Maintaining the accuracy and integrity of balance sheets is paramount for businesses of all sizes and across industries. Achieving this manually, however, can be time-consuming, error-prone, and overall resource-intensive. This is where balance sheet reconciliation software can help, improving the efficiency of the process and ensuring meticulous accuracy in financial reporting.

Businesses across industries are increasingly recognizing the importance of leveraging advanced tools to enhance their financial operations. Balance sheet reconciliation software offers a comprehensive solution to this end, enabling organisations to automate reconciliation, reduce errors, and better achieve compliance with regulatory requirements.

In this article, we cover the definition and significance of balance sheet reconciliation, and explore some of the top softwares available in the market to do this. We will also discuss key features to consider when evaluating these tools and highlight why Nanonets stands out for balance sheet reconciliation. Whether you're a small business or a large enterprise, finding the right balance sheet reconciliation software can greatly improve your financial management practices and drive efficiency and accuracy in your operations.

What is Account Reconciliation ?

Account reconciliation is a fundamental process in accounting and financial management that involves comparing two sets of records to ensure their accuracy and consistency. The primary goal of account reconciliation is to identify and resolve discrepancies between different sources of financial data, such as bank statements, general ledger accounts, and transaction records.

Account reconciliation essentially involves verifying that the balances in various accounts match the corresponding values in external documents or records. This process helps ensure that all financial transactions are properly recorded, categorised, and accounted for in an organisation's financial statements.

There are several types of account reconciliation, each serving a specific purpose in the financial management process. These include bank reconciliation, balance sheet reconciliation, accounts payable reconciliation, accounts receivable reconciliation, petty cash reconciliation, expense reconciliation, among others. While the specific procedures and methodologies may vary depending on the type of reconciliation, the overarching objective remains the same: to ensure the accuracy and integrity of financial data.

What is Balance Sheet Reconciliation?

Balance sheet reconciliation is a specific type of account reconciliation that focuses on ensuring the accuracy and integrity of a company's balance sheet. The balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time, typically at the end of a reporting period.

Balance sheet reconciliation involves comparing the balances of various accounts reported on the balance sheet with their corresponding values in supporting documentation, such as bank statements, general ledger accounts, and other financial records. The goal is to verify that the balances reported on the balance sheet accurately reflect the company's financial transactions and obligations.

The process of balance sheet reconciliation typically includes the following steps:

- Identifying Accounts: The first step in balance sheet reconciliation is to identify the accounts that need to be reconciled. This includes assets, liabilities, and equity accounts listed on the balance sheet.

- Gathering Documentation: Next, relevant supporting documentation for each account is gathered, including bank statements, account statements, invoices, and other financial records.

- Comparing Balances: The balances reported on the balance sheet are compared with the corresponding balances in the supporting documentation. Any discrepancies or differences are identified and investigated.

- Resolving Discrepancies: Once discrepancies are identified, the next step is to investigate the root causes of the discrepancies and take corrective action to resolve them. This may involve adjusting entries, correcting errors, or reconciling differences between accounting records.

- Documenting the Reconciliation: Finally, the reconciliation process is documented to provide a clear audit trail and evidence of compliance with internal controls and regulatory requirements.

Balance sheet reconciliation is a critical control process that helps ensure the accuracy of financial reporting and compliance with accounting standards and regulations. By regularly reconciling balance sheet accounts, organisations can identify errors and discrepancies early, mitigate risks, and maintain financial integrity.

Doing this process manually, however, can compound the challenges involved. In the next few sections, we’ll cover why automation helps with balance sheet reconciliation, the best softwares for balance sheet reconciliation, and how to make a choice that’s right for your business.

Why Do We Need Balance Sheet Reconciliation Software?

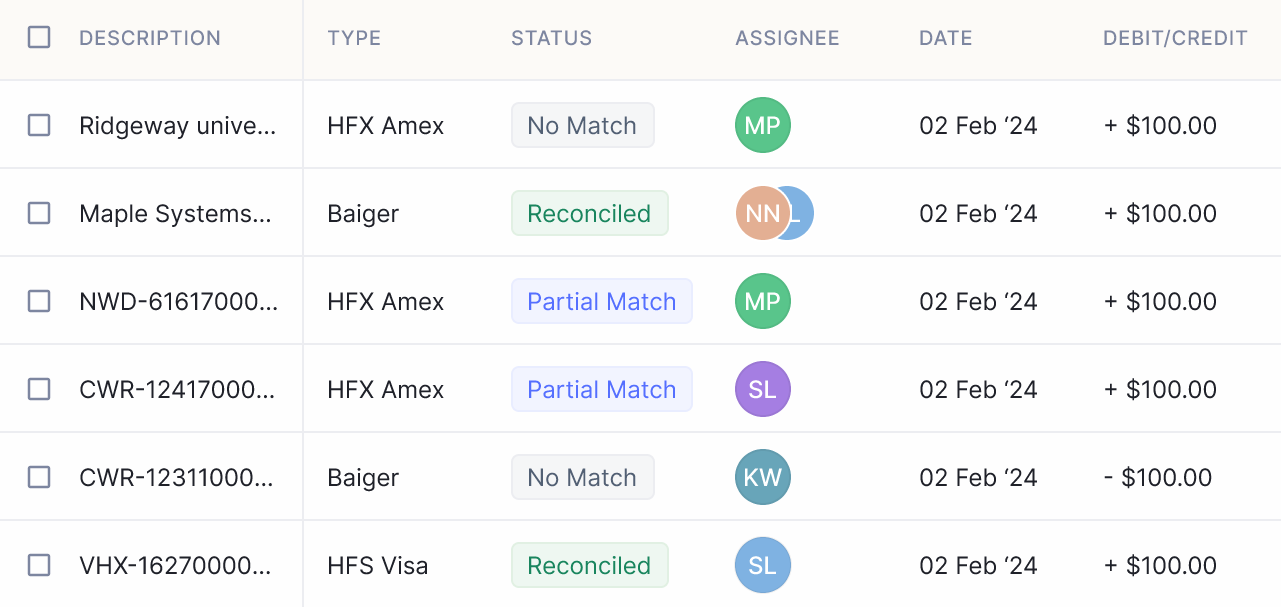

Balance sheet reconciliation software, also known as accounts reconciliation software, is a specialized tool designed to streamline and automate the process of reconciling balance sheet accounts within an organization's financial system. This software enables finance professionals to compare and match transactions and balances recorded in the general ledger with external sources such as bank statements, vendor invoices, and other financial documents. It leverages advanced algorithms and artificial intelligence to identify discrepancies and errors, allowing finance teams to promptly investigate and resolve issues.

Balance sheet reconciliation software is not just a luxury but a necessity in today's fast-paced and highly regulated business environment, for the following reasons.

- Complexity of Financial Transactions: With businesses expanding globally and engaging in a myriad of financial transactions, the complexity of reconciling accounts has skyrocketed. From multiple currencies to diverse payment methods, the sheer volume and variety of transactions make manual reconciliation prone to errors and delays.

- Time and Resource Constraints: Traditional methods of reconciling balance sheets involve extensive manual labor, consuming valuable time and resources. Human errors are not uncommon, and the time spent rectifying these mistakes could be better utilized for strategic financial analysis and decision-making.

- Regulatory Compliance: Compliance with regulatory standards such as GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) is non-negotiable for businesses. Balance sheet reconciliation software offers built-in compliance checks and audit trails, ensuring adherence to regulatory requirements and mitigating the risk of non-compliance penalties.

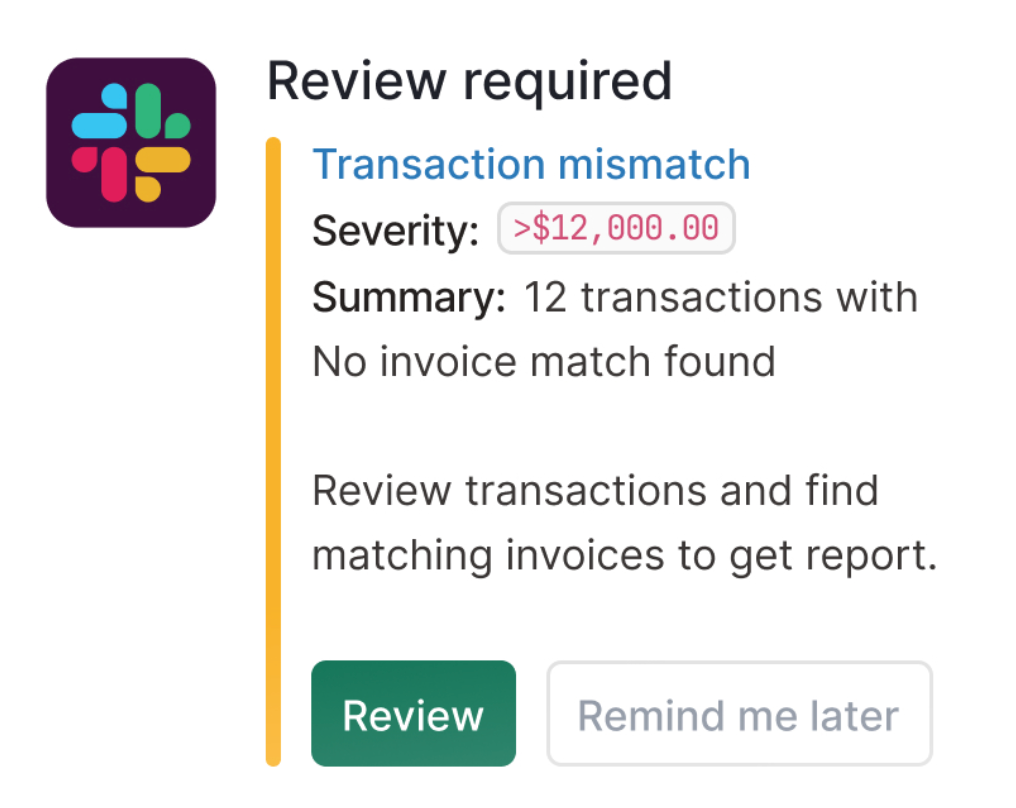

- Risk Management: Accurate and timely reconciliation is critical for effective risk management. Discrepancies in balance sheets can signal underlying issues such as fraud, mismanagement, or operational inefficiencies. By automating the reconciliation process, software solutions enable real-time identification and resolution of discrepancies, thereby enhancing risk mitigation efforts.

- Enhanced Efficiency and Accuracy: Balance sheet reconciliation software leverages advanced algorithms and automation capabilities to streamline the reconciliation process. By eliminating manual data entry and automating routine tasks, these software solutions reduce the likelihood of errors and enable finance teams to focus on value-added activities.

Challenges with Balance Sheet Reconciliation and Why Automation Helps

Balance sheet reconciliation can be a complex and time-consuming process fraught with various challenges, with the common ones including:

Data Volume and Complexity: Large organisations deal with vast amounts of financial data from multiple sources, making reconciliation a daunting task. The complexity further increases when dealing with diverse currencies, accounts, and subsidiaries.

Manual Errors: Manual reconciliation processes are prone to human errors, such as typos, transposition errors, and data entry mistakes. These errors can lead to inaccuracies in financial reporting and compliance issues.

Time Constraints: Performing manual reconciliations requires significant time and effort, especially during month-end or year-end closings. This can delay financial reporting and decision-making, impacting business operations.

Regulatory Compliance: Adhering to regulatory requirements and accounting standards adds another layer of complexity to reconciliation. Ensuring compliance with regulations such as GAAP or IFRS requires meticulous attention to detail and documentation.

Audit Preparation: Organisations undergo periodic audits to verify the accuracy and integrity of their financial statements. Manual reconciliation processes can make audit preparation challenging and time-consuming, increasing the risk of audit findings and penalties.

Automation helps address these challenges by streamlining the reconciliation process. Automated balance sheet reconciliation software, such as Nanonets, leverages advanced technologies like artificial intelligence and machine learning to:

- Enhance Accuracy: Automation reduces the risk of manual errors by automatically matching transactions, identifying discrepancies, and flagging exceptions for review.

- Improve Efficiency: By automating repetitive tasks, such as data extraction, matching, and validation, organisations can save time and resources, enabling finance teams to focus on value-added activities.

- Ensure Compliance: Automated reconciliation software enforces consistency and compliance with regulatory requirements, reducing the risk of non-compliance and associated penalties.

- Facilitate Audit Readiness: With automated reconciliation, organisations can maintain detailed audit trails, documentation, and reporting, streamlining the audit preparation process and demonstrating regulatory compliance.

In summary, automation helps overcome the challenges associated with balance sheet reconciliation by improving accuracy, efficiency, compliance, and audit readiness.

What to Look for In Balance Sheet Reconciliation Software?

Choosing the right balance sheet reconciliation software is crucial for streamlining financial reporting processes, reducing errors, and ensuring compliance with accounting standards. Here are some key factors to consider when evaluating balance sheet reconciliation software:

- Robust Automation Capabilities: Look for software that offers automation features to streamline the reconciliation process. Automation can help eliminate manual tasks, reduce errors, and improve efficiency by automatically matching transactions, identifying discrepancies, and generating reconciliation reports.

- Integration with Existing Systems: Ensure that the reconciliation software seamlessly integrates with your existing accounting systems, ERP software, and other financial management tools. This allows for smooth data transfer and ensures consistency across all financial processes.

- Customization Options: Choose software that offers customization options to tailor the reconciliation process to your organisation's specific needs and workflows. Look for features such as customizable reconciliation templates, user-defined rules, and flexible reporting options.

- Scalability: Consider the scalability of the software to accommodate your organisation's growing needs and volumes of transactions. Ensure that the software can handle large volumes of data and transactions without sacrificing performance or accuracy.

- Data Security: Data security is paramount when dealing with financial information. Choose software that prioritizes data security and compliance with industry standards and regulations. Look for features such as encryption, role-based access controls, and regular security updates.

- User-Friendly Interface: A user-friendly interface is essential for ensuring that employees can easily navigate and use the reconciliation software. Look for software with an intuitive interface, customizable dashboards, and helpful user guides or tutorials.

- Audit Trail and Compliance: Ensure that the software provides a comprehensive audit trail and supports compliance with regulatory requirements and accounting standards. Look for features such as audit logs, version control, and compliance reporting capabilities.

- Customer Support and Training: Consider the level of customer support and training offered by the software vendor. Look for vendors that provide responsive customer support, comprehensive training programs, and ongoing assistance to help you maximise the value of the software.

By considering these factors when evaluating balance sheet reconciliation software, you can choose the right solution to streamline your financial reporting processes, improve accuracy, and ensure compliance with accounting standards and regulations.

Best Balance Sheet Reconciliation Softwares

Our team browsed through the best accounting and balance sheet reconciliation softwares to put together a list that introduces each solution, its typical customers, eminent features and pricing range. You could accordingly choose one that meets your specific business requirements and needs.

Quickbooks: QuickBooks is a popular accounting software that offers balance sheet reconciliation features as part of its wide suite of financial management tools. It is widely used by small and medium-sized businesses across various industries, including retail, professional services, and construction. QuickBooks is especially suitable for businesses of all sizes, from sole proprietors and startups to larger enterprises. It’s received high ratings on platforms like G2 and Capterra for its user-friendly interface, robust features, and affordability.

Some common pros include ease of use, integration capabilities, and a wide range of accounting features. However, users may experience limitations in customization and scalability. It offers holistic features such as bank reconciliation, expense tracking, invoicing, and financial reporting.

Pricing varies by plan and tiers, with options ranging from $25- $180 per month.

Oracle NetSuite ERP: Oracle NetSuite ERP is a cloud-based enterprise resource planning (ERP) solution that includes advanced reconciliation capabilities for balance sheet management, along with a host of financial management features. It is used by mid-sized and large companies across industries such as manufacturing, wholesale distribution, and e-commerce. This solution is best suited for enterprises with complex financial management needs.

Reviews for Oracle NetSuite ERP are generally positive, with users praising the comprehensive functionality, scalability, and customization options. However, some users may find the software complex to set up and navigate, and pricing can be relatively high. Oracle NetSuite ERP offers advanced reconciliation features, including multi-currency support, intercompany reconciliation, and automated journal entries. Pricing is available upon request and varies based on the modules and customization required.

Blackline: BlackLine is a leading provider of financial close and reconciliation automation software designed to streamline the entire reconciliation process. It is used by finance and accounting teams in mid-sized to large enterprises across industries such as banking, healthcare, and technology. BlackLine is thus best suited for firms with complex reconciliation needs and high transaction volumes.

BlackLine receives positive reviews for its comprehensive features, automation capabilities, and integration options. Users appreciate its ability to reduce manual effort and improve efficiency in the reconciliation process. However, some users may find the software complex to implement and require extensive training.

BlackLine offers a range of reconciliation features, including automated matching, variance analysis, and task management. Pricing is available upon request and varies based on the modules and customization required.

FloQast: FloQast is a cloud-based accounting software designed to streamline the month-end close process, including balance sheet reconciliation. It is also used by accounting teams in mid-sized to large enterprises across industries such as manufacturing, retail, and technology.

FloQast receives positive reviews for its automated workflows and real-time collaboration features. Users appreciate its ability to centralise the close process and reduce the time spent on manual tasks. However, some users may find the initial setup process complex.

Offering features such as automated reconciliation, task management, and financial reporting, FloQast’s pricing is available upon request and varies based on the size of the organisation and the modules required.

Oracle Hyperion: Oracle Hyperion is an enterprise performance management software suite that includes advanced financial reconciliation capabilities. It is commonly used by large enterprises and multinational corporations across industries such as finance, manufacturing, and healthcare, and is thus best suited for companies with complex financial management and reporting requirements.

Reviews for Oracle Hyperion praise its scalability and integration capabilities. Users appreciate its ability to handle large volumes of data and provide advanced analytics. However, some users may find the software complex to implement and require extensive training. Oracle Hyperion offers features such as advanced financial consolidation, intercompany reconciliation, and financial reporting. Pricing is available upon request and varies based on the modules and customization required.

Redwood: Redwood Software offers automation solutions for financial processes, including balance sheet reconciliation and close management. It is used by finance and accounting teams in mid-sized to large enterprises across industries such as banking, insurance, and retail.

Redwood receives positive reviews for its automation capabilities, scalability, and ease of integration with existing systems. Users appreciate its ability to streamline repetitive tasks and reduce manual effort. Redwood offers features such as automated reconciliation, workflow management, and audit trail tracking. Pricing is available upon request and varies based on the size of the organisation and the modules required.

Dolibarr: Dolibarr is an open-source ERP and CRM software that includes basic accounting and financial management features, including basic reconciliation capabilities. Due to this open-source nature, Dolibarr is commonly used by small to mid-sized businesses across various industries, including services, consulting, and nonprofits. It is suitable for small to mid-sized companies with basic accounting needs and limited budgets for software.

Dolibarr offers basic accounting features such as invoicing, expense tracking, and bank reconciliation. Pricing is free for the basic version, with additional modules available for purchase for extended functionality.

Reviews for Dolibarr vary, with some users praising its simplicity, flexibility, and cost-effectiveness for small businesses. However, others may find its accounting features limited compared to more robust solutions. Users appreciate its ease of use and open-source nature but may encounter challenges with customization and support.

How Nanonets Stands out For Balance Sheet Reconciliation

Nanonets offers a comprehensive solution for balance sheet reconciliation that sets it apart from traditional methods and other software providers.

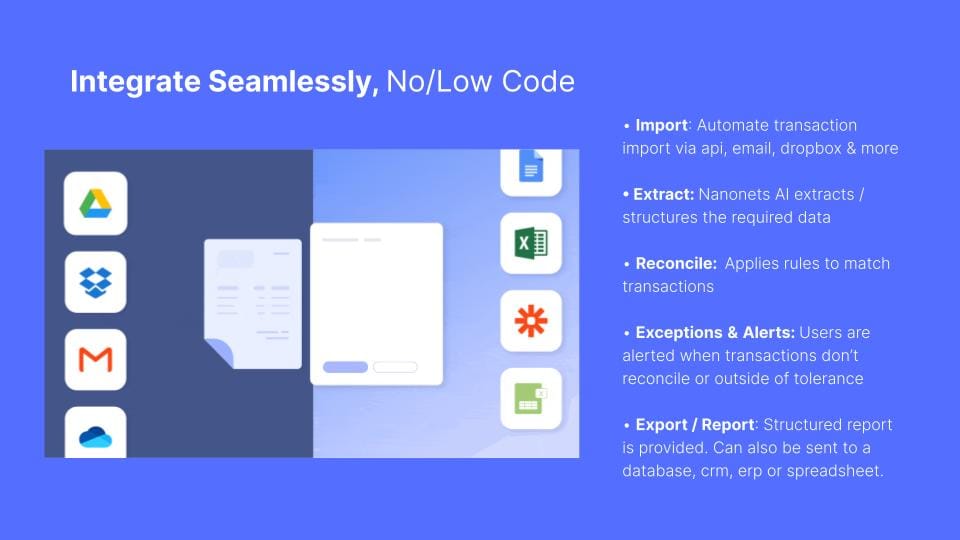

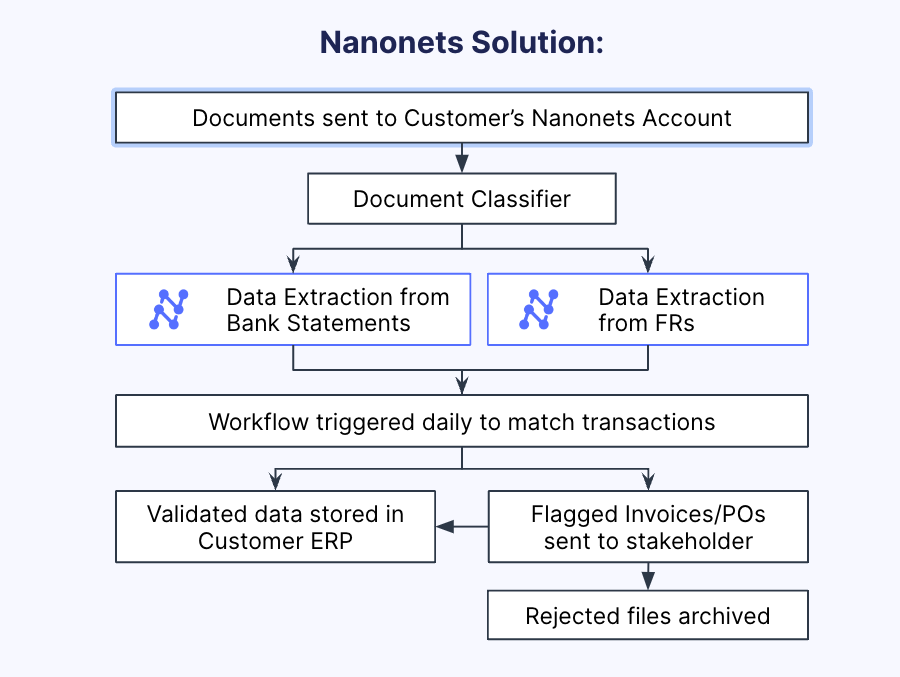

Nanonets’ advanced AI Technology leverages artificial intelligence and machine learning algorithms to automate the reconciliation process, accurately extracting, matching, and reconciling large volumes of financial data with minimal human intervention.

It provides customizable workflows that allow organisations to tailor the reconciliation process to their specific requirements. Users can define rules, thresholds, and exceptions to automate decision-making and streamline reconciliation.

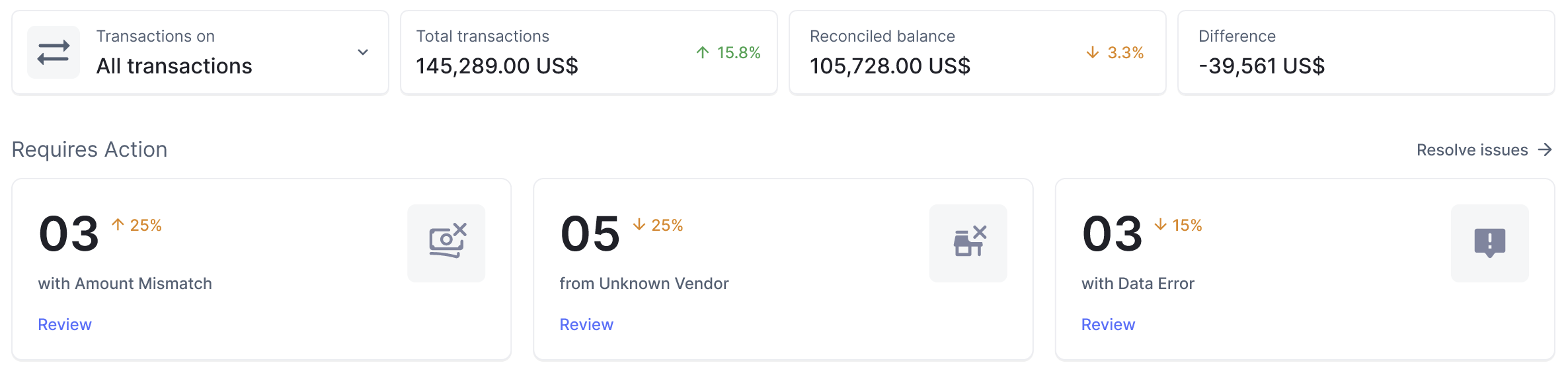

Nanonets also offers real-time monitoring and reporting capabilities, enabling finance teams to track the progress of reconciliation tasks, identify bottlenecks, and generate comprehensive reports for management and audit purposes.

It easily integrates with existing ERP systems, accounting software, and data sources, eliminating data silos and streamlining data exchange. Its flexible integration options ensure compatibility with diverse IT environments and workflows.

Nanonets is designed to scale with the evolving needs of businesses, from small startups to large enterprises. Its cloud-based architecture ensures scalability, reliability, and performance, even with large volumes of data and complex reconciliation requirements.

Nanonets prioritises user experience, offering an intuitive interface and user-friendly features that make reconciliation accessible to finance professionals of all skill levels. Its guided workflows, built-in validations, and error handling mechanisms simplify the reconciliation process and minimise training requirements.

Take Away

As organizations navigate through the complexities of modern business transactions, the need for automation, accuracy, and efficiency becomes paramount. Bank balance reconciliation software streamlines the reconciliation process and enhances data integrity, regulatory compliance, and risk management. By leveraging advanced technologies such as artificial intelligence, machine learning, and automation, these software solutions empower finance professionals to reconcile accounts with speed and precision. Seamless integration with existing financial systems, customizable workflows, and intuitive interfaces ensure a seamless user experience, regardless of the organization's size or complexity.

As demonstrated by the diverse range of software options available, from Nanonets to QuickBooks, organizations have the opportunity to choose a solution that best aligns with their specific requirements and objectives. By conducting due research, considering user reviews, and evaluating features, organizations can select the ideal bank balance reconciliation software to optimize their financial processes and achieve sustainable growth.