Managing countless claims and endless paperwork with repeated manual tasks is a constant struggle for insurance agents and underwriters. While the claims backlog grows, customer complaints pile up.

To keep up with the rising demand, the insurance industry needs to be able to process claims 4X faster with increased accuracy. Many insurance companies are still stuck with inefficient, manual processes where each agent has to review hundreds of documents with complex, unstructured data.

A major overhaul and transformation is necessary.

In this article, we’ll explore human-centric AI solutions to the biggest claims process challenges and explore the available claim automation tools.

Read About: Straight-Through Processing in Insurance

What is claims process automation?

50% of insurance operating costs come from time-consuming claims processing.

This happens because every agent has to manage, review, and verify a lot of paperwork to process a single claim.

While human oversight is crucial and irreplaceable, AI-driven solutions can dramatically improve claims processing and streamline claims management process. By automating routine tasks like document handling, data extraction, and validation, agents can focus on more strategic tasks and build stronger customer relationships.

Claims process automation leverages advanced technologies like AI, machine learning (ML), and intelligent document processing (IDP) to automate repetitive tasks such as claim submission, investigation, and decision-making.

As claims are processed quickly and more accurately, the benefits are substantial:

- It allows insurers to eliminate repetitive tasks like data entry and document verification, leading to up to 80% fewer processing errors, a higher volume of claims processed, shorter claim cycles, and significantly faster claim settlements.

- Insurers adopting automation also report dramatic cost reductions, enhanced fraud detection, higher compliance, and a boost in customer satisfaction.

These claim automation tools analyze data, learn from past claims, and streamline every process step, allowing insurers to focus on more complex issues while maintaining complete control over claims processing.

Technologies in insurance claims processing automation

Let’s explore the key technologies that drive automated claims processing:

Machine Learning (ML)

By analyzing historical claims data, ML algorithms can identify patterns and trends, predict outcomes, assess risk levels, and flag fraudulent claims. This reduces manual interventions and expedites claims settlements.

E.g., ML models can help companies accurately estimate repair costs in auto insurance claims by comparing them against vast datasets of similar claims.

Artificial Intelligence (AI)

AI is particularly brilliant at handling complex tasks like fraud detection, risk assessment, and claims adjudication.

Advanced AI systems can cross-check claim details against policy data, third-party databases, and historical claim records to detect anomalies and assess claim validity. This significantly reduces the likelihood of fraudulent payouts and improves overall claim accuracy.

Natural Language Processing (NLP) and Intelligent Document Processing (IDP)

NLP extracts information from unstructured data like handwritten notes and emails, while IDP uses NLP and ML to automate document processing, reducing review time and enhancing customers' experiences.

Robotic Process Automation (RPA)

RPA automates repetitive, rule-based tasks such as data entry, claim verification, and status updates. This frees up time for insurers to focus on complex activities, increasing operational efficiency and reducing human error.

Optical Character Recognition

Accurate OCR digitizes physical documents by converting them into machine-readable text. Insurers can swiftly process forms, invoices, and other claim documents to extract critical information like names, dates, and claim numbers.

Advanced OCR, combined with AI, handles document formats and quality variations, ensuring data accuracy for further processing.

Such intelligent automation can help insurance companies process thousands of policy documents faster and more accurately.

Claims Processing Automation ROI Calculator

Notes and assumptions (click to expand)

- This calculator provides a simplified estimate of the potential ROI from implementing Nanonets Claims Processing Automation.

- The hourly rate should represent the average hourly wage of employees involved in manual claims processing.

- The calculation assumes that the time saved by automating claims processing will be fully reallocated to other productive tasks.

- The calculator uses Nanonets' Pro Plan pricing as a basis for comparison. Nanonets also offers a pay-as-you-go model suitable for smaller businesses or lower document volumes, with the first 500 pages free and a charge of $0.3 per page thereafter.

- The calculation assumes a consistent monthly claims volume and average pages per claim throughout the year.

- The actual time saved by automating claims processing may vary depending on factors such as claim complexity and system efficiency.

- Implementing claims processing automation may require some upfront investment in terms of time and resources for setup, integration, and training.

- The calculator provides a high-level estimate and should not be relied upon as a precise financial projection.

Benefits of claims automation

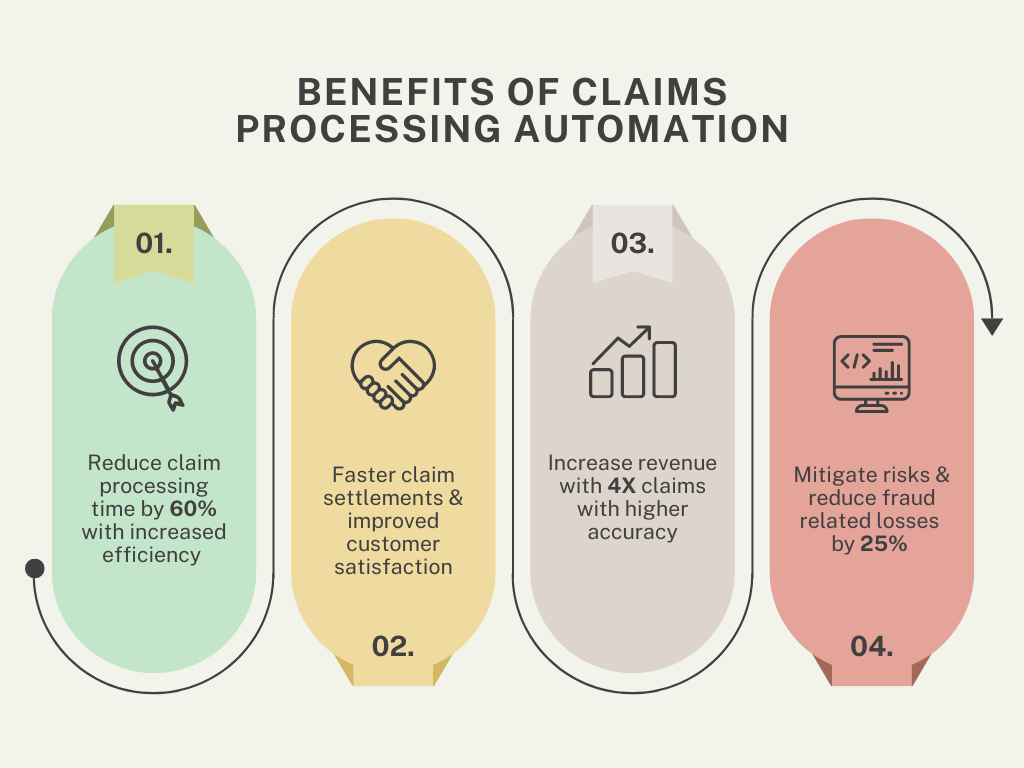

Automating claims processing offers numerous advantages that enhance the efficiency and effectiveness of insurance operations. Here’s how:

- Increased efficiency: Automation reduces manual tasks, cutting processing times by 60%. Insurers using RPA and AI can handle 10x more claims, reducing operational costs and boosting productivity.

- Faster claim settlements: AI tools reduce claim verification and fraud detection from weeks to days. Automated systems cut settlement times by 70%, leading to quicker payouts and better customer retention.

- Improved customer service: Automation drives 15-20% higher customer satisfaction through faster processing, real-time updates, proactive communication, and more accurate payouts.

- Increased revenue and cost savings: Advanced claim automation boosts revenue by up to 20% through increased efficiency and customer retention while minimizing manual work and reducing operational costs by 30%.

- Risk mitigation and fraud prevention: AI-powered fraud detection has reduced the $40 billion annual cost of fraud in the U.S., decreasing fraud-related losses by 25% with instant flagging of suspicious patterns.

How to resolve challenges in claims processing with automation

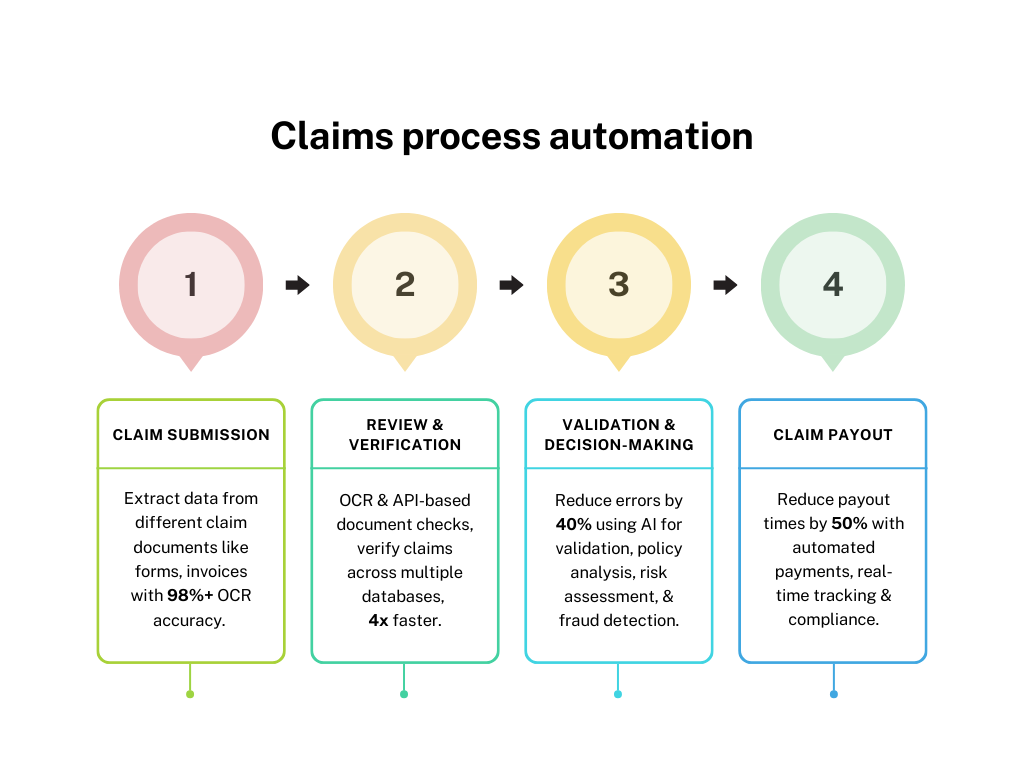

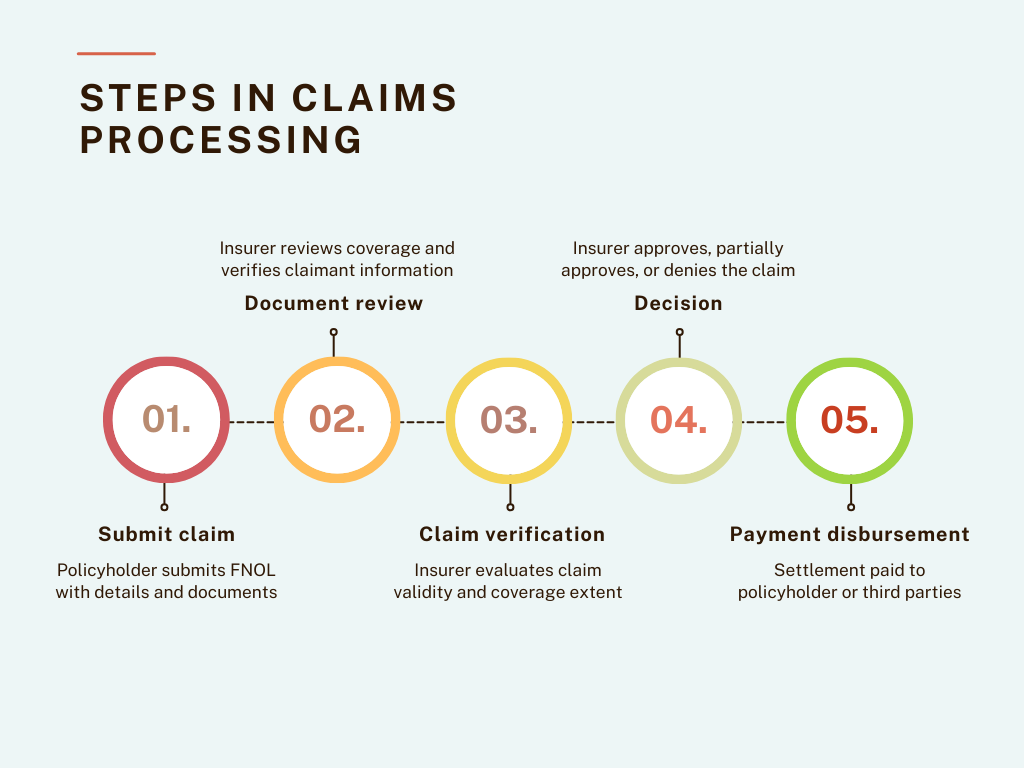

Insurance claims processing involves multiple steps that can take weeks without automation. Here’s how automation solves common challenges:

Claim submission

The process begins with the policyholder filing a First Notice of Loss (FNOL) through the insurance platform or the broker.

The policyholder provides basic information about the claim, such as the date and location of the incident and any supporting documentation or images as evidence.

Challenges and automated solutions in the claims submission process:

Solution: Create a comprehensive self-service portal and implement intelligent workflows with the following features:

- Automated document checklists: Guide claimants and flag missing files in real time.

- AI chatbot: Guide users through the submission process based on incident details

- Pre-filled forms: Automatically populate data from existing customer records

- Omnichannel intake system: Pull claims from all sources (email, WhatsApp, cloud storage) into a single digital platform

- AI-driven document parser: Convert claims from multiple formats into standardized digital formats

- Automated deduplication: Use ML to flag duplicate files and route them for mandatory human review.

- Intelligent approval workflows: Use conditional logic to manage multi-step processes based on claim complexity. Automatically route high-risk or priority claims to relevant key persons.

- Guided form-filling and reminders: Provide estimated completion times, explanations for complex terms, and reminders for pending items.

Review and verification

After the claim is submitted, it goes through a detailed review and verification process to confirm the accuracy of the information provided.

This step focuses on gathering and verifying supporting evidence, including assessing reported damages and validating claimant identity.

Insurers use various methods, such as consulting third-party databases and analyzing the provided documentation, to ensure that all necessary details are correct and accurate before proceeding.

Challenges and automated solutions in the claim review and verification process:

Solution: Implement an integrated AI-powered review system with the following features:

- Advanced OCR and NLP: Extract and analyze information from submitted documents with 97%-99% accuracy.

- ML algorithms: Verify document authenticity and detect tampering or fraud.

- AI document processing: Use automated data extraction tools to accurately handle various formats (PDFs, scanned images, handwritten text).

- API integration: Connect with external databases (e.g., DMV records, medical databases, credit bureaus) for data verification.

- Multilingual capability: Extract meaningful data from free-text descriptions in various languages.

- Collaboration tools: Facilitate communication between departments to streamline approvals.

Claim validation and decision

Once the claim is verified, the next step is to determine its eligibility. This involves evaluating the claim against policy terms, assessing the extent of coverage, and deciding whether to approve, partially approve, or deny the claim.

At this stage, all verified evidence is analyzed, and if the claim meets the policy criteria, the insurer calculates the appropriate payout.

Challenges and automated solutions in the claims validation and decision process:

Solution: Implement an intelligent decision-making system that includes:

- Rule-based workflow: Use consistent criteria across all claims.

- ML models: Leverage historical data for standardized decision-making.

- Adaptive fraud detection: Refine fraud detection criteria using feedback from human reviewers.

- Behavioral analytics: Differentiate legitimate claims from fraudulent ones by creating detailed policyholder profiles.

- AI-powered payout calculation: Use rule-based calculators to factor in policy limits, incident type, and market conditions to ensure accurate payouts and reduce disputes and dissatisfaction.

Claim payout

The final step of payment disbursement involves transferring the approved settlement amount to the policyholder or third parties, such as repair facilities or healthcare providers.

Delays or errors in payouts breed mistrust and dissatisfaction, making it essential to ensure this step is both accurate and completed in time.

Read About: Healthcare Claims Automation

Challenges and automated solutions in the claims disbursement process:

Solution: Implement a comprehensive automated payout system with:

- Validation checks: Cross-reference payout amounts against policy terms to avoid mismatches.

- Real-time payment tracking: Provide updates through digital portals or mobile apps.

- Instant acknowledgment: Send tracking IDs to policyholders upon claim approval.

- Flexible payment management: Enable adjustments or reversals when necessary.

- Integrated financial management: Automate tax calculations, generate required tax documents (e.g., 1099 forms, Form 1040 (Schedule A), Form 720), and match disbursements with internal records using API integration.

- Automated auditing and reporting: Streamline financial reporting processes and ensure compliance.

Best AI insurance claim automation tools

Let's have a look at some of the best tools that are leveraging advanced AI for claims processing to automate different steps of claims processing in the insurance industry.

Best for automating claims submission

- Snapsheet offers a digital claims platform that allows policyholders to submit claims online or through a mobile app.

- ClaimVantage by Majesco provides an advanced cloud-based claims management system tailored for life, health, and disability insurance. It offers automated workflows, online claim submission, and tracking capabilities.

- Lemonade automates the claims process, from submission to decision-making. Its AI bot, “Jim," processes claims instantly, assessing eligibility and disbursing payments within minutes for simple claims.

Best for document verification and validation

- Nanonets OCR technology automates the extraction of key information from claim forms, such as policy numbers, claimant names, and damage descriptions. By leveraging machine learning algorithms, Nanonets helps insurers quickly validate claims, reducing manual work and improving accuracy.

Trusted by 34% of Fortune 500 companies, Nanonets is particularly popular for automating document-heavy processes like claims validation, data extraction from medical records, forms data extraction, and even handwritten scanned documents. - Tractable uses computer vision and AI to assess vehicle damage and automatically determine the appropriate repair costs. Tractable’s AI can make rapid, data-driven decisions, significantly reducing the time required to settle auto insurance claims.

- Verisk Analytics: Offers an extensive suite of tools for claims validation, including predictive analytics, property and casualty claims analytics, and medical bill review. This tool is trusted to validate complex claims such as workers' compensation and property damage.

Best for claims verification and fraud detection

- Shift Technology is popular for its AI-driven fraud detection capabilities. It analyzes claims data to identify potential fraud, errors, and anomalies. Its algorithms are trained on vast datasets, ensuring high accuracy in flagging suspicious claims, thereby reducing the risk of fraudulent payouts.

- FRISS is a comprehensive insurance fraud detection platform that uses AI and predictive analytics to monitor and verify claims. It evaluates risk scores in real-time during the claim lifecycle, helping insurers detect and prevent fraud at an early stage.

Best for claims calculation and payouts

- Octo Telematics uses data to analyze driving behavior and adjust premiums based on risk, leading to more accurate pricing and better risk management.

- Checkbook.io offers a digital check platform that allows insurers to issue payments electronically and securely.

- One Inc provides a digital payments platform designed specifically for the insurance industry. One Inc. offers secure, real-time payment solutions for claims disbursement via ACH, credit cards, and digital wallets. Its integration with existing claims systems ensures seamless and efficient payment processing.

How to set up a claims automation process using Nanonets

Extracting claim document information

- Sign up on Nanonets

- Choose the suitable Pre-Built Extractor model for claim documents such as invoices receipts, or use the Zero-training AI model.

- Upload all your documents and wait for the model to extract data from them.

- Customize different fields per document to extract only relevant information accurately.

- Review all the extracted information from each document.

Document review and verification

- Share/Export all the extract documents for further approvals by setting up review workflows.

- Set up an approval workflow and share the extracted data file with stakeholders.

- Depending on the priority and risk of claims, add rules to highlight or flag them. Add multiple reviews—mandatory or optional for different types of claims.

- Set up automated notifications for reminders to get quick approvals by integrating Slack, Email, or any other internal channel.

Claim validation

- Set up data validation by enriching the extracted data with customized actions, for example:

- For cross-border claims, use actions like currency converter or removing currency symbols to keep only numbers, decimals, and commas in amounts, converting date formats

- For repeat claimants, look up data from databases and external sources such as PostgreSQL, MySQL, accounting software, or Google Sheets.

Integrations for payments and accounting

- Integrate with your accounting or ERP tools for efficient workflow automation across all platforms with API integrations.

- You can set up integrated workflows with any third-party or in-house system to ensure seamless data flow.

- For example: If you already have an insurance claims management platform, integrate the tool to automate only specific steps of the process (like accurate OCR extraction or setting up approval workflows).