Introduction

There is simply no escaping the fact that AI is the most talked about topic on the internet in all of 2024. Chat-GPT, the popular chat-based interface for exploring the LLM (Large Language Model) capabilities developed by OpenAI, was released to the public earlier in the year.

Play around with it for just a few minutes, and you can begin to understand why everyone and their dog is talking about this - Chat-GPT is able to demonstrate superhuman proficiency in virtually every domain. AI clearly promises to significantly transform many areas of work - while potentially impacting millions of jobs and careers.

Artificial intelligence is now being applied across professional domains that are ripe for automation - areas of work such as software, law, accounting, consulting, finance and so on. Within finance, the accounts payable function is one that comes into the spotlight as somewhat unique - especially as there seems to be an equal amount of noise on both sides of the argument, with AI advocates and naysayers both having a raging debate on what will (or won’t) happen.

The jury is still out on how exactly this rapid transformation will be achieved - and this is where most discourses on the benefits of ChatGPT in particular (and AI in general) tend to draw the line.

The Need for AI in Accounts Payable

In traditional AP operations, companies often rely on manual processes, extensive paperwork, and repetitive tasks to handle their payables function. These tasks are activities like data entry, invoice processing, and financial analysis, which are crucial for decision-making, operational planning, and risk management.

However, these processes involve spending time (and money). The major drawbacks of manual AP work are:

- Manual data entry introduces a high potential for errors, as humans can make mistakes when entering data in high volumes. Think of fields like invoice numbers, dates, dollar amounts - getting any of these wrong has major consequences.

- It is time-consuming, requiring long hours of work to reconcile accounts, generate reports, and perform financial analysis.

- It is heavy on synchronous communication.

Have you encountered situations like the ones below?

a. Approvals don't happen until you get the CFO and Business Head on a Zoom/Skype call

b. Line items don't get resolved until the AP function schedules a meeting with the procurement management team and the vendor.

All of this leads to delays in vendor payments, inadequate expense planning, and difficulties in maintaining financial integrity.

How to Implement AI in Accounts Payable

The problems listed above are well-documented - and when asked, most accounting teams will agree that introducing AI will definitely help them out. Technologies such as machine learning and natural language processing have the ability to revolutionize the AP function in a very deep way - provided they’re implemented and integrated in the correct manner.

However, this usually leads many to the conclusion that AI-based AP automation is not for them - it seems cumbersome, time-consuming and expensive to implement.

The reality, though, could not be more different - today it is possible to get started with using AI for your AP process within minutes. And you can achieve this without compromising on your current process's reliability, security and efficiency.

Put generative AI and LLMs aside for one moment - the reality is that even entry-level AI automation can help significantly in addressing these issues. Even the humble OCR - that has been around for decades - reduces the time taken to process an invoice by at least 60%, saving your AP team multiple days every month. And yet adoption of this technology is still not widespread.

Looking to integrate AI into your AP function? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

Use Cases for AI within Accounts Payable

AI can speed up many processes in Accounts Payable - starting from invoice and PO data capture, all the way to automated data validation, invoice coding, spend approvals, and payment release.

So how exactly are you supposed to integrate AI into your AP process? Where do you start?

The first place to begin is to look at which part of the process really take up most of the time. Tyical bottlenecks that are reported by an AP team are activities like:

- Invoice coding

- General Ledger (GL) mapping

- Payment Details Verification (to check for fraud)

- Duplicate Detection

There is a very clear underlying theme here - manual data entry and verification is what causes these tasks to be tedious and time-consuming.

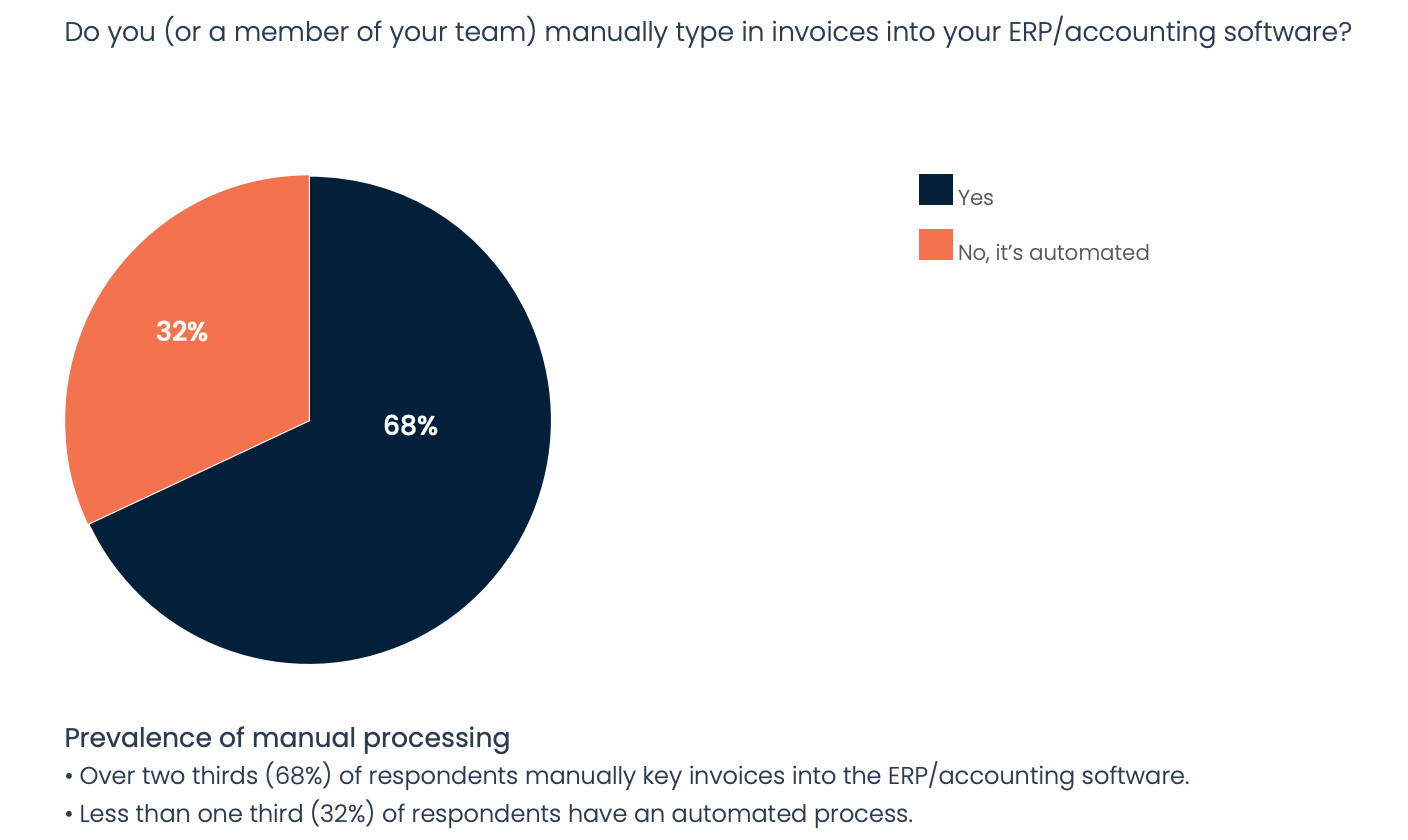

This survey graphic above (from the Automation Trends 2022 report) reveals a lot - almost 70% of people have still not automated the most pressing issues in their AP process. The tasks listed above are all manual - someone needs to look at the actual data on the invoice and confirm that it is correct, before proceeding further.

As such, automating these tasks might feel overwhelming, since you're now trusting a machine to have the same level of discretion as a (trained) human.

The good news? AI can be trained equally well too! We go deeper into some use cases of this, below.

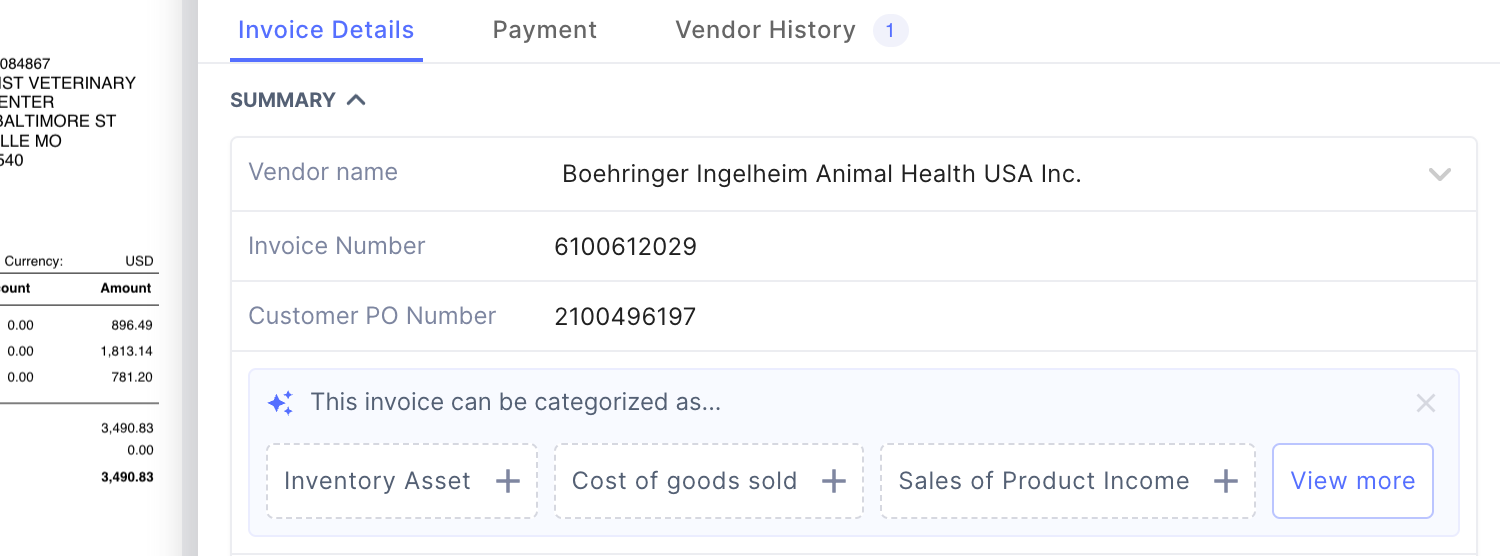

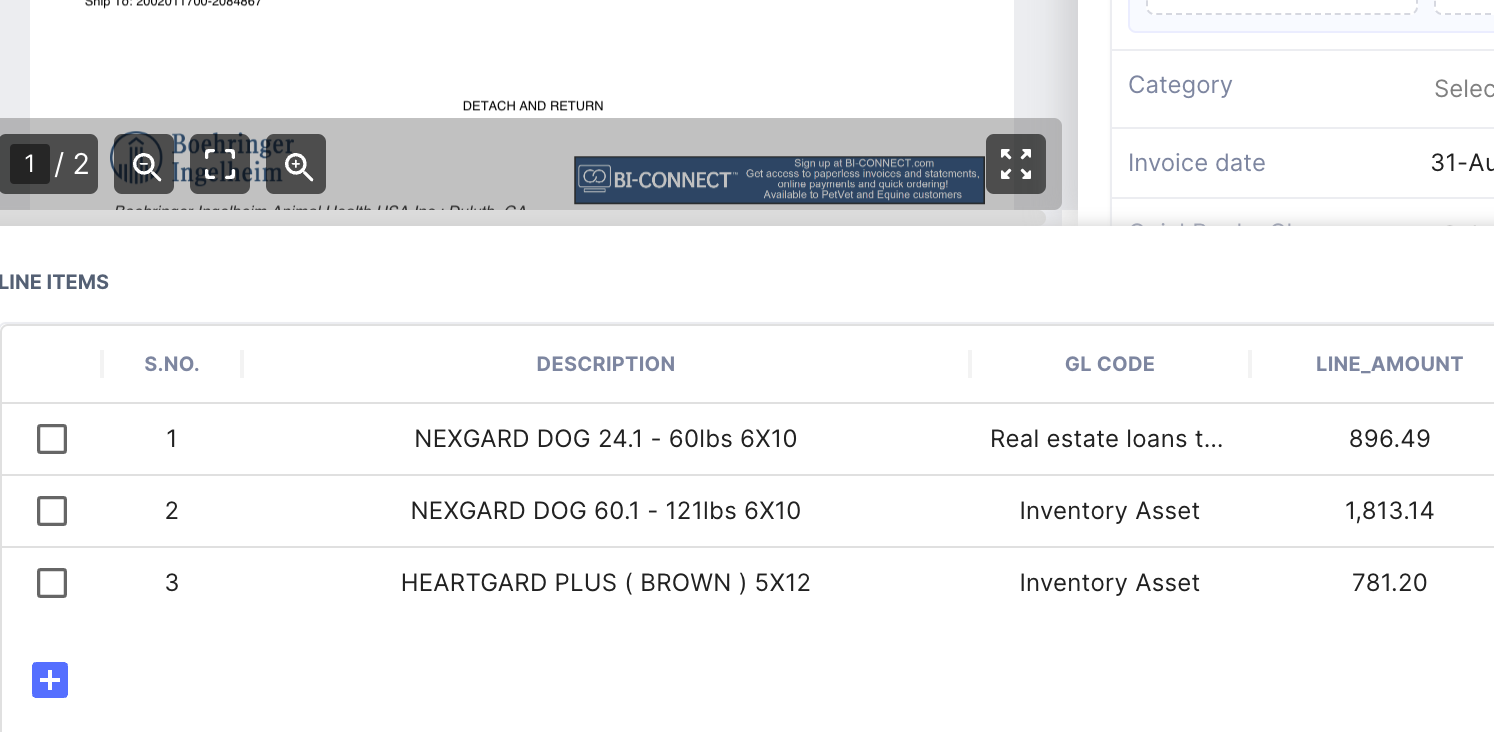

1. Invoice coding and General Ledger (GL) account mapping

Perhaps one of the most difficult tasks to automate is assigning invoices and receipts to the right category and GL code within your accounting system. Why is this particularly tricky?

- There are often multiple GL codes that apply to the same expense, split by line items/individual product codes. Assignment of these GL codes is usually manual, and must be done in consultation with business teams and the CFO.

- Assigning a GL code to an invoice is sometimes subjective - for example, while regular sales invoices might always be assigned to “Sales” in your chart of accounts, sometimes the exact same invoice format ends up being used for contractors and non-employees. This can lead to contractual expenses being incorrectly tagged as “Sales” by basic automation tools.

How can AI help here?

- Automate invoice coding based on LLM processing - here, the AI basically tells you which GL this invoice should be categorized in, and this can be configured to offer multiple suggestions that can be appropriate. This makes the user’s task somewhat easier.

- Learn and memorize user inputs - once a user actually selects the GL code, the system can remember the selection and automate it the next time for the same vendor.

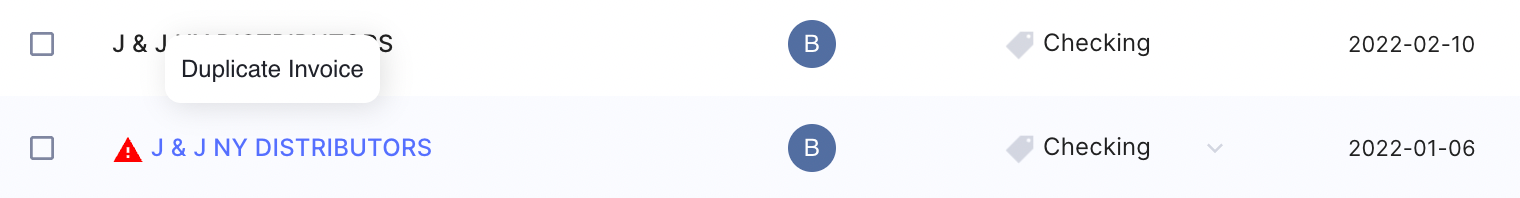

2. Fraud detection and error handling

Another crucial task that an AP team has is catching errors before they happen. It might be as serious as wrong payment details and invoice fraud, or it might be as simple as a duplicate invoice.

Without a doubt, these problems are best prevented before they happen. Most organizations insist on making this process manual. However, having a human check each invoice makes things difficult because:

- It gives a single point of failure (and bottleneck) for the process - while it is good to have an employee check every expense for errors, sometimes things can slip through the cracks.

- It ensures that only the person with the most context on vendor payments (CFO/AP head) can make corrections, and no one else. All the knowledge and context is only with a few people, and not spread across the organization.

How can AI help here?

- Smarter duplicate detection/wrong information - Basic file duplicate checks verify only if the two files are the same. With advanced AI duplicate checks, you can go one step further - checking if the contents of two different files are suspiciously similar.

- Multiple data validations on invoice data - Just auto-reading the invoice data is no use if someone has to login and verify it anyway. Advanced AI tools can now carry out data validation to ensure hygiene checks (for example, if a new bank account number on an invoice doesn’t match the usual one for a vendor, you’ll get notified!)

3. Learning simple actions that are repeatable

Ask anyone what they REALLY want AI to do, and this is the answer that comes out on top - many people feel that the real value of AI is when it can learn their patterns and save time for them.

For example, there are many small tasks that are done exactly the same way, for multiple types of invoices/receipts. Some examples:

- Assigning an invoice to the right category/class/project in your ERP

- Changing the GL mapping for one specific line-item of an invoice

- Sending a particular vendor's invoice for AP approval to the same person, every time

How can AI help here?

The first step is identifying the steps in the AP process that are ideally suited to iterated re-learning (i.e., activities which you keep doing daily, that can eventually be memorized by the AI and automated 90% of the time).

Good examples of this are:

- GL code assignment - The logic here is simple: if the application assigns the right GL code to an invoice, great! If not, you change it yourself, and the AI remembers this change for next time. As a result, the automatic GL code assignment keeps getting better with every click you make.

- Category/Class/Project classification - If a particular vendor invoice can’t be auto-classified into the right category, AI can learn patterns in your selection (for instance, are you always classifying Uber receipts as "Project Costs" instead of "Travel"?). Over time, this becomes a rule-set within your platform, and is automatically applied.

Benefits of AI Automation in Accounts Payable

When integrated successfully into the company’s operations, the AP department benefits from AI automation in a number of ways. Some of the key benefits include:

- Increased Efficiency

- Cost Savings

- Improved Accuracy

- Enhanced Compliance

- Better Fraud Detection

- Improved Vendor Relationships

- Deeper Data Insights

Could Future Accounts Payable Teams be Replaced By AI?

The use of AI in the Accounts Payable, it does not imply that the occupation available in this field will soon be eliminated. Instead, AI can enhance AP’s competence and alter the scope of AP jobs. Here’s how:

Shift to Strategic Roles: As more of the routine and monotonous work is taken care of by AI, AP professionals can concentrate more on value-add tasks like analytics, supplier relations, and continuous enhancement.

Job Evolution: AP jobs will change, and people will have to acquire new competencies concerning the management of AI systems, data analysis, and supervising automated procedures.

Increased Job Satisfaction: Shifts in mundane task execution will release AP professionals for more engaging and fulfilling work.

How Nanonets can help you with AI in your Accounts Payable Process

The examples above are probably just the tip of the iceberg - there is a lot more than AI can do for your AP process that is only limited by how deep you are able to go into the process of automation and machine learning.

Fortunately, today you do not have to be technically savvy in order to begin implementing AI capabilities into your accounts payable process - there are tools that allow you to get started almost immediately.

For instance, Nanonets has an AI platform that can transform your current AP process, and add those vital AI elements to your workflow. It can do all that has been demonstrated above - and much, much more.