Dealing with invoices isn't exactly the most exciting part of running a business, is it? It can get really boring, repetitive, and time-consuming, even more so if you are stuck manually scanning stacks of paper bills.

Digging through a folder full of oddly named PDFs, struggling with free OCR tools while handling the stress of payment deadlines - it can get a lot if you don't have a system in place.

That's where the right invoice scanning software can make all the difference. It automates tasks like digitizing invoices, extracting key details, and integrating data directly into your accounting system.

In this article, I’ll walk you through everything you need to know about finding the best invoice-scanning solution. From how it works and its benefits to the top tools available today, this article will help you make the right investment to make your invoicing process more efficient.

Quick overview: Top invoice scanning software

| Software | Best For | G2 Rating |

|---|---|---|

| Nanonets | Medium to large businesses with high volume of varied document types | 4.8/5 |

| Rossum | Mid to large enterprises | 4.4/5 |

| BILL AP/AR | Small to medium businesses | 4.4/5 |

| HyperScience | Businesses needing advanced automation | 4.6/5 |

| Laserfiche | Medium to large organizations | 4.7/5 |

| Docsumo | SMBs in financial services | 4.7/5 |

| Docparser | Businesses of all sizes | 4.6/5 |

| Medius | Businesses automating spend management | 4.4/5 |

| DocuWare | Small to medium businesses | 4.5/5 |

| Tungsten Automation | Large businesses | 3.6/5 |

Read About: Best Invoice Management Software

10 best invoice scanning software for businesses in 2025

I've evaluated the top 10 tools based on their OCR accuracy in data extraction, usability with automated workflows to simplify processes like approvals and integrations, and scalability to cater to businesses ranging from small businesses to large enterprises. I have also considered ease of use and pricing to ensure the tools are practical, efficient, and cost-effective.

Let’s explore how these tools stack up!

1. Nanonets

Nanonets is an AI-based intelligent automation software that automates every aspect of invoice processes. The software is designed to integrate with your accounting software, like QuickBooks, Freshbooks, or Sage, allowing you to scan invoices from anywhere and send them directly into your accounting system.

Top features

- Invoice ingestion: You can upload your invoices automatically from emails, drives, or desktops. No need to keep checking your emails for new invoices. Nanonets reduce the manual effort to upload invoices into the system with automated workflows.

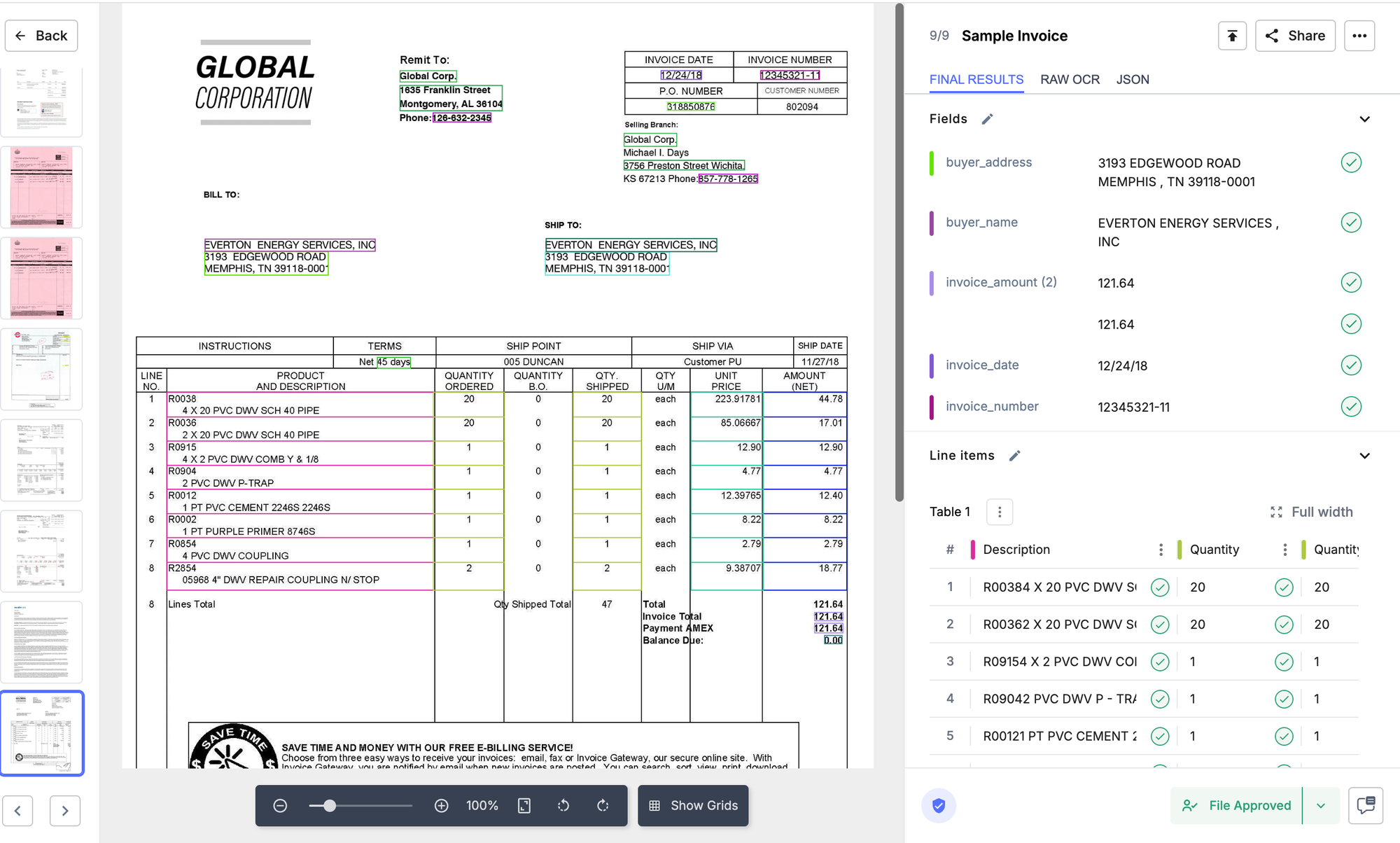

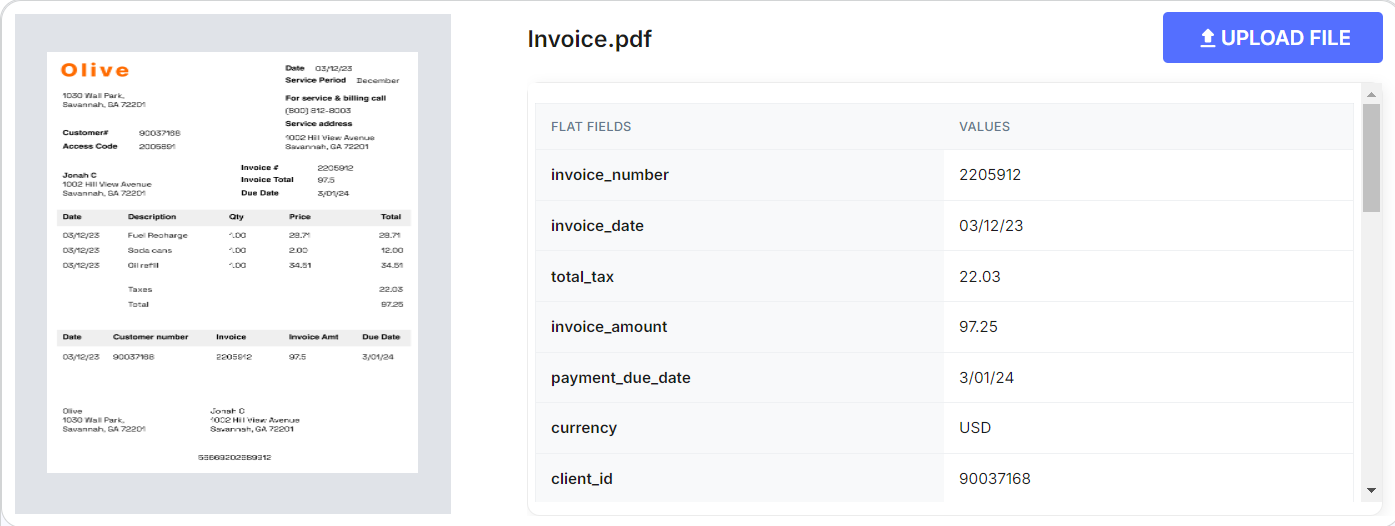

- Invoice data extraction: Once the invoices are uploaded, the Nanonets OCR engine extracts the invoice data like invoice amount, tax amount, vendor information, line items, and more into a labeled format of your choice. Check it out.

- Accounts payable automation: You can automate every aspect of accounting processes like multi-line table extraction, approvals, 3-way matching, status updates, and more with automated Accounting workflows.

- Expense management: Monitor all your business expenses with real-time expense reimbursement and data synchronization.

- Vendor management: Automate vendor onboarding, id verification, vendor payments, and more.

- Database syncing: Export all the extracted data from Nanonets to a system of your choice in real time. Nanonets integrates with 5000+ apps with API and Zapier.

- Custom formatting and post-processing: Apply custom formatting rules to standardize extracted data according to your business needs.

Here is a short demo of Invoice OCR on Nanonets

Here's a video on how Nanonets' AI extract line item data from invoice tables

Pros

- Easy to use

- Modern User Interface

- 95% OCR Accuracy

- Extract from various invoice layouts — no pre-defined templates

- Automate approval process with customizable workflows

- Easy accounting software integrations

- Create audit logs automatically

- Process invoices on autopilot

- GDPR and CCPA compliant

- Supports multiple languages and currencies

- Detect and flag duplicate or potentially fraudulent invoices

- 24x7 Support

- Transparent Pricing

Cons

- Limited outcomes when used internally

- It takes some time to tag invoices and map the details.

- No mobile app

Pricing: First 500 documents are free, after that, pay as you go (starting at $0.3/document)

"Being a financial controller in charge of accounts payable is hard work. The more projects we become involved in, the more money we spend. With more than 4,000 vendors and subcontractors we use regularly to complete our services, invoicing can become a difficult and tedious process. I saw that entering invoices one by one was an inefficient process. I was looking for a way to make entering invoices more convenient and accurate when I came across NanoNets."

- Ryan HessHead of Accounts Payable

2. Rossum

Rossum is an Intelligent Document Processing (IDP) solution that utilizes advanced AI technology for invoice scanning and data extraction. It's designed to automate significant portions of manual document processing work.

Key features

- AI-driven data extraction with high accuracy

- Customizable user interface

- API for integration with existing systems

- Multi-language support

- Self-learning AI that improves over time

Pros

- User-friendly interface

- Responsive customer support

- Flexible customization options

- Regular product updates and improvements

Cons

- Learning curve for advanced customizations

- Processing issues with large PDF documents

- Line item extraction can be challenging

Pricing: Custom pricing based on volume.

3. BILL

BILL AP/AR (formerly BILL.com) is a cloud-based financial operations platform that automates accounts payable and accounts receivable processes. It streamlines invoice management, payment processing, and financial workflows to improve efficiency and visibility.

Key features

- Automated invoice processing and payment

- Multi-level approval workflows

- Integration with major accounting software

- International payments support

- Vendor management tools

- Mobile app for on-the-go access

Pros

- User-friendly interface

- Efficient invoice processing and payment system

- Strong integration capabilities with accounting software

- Robust approval workflows

- Paperless document management

- Multiple payment options (ACH, wire transfers, checks)

- Centralized dashboard for visibility

Cons

- Syncing issues with some accounting software are common

- Customer support quality can be inconsistent

- Issues with invoice matching

- Mobile app functionality may differ from desktop version

- Pricing may be high for very small businesses

- Limited reporting capabilities

Pricing: Varies based on plan, with the basic plan starting at $45/user/month.

4. HyperScience

HyperScience is a cloud-based invoice automation platform that provides real-time data analysis, forecasting, and reporting.

Key features

- Automatic payroll taxes calculation

- Automatic invoice generation

- Handles various content types, from structured forms to complex contracts

- Integration with enterprise systems and workflows

- Real-time data analysis and reporting

- Multi-language support

- GDPR and SOX compliant

Pros

- High accuracy in data extraction

- Efficient automation of manual tasks

- Handles unstructured data well (e.g., emails, reports, surveys)

- Adaptable to different document templates

Cons

- High infrastructure requirements

- Potential limitations on licensing

- Limited features

- May be complex to set up initially

Pricing: Custom pricing. Contact Hyperscience for a quote.

Read About: Hyperscience Alternatives and Competitors

5. Laserfiche

Laserfiche is an enterprise content management (ECM) and business process automation platform that offers solutions for document management, including invoice scanning and processing.

Key features

- Document capture and intelligent data extraction

- Customizable workflow automation

- Integration capabilities with core industry systems like Epic and Workday

- Records management and compliance tools

- Low-code application development options

- Cloud and on-premises deployment options

Pros

- Ease of use, especially in document retrieval and form creation

- Strong capabilities in eliminating paper-based processes

- Effective in automating various business processes beyond just document management

- Robust security and compliance features

- Scalable for organizations of all sizes

- Customer support and community resources

Cons

- A steep learning curve, especially for advanced features

- Occasional challenges with complex workflow setups

- The configuration interface could be modernized

- Difficulties with upgrades and maintenance

Pricing: The starter plan is priced at $50 USD /user/month.

6. Docsumo

DocSumo is an IDP solution designed for SMBs, lenders, insurers, and commercial real estate investors to automate their document processing requirements.

Key features

- Data capture from forms, semi-structured, and unstructured financial documents

- Pre-trained API stack for loan application and insurance compliance documents

- Review & edit tool for easy data capture without manual entry

- Out-of-the-box API endpoint and CSV download option

- Multiple learning mechanisms to ensure maximum accuracy

- Customizable fields and template definition for recurring documents

Pros

- User-friendly interface

- Efficient data extraction, especially for invoices

- Strong customer support and onboarding process

- Customizable to specific business needs

- SOC-2 certified and GDPR compliant

Cons

- Limited database connection capabilities

- Functionality is tied to available credits,

- Occasional OCR accuracy issues with complex and large documents

Pricing: The basic plan starts at $500+ per month. Contact DocSumo for specific pricing.

7. Docparser

Docparser has a fully featured set of tools, including automated accounting, billing and reminders, email support, and more. Docparser is a great invoice processing software for small businesses that want to quickly create invoices without paying for an expensive professional template.

Key features

- Custom parsing rules for precise data extraction

- Integration with popular tools like Zapier, Google Sheets, and Microsoft Power Automate

- Cloud-based processing for accessibility and scalability

- Routing functionality to direct documents to appropriate parsing rules

- Support for multiple document formats including PDF, Word, JPG, and PNG

Pros

- Easy to use

- Helps identify new business opportunities

- Feature-rich data extraction software

- Multiple documentation

- Ability to parse documents multiple times

Cons

- Does not implement two-factor authentication

- Only one user per account allowed

- Inconsistent formatting

- Learning curve for setting up complex parsing rules

- Slight changes in document format may require rule adjustments

- Pricing model with expiring credits can be challenging to manage

- Limited options for handwritten document recognition

Pricing: The starter plan is priced at $39/month for 100 documents.

8. Medius

Medius is a full-featured cloud-based invoice and document management software that provides real-time data analysis, forecasting, and reporting.

Key features:

- Automated invoice processing and approval workflows

- Integration with major ERP systems

- Real-time data analysis and reporting

- Multi-language support

- Modular solution suite including AP Automation software, Procurement, Sourcing, and Contract Management

Pros of using Medius:

- ACH payments automation

- Easier Coding Mobile Capabilities

- Comment threads for each invoice

- User-friendly interface

- Efficient invoice processing and approval system

- Strong integration capabilities, especially with Microsoft Dynamics

- Mobile app for on-the-go approvals

Cons of using Medius:

- Advanced features may have a learning curve

- Some limitations in customization options — can't make changes to invoices already made

- Reporting functionality for multiple legal entities could be improved

- Occasional system bugs and glitches

Pricing: Custom pricing based on modules selected and business size. Contact Medius for a quote.

9. DocuWare

DocuWare is a document management and workflow automation platform that offers cloud and on-premises deployment options designed to streamline business processes, including invoice scanning and processing.

Key features

- Document capture and data extraction capabilities

- Customizable workflow automation

- Web-based forms for data capture and process initiation

- Integration with major ERP and accounting systems

- Available in 17 languages, including Arabic, German, English, French, and more

- Mobile app for document access and approvals

Pros

- Ease of use and user-friendly interface

- Effective in reducing paper-based processes and storage needs

- Strong capabilities in automating accounts payable workflows

- Robust search functionality for quick document retrieval

- Flexible deployment options (cloud or on-premises)

Cons

- Limitations in document editing capabilities within the system

- Occasional challenges with setting up complex workflows

- Steep learning curve for advanced features

Pricing: Custom pricing based on organizational needs. Contact DocuWare for a quote.

10. Tungsten Automation

Tungsten Automation (formerly Kofax) has a cloud-based invoice scanning solution that offers fully integrated, feature-rich, scalable, and flexible software for managing the purchase order, invoice, and payment cycle.

Key features

- Automated invoice capture and data extraction

- Integration with accounting and ERP systems

- Multi-channel input support (email, fax, mail)

- AI-powered learning mechanism for improved accuracy

- Customizable workflows and approval processes

Pros

- Easy to find a text field and notate duplicates

- Can easily copy items or fields

- Processing scanned documents

- Adding typewriter text

- Easy compressing

- Efficiency

Cons

- Hard to download/install

- Licensing and training costs can be high

- User interface can be challenging to navigate

- The support has a slow turnaround time

Pricing: Custom pricing based on business needs. Contact Tungsten for a quote.

How does invoice scanning software work?

The McKinsey Finance 2030 report reveals that top-performing finance teams spend nearly 20% more time on value-added activities than their peers.

How?

By leveraging technologies like invoice scanning software to automate routine tasks.

Invoice scanning software typically follows these steps:

- Document capture: The software ingests invoices in various formats – paper (via scanner), PDF, email attachments, or even photos captured on phones.

- Data recognition: The software reads the document using built-in OCR technology, converting the image into machine-readable text.

- Data extraction: The software identifies and extracts key information using a combination of OCR and machine learning algorithms. It knows exactly where to look for invoice numbers, dates, amounts, and vendor details.

- Data validation: The extracted data is automatically checked for accuracy, flagging any discrepancies for human review.

- Integration: The validated data is then seamlessly exported to your accounting or ERP system, ready for processing and payment.

But here's the best part: these systems become more intelligent with machine learning capabilities over time. They learn to handle even the trickiest invoice layouts with increasing accuracy, adapting to your specific business needs.

How to decide the right invoice scanning software for you?

Your priority of invoice processing features should align with your business's requirements. For instance, multi-currency support may be vital for those with international vendors, while stringent industries may prioritize robust fraud detection and audit trails.

First, identify your current invoice processing pain points and the features that would best address them. However, there are certain core functionalities that are universally beneficial for most businesses and should be considered as a starting point:

Key features to look for:

- Optical Character Recognition (OCR): Advanced OCR technology is the backbone of effective invoice scanning software. It allows for accurate extraction of data from various document formats, minimizing manual input and errors.

- Data capture and extraction: The software should be able to identify and extract key information such as invoice numbers, dates, amounts, and vendor details automatically.

- Integration capabilities: Look for software that seamlessly integrates with your existing accounting systems, ERP platforms, and other financial tools.

- Automated workflows: The ability to set up custom approval workflows can significantly streamline your accounts payable process.

- Machine Learning and AI: These technologies enable the software to improve its accuracy over time and handle complex document layouts.

- Multi-currency and multi-language support: Essential for businesses operating in multiple countries or dealing with international vendors.

- Fraud detection: Advanced systems can flag potential duplicate invoices or unusual patterns that might indicate fraudulent activity.

- Reporting and analytics: Comprehensive reporting tools provide insights into your AP processes and help identify areas for improvement.

Types of documents handled

When selecting a scanner, ensure it can handle these essential financial documents:

- Invoices: Both paper and digital invoices in various formats (PDF, Word, Excel, etc.)

- Purchase Orders: To facilitate three-way matching and ensure accuracy

- Receipts: For expense management and reimbursement processes

- Bills: Including utility bills and other recurring expenses

- Credit Notes: To accurately track refunds and adjustments

- Packing Slips: For inventory management and order verification

- Contracts: To extract key terms and payment schedules

It's worth noting that the best invoice scanning software can handle both structured (standardized forms) and unstructured (varied layouts) documents. This flexibility is crucial as businesses often deal with invoices from multiple vendors, each with their unique format.

Final thoughts

The typical processing time for an invoice is 14.6 days, and almost 40% of invoices tend to have errors. Invoice scanning software addresses these challenges by automating the process and reducing processing time and errors.

It is a game-changer for companies looking to streamline their accounts payable processes. These tools offer significant time and cost savings by automating data entry, reducing errors, and integrating with existing systems.

When selecting a solution, consider your organization's specific needs, budget, and scalability requirements. Look for features like OCR, data extraction, and workflow automation, and ensure the software can handle all your essential financial documents. With the right invoice scanning tool in place, you'll be well on your way to transforming your invoice management process and boosting overall operational efficiency.

FAQs

What machine is used to scan invoices?

Modern invoice scanning uses specialized software with OCR technology, not just physical machines. However, businesses often use high-quality document scanners or multifunction printers with scanning capabilities for paper invoices. Smartphone cameras can also capture invoice images for processing by invoice scanning software.

What are the benefits of invoice scanning?

Invoice scanning significantly improves efficiency and accuracy in accounts payable. Key benefits include:

- Reduces processing time

- Achieves up to 95% data extraction accuracy, reducing errors

- Reduces processing costs from $6.30 to $1.45 per invoice

- Provides real-time tracking of invoices

- Handles increased volume without additional staff

Which is the best invoicing software?

The best invoicing software depends on your specific business needs. Consider these factors:

- Integration capabilities with your existing systems

- Ease of use and user interface

- Automation features (OCR, data extraction)

- Scalability as your business grows

- Pricing structure and ROI

- Customer support and training resources

- Security and compliance features

Top-rated options include Nanonets, BILL AP/AR, Laserfiche, DocuWare, and Docsumo. Evaluate each based on your unique requirements.

What is invoice scanning software?

Invoice scanning software automates converting physical or digital invoices into structured, machine-readable data. It uses OCR and AI technologies to extract critical information like invoice numbers, dates, amounts, and vendor details. This software streamlines accounts payable processes, reducing manual data entry, improving accuracy, and speeding up invoice processing.

How can I calculate the due date for an invoice?

- You can easily determine the due date for your invoices using our Invoice Due Date Calculator.