In today's complex financial landscape, businesses are drowning in a sea of bank statements. In 2022, a staggering 98.6% of Americans held transaction accounts, generating an unprecedented volume of financial data.

For businesses performing bank statement verification on thousands of bank statements daily—from insurance companies to financial institutions—bank statement processing presents a challenge and an even bigger opportunity for automation.

Traditional manual processing and reconciling, which consumes an average of 10-12 hours per week, is no longer an option. It often leads to errors, delays, and missed insights, making statement management a logistical nightmare.

In this article, we’ll explore applications of AI and automation for bank statement processing. We'll also guide you through setting up an efficient bank statement processing system and share best practices to transform this data flood into a strategic asset.

What is bank statement processing?

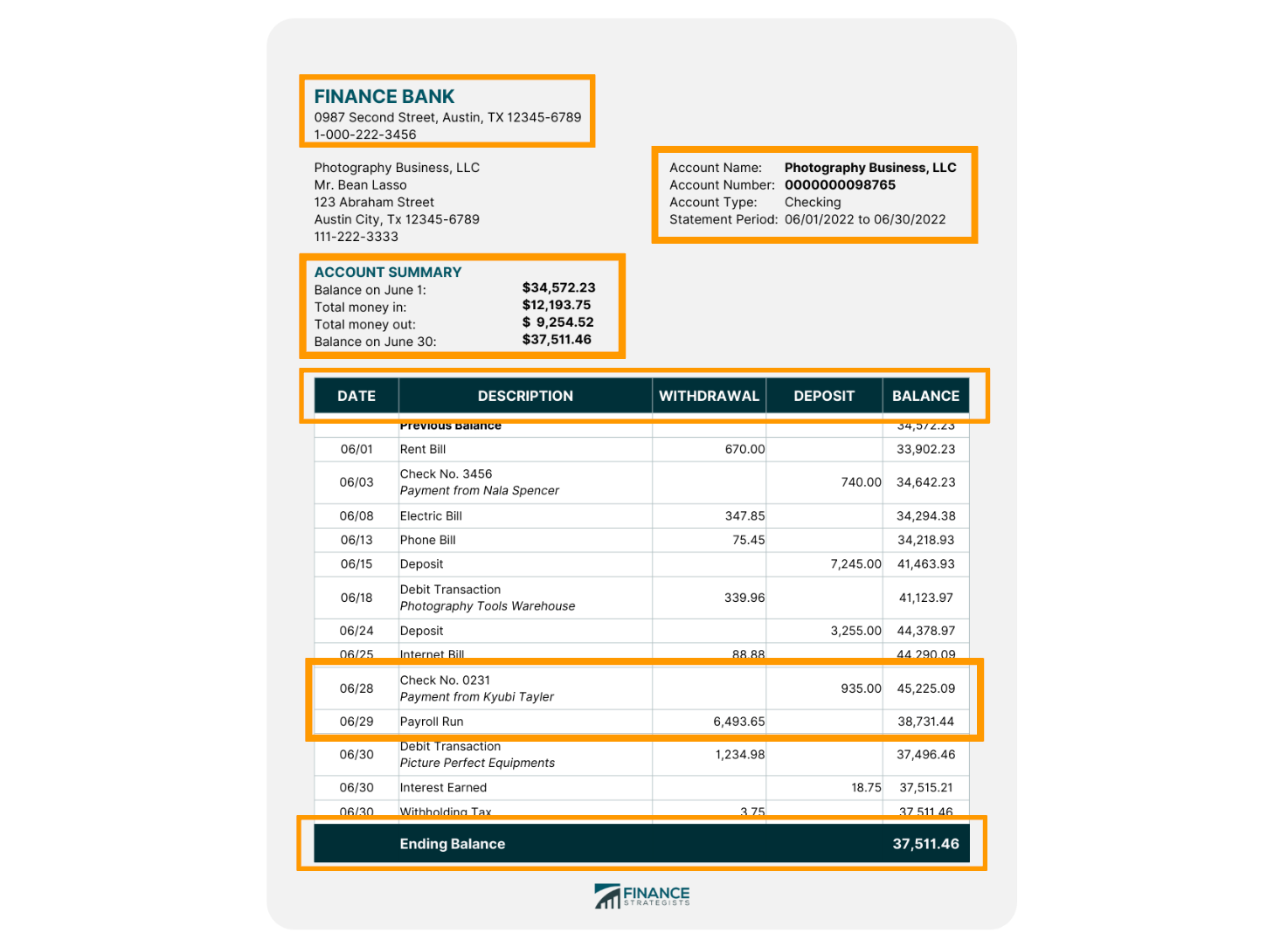

Bank statement processing is extracting and analyzing financial data on bank statements.

- It involves extracting key details from bank statements, such as transaction amounts, dates, descriptions, account balances, payee names, account numbers, and transaction types (e.g., debit or credit, etc.

- The bank extract information is then converted into a structured format for these and other accounting operations.

- The extracted data is then sent for bank statement analysis, further processing, and accounting.

Bank statement processing is essential for accurate reconciliation, auditing, and financial reporting.

In recent years, AI-powered bank statement extraction software use natural language processing (NLP) and machine learning (ML) have revolutionized this process.

These tools enable businesses to process statements faster and more accurately by automating transaction data extraction, categorization, and analysis. The result is improved efficiency and scalability in financial operations, reducing human errors and saving time for higher-value financial tasks.

Steps in bank statement processing

Let’s look at the steps involved in bank statement processing and a few best practices for each step:

Gathering bank statements

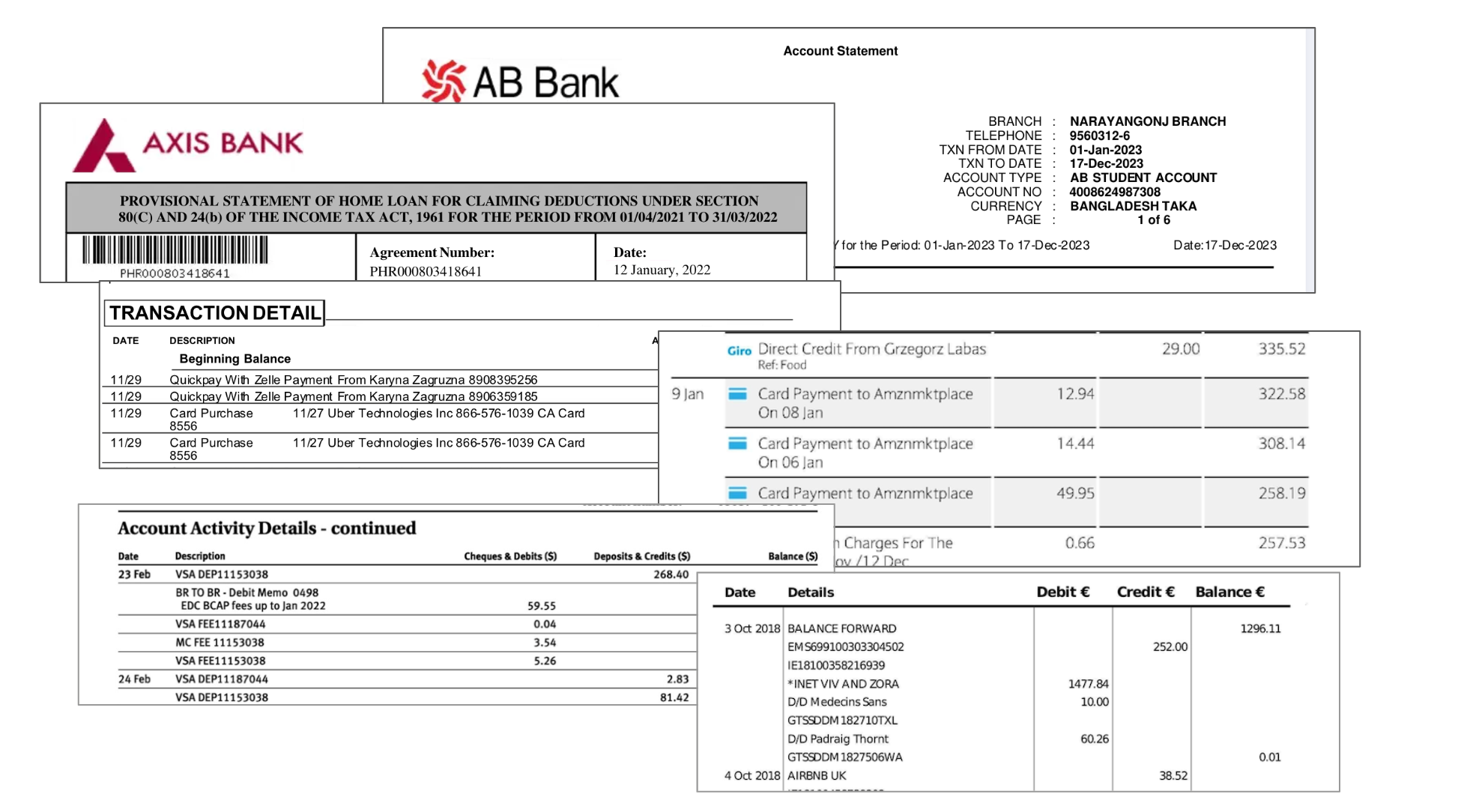

Bank statements come in various formats, such as email attachments, PDFs, physical copies, or spreadsheets, each requiring a different approach.

Traditionally, accountants and bookkeepers manually input data from bank statements into their accounting software. Collecting and tracking all such bank statements from various sources is tedious and wastes precious time.

This makes maintaining an efficient audit trail difficult and hampers the month-end and year-end processes.

Data extraction

Data extraction tools automatically extract pertinent information from bank statements using machine learning-enhanced optical character recognition (OCR) technology.

These tools can identify key details such as transaction dates, amounts, and descriptions, reducing the time and effort spent on manual data entry.

These tools come in different formats, like template-based data extraction tools, and advanced AI-powered OCR software.

The cost of using template-based data extraction tools is close to 17% higher than AI-based software.

If you are using a template-based tool, ensure it is compatible with different statement formats and templates for seamless integration.

However, if you receive bank statements in different formats, languages, currencies, and templates, consider investing in an automated AI-based data extraction solution that relies on highly accurate advanced OCR and machine learning models.

Set up rule-based workflows to identify and remove duplicate entries and perform human reviews for complex or ambiguous transactions.

Reconciliation

This step involves matching the extracted bank statement data with the company’s internal financial records.

Manual reconciliation is a slow process that involves accountants or finance teams comparing thousands of transactions across multiple statements and accounts. EY reports that AI reduces reconciliation errors by as much as 90%, decreasing the likelihood of mismatched transactions.

AI can process 1,000+ transactions in under 2 minutes, while manual reconciliation for the same amount would take several hours or even days.

Create rule-based workflows that allow AI to handle repetitive tasks but involve human intervention when AI flags a complex exception or a high-risk anomaly.

Discrepancy identification

Discrepancy identification is a critical aspect of bank statement reconciliation. During reconciliation, any mismatches are flagged for further review.

Routine discrepancies such as timing differences (e.g., uncleared checks and bank fees) are common, and AI can easily detect and flag these discrepancies.

Automating the identification and categorization of these high-frequency discrepancies reduces the workload for human reviewers.

This can reduce fraud-related losses by 30-40% from discrepancies such as duplicate invoices or suspiciously large payments.

Adjustments

Once the accounting team identifies and explains discrepancies, they make the necessary adjustments. These adjustments ensure that discrepancies between bank statements and internal records are resolved promptly and accurately.

With pre-defined rules, AI can handle routine adjustments, such as small variances in amounts or currency conversions, by automatically updating the accounting system once these adjustments are validated against historical data.

Set up predefined rules for adjustments due to common discrepancies, such as rounding errors or clearing delays, so that AI can automatically resolve them or flag them as expected without human intervention.

Prioritize discrepancies based on risk and use AI to classify them into low, medium, and high priority.

Transaction analysis

After reconciliation, businesses often analyze the transaction data for insights.

Accountants review individual transactions to ensure they align with internal financial records. AI can enhance transaction analysis by automating categorization, detecting patterns, and identifying discrepancies.

Setting up automated classification and categorization of transactions based on predefined rules and historical data can significantly improve the bank statement analysis.

Reporting

Finally, the processed data is summarized into reports highlighting the organization’s financial status. These reports can include insights on cash flow, expenditures, and overall financial health, providing stakeholders with a clear understanding of the company's financial position.

Implement AI-powered reporting tools to automate the creation of financial reports. These tools can pull data directly from reconciled bank statements and generate reports with minimal manual input, ensuring consistency across reporting periods.

Using NLP tools to generate simple-language explanations of financial reports can help build a great narrative. These reports should highlight key trends, variances, and insights to make reports more accessible to non-financial stakeholders.

AI-powered technologies in bank statement processing

Artificial Intelligence (AI) has transformed bank statement processing, making it faster, more accurate, and capable of handling large data volumes. AI-powered systems are revolutionizing how businesses categorize transactions, detect fraud, and maintain financial accuracy.

Here's a closer look at the AI-enhanced technologies that play a key role in modern bank statement processing:

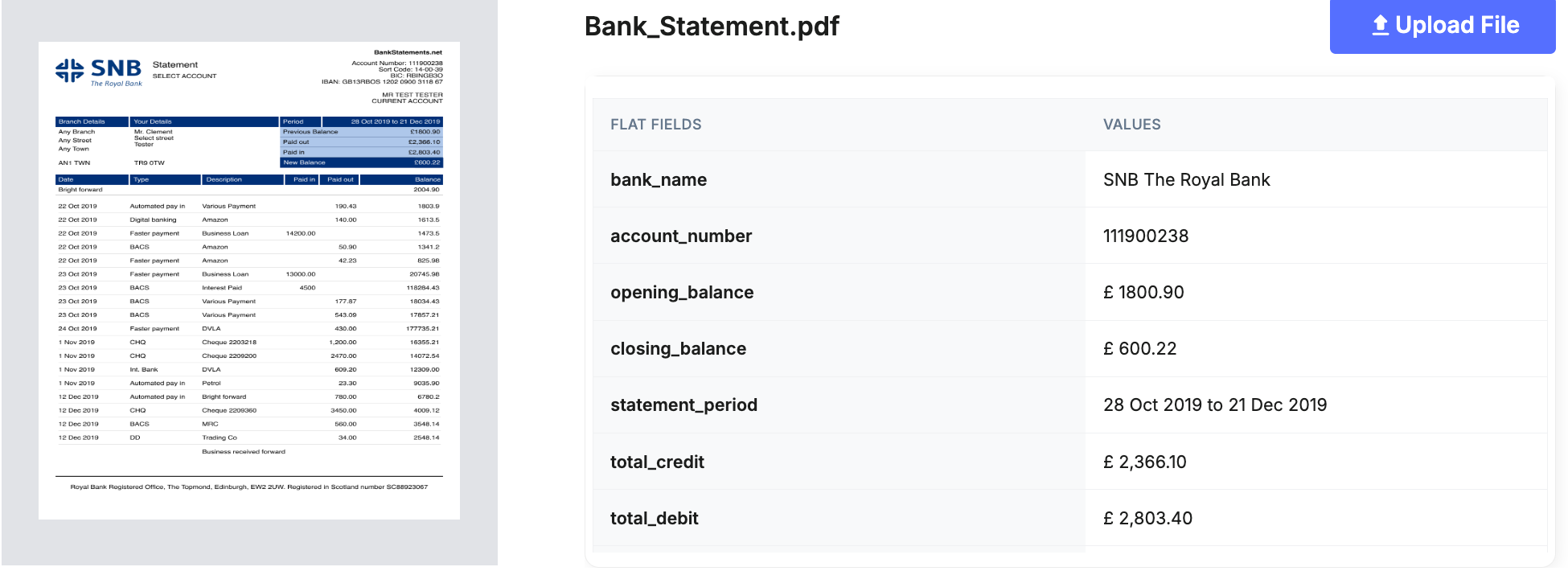

AI-powered OCR extraction

AI-powered Optical Character Recognition (OCR) tools are indispensable in bank statement processing, especially when dealing with unstructured formats like PDFs, scanned documents, and handwritten text.

These tools accurately extract essential details such as transaction amounts, dates, descriptions, and account numbers, regardless of formatting complexity (tables, logos, etc.).

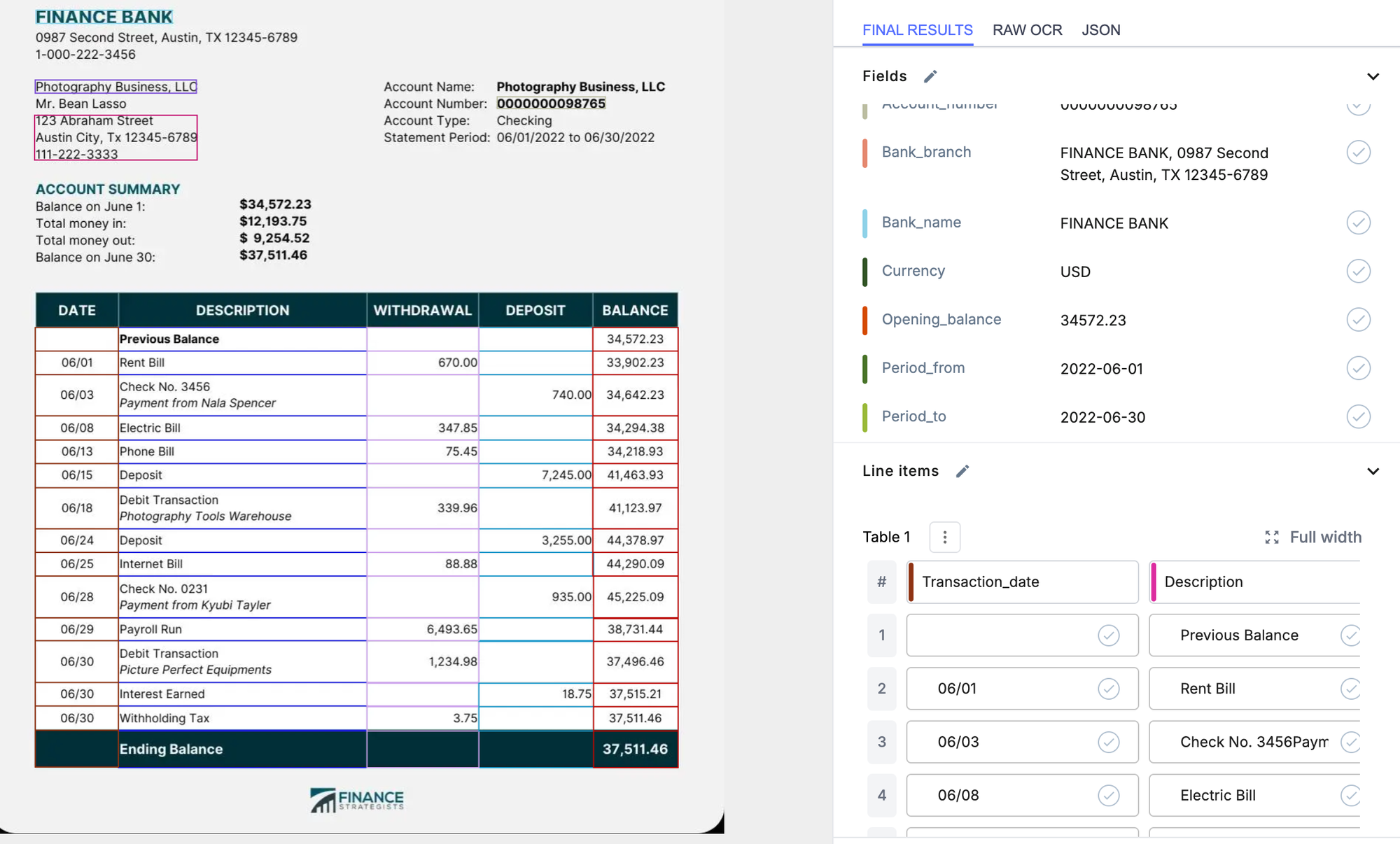

AI-driven OCR is much more advanced than traditional OCR tools and can extract key information with up to 99% accuracy. For instance, platforms like Nanonets can extract data from diverse formats and languages seamlessly.

The AI engine reads and organizes data into a structured format, helping businesses streamline reconciliation and financial reporting. This level of automation minimizes manual input, reduces errors, and improves the overall speed and accuracy of financial data management.

Natural Language Processing (NLP)

Natural Language Processing (NLP) enhances bank statement processing by interpreting and categorizing transaction descriptions, allowing for better transaction organization.

Unlike simple keyword-based categorization, NLP tools understand the context of transactions. For example, NLP can differentiate between “AMZN*XXXX2” (an Amazon purchase) and “TRANSFER TO SAVINGS” (a bank transfer), accurately categorizing these transactions.

In practice, this allows for more efficient financial management and accurate categorization of expenses, helping businesses maintain accurate budgets, identify spending patterns, and optimize resources.

Pattern recognition and fraud detection using ML

Machine Learning (ML) models analyze historical transaction data to detect fraud and recognize patterns in spending behavior. ML tools continuously learn from new transaction data, enhancing their ability to flag anomalies that deviate from established patterns.

For example, if a customer typically makes small purchases from a familiar vendor but suddenly has a large transaction at an unknown vendor, the system might flag it as unusual.

ML-driven fraud detection systems offer real-time monitoring and adaptive learning, enabling businesses to protect their assets from unauthorized transactions and identify potential financial risks early on.

Open banking and API integrations

Efficient bank statement processing relies heavily on integrating financial systems such as accounting software, ERP platforms, and databases. With Open Banking and API integrations, businesses can directly connect their bank statement processing tools with these systems, ensuring seamless data flow.

Tools like Nanonets integrate with popular platforms like SAP, Xero, Sage, Netsuite, and QuickBooks, enabling automatic data extraction and direct import of key financial information into accounting systems. This eliminates data silos, reduces manual data entry, and ensures consistency across financial reports.

Automated reconciliation

AI enhances reconciliation by automatically comparing data from bank statements with internal financial records (e.g., general ledgers). AI algorithms match transactions based on details like dates, amounts, and payee names, flagging discrepancies for manual review.

By automating reconciliation, businesses save time and reduce the likelihood of human errors, ensuring that their financial statements are accurate. This process is critical for companies with high transaction volumes, where manual reconciliation is time-consuming and error-prone.

Advanced analytics and predictive insights

With real-time processing, AI-enabled tools can deliver instant insights into financial data. Imagine being able to spot trends as they happen—this means you can budget more accurately and prepare for future expenses without the guesswork.

AI doesn’t just crunch numbers; it can also analyze customer behavior through sentiment analysis. By looking at transaction data and customer interactions, AI helps uncover what customers think and feel. This insight allows you to tailor your services to better meet their needs.

Contextual learning for continuous improvement

AI systems evolve with contextual learning, adapting to the data they process and the feedback they receive. For example, if a transaction is misclassified (e.g., personal expense versus business expense), the user can correct it, and the system will learn from this correction, improving future categorizations.

With more data and consistent feedback, AI models become increasingly accurate over time, minimizing manual intervention. Businesses implementing AI-powered solutions benefit from systems that continually improve, reducing reliance on human oversight and enhancing overall efficiency.

How to set up an automated bank statement processing workflow

Here’s a step-by-step guide to setting up a bank statement processing workflow using Nanonets, an AI-powered data extraction tool:

Import all bank statements

- Sign up on app.nanonets.com for free and select Pre-built bank statement extractor.

- Collect and import all your bank statements from various sources, such as Dropbox, Google Drive, Email, Zapier, and OneDrive.

You can also set up an import block based on specific triggers, such as the arrival of a new file in your cloud storage.

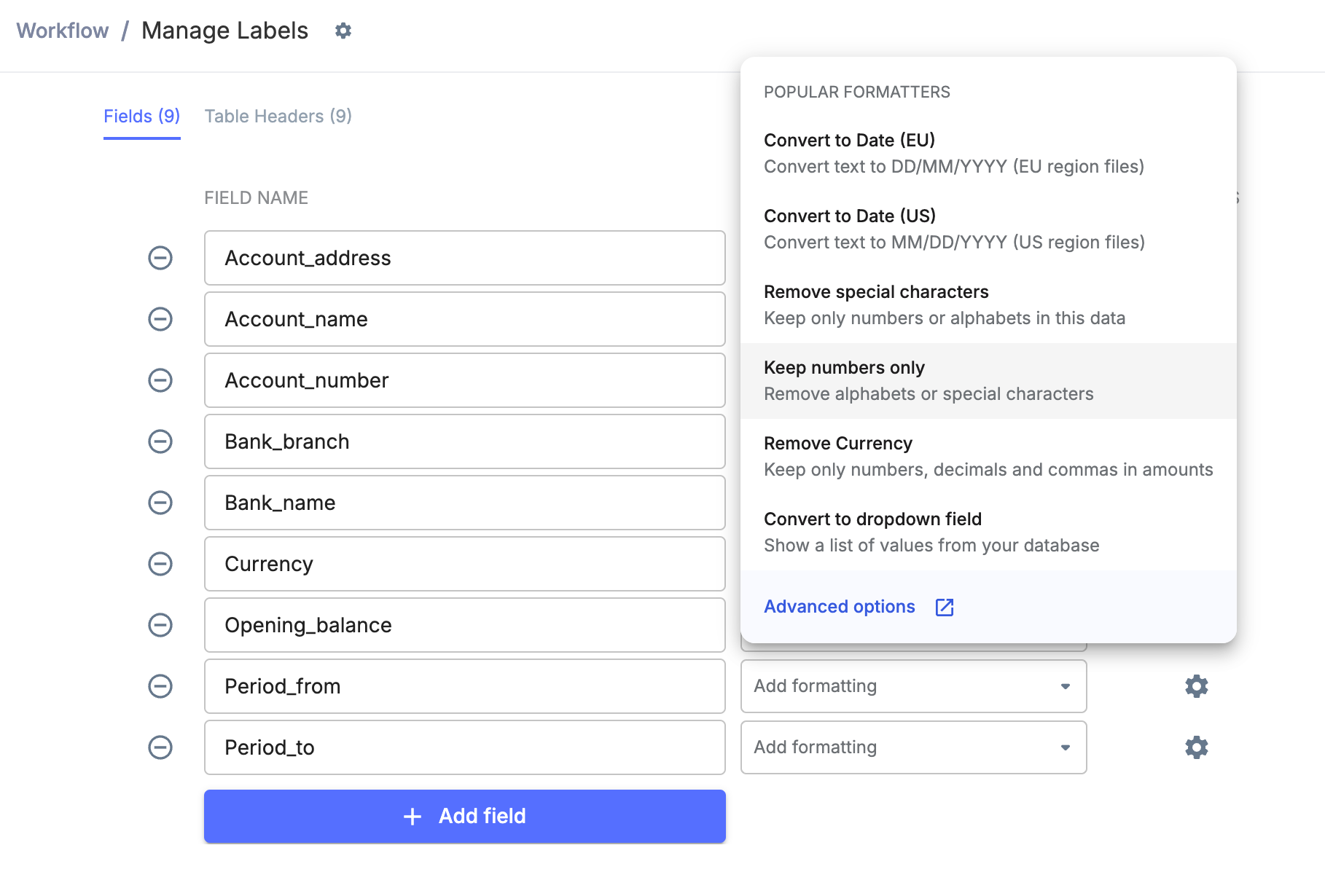

Customize data actions

- Set up advanced conditional data action steps for your bank statement processing, such as –

- Standardize date formatting

- Currency detector and symbol removal

- QR code and bar code scanner

- URL parser

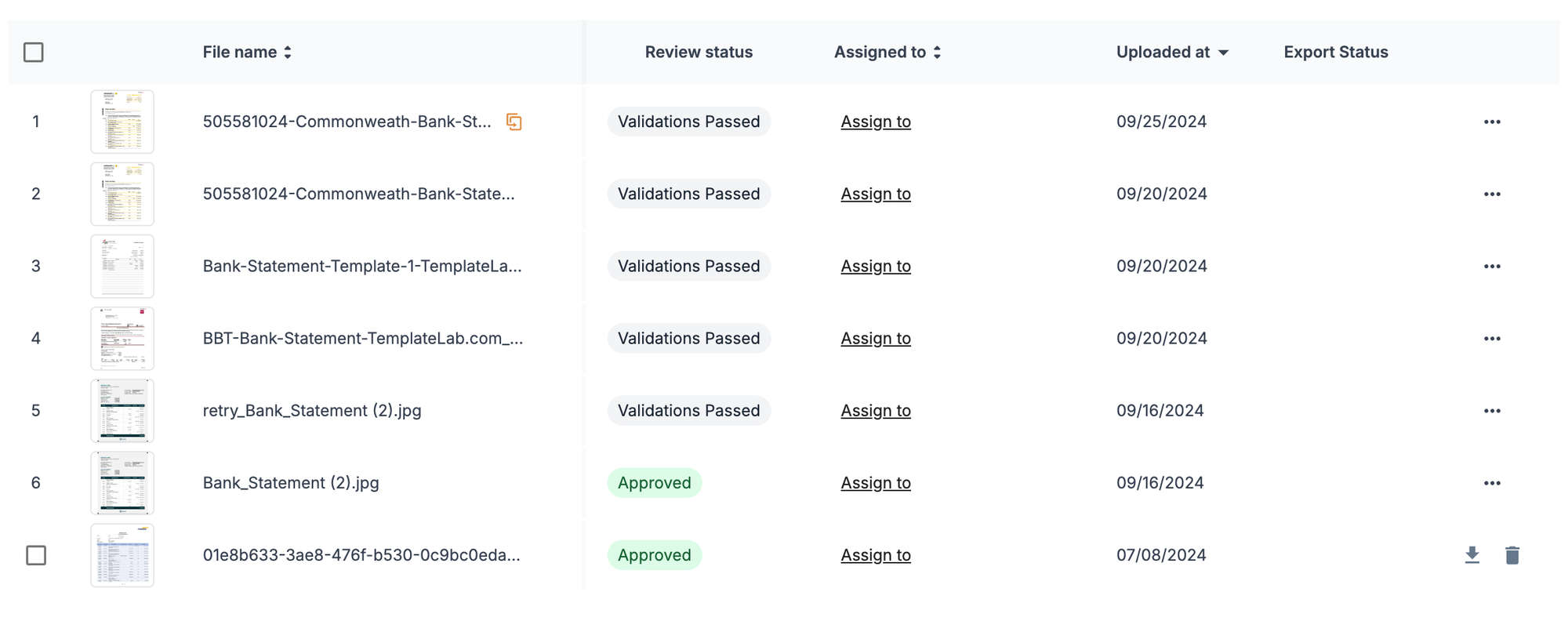

Review extracted bank statement data

- Review the extracted data and customize your output by keeping only the relevant fields.

- Remove unnecessary fields or add relevant missed fields to ensure a clean output.

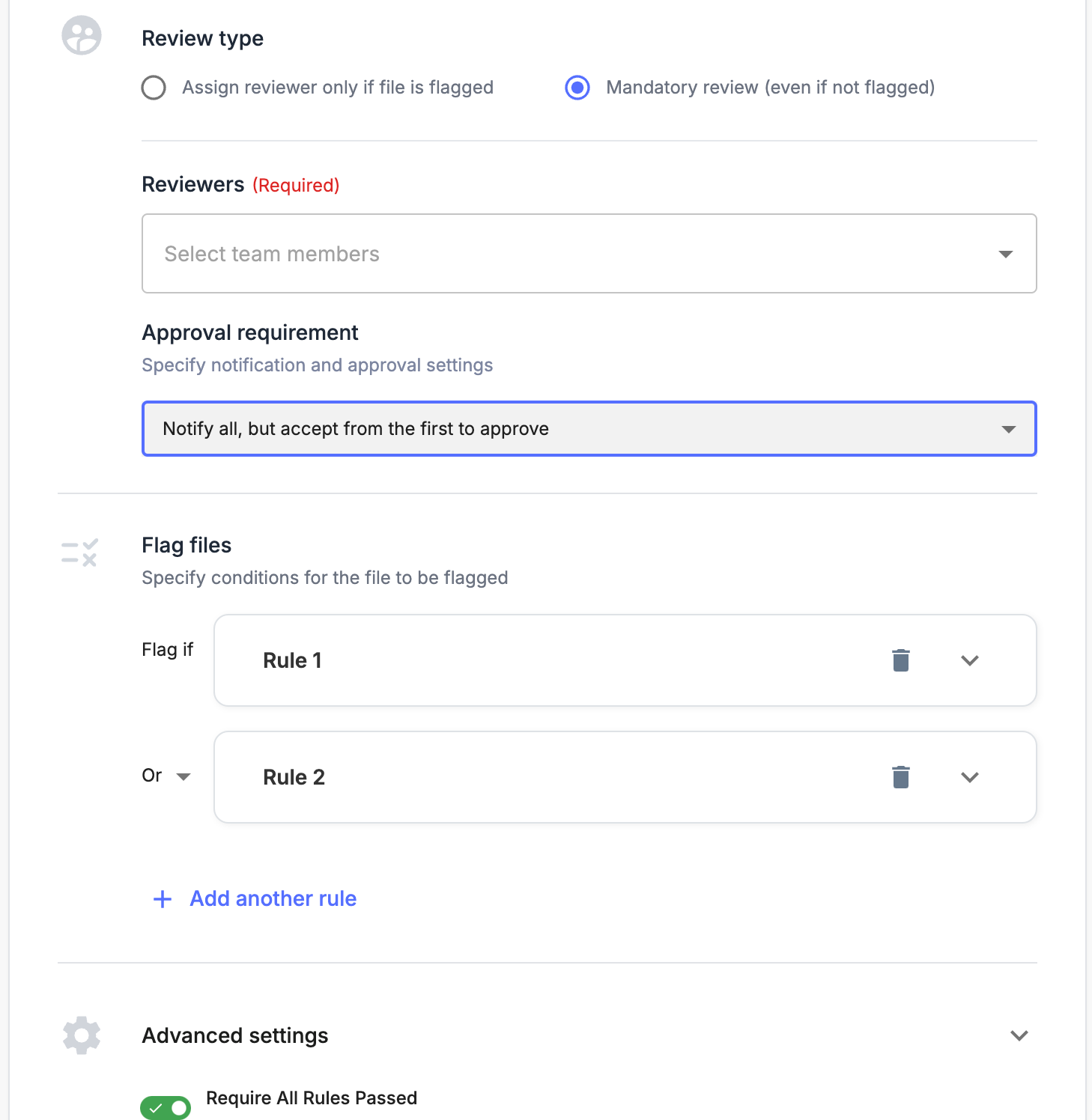

Set up rule-based approvals

- Configure and set up rules –

- Flag statements based on fields like high transaction amounts or missing account numbers

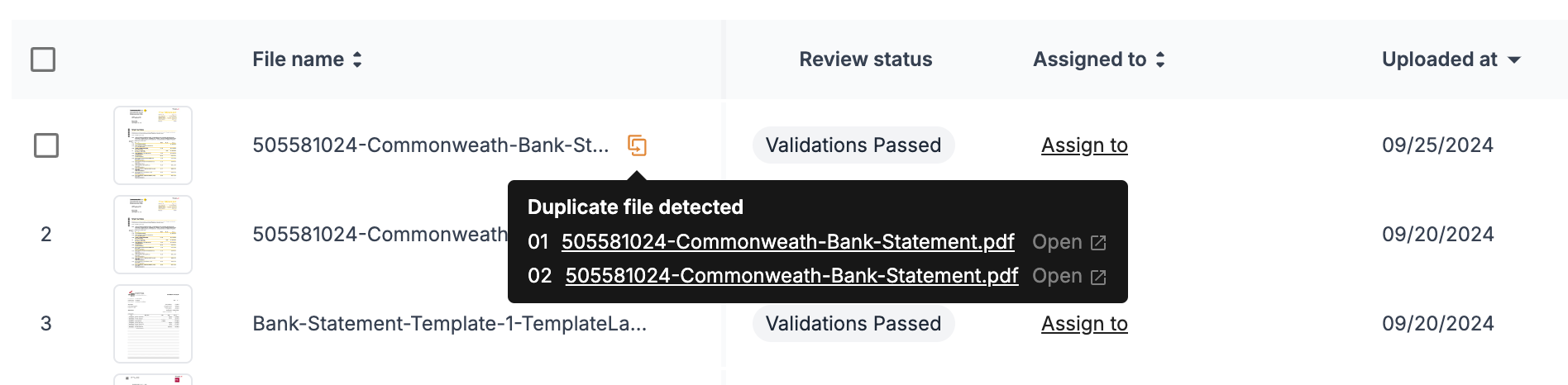

- Flag duplicate bank statements

- Setting up approval process with multiple reviewers – mandatory and for flagged

Export for processing

- You can download or export the final results in different formats, such as CSV, XML, Google Sheets, or Excel, or create a shareable link to share with the team.

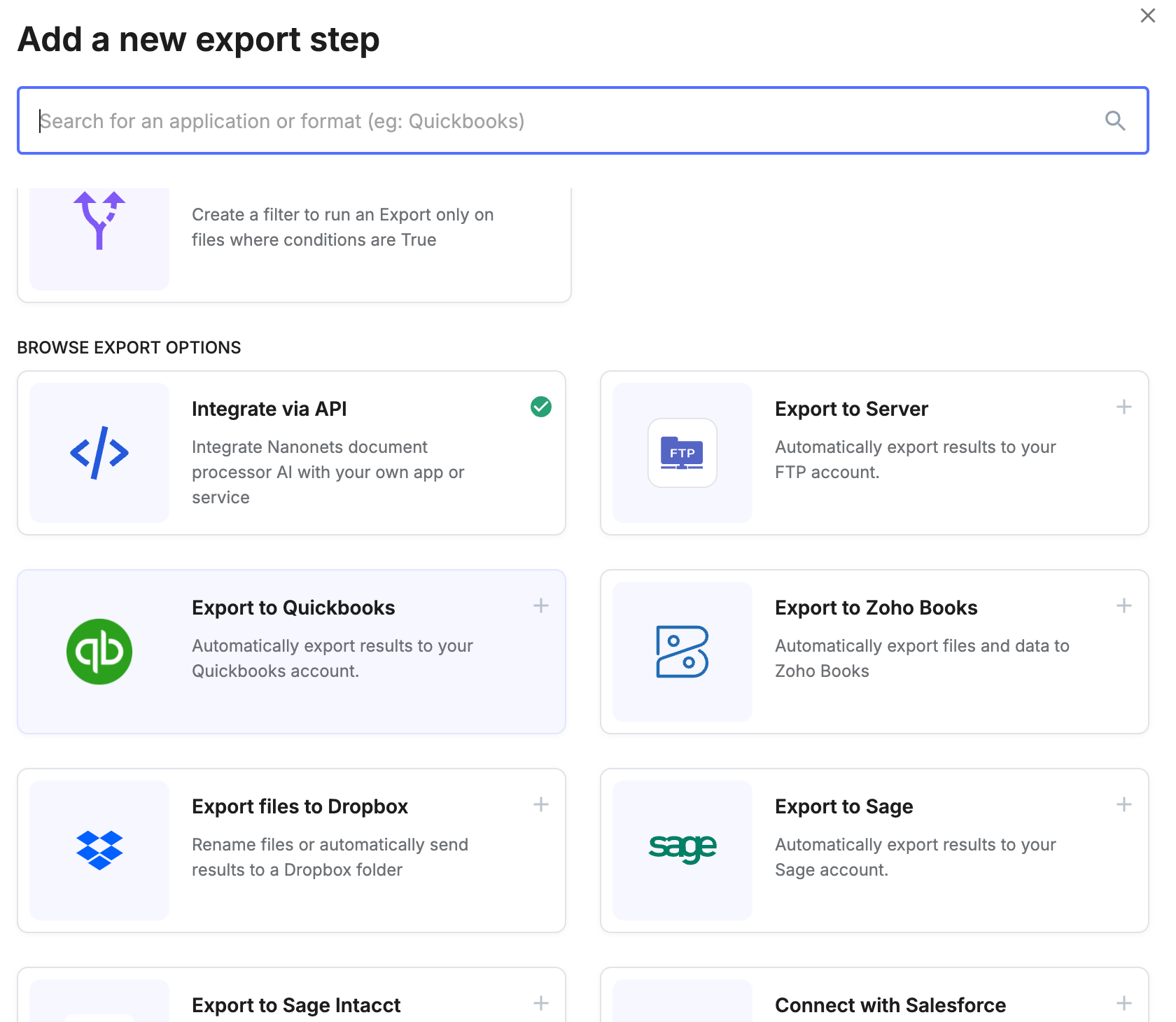

- For post-extraction processing, integrate with third-party tools using built-in integrations –

- Integrate with accounting and ERP software like Quickbooks, Zoho Books, Sage, Xero, Netsuite

- Database export options, such as PostgreSQL, MySQL, and MSSQL.

- Export to custom Python scripts for specialized processing

- Or integrate with any tool via API

Best practices for automated bank statement processing

To ensure successful automated bank statement processing, consider the following best practices:

Integration with existing financial systems

Create a digital ecosystem by integrating your automated bank statement processing tools with existing financial systems.

This integration should go beyond simple data transfer; aim for intelligent interactions where processed statement data automatically triggers relevant actions in your accounting software, such as updating cash flow forecasts or flagging potential discrepancies for review.

Data security and compliance

Protecting sensitive financial data should be a priority. Encryption ensures data security both when stored and when transmitted.

Limiting access to only authorized personnel, implementing Multi-Factor Authentication (MFA), and employing data masking techniques reduce the risk of data breaches.

To maintain data privacy and user trust, always stay compliant with regulations like GDPR, HIPAA, and SOC.

Third-party vendor management

When working with external vendors, vet their security protocols and compliance measures to ensure they meet industry standards.

Establish legal agreements that outline how data should be handled and conduct regular assessments to verify that vendors adhere to your security and operational requirements.

Clear communication is essential to maintain strong relationships and address any issues promptly.

Monitor and review

Regularly auditing data quality is vital for maintaining accuracy and compliance.

Use feedback loops to refine AI algorithms and improve processing accuracy. Keep detailed logs of transactions and data changes to ensure accountability and compliance with internal and external standards.

Structured workflows, including approval processes for data exports, can further enhance transparency and efficiency.

System maintenance and updates

Adopt a DevOps approach to system maintenance, enabling continuous updates and improvements without disrupting daily operations.

Implement an AI-powered documentation system that automatically updates SOPs and manuals based on system changes and user interactions.

Create a knowledge graph of your processing system. This will allow staff to visualize interconnections between different components and quickly identify the impact of any changes.