Accounting is evolving, and AI is leading the charge. With the AI accounting market set to hit $26.66 billion by 2029, tools like ChatGPT are transforming the way accountants work.

But ChatGPT’s entry and universal acceptance have put the spotlight on AI. While there is excitement, experts have also highlighted concerns.

The most common concern among accounting professionals is whether ChatGPT will replace accounting jobs. The answer is no—ChatGPT should be seen as an assistant, not a replacement. Let's find out how.

How can ChatGPT help accountants?

ChatGPT allows accountants to focus on higher-level strategic work by automating tedious tasks. By using it wisely with human oversight for accuracy and nuanced decision-making, ChatGPT can significantly boost your accounting efficiency without compromising quality.

ChatGPT can be a valuable tool for accountants. It can -

- Improve productivity by automating repetitive daily tasks

- Assist in creating budget plans

- Prepare client meeting agendas

- Automate client communication

- Categorize fields in financial documents

- Provide valuable insights from documents

- Analyze financial trends

- Assist with advertising for accounting firms

- Support payroll processing

- Streamline compliance tasks

- Detect discrepancies and aid fraud detection

– all with greater efficiency!

For example, ChatGPT can process thousands of transactions in just a few minutes, making it easier to identify financial trends.

It can highlight patterns such as a 15% rise in operational costs or a 10% dip in sales, allowing you to spot potential issues quickly. Such a data-driven approach can lead to up to 20% improvement in financial forecasting accuracy by helping you make more informed and timely decisions with greater precision and speed.

Accounting GPT model of ChatGPT

ChatGPT Accounting refers to a customized ChatGPT model that is tailored for specific accounting tasks. It is not a distinct product launched by OpenAI under that name. As per ChatGPT Accounting itself:

- ChatGPT Accounting is trained to understand accounting standards (e.g., IFRS, GAAP), financial statement analysis, auditing practices, tax regulations, and other industry-specific financial concepts and policies.

- It is especially useful for professionals looking for support with specific areas like financial reporting, cost accounting, investment appraisals, budgeting, tax filings, or even international accounting differences.

How should accounting firms and accountants use ChatGPT?

While ChatGPT is famously known for its content creation, accountants and accounting firms can use it to boost productivity and day-to-day efficiencies in many ways.

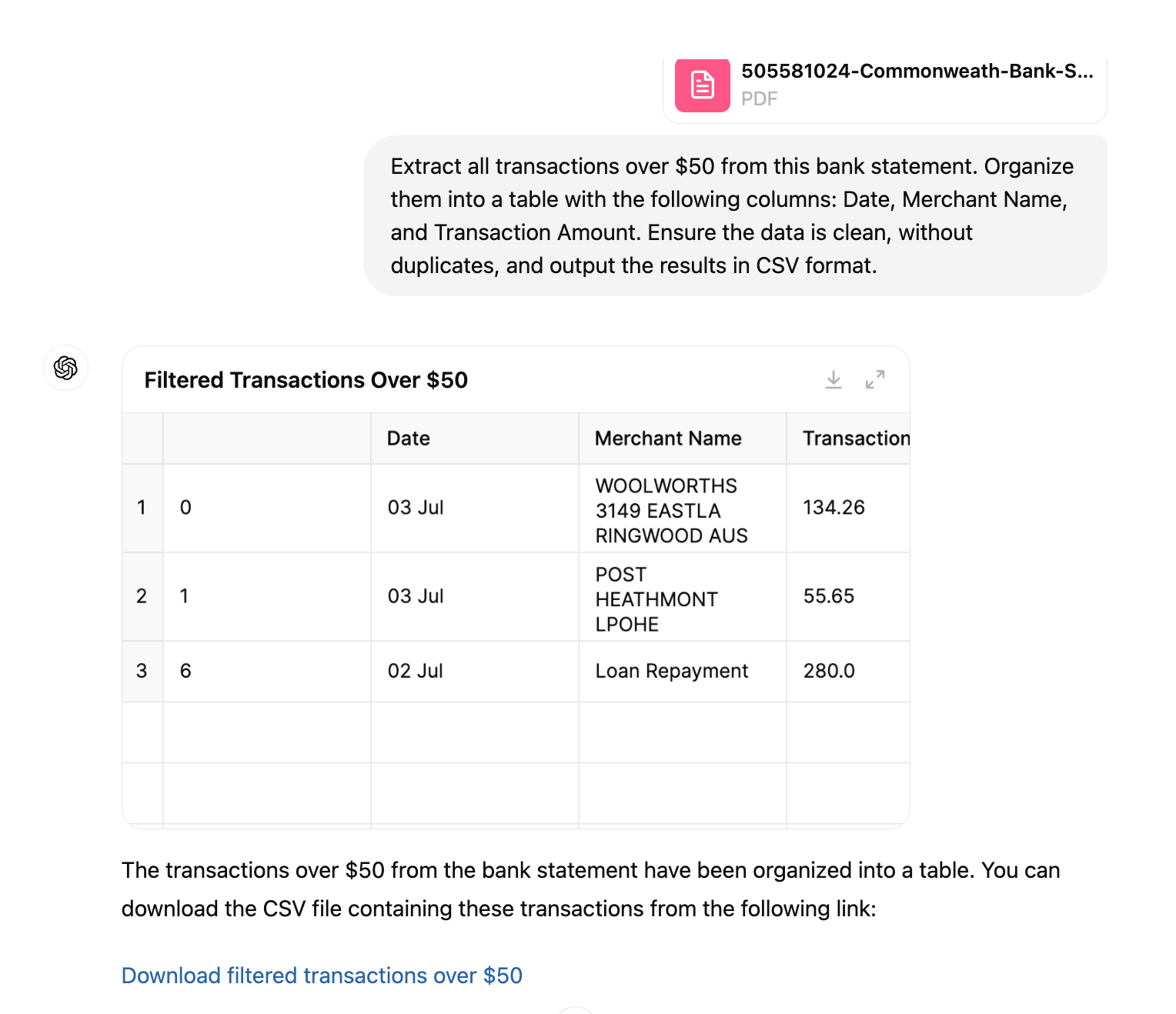

Bookkeeping, data entry, and data extraction

These are the key areas where ChatGPT can significantly assist accounting firms.

ChatGPT can quickly extract relevant information from unstructured documents such as PDFs, bank statements, and invoices by automating repetitive tasks like categorizing transactions, inputting data from invoices, and managing receipts.

ChatGPT helps organize the data into structured formats like spreadsheets or CSV files, reducing manual work by nearly 80%. This boosts productivity and minimizes errors in day-to-day operations.

Show me the prompt

Extract all transactions over $50 from this bank statement. Organize them into a table with the following columns: Date, Merchant Name, and Transaction Amount. Ensure the data is clean, without duplicates, and output the results in CSV format.

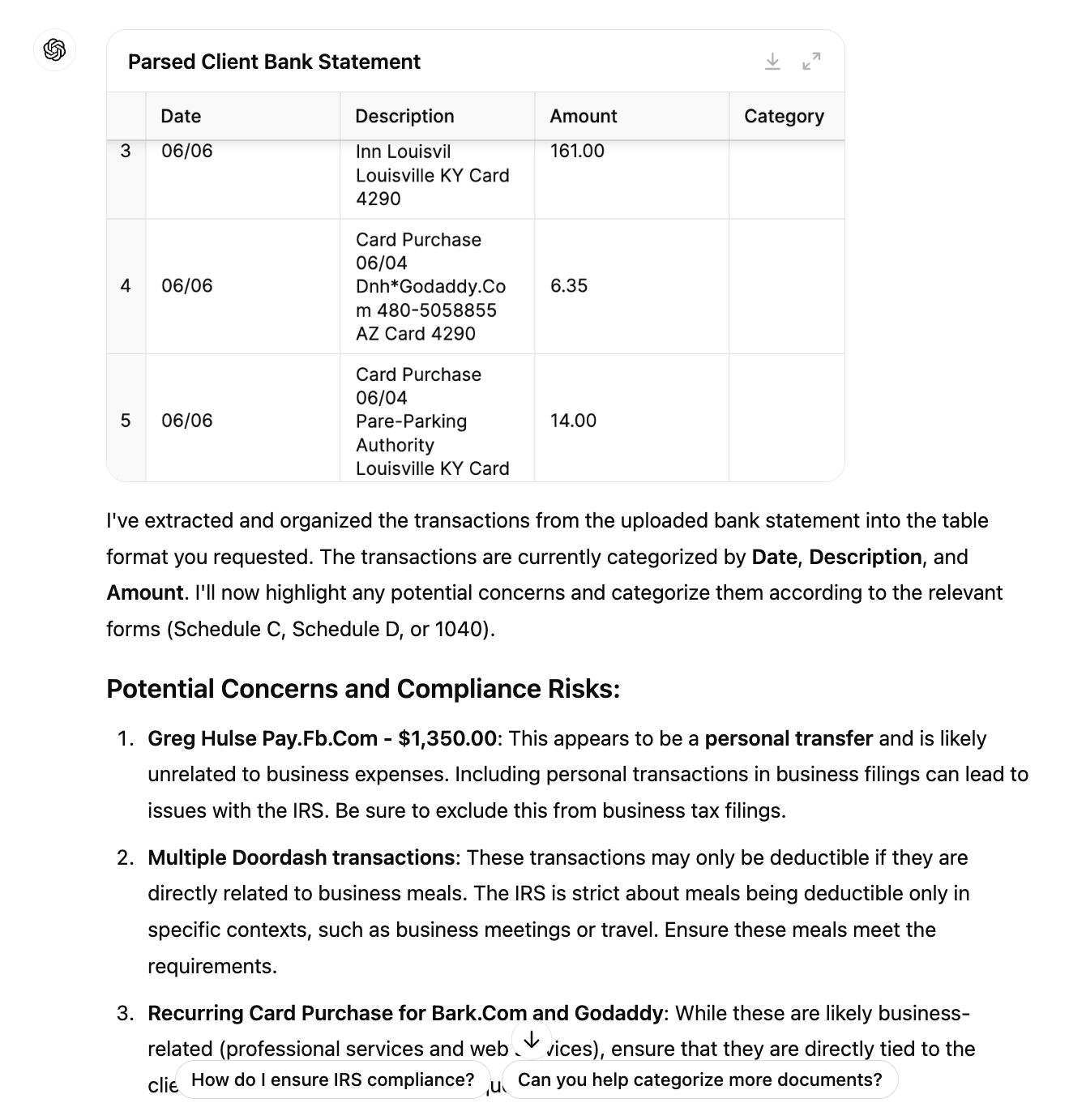

Taxation

- Gary Hemming, Owner & Finance Director, ABC Finance

ChatGPT 4.0 can summarize complex tax laws, generate tax filing drafts, and even suggest potential tax-saving strategies based on the financial data provided (provided you give specifics about your requirements).

It can also assist in preparing documents for compliance checks by summarizing relevant tax regulations quickly, ensuring that firms remain updated with ever-changing laws.

Tax laws change frequently. Rather than spending time reading and understanding them periodically, ChatGPT can shorten the learning curve by helping you understand changes.

Show me the prompt

I am an accountant working with a client based in [client's location]. I need help analyzing their bank statement for tax filing purposes.

Please analyze all transactions and highlight any potential IRS audit triggers, suspicious personal expenses, or compliance risks.

Organize the transactions into a copyable table with columns for Date, Merchant Name, and Transaction Amount. Categorize the transactions according to their relevance for Schedule C, Schedule D, and 1040 filings.

Auditing

ChatGPT can be a valuable tool for accountants in the auditing process. It can assist in creating audit checklists, plans, templates, and reports, ensuring that all critical steps, such as internal control reviews, risk analysis, and compliance checks, are covered efficiently.

ChatGPT can also help analyze large data sets, flagging unusual transactions or discrepancies that may require further investigation.

Additionally, it can draft and automate audit documentation, saving time and reducing manual errors. By integrating ChatGPT into the audit process, accountants can streamline audit planning, enhance accuracy, and focus on higher-value tasks such as strategic analysis and risk management.

Show me the prompt

I need a comprehensive audit report for a small business based in Texas. The audit period is [insert period], and I need you to focus on [insert specific focus areas, e.g., financial compliance, tax compliance, internal controls, etc.]. Here are the documents I have [mention all documents].

Reconcile the general ledger with the bank statements, verify the accuracy of financial reports, identify any tax compliance issues, and assess the company’s internal controls.

Highlight any financial risks and provide recommendations for improvement.

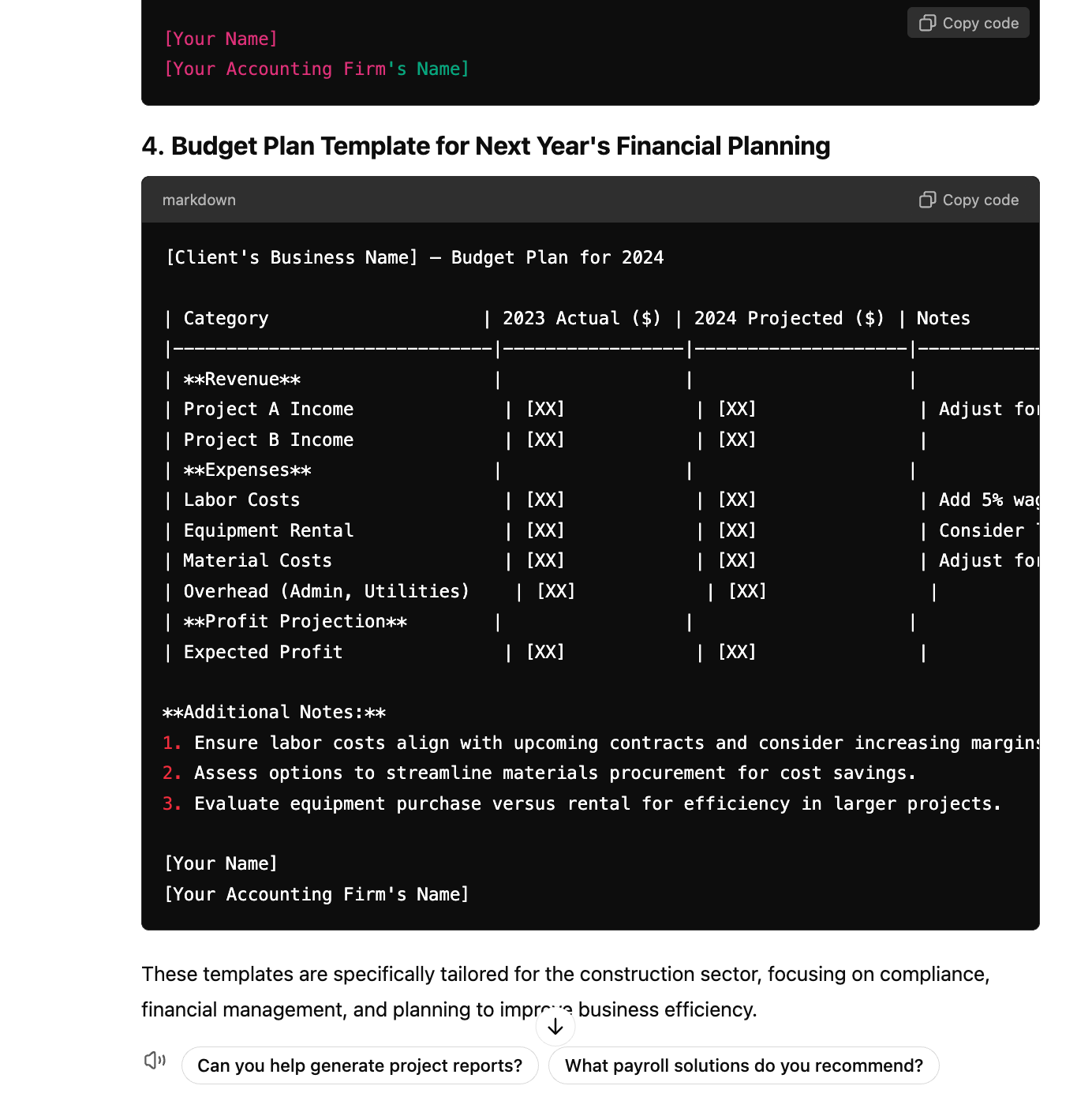

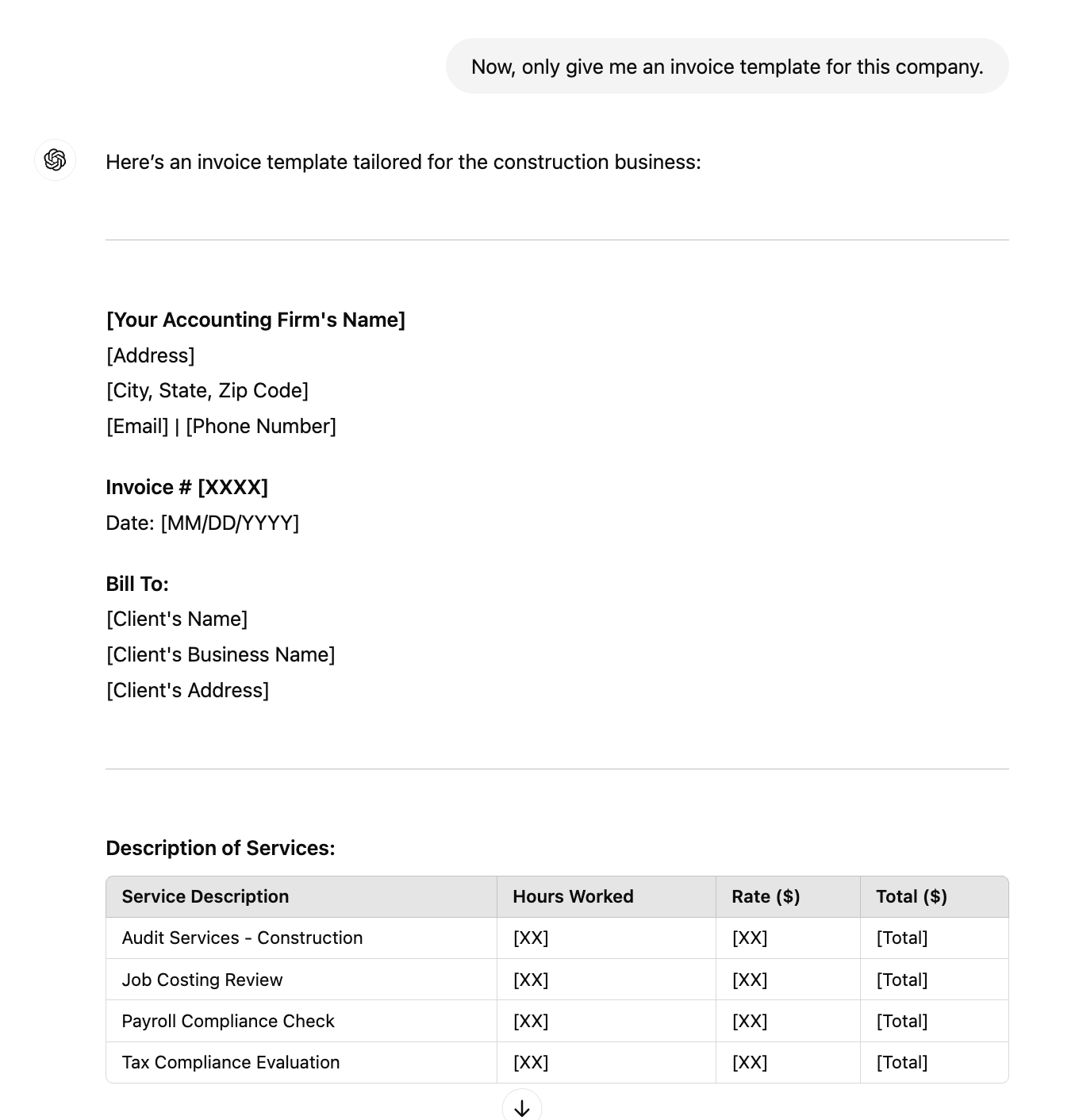

Creating task-oriented templates

ChatGPT can help accountants and accounting firms by generating numerous templates for routine tasks, streamlining workflows, and saving them considerable time. It can create customized formats per your industry and company requirements, such as invoices, client emails, budget plans, financial reports, etc.

For example, accountants can use invoice templates to quickly generate client bills or a budget plan template to offer financial projections for clients. Here are a few templates that can be helpful:

- Invoice and payment reminder templates

- Client onboarding checklist

- Client email template for tax season reminders

- Budget plan template

- Financial statement summaries

- Audit checklist template

- Profit and Loss (PnL) templates

These templates can be customized and reused, ensuring efficiency and accuracy across multiple accounting tasks.

For best results: Keep the prompts specific. Sometimes, this may present a challenge. So, the best way to tackle this would be to break up your tasks into steps and prompts and refine the questions based on the results.

Show me the prompt

I manage an accounting firm and need assistance with an audit for a client based in [location]. The business operates in the [industry] sector, has [number of employees], and generates approximately [annual revenue]. The audit covers the period from [start date] to [end date].

Provide the following templates, customized for this audit? [Mention all templates]

Please ensure these templates are tailored for the [industry] sector, with a focus on key compliance areas. Also, recommend any automation tools that could streamline the audit process.

Show me the prompt

Create a template for an invoice with fields for client name, date, service description, rates, and total amount due.

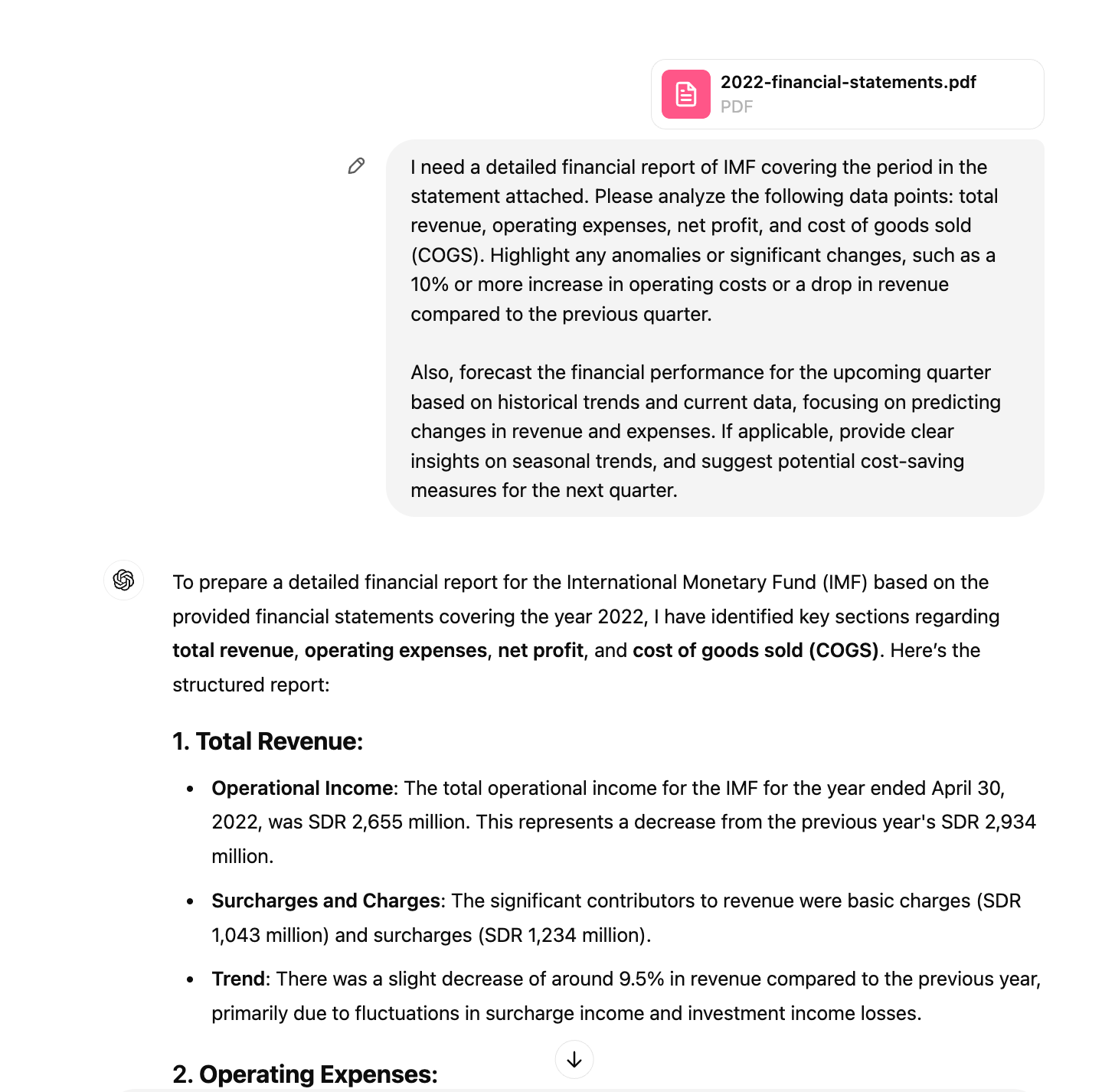

Financial report generation, analysis, and forecasting

- Abid Salahi, Co-founder & CEO, FinlyWealth

A study by IBM shows that AI tools can identify trends, predict future sales more accurately, and reduce financial forecasting errors by up to 15-20%.

ChatGPT can generate financial reports, analyze historical data, and forecast future trends by identifying patterns and anomalies in the accounting industry.

For example, suppose a firm is analyzing quarterly performance. In that case, ChatGPT can highlight a 12% increase in operating costs or identify seasonal trends, allowing the accountant to provide more accurate insights and offer more informed recommendations.

For best results: The prompt should specify precisely the type of report or analysis needed, including time frames and data points. Provide details about the period (quarter, year), specific financial metrics (revenue, expenses), and any areas of focus (e.g., anomalies, trends).

Show me the prompt

I need a detailed financial report for my client covering the period from [start date], to [end date]. Please analyze the following data points: total revenue, operating expenses, net profit, and cost of goods sold (COGS).

Highlight any anomalies or significant changes, such as a 10% or more increase in operating costs or a drop in revenue compared to the previous quarter.

Also, forecast the financial performance for the upcoming quarter based on historical trends and current data, focusing on predicting changes in revenue and expenses. If applicable, provide clear insights on seasonal trends, and suggest potential cost-saving measures for the next quarter.

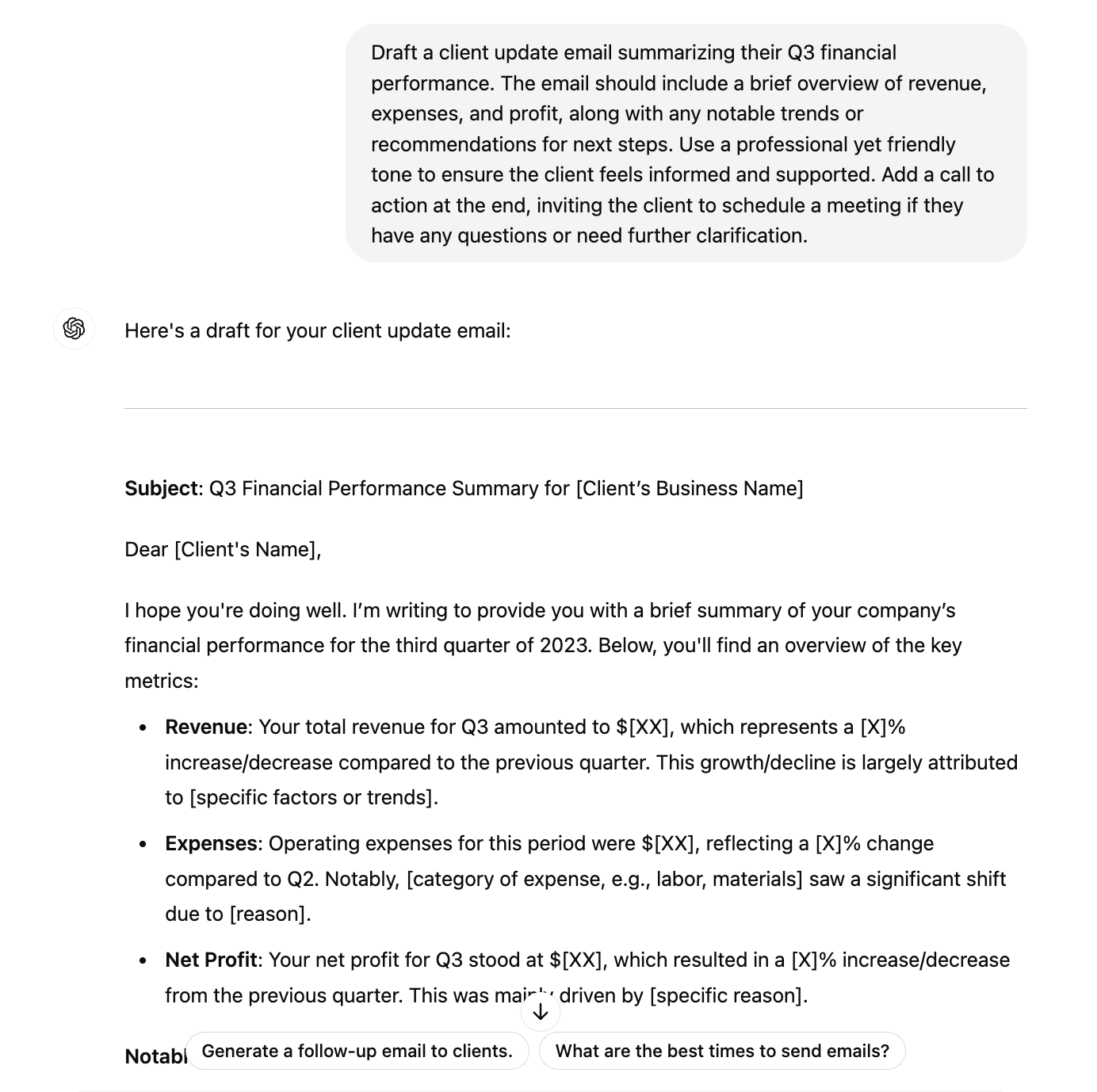

Client communication and relationship management

Effective communication with clients is crucial for accounting firms, and ChatGPT can help by automating emails, client follow-ups, and report sharing. Using AI to improve customer service and communication can lead to a 25% increase in client satisfaction and a 30% reduction in response times.

Accountants can use ChatGPT to automatically generate and send a summary email to clients after their financial statements are prepared, keeping clients in the loop without requiring manual effort from the accountant.

For best results: Include specific details on the content and tone of client communications. You can also ask ChatGPT to adopt a persona. Specify the content (e.g., financial update, service reminder) and tone (e.g., professional, friendly).

Show me the prompt

Draft a client update email summarizing their Q3 financial performance. The email should include a brief overview of revenue, expenses, and profit, along with any notable trends or recommendations for next steps.

Use a professional yet friendly tone to ensure the client feels informed and supported. Add a call to action at the end, inviting the client to schedule a meeting if they have any questions or need further clarification.

ChatGPT vs. traditional accounting software

ChatGPT is an LLM (large language model) tool that facilitates data processing, automation, and communication through natural language prompts.

Conversely, traditional accounting software is purpose-built for tasks like bookkeeping, payroll, and financial reporting.

While ChatGPT excels in handling unstructured data and drafting communications, accounting software offers precise, real-time financial management tools.

While comparing ChatGPT with traditional accounting software, it's important to understand their unique strengths and how they complement each other.

| Feature | ChatGPT | Traditional Accounting Software |

|---|---|---|

| Purpose | Automation, data processing, communication | Bookkeeping, payroll, invoicing, reporting |

| Cost | Free or subscription-based | Subscription or one-time, typically higher |

| Data Entry | Extracts from unstructured inputs | Structured, template-based |

| Automation | Repetitive tasks (e.g., data extraction) | Transaction logging, tax calculations |

| Accuracy | Varies with prompt quality | Consistently accurate |

| Learning Curve | Easy with prompt knowledge | User-friendly, needs accounting knowledge |

| Data Analysis | Insights via prompts | In-depth, requires setup |

| Customization | Highly customizable via prompts | Limited, with advanced settings |

| Complexity Handling | Handles simple tasks | Manages complex tasks, needs setup |

| Compliance | Not always compliant | Can be customized for compliance |

| Security | Privacy concerns, cautious use | Built-in security features |

| User Interaction | Conversational, AI-driven | Menu-driven with predefined functions |

| Collaboration | Drafts emails, aids communication | Integrates with CRM, ERP |

Tips to use Chat GPT for accounting effectively

Start small, validate results

Begin with small, routine tasks and always double-check ChatGPT’s output. Conduct pilot tests before full integration. For complex tasks like tax calculations, cross-check AI-generated reports with raw data to ensure accuracy.

Always review outputs for accuracy, especially in accounting. Cross-check key figures and facts with original sources to avoid mistakes. Be alert for overlooked data points, such as industry benchmarks or tax laws. Use your expertise to fill in gaps or refine your prompt.

Human review is critical to catching errors, as ChatGPT may misinterpret context.

Here's an interesting short video I found that could help you get started with ChatGPT:

Automate repetitive tasks first

- Julie Ginn, Vice President Global Revenue Marketing, Aprimo

The best way to optimize ChatGPT is to use it to handle repetitive accounting tasks and rely on your expertise to interpret the results.

For example, accountants who use Excel can benefit from ChatGPT’s ability to suggest formulas and automate data entry. This can automate mundane tasks like transaction categorization, cash flow forecasting with formulas, and comparing two lists of transactions for reconciliation.

You can also use ChatGPT to automate invoice generation with templates. It can draft client follow-ups, such as tax reminders and payment notices, and save you time while maintaining professionalism.

Use ChatGPT as a collaborative partner and not a one-stop-solution

ChatGPT is a powerful tool, but applying your critical thinking to its results is essential. Treat it as a collaborator by engaging in a back-and-forth conversation, like how you would have a conversation with a know-it-all guide.

Leverage your domain knowledge for best use. Use industry-specific jargon to ensure that ChatGPT produces results relevant to your specialized accounting field.

Split complex tasks into simpler subtasks. For longer reports, give ChatGPT time to process and "think" through the documents. In fact, you can even ask the model to take time before rushing through the conclusion.

Start with broader prompts and refine the output by tweaking them to get more precise results. Tailor ChatGPT's responses to fit your specific needs. For instance, if generating a financial report summary, adjust it to reflect your client's unique circumstances.

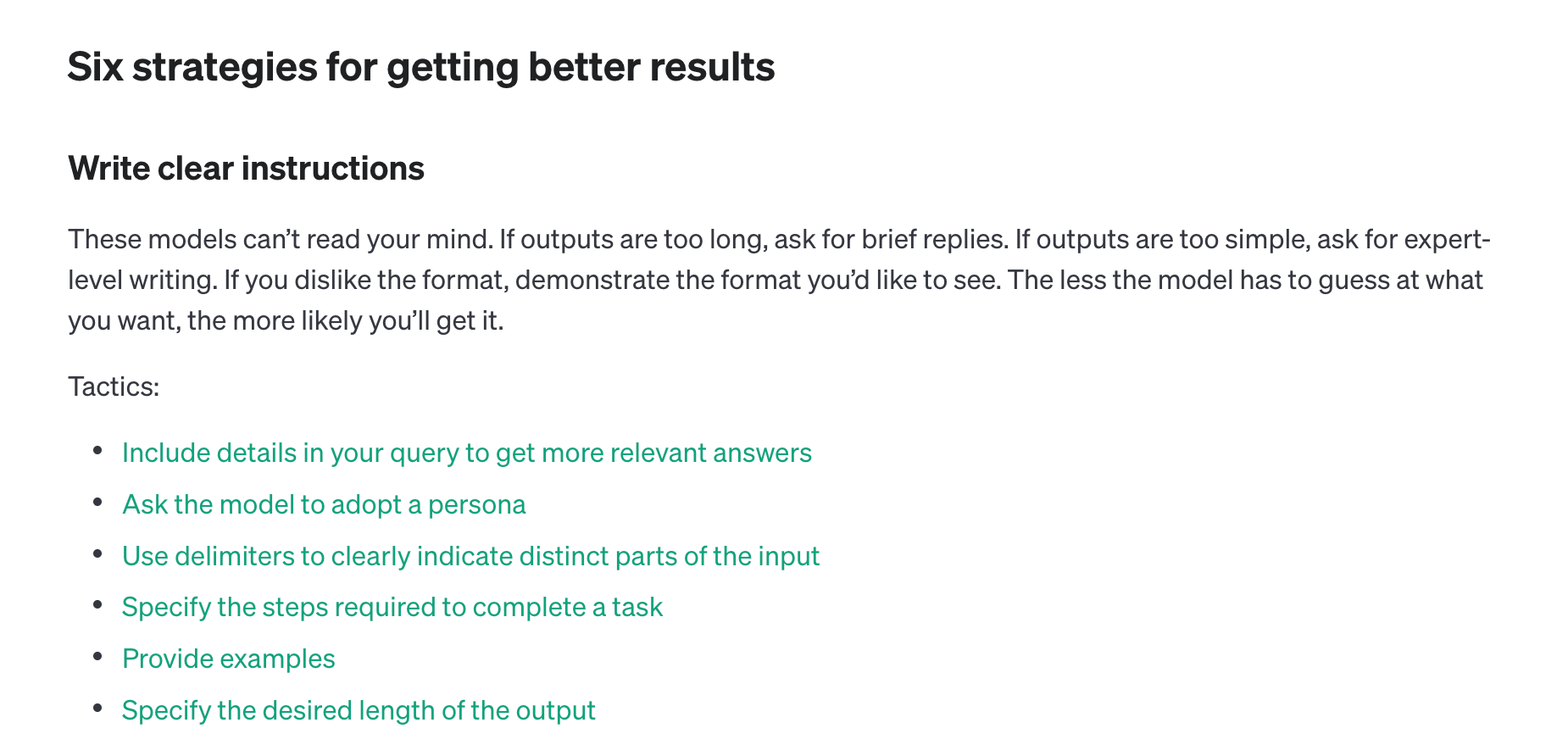

Master prompt engineering

Prompt engineering is essential for leveraging ChatGPT effectively for accounting workflows. The better the prompt, the more accurate the output.

With LLMs becoming increasingly important in personal and professional settings, more so than smartphones for some, prompt engineering is now a sought-after skill.

Invest in learning prompt engineering to improve ChatGPT’s accuracy. Tailoring prompts ensures more precise and reliable results for accounting tasks.

Combine ChatGPT with other tools for the best results

Maximize ChatGPT’s effectiveness by using it along with traditional accounting software like Quickbooks or Xero for tasks like report generation, data extraction, and client management.

ChatGPT is excellent for drafting, brainstorming, and automating communication while accounting software ensures precise, real-time financial data management.

Limitations of using ChatGPT

While ChatGPT excels at automating routine tasks, it still faces key limitations, particularly in complex financial decision-making.

Experts emphasize that ChatGPT should be a supporting tool rather than a standalone decision-maker. Below are some key challenges when using ChatGPT in accounting:

Lack of contextual understanding and human insight

ChatGPT can analyze data and recognize patterns but lacks the human intuition needed for complex decisions.

For example, while it can analyze historical stock data, it can't predict future market trends or provide strategic investment advice. It also struggles with external factors like economic shifts or regulatory changes, which could impact financial outcomes.

ChatGPT may miss nuanced changes in standards like IFRS or GAAP for compliance, leading to inaccurate financial reports.

Difficulty processing complex financial documents

ChatGPT struggles with extracting data from complex, detailed documents such as financial statements and invoices, especially if scanned or handwritten. While it handles typed data efficiently, its accuracy drops significantly with poorly formatted or unstructured data.

Tools like Nanonets, with advanced OCR capabilities, offer more reliable solutions and handle such documents with up to 99% accuracy.

Free vs. paid versions

The free version of ChatGPT (based on GPT-3.5) is adequate for basic tasks but lacks the capabilities needed for advanced financial analysis and real-time data access.

ChatGPT Plus (GPT-4) as the paid version offers enhanced performance, such as better data interpretation and more precise responses. Accountants handling complex tasks can consider paid options or explore other specialized LLM APIs like Nanonets API for document extraction or Claude by Anthropic for secure data handling.

Ethical considerations and data privacy risks

Using ChatGPT to process sensitive financial documents raises concerns over data privacy and bias. Since it is trained on vast internet data, societal biases may influence its outputs.

Accountants must evaluate ChatGPT's responses critically, ensuring accuracy and neutrality and avoiding inputting sensitive client data. Even with legal agreements in place, the risk of data misuse persists.

Dependence on historical data (pre-September 2021)

The free version of ChatGPT relies on data from before September 2021, making it outdated for recent changes in tax laws or market conditions.

However, the paid version can be browsed on the Internet to provide more up-to-date information, making it more suitable for tasks requiring current data. Accountants must choose the version based on the relevance and accuracy of the data needed.

Conclusion

As this area evolves, ChatGPT and AI for accountants will expand beyond routine tasks, offering even more advanced capabilities such as real-time financial forecasting and decision-making assistance. However, with these evolving capabilities come new challenges, including ensuring data privacy, maintaining up-to-date knowledge, and navigating AI’s limitations in handling complex financial scenarios.

The future of accounting lies in striking the right balance between AI assistance and human expertise. While ChatGPT can automate and enhance efficiency in many areas, accountants must always apply critical thinking, industry knowledge, and personalized insights. The key is to leverage AI as a supportive tool that complements, rather than replaces, the judgment and expertise of accounting professionals.

Frequently Asked Questions (FAQs)

Is ChatGPT reliable for financial tasks?

ChatGPT can assist with routine financial tasks like organizing data or generating reports. Still, it should not be used for critical financial decisions due to its accuracy limitations and lack of real-time updates. Always review AI-generated outputs for errors and ensure compliance with the latest regulations.

How are accountants using ChatGPT with Excel?

Accountants are using ChatGPT with Excel to automate tasks like data entry, generating financial reports, and creating formulas.

ChatGPT can assist in writing complex Excel formulas, organizing data, and even extracting information from unstructured sources into spreadsheet formats, saving time and reducing manual effort. Additionally, it helps troubleshoot formula errors and optimize workflows within Excel.

How do I train ChatGPT for specific tasks?

You can “train” ChatGPT using clear, structured prompts detailing your task and desired outcomes. Provide reference text and specific instructions in your queries for more accurate results.

Additionally, in ChatGPT 4.0 (paid version), you can also try model distillation, which allows you to leverage the outputs of a large model to fine-tune a smaller model, enabling it to achieve similar performance on a specific task. This process can significantly reduce cost and latency, as smaller models are typically more efficient.

What other LLM models can you suggest as alternatives to ChatGPT?

There are several options if you are looking for alternatives to ChatGPT.

Popular LLM options include Google’s Bard, which integrates well with Google tools, and Claude by Anthropic, known for strong ethical AI practices and handling sensitive data securely. Additionally, Microsoft Azure OpenAI provides robust integration with enterprise-level applications, and IBM Watson offers powerful natural language processing tailored for industries like finance.

Unlike other traditional LLMs, Nanonets excels in document data extraction, which is particularly useful for accountants handling complex financial documents like invoices and receipts.