with popular accounting software

4. Line item extraction for detailed data entry

5. Document organization and secure storage

Pros of AutoEntry | Cons of AutoEntry |

|---|---|

Reduces manual data entry | Limited to standard document types |

User-friendly interface | Some users report OCR accuracy issues |

Affordable for low volumes | Can struggle with complex invoices |

Strong accounting software integrations |

Pricing: AutoEntry offers various pricing tiers depending on document volume, starting with a basic package at $12/month for a fixed number of documents.

Best suited for: Small to medium-sized businesses that need efficient data entry automation and document management.

How does AutoEntry compare to Dext?

| Parameter | AutoEntry | Dext |

|---|---|---|

| Ease of Use | 8.2 | 9.4 |

| Ease of Setup | N/A | 9.2 |

| Quality of Support | 7.4 | 8.9 |

| Meets Requirements | 8.0 | 9.2 |

| Product Direction (% positive) | 6.5 | 9.4 |

4. Ramp

Ramp is an all-in-one spend management platform that combines corporate cards, expense management, bill payments, and accounting integrations. It helps businesses automate manual processes and gain real-time visibility into spending.

1. Corporate cards with customizable spend controls

2. Automated expense reporting and reimbursement processes

3. Invoice capture and processing

4. Real-time spend visibility and reporting

5. AI-driven savings insights

Pros of Ramp | Cons of Ramp |

|---|---|

Comprehensive spend management solution | Corporate card switching required |

Excellent reporting capabilities | Not suitable for non-U.S. businesses |

User-friendly interface | Limited features for smaller teams |

Strong support and onboarding | May be too complex for very small businesses |

Pricing: US-based small and mid-sized businesses looking for a comprehensive spend management platform with built-in corporate cards.

Best suited for: Ideal for mid-sized businesses looking for a robust solution to manage corporate spending and streamline financial workflows.

How does Ramp compare to Dext?

Parameter | Ramp | Dext |

|---|---|---|

Ease of Use | 9.5 | 9.4 |

Ease of Setup | 9.3 | 9.2 |

Quality of Support | 9.2 | 8.9 |

Meets Requirements | 9.4 | 9.2 |

Product Direction (% positive) | 9.7 | 9.4 |

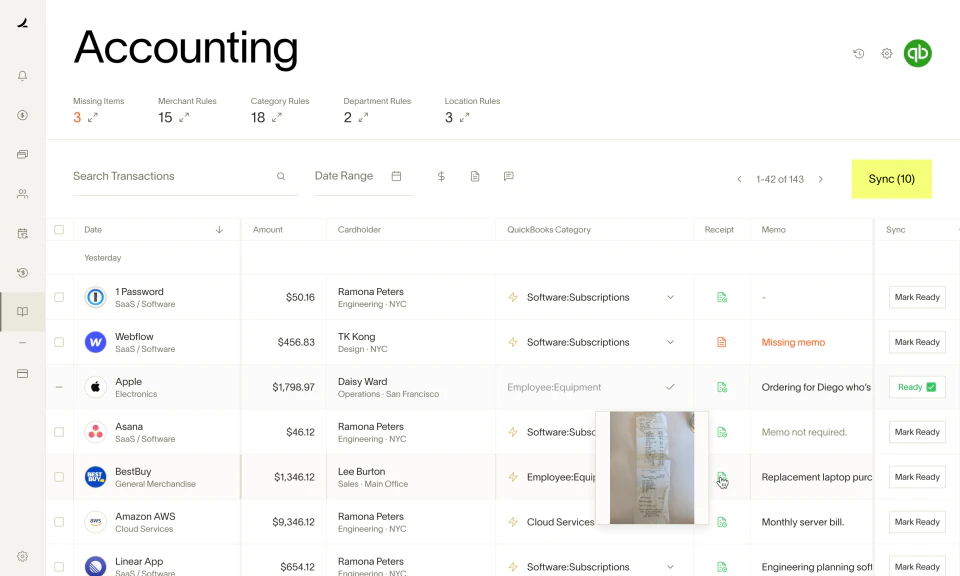

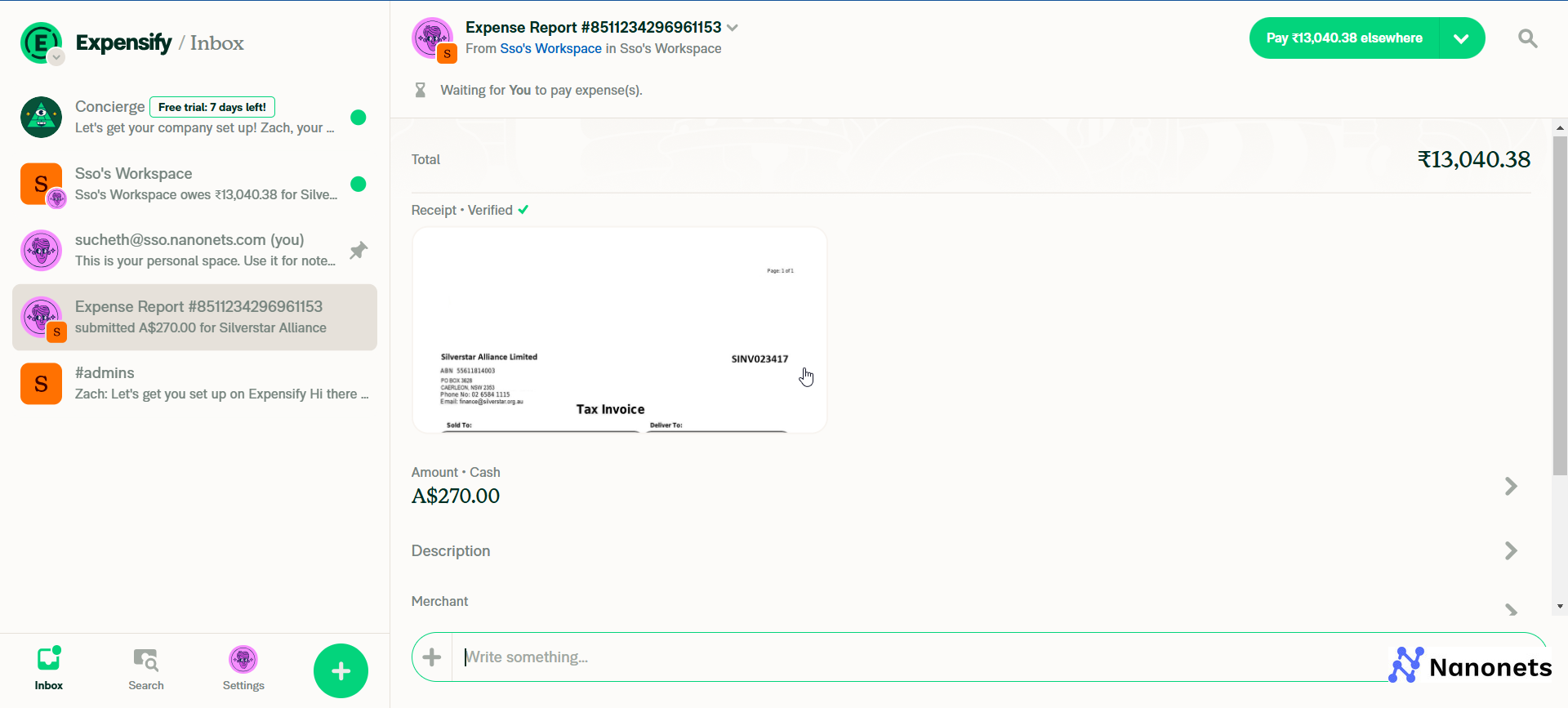

5. Expensify

Expensify is a complete expense management solution designed to simplify expense reporting, reimbursement, and financial processes for businesses of all sizes. It aims to streamline the workflow from receipt capture to reimbursement.

1. SmartScan technology for automatic receipt data extraction

2. User-friendly mobile app for expense tracking on-the-go

3. Automated expense report generation

4. Strong integrations with various accounting software

5. Customizable approval workflows

Pros of Expensify | Cons of Expensify |

|---|---|

Reduces manual entry of expenses | Free plan limits to 25 SmartScans |

Intuitive mobile interface | Learning curve for complex setups |

Automates expense reporting | Occasional sync issues |

Strong integrations with popular tools | Limited customization for reports |

Pricing: Expensify offers a free plan for individuals, while paid plans start at $5 per user per month.

Best suited for: Mid-market organizations needing automated expense management with strong mobile capabilities and accounting integration.

How does Expensify compare to Dext?

| Parameter | Expensify | Dext |

|---|---|---|

| Ease of Use | 9.1 | 9.4 |

| Ease of Setup | 8.5 | 9.2 |

| Quality of Support | 8.9 | 8.9 |

| Meets Requirements | 9.3 | 9.2 |

| Product Direction (% positive) | 8.4 | 9.4 |

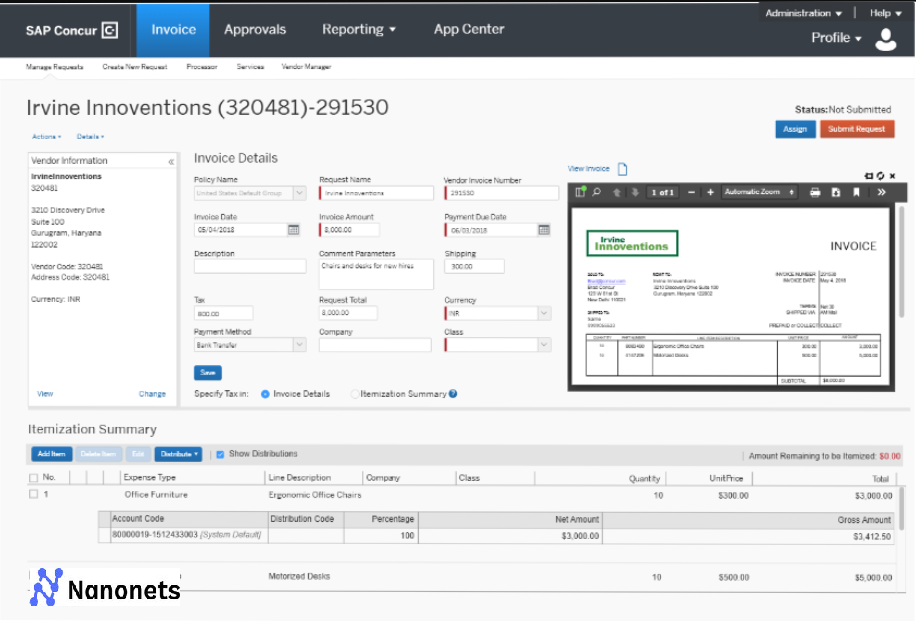

6. SAP Concur

SAP Concur is a cloud-based platform that combines expense management, travel booking, and invoice processing in one system. It helps businesses automate their spending processes and manage employee expenses more effectively.

1. Enterprise-grade expense automation

2. Integrated travel and expense management

3. Global compliance and currency handling

4. Receipt scanning and matching

5. Policy compliance tools

Pros of SAP Concur | Cons of SAP Concur |

|---|---|

Complete travel management | Takes time to set up |

Works well internationally | Steep learning curve |

Strong policy controls | More expensive than Dext |

Good mobile experience | Complex for small teams |

Wide integration options | Support can be slow |

Pricing: Starts at $9 per expense report. Enterprise pricing available on request.

Best suited for: Large organizations, especially those that need to manage both travel and expenses in one system.

How does SAP Concur compare to Dext?

| Parameter | SAP Concur | Dext |

|---|---|---|

| Ease of Use | 8.0 | 9.4 |

| Ease of Setup | 7.8 | 9.2 |

| Quality of Support | 8.0 | 8.9 |

| Meets Requirements | 8.7 | 9.2 |

| Product Direction (% positive) | 7.1 | 9.4 |

7. Zoho Expense

Zoho Expense is a cloud-based expense management tool that helps businesses track and manage employee expenses, mileage, and receipts. It's particularly popular among small businesses looking for a cost-effective solution.

1. Receipt scanning and data extraction

2. Mileage tracking with GPS

3. Multi-currency expense handling

4. Automated expense reports

5. Project-based expense tracking

Pros of Zoho Expenses | Cons of Zoho Expenses |

|---|---|

Free plan available | Limited reporting filters |

Good mileage tracking | Basic analytics capabilities |

Easy mobile receipt capture | Integration mainly with Zoho products |

Affordable pricing | Project tracking needs improvement |

Quick expense approval | Some UI limitations |

Pricing:

- Free plan: Up to 3 users, 20 receipt scans/month

- Premium: $15/month for 10 users ($2/month per additional user)

- Enterprise: Custom pricing for larger teams

Best suited for: Small businesses and freelancers who need basic expense tracking without complex approval workflows.

How does Zoho Expense compare to Dext?

Parameter | Zoho Expense | Dext |

|---|---|---|

Ease of Use | 8.8 | 9.4 |

Ease of Setup | 8.6 | 9.2 |

Quality of Support | 8.5 | 8.9 |

Meets Requirements | 8.8 | 9.2 |

Product Direction (% positive) | 9.0 | 9.4 |

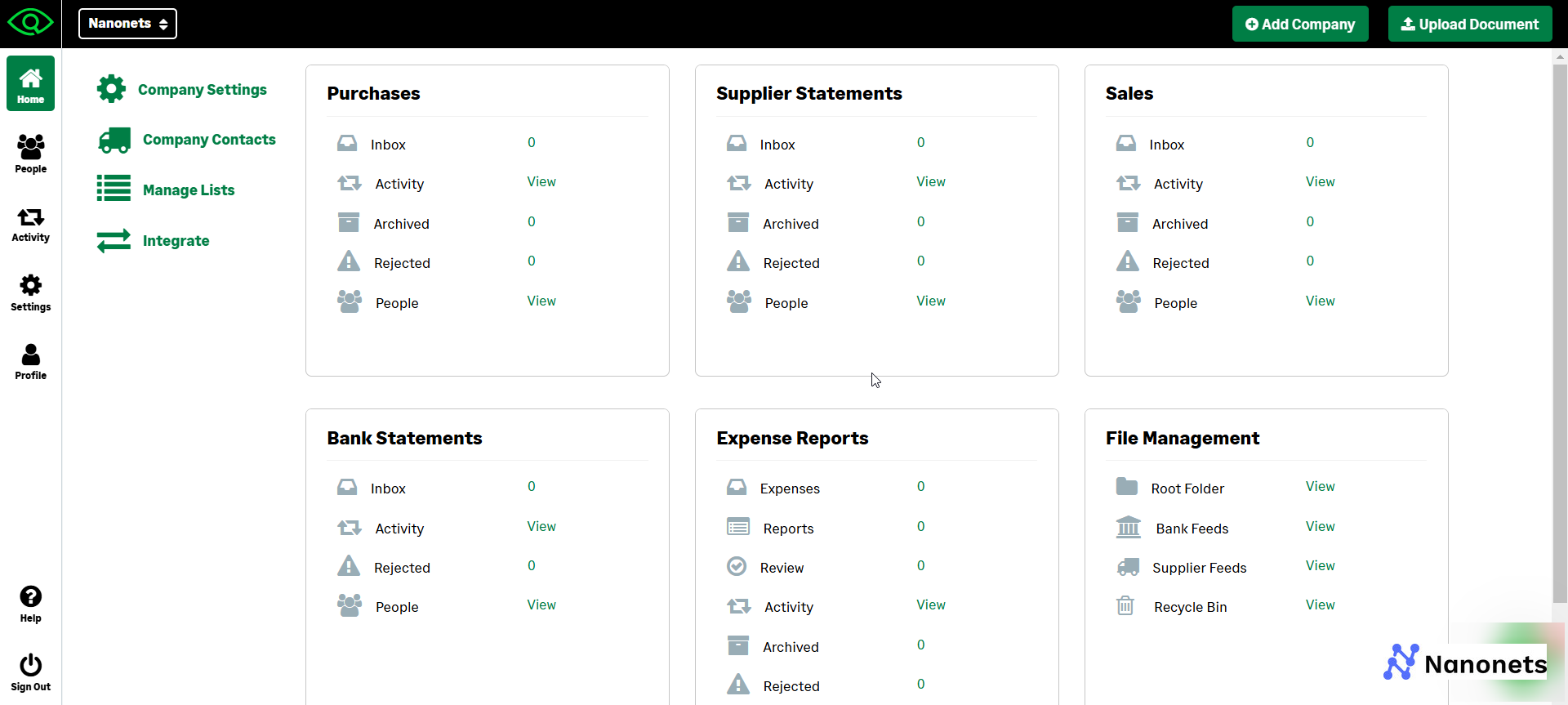

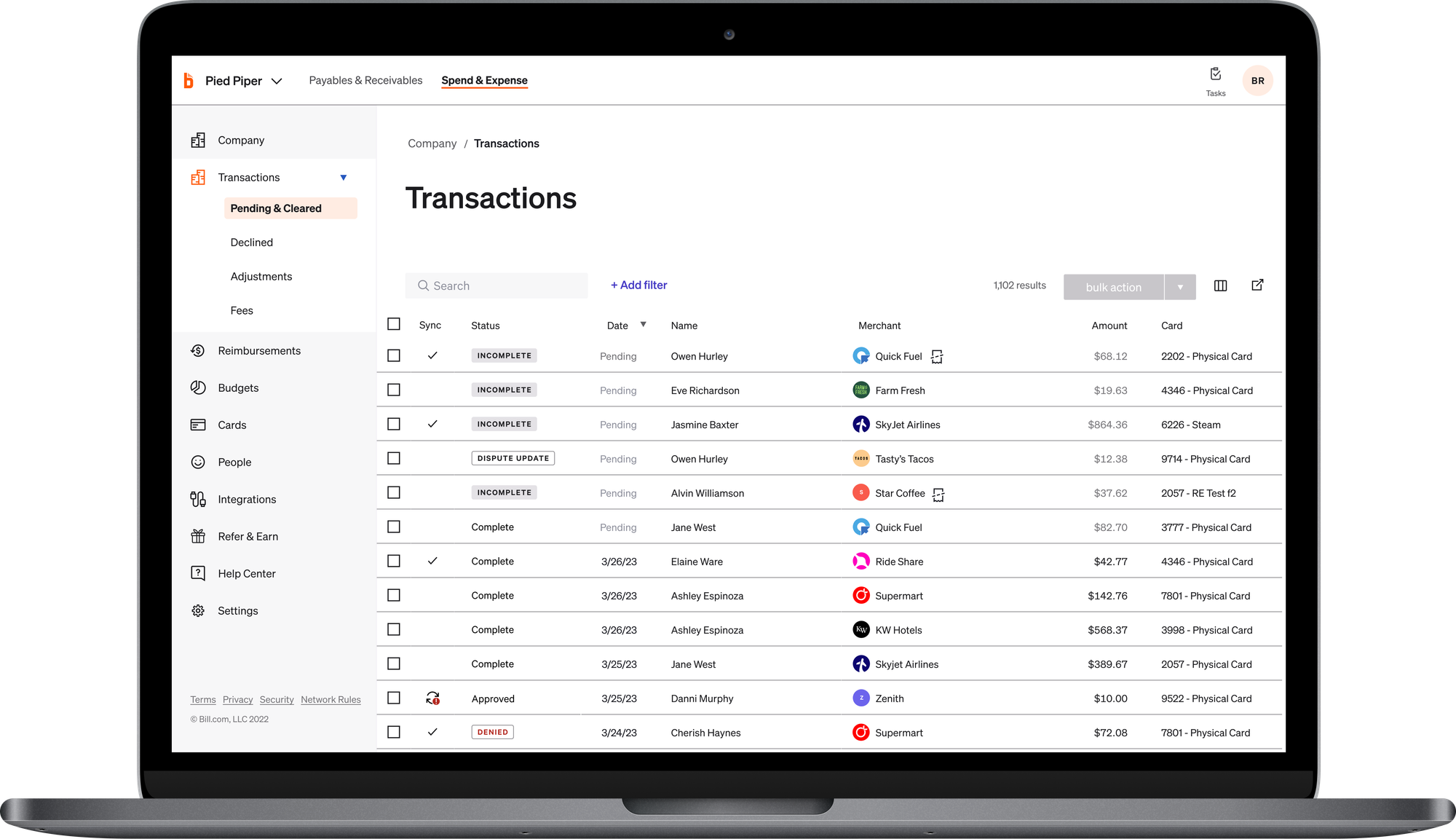

8. BILL (Formerly Divvy)

BILL is a spend management platform that combines expense tracking with corporate cards. With a strong presence in small to mid-sized businesses, it offers a different approach to expense management than Dext's receipt-focused solution.

1. Individual cards with customizable spending limits

2. Virtual vendor cards to prevent fraud

3. Mobile app for instant receipt capture

4. Real-time transaction notifications

5. Budget controls by department/employee

6. Automated QuickBooks/Xero sync

7. Multi-level approval workflow

| Pros | Cons |

|---|---|

| No subscription fees | Limited to US-based companies |

| 99% reduction in fraudulent charges | Requires credit approval |

| Easy mobile receipt capture | Reward redemption can be slow |

| Real-time spending visibility | Some features have learning curve |

| Automated expense coding | Credit limits can change |

| Quick implementation | Initial budget setup takes time |

| Built-in rewards program | |

| Virtual cards for vendors |

Pricing:

- Free: Unlimited users with corporate cards

- Team: Custom pricing with advanced controls

- Enterprise: Contact for custom solutions

- All plans include credit card rewards

Best suited for: US-based small to mid-sized businesses looking for combined corporate card and expense management solution, especially those wanting to prevent overspending rather than just track expenses after the fact.

How does BILL compare to Dext?

Parameter | BILL | Dext |

|---|---|---|

Ease of Use | 9.1 | 9.4 |

Ease of Setup | 8.8 | 9.2 |

Quality of Support | 8.6 | 8.9 |

Meets Requirements | 9.0 | 9.2 |

Product Direction (% positive) | 9.1 | 9.4 |

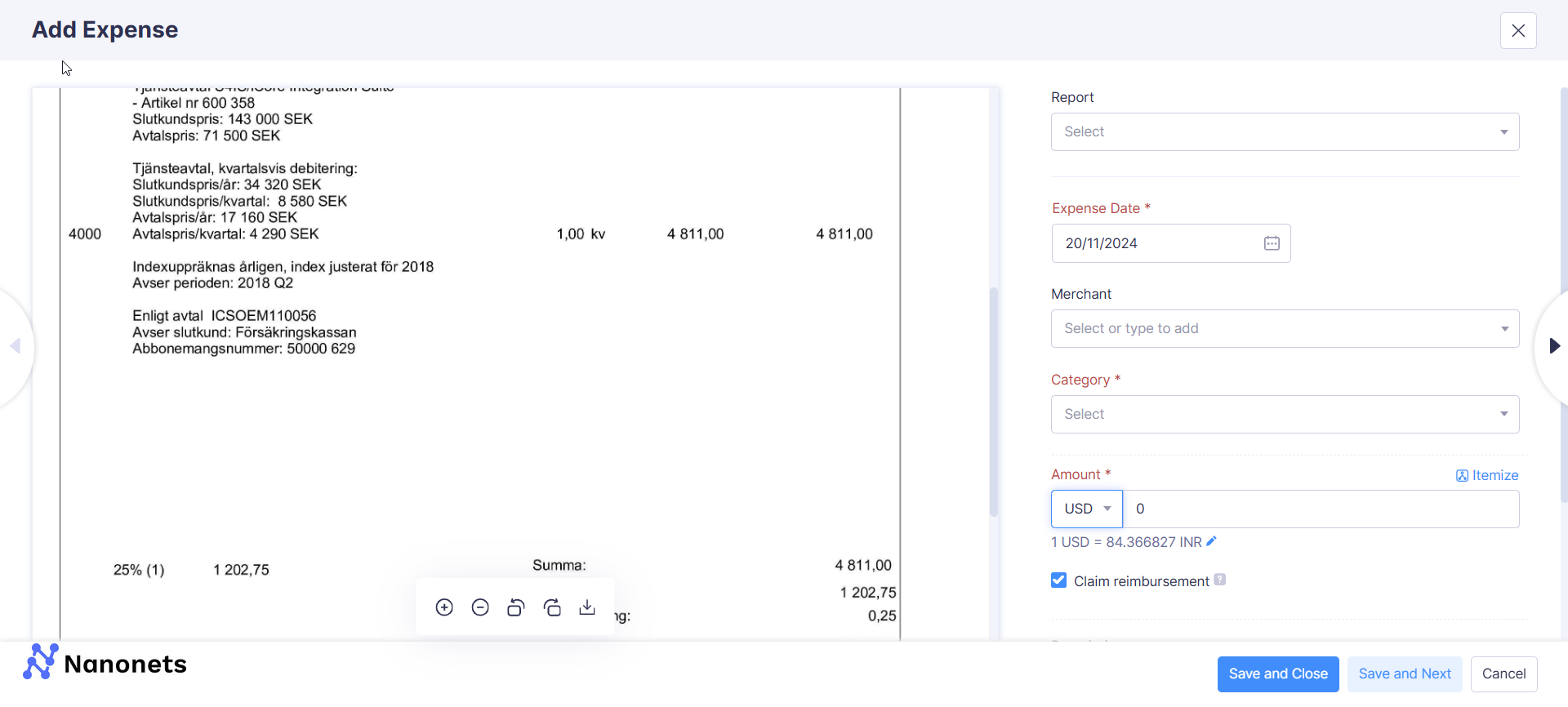

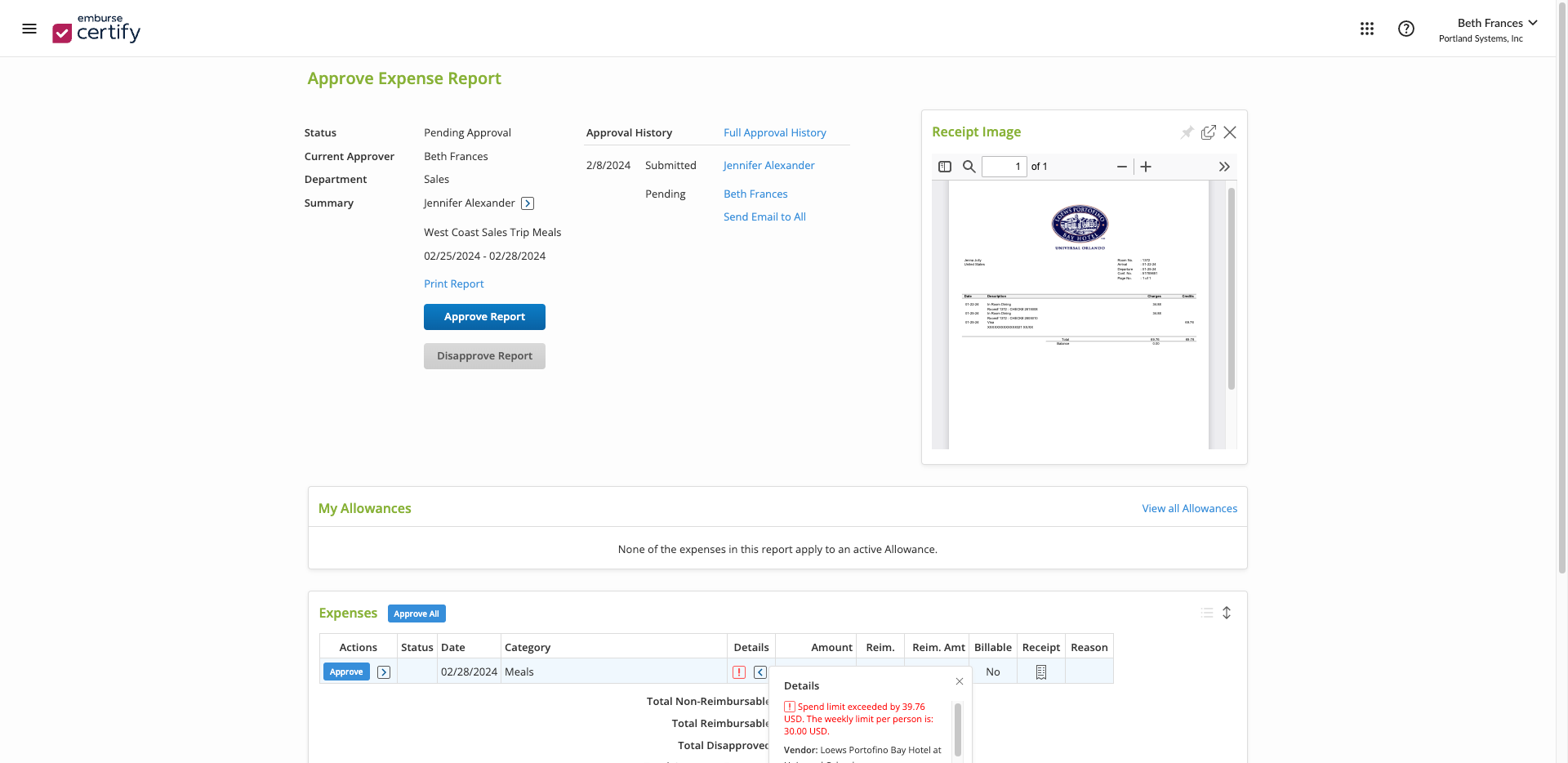

9. Emburse Expense Professional

Emburse Expense Professional (formerly Certify Expense) focuses on automating the entire expense management workflow. Unlike Dext's focus on document processing, Emburse provides a complete travel and expense management solution with strong approval workflows and compliance features.

1. Automated expense report creation

2. Mobile receipt capture and processing

3. Multi-currency support

4. Built-in compliance tools

5. Advanced approval workflows

6. Real-time policy enforcement

| Pros of Emburse | Cons of Emburse |

|---|---|

| Higher accuracy in expense processing | Higher starting price point |

| Strong mobile receipt capture | Some users report syncing issues |

| Automated report generation | OCR struggles with handwritten amounts |

| Multi-currency support | Setup can be complex |

| Good compliance tools | Limited customization options |

| QuickBooks/Xero integration | Learning curve for advanced features |

| Easy reimbursement process | |

| Strong audit capabilities |

Pricing:

- Starting at $3,000 per year

- Custom pricing based on needs

- Free mobile app included

- Unlimited cloud storage

- Volume discounts available

Best suited for: Mid-sized to large organizations needing combined travel and expense management with strong compliance features.

How does Emburse compare to Dext?

| Parameter | Emburse | Dext |

|---|---|---|

| Ease of Use | 9.0 | 9.4 |

| Ease of Setup | 8.5 | 9.2 |

| Quality of Support | 9.0 | 8.9 |

| Meets Requirements | 9.2 | 9.2 |

| Product Direction (% positive) | 8.7 | 9.4 |

How to choose the best Dext alternative?

If you're reading this, you're probably feeling the impact of Dext's recent price increases or struggling with its limitations. You're not alone. In this section, we'll break down exactly what to look for based on real experiences from companies that made the switch.

Whether you're a small business owner tired of chasing receipts, an accountant managing multiple clients, or a finance manager looking for better automation, this section will help you evaluate alternatives systematically.

Scoring methodology*

At Nanonets, we process thousands of receipts and invoices monthly for Fortune 500 enterprises. This gives us unique insights into what businesses need from their document processing solutions.

We evaluated each alternative across five key parameters that matter most to organizations switching from Dext:

- Ease of use: How quickly teams can start using the tool

- Ease of setup: Implementation effort and time to value

- Quality of support: Availability and responsiveness of support teams

- Meets requirements: Ability to handle varied document processing needs

- Product direction: Continuous improvement and feature development pace

| Product | Ease of Use | Ease of Setup | Support Quality | Meets Requirements | Product Direction | Total Score |

|---|---|---|---|---|---|---|

| Dext | 9.4 | 9.2 | 8.9 | 9.2 | 9.4 | 46.1 |

| Nanonets | 9.3 | 9.1 | 9.4 | 9.1 | 9.6 | 46.5 |

| Hubdoc | 8.8 | 8.5 | 8.9 | 8.6 | 8.8 | 43.6 |

| AutoEntry | 8.2 | 8.0 | 7.4 | 8.0 | 6.5 | 38.1 |

| SAP Concur | 8.0 | 7.8 | 8.0 | 8.7 | 7.1 | 39.6 |

| Zoho Expense | 8.8 | 8.6 | 8.5 | 8.8 | 9.0 | 43.7 |

| BILL | 9.1 | 8.8 | 8.6 | 9.0 | 9.1 | 44.6 |

| Emburse | 9.0 | 8.5 | 9.0 | 9.2 | 8.7 | 44.4 |

Key decision factors

Based on common pain points users report with Dext, consider these aspects:

Receipt and invoice processing

- Do you need better accuracy for specific document types?

- Is mobile receipt capture critical for your team?

- How important is automated categorization?

- Do you process international receipts in multiple currencies?

Accounting software integration

- Are you using Xero, QuickBooks, or other accounting platforms?

- Do you need real-time sync capabilities?

- How important is automated reconciliation?

- Do you need custom field mapping options?

Cost structure

- Has Dext's recent price increase affected your budget?

- What's your monthly document volume?

- Do you prefer per-user or per-document pricing?

- Are you looking for unlimited document processing?

Workflow requirements

- Do you need approval workflows?

- How important is expense policy enforcement?

- Do you require audit trail capabilities?

- Are automated reminders necessary?

Support and training

- Do you need dedicated account management?

- What level of implementation support is required?

- How important is local timezone support?

- Do you need training resources for your team?

*Disclaimer: This analysis uses data from independent user reviews, technical documentation, and implementation case studies available as of November 2024. Since expense management solutions evolve rapidly:

- Feature sets and capabilities may have changed

- Pricing models might differ from what's listed

- Performance metrics could vary based on your specific use case

- Integration options may have expanded

- New features may have been added

We recommend reaching out to vendors directly for the most current information and testing any solution thoroughly with your actual receipts and invoices before making a decision.

FAQs

What's the real cost difference between Dext and its alternatives?

With Dext's new pricing starting at $24 per month and reaching $250+ for larger teams, we're seeing businesses save significantly with alternatives. Here's what our analysis shows:

- Small teams (1-5 users): Can save 30-40% annually

- Mid-sized teams (6-20 users): Often see 40-50% savings

- Large teams (20+ users): Potential savings of 25-35%

Remember to factor in implementation costs and any volume-based fees when comparing prices.

What features should I look for in a Dext alternative?

Based on our analysis, prioritize these essential features:

- Reliable OCR accuracy for receipts and invoices

- Direct integration with your accounting software

- Mobile app for receipt capture

- Multi-currency support

- Automated categorization

- Flexible approval workflows

- Responsive customer support

Which features matter most for daily use?

After analyzing hundreds of user experiences, these four features make the biggest impact:

- One-click receipt capture: Saves 2-3 minutes per document

- Smart categorization: Reduces errors by up to 60%

- Real-time sync with accounting software: Eliminates double entry

- Automated approval workflows: Cuts processing time by 70%

Focus on these core features rather than nice-to-have extras that you might rarely use.

Can I test different Dext alternatives before committing?

Yes, most alternatives offer free trials or demo periods:

- Nanonets offers 500 free pages

- AutoEntry provides credit-based trials

- Zoho Expense offers a 14-day free trial

- BILL offers free demos and trials

We recommend testing any solution with your actual documents before making a switch.