Managing your accounts receivable (AR) is essential to business finance. Accounts Receivable refers to the funds your customers owe you for purchased products or services. It's considered an asset on the balance sheet and is crucial in maintaining a healthy cash flow and fostering business growth.

In this post, we'll take a deep dive into accounts receivable, explaining key terms, exploring best practices, and offering practical tips to manage your AR effectively. From the importance of AR to your cash flow to the ins and outs of AR turnover ratio, we've got you covered.

What is accounts receivable?

Accounts receivable, often abbreviated as AR, is money owed to a company by its customers. It's a line item that appears on the company's balance sheet, representing sales that have been made but not yet paid for. These sales are often made on credit, meaning the company has extended a line of credit to the customer, and they will pay the company later. The credit period is often short, ranging from a few days to a year.

When a company makes a sale on credit, it records the amount as accounts receivable on its balance sheet. This increases the company's assets because money will be received. However, until the payment is collected, it remains a receivable and does not become cash in hand.

What is accounts receivable management?

Accounts Receivable (AR) Management is the strategic practice of securing customer payments within a fixed timeframe. For organizations engaged in product and service sales, AR management is essential for meticulously tracking and overseeing each stage of the payment collection process following customer orders.

AR management involves clear procedures and best practices, including setting credit terms, issuing timely invoices, providing suitable payment options, and following up on late payments. These strategies maintain healthy cash flow and build trusting transparent customer relationships.

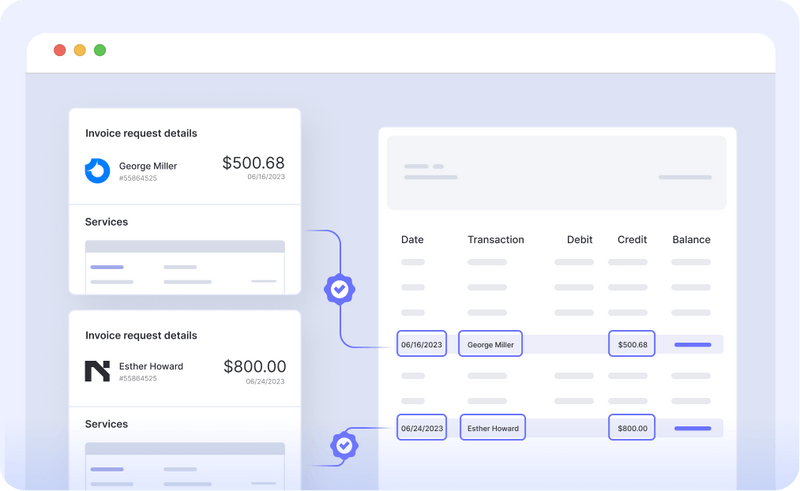

AP and AR automation tools like Nanonets can automate invoices, track payments, and send reminders, increasing efficiency and reducing manual errors. This optimization of accounts receivable processes can significantly improve cash flow management.

Now, the question can arise, how to do accounts receivable management? Let's find out by first understanding the accounts receivable cycle.

Understanding the accounts receivable cycle

The accounts receivable cycle, also known as the order-to-cash cycle, is a series of steps that companies follow from when a sale is made on credit to when the payment is received and recorded.

The cycle starts with creating a credit application process and ends with reconciliation and bad debt management.

Here's a brief overview of the AR cycle steps:

- Creating a credit application process: Ensures customers are creditworthy.

- Sending invoices: Details payment terms, due date, and amount owed.

- Setting payment terms: Sets a mutually acceptable due date.

- Conducting monitoring and AP reporting: Tracks outstanding invoices and their performance.

- Recording AR activity: Logs invoices, payments, and adjustments.

- Receiving customer orders: Processes product or service orders.

- Approving credit: Evaluates and approves customer credit.

- Dispatching invoices: Sends invoices for credit purchases.

- Collecting payments: Direct collections or follow-ups for unpaid dues.

- Depositing funds: The received funds are deposited and recorded.

- Reconciliation: Comparing the recorded AR with the actual cash received.

- Bad debt management: Writing off non-collectable amounts and managing bad debts.

This cycle helps maintain a smooth cash flow, ensure timely payment, and manage credit sales effectively. By understanding and implementing this cycle, businesses can improve their financial health and customer relationships.

The importance of accounts receivable aging

Accounts receivable aging is a method to categorize unpaid invoices based on their due dates. It helps businesses identify overdue payments and take necessary actions. It is a valuable tool to assess a company's financial health and the effectiveness of its credit policies.

Unpaid invoices are typically classified into 30, 60, 90, and beyond 90-day time frames. This aids in pinpointing customers with pending payments and enables prompt action for debt recovery. Managing this process well minimizes bad debts and enhances financial stability for the business.

The aging report provides a clear picture of the company's cash flow and highlights which customers owe the most money and for how long. This information can be used to refine credit policies, improve collection strategies, and make informed business decisions.

Calculating AR turnover

The accounts receivable turnover ratio is a key measure of a company's efficiency in collecting payments. It's calculated by dividing net credit sales by the average accounts receivable over a set period.

This ratio sheds light on how well a company's credit policies work and how fast it collects payments. A higher ratio means fast collections, while a lower one suggests a need for improvements. By watching this ratio, companies can spot trends, set suitable credit terms, and strategize to boost turnover.

| Key Metrics | Formula |

|---|---|

| Accounts Receivable Aging | Outstanding Amounts by Due Date |

| Accounts Receivable Turnover | (Net Credit Sales) / (Average Accounts Receivable) |

Accounts receivable vs. accounts payable

Understanding accounts receivable and accounts payable is crucial in business. Simply put, accounts receivable is what customers owe you, while accounts payable is what you owe suppliers.

Accounts receivable is an asset on your balance sheet. It's the revenue you've earned but haven't yet collected. Effective AR management keeps cash flow healthy and ensures timely payment.

In contrast, account payment is a liability. It's what you owe suppliers for goods and services. Paying these on time maintains good relationships and avoids penalties. In the balance sheet, "trade payables" another term for accounts payable are recorded under current liabilities.

| Accounts Receivable | Accounts Payable |

|---|---|

| Money owed to the company | Money owed by the company |

| Represents an asset on the balance sheet | Represents a liability on the balance sheet |

| Reflects revenue earned but not yet received | Reflects expenses incurred but not yet paid |

Managing AP and AR effectively is key to your business's financial health. This requires:

- Clear invoicing procedures

- Efficient payment tracking

- Timely collections

- Regular reconciliations

- Rigorous credit checks

- Streamlined payment processes

- Proactive supplier management

Understanding the intricacies of both AR and AP can help a business improve its cash flow, maintain good relationships with both customers and suppliers, and ultimately, enhance its financial stability and growth.

Strategies for encouraging timely payments

Your business can face cash flow issues if you don’t receive timely payments. But at the same time, maintaining a positive relationship with your customers is crucial. So how to do accounts receivable management?

This means you must be more strategic and proactive in your approach to encourage timely payments without alienating your customers.

Offer early payment incentives: This can prompt customers to pay quickly and choose your business over competitors. For instance, a 10% discount for payments made within 10 days of invoice issuance benefits both parties.

Use automated tools: Nanonets can automatically send payment reminders, flag overdue invoices, and provide real-time updates for both the business and its customers. Automated workflows not only save you time but also reduces the risk of errors and delays.

Clear and concise invoicing: Ensure your invoices are easy to understand, with clear payment terms, due dates, and contact information for any queries. This can avoid confusion and disputes, encouraging faster payment.

Flexible payment options: Offering multiple payment methods, such as credit cards, bank transfers, or digital wallets, can make it easier for customers to settle their dues. The convenience of various payment options can expedite payment processes and improve customer satisfaction.

Maintain regular communication: Keep your customers informed about their account status, upcoming payments, and any changes in your payment policies. Regular communication can foster a healthy business relationship and help prevent misunderstandings that could delay payments.

Implement a well-defined credit policy: This policy should include credit approval processes, interest rates for late payments, and the steps taken when payments are overdue. It provides a guideline for both the business and its customers, ensuring everyone is on the same page regarding payment expectations.

Train your staff: Ensure your staff is well-trained in managing accounts receivable and knows how to communicate with customers. They should be able to handle customer queries, negotiate payment terms, and follow up on overdue payments professionally.

Regularly review customer creditworthiness: Creditworthiness can change over time due to various factors like market conditions or changes in a customer's financial position. Regular reviews of a customer's credit score, payment history, and overall financial health can help you adjust credit terms accordingly and reduce the risk of non-payment.

Timely collection of owed funds ensures smooth daily operation and provides resources for future growth. Stay proactive in managing receivables for a healthy business.

Utilizing AR software to streamline processes

How do you manage your accounts receivable efficiently? The answer lies in leveraging technology and using accounts receivable software.

These software simplifies the accounts receivable management process, providing real-time insight into customer payment behavior, tracking invoices, and automating follow-ups.

This software is designed to reduce manual work, minimize errors, and speed up collections, thus improving cash flow.

Here are some benefits of using accounts receivable software:

Automated accounts receivable processes: The software automates routine tasks such as invoice generation, reminders for overdue payments, and tracking of payment status. This ensures accuracy, saves time, and allows your staff to focus on other strategic tasks.

Real-time data and analytics: With accounts receivable software, you get instant access to all AR data. This includes detailed reports on customer payment history, overdue invoices, and overall AR status. This data can provide valuable insights and help you make informed decisions to optimize your cash flow.

Improved customer service: The software can provide a self-service portal for customers where they can view their invoices, payment history, and make payments. This enhances customer experience, speeds up payment, and reduces the workload of your customer service team.

Increased security: Enhanced security features of accounts receivable software help protect sensitive customer and business information. This includes encryption, secure payment gateways, and access controls, ensuring that your financial data remains safe and confidential.

Integration with other business systems: Accounts receivable software can integrate with other business systems such as CRM, ERP, or accounting software. This allows for seamless data flow and coordination between different departments, streamlining business operations and ensuring consistency in data.

Scalability: As your business grows, the volume of invoices and payments can increase significantly. Accounts receivable software is scalable and can handle high volumes of data, providing the necessary flexibility to meet the evolving needs of your business.

Compliance: The software helps maintain compliance with financial regulations and standards like GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards). It ensures accurate record-keeping and generates necessary reports for audit purposes, making it easier to adhere to financial laws and guidelines.

24/7 Accessibility: Most accounts receivable software is cloud-based, meaning you can access your accounts receivable data anytime, anywhere. This provides flexibility and ensures that you always have up-to-date information at your fingertips.

Automate AR management with Nanonets

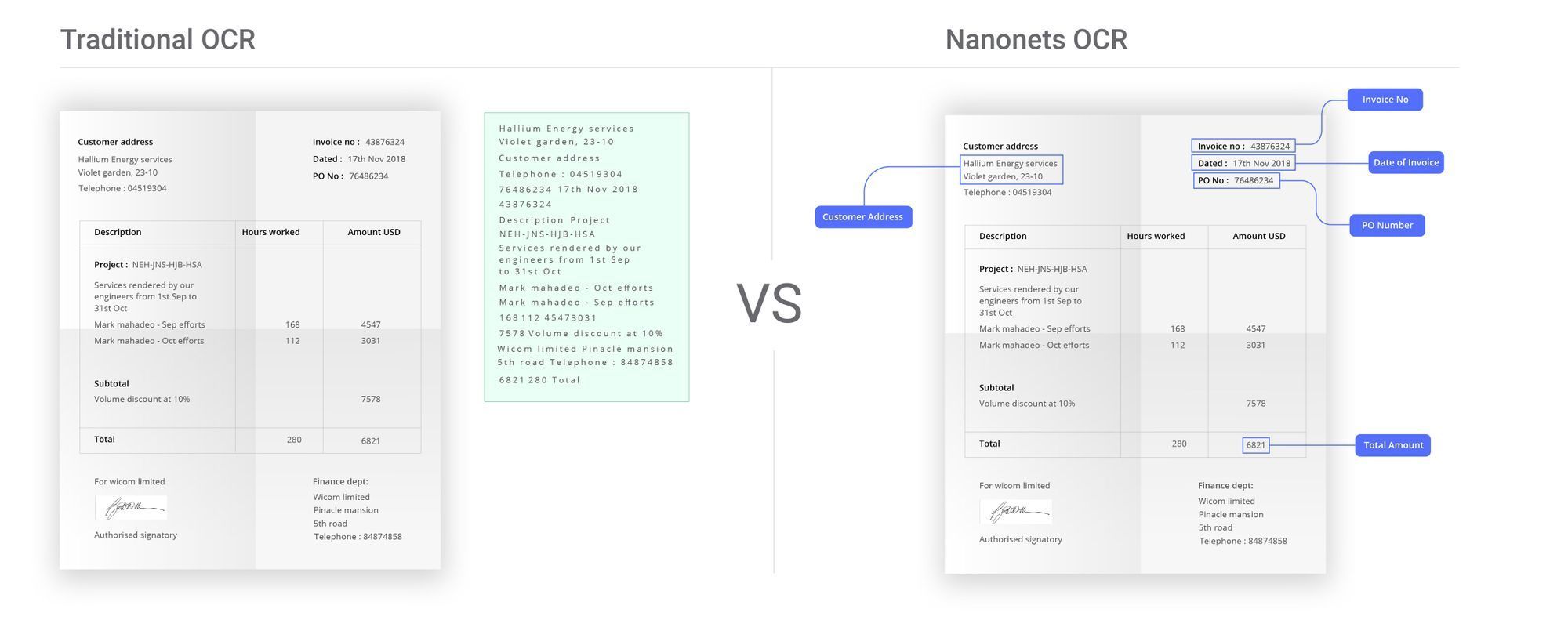

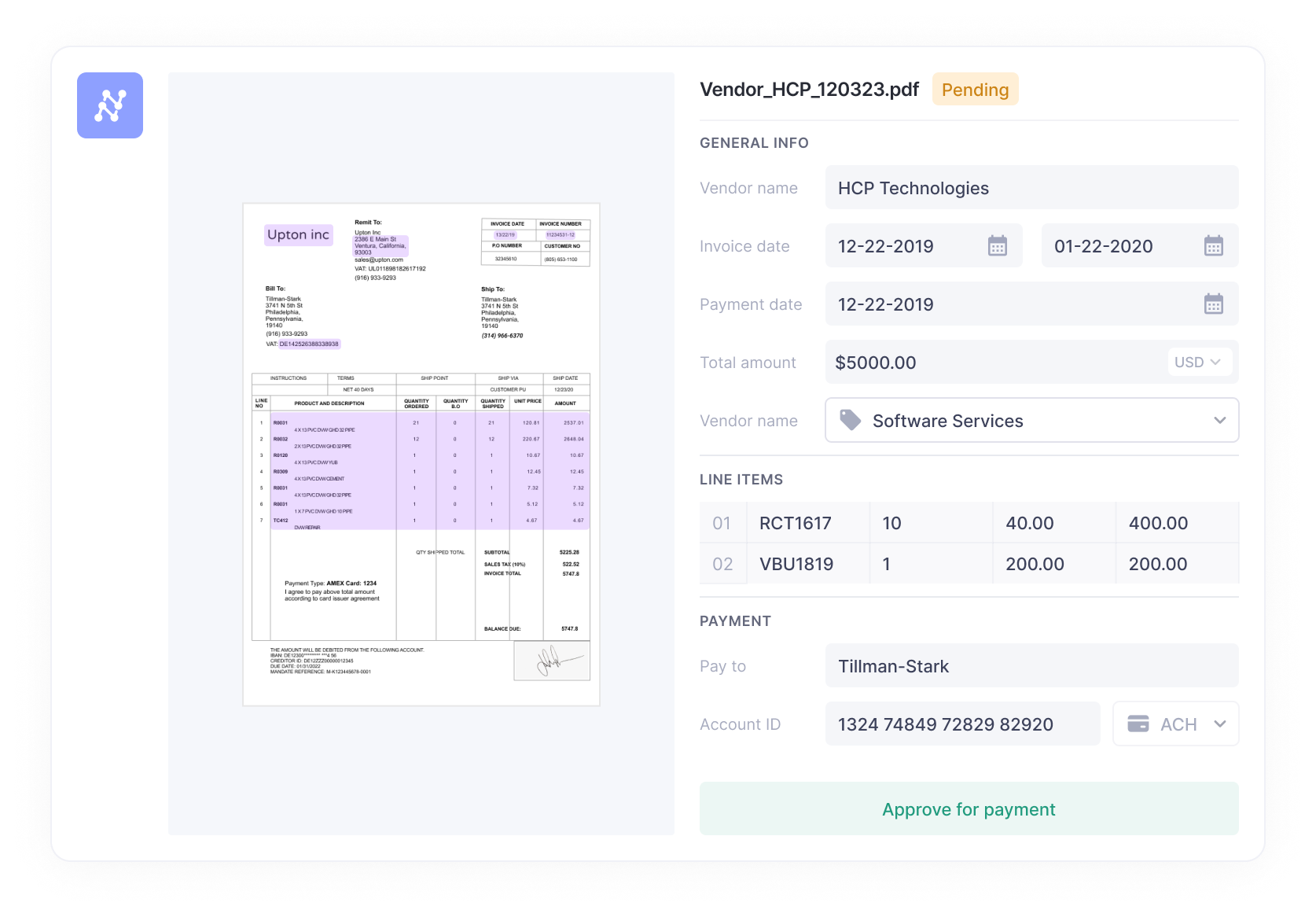

Nanonets offers an AI-based, no-code accounts receivable automation solution that can transform the way you manage your receivables. It combines Optical Character Recognition and AI technology to quickly and accurately extract data from invoices and other documents, reducing manual data entry and improving efficiency.

By deploying Nanonets to automate your accounts receivable, you can achieve the following:

- Set up predefined rule-based or customizable workflows that automates accounts receivable processes from invoice generation to payment collection.

- Create rules for flagging invoices that need special attention during collections, ensuring no invoice slips through the cracks.

- Streamline communication with customers through automated reminders and notifications about their invoice status and payment dues.

- Improve customer service by providing them with a self-service portal where they can view, verify, and pay their invoices online.

- Ensure data accuracy and security with robust encryption and access controls, safeguarding your sensitive financial data.

- Seamlessly integrate with accounting software like Xero, QuickBooks, and Sage, and other important tools like Zapier, Google Drive, SAP and more, for streamlined data flow and improved operational efficiency.

- Get real-time insights and reports on your accounts receivable status, enabling proactive decision making and improved cash flow management.

- Automate invoice validation, matching, and reconciliation, reducing manual errors and speeding up the payment process.

- Maintain compliance with financial regulations and standards with automatic record-keeping and audit trail generation.

- Access your accounts receivable data anytime, anywhere with a cloud-based solution that is accessible 24/7.

That’s not all. The AI model learns from every manual correction and interaction, getting smarter and more efficient over time. It adapts to your specific business needs, providing a tailored solution that can significantly enhance your accounts receivable management.

With Nanonets, you can provide your customers with a seamless, efficient payment experience, while improving your own financial management and cash flow health. Moreover, it frees your staff from time-consuming manual tasks, allowing them to focus on strategic initiatives that drive your business forward.

The importance of cash flow management

Cash flow management is vital for businesses. It's about having enough to meet costs, invest in growth, and pay debts on time. Key metrics like accounts receivable turnover and days sales outstanding offer crucial insights.

Accounts receivable turnover shows how well a business collects customer payments. It's simply your net credit sales divided by your average accounts receivable for a given period. The higher the ratio, the quicker you're being paid. Regularly monitoring this ratio can highlight any collection issues.

Days sales outstanding (DSO) is the average time taken to collect payment post-sale. Lower DSO means faster payment and healthier cash flow. Using DSO, businesses can spot trends and make necessary changes to their collection process.

| Metric | Formula | Interpretation |

|---|---|---|

| Accounts Receivable Turnover Ratio | Net Credit Sales / Average Accounts Receivable | A higher ratio indicates efficient payment collection. |

| Days Sales Outstanding (DSO) | (Accounts Receivable / Average Sales per Day) | A lower DSO indicates faster payment collection. |

Businesses need proactive accounts receivable management. Clear payment terms, effective communication, and timely collection are essential. Monitor your accounts, chase overdue invoices and maintain effective credit control to ensure healthy cash flow.

Through efficient accounts receivable management, businesses can enhance cash flow, lessen financial risk, and set themselves up for long-term success.

Overcoming cash flow challenges with AR financing options

Cash flow problems? Accounts receivable financing options like factoring and invoice discounting can help. Factoring is selling your unpaid invoices to a third party for immediate cash. Invoice discounting is borrowing against your unpaid invoices. Both can boost cash flow fast.

Immediate access to cash is a big plus point of accounts receivable financing. It's particularly beneficial for small businesses struggling to secure traditional bank loans. It's a quicker, more flexible way to get working capital.

Accounts receivable financing can also bring financial stability. It turns unpaid invoices into cash, helping businesses manage expenses and avoid liquidity issues.

| Accounts Receivable Financing Options | Benefits |

|---|---|

| Factoring |

|

| Invoice Discounting |

|

The impact of AR on business finances

Accounts receivable management is vital for your business's financial health, cash flow, and profitability. It's a key part of revenue generation and customer payment collection. It directly affects your cash flow cycle, essential for business vitality.

The accounts receivable turnover ratio shows how fast you collect payments. High ratio? Good collection. Low ratio? Might have collection issues or slow payers.

Days sales outstanding (DSO) is another crucial indicator. It shows the average time it takes to collect payments. A high DSO may strain your cash flow, complicating your ability to meet financial obligations. Minimizing DSO and speeding up collections are crucial for healthy cash flow.

How to do accounts receivable management better? Consider strategies to motivate timely payments. Early payment discounts or late payment penalties could spur customers to pay swiftly. Clear, detailed invoicing can prevent misunderstandings and payment delays.

Consider automating tasks like invoice creation, payment tracking, and reminders with Nanonets. This could lessen errors, boost efficiency, and improve overall cash flow management. Adopting tools that integrate well with your accounting software allows you to concentrate more on core operations and strategic growth.

| Key Performance Indicators | Definition | Importance |

|---|---|---|

| Accounts Receivable Turnover Ratio | Measures the speed of collecting payments | Indicates efficiency of collections |

| Days Sales Outstanding (DSO) | Measures the average time to collect payments | Highlights cash flow efficiency |

Final thoughts

Understanding and managing accounts receivable is vital for a company's financial health. It's the key to maintaining cash flow and achieving sustainable growth.

Here’s hoping this guide has shed some light on the importance of effective AR management and how you can implement it in your business. Remember, it's not just about getting paid, but getting paid on time.

By implementing clear policies, regular monitoring, and proactive communication, you can ensure timely collections and maintain healthy cash flows. Automate where possible to reduce errors and enhance efficiency.

Using accounts receivable financing can help overcome cash flow challenges, providing immediate access to funds, financial stability, and flexibility. It's a practical solution for businesses, particularly SMEs, struggling with liquidity issues.

Want to learn more about how Nanonets can improve how you do accounts receivable management? Schedule a demo today. Take a step towards better financial health and enhanced business performance now.

FAQs

1. What do you mean by accounts receivable?

AR refers to the money a company owes its customers for goods and services provided on credit. It is a legally enforceable claim for payment held by a business for products supplied or services rendered to customers.

2. What is an example of accounts receivable?

An example of AR would be if a wholesaler sells a product to a retailer on credit. The wholesaler would then record the cost of the goods and services sold as AR until the retailer pays for them.

3. What is the difference between AR and AP?

AR refers to the money owed to a company by its customers, while AP is the amount a company owes to its suppliers or vendors for goods and services received. In short, AR is money coming in, and AP is the money going out.

4. Is accounts receivable a debit or credit entry?

AR is a debit entry. When a sale is made on credit, a debit entry is made to AR to signify that money is owed to the company, increasing the AR balance.

5. What is meant by account receivable?

AR is the amount owed to a business by its customers who have purchased goods or services on credit. It is considered an asset on the company's balance sheet.

6. What are the 4 types of account receivable?

The four types of AR are trade receivables, notes receivable, non-trade receivables, and employee receivables. Trade receivables occur from regular business operations, while notes receivable are formal credit arrangements. Non-trade receivables arise from non-business transactions, and employee receivables are from employees for advances or loans.

7. What is the purpose of the accounts receivable?

The purpose of the AR is to track all outstanding invoices a company has with its customers. It's a key component of a firm's working capital and cash flow. Effective AR management can help maintain healthy cash flow, meet financial obligations, and support business growth.

8. What is meant by accounts receivable management?

AR management refers to the set of practices, procedures, and policies used by a company to manage the money it is owed by its customers. This includes invoice creation, payment tracking, reminder systems, and strategies to motivate timely payments, such as early payment discounts or late payment penalties.

9. What are the five steps in managing accounts receivable?

The five steps in managing AR include: Establishing credit practices, sending detailed invoices promptly, regularly monitoring receivables, maintaining proactive communication with customers, and utilizing accounting software and automation tools to streamline invoice creation and payment tracking.

10. What is an example of accounts receivable management?

An example of AR management could be a company implementing a credit policy that includes thorough credit checks on potential customers. This company might also use an automated system for sending invoices and payment reminders and regularly review its accounts receivable aging report to identify and address late payments.

11. What are the three types of receivables?

The three types of receivables are accounts receivable, notes receivable, and other receivables. AR are amounts owed by customers for goods or services purchased on credit. Notes receivable are amounts owed by parties who have confirmed their debts in writing. Other receivables include non-trade receivables like interest receivable, tax refund receivable, and insurance claims receivable.