For small businesses, effective cash management is more than a financial imperative – it’s key to survival. That’s why effective accounts payable management are linchpins to long-term cash management. Luckily, digital advances like artificial intelligence and cloud computing are bringing mega-corp accounting solutions to Main Street.

A range of solutions and platforms exist, but make sure your selection works for you – all businesses are unique with platforms able to adapt to their needs, and ensuring your needs are met before a long-time commitment is the best way to squeeze as much value from your small business accounts payable software.

Specific Challenges Small Businesses Face & How AP Software Can Help

Small businesses face a range of unique challenges and problems stunt growth and stall efficiency. Unfortunately, many education resources tend to skip over these unique problems in favor of those faced by larger, enterprise-level operations. And why not? By comparison, SMB issues are small potatoes – but that isn’t the case if you’re a small business owner trying to navigate scale-specific issues on your own.

For some issues, though, implementing AP software goes a long way toward minimizing some of the more severe and crippling issues. Some of the issues that are devastating as you face them include:

1. Manual data entry and inevitable errors: AP software automates data capture, integration, and storage – ensuring its integrity and cutting down on user error.

2. Late payments and fees: By using automated scheduling within AP software, SMBs can stay on top of payment windows, avoid late payments, and even maximize early payment discounts.

3. Inefficient paper systems: Accounting is one of the few domains that paperless society goals have yet to fully penetrate; digitizing operations through AP software helps eliminate the need for excess paper, increases efficiency (especially for remote or dispersed teas), and is more eco-friendly.

Other, more impactful, challenges include:

Challenge #1: Limited Resources

Small businesses often have limited financial resource and human capital, making margin management paramount to long-term success and growth.

How small business AP software can help: AP software helps solve resource challenges by automating common accounting tasks, reducing the burden on human staff so they can better devote time elsewhere and generally facilitating better resource allocation.

Challenge #2: Data Entry & Processing

We hit this one briefly above, but it bears reiterating. Manual data entry and document processing is time-consuming, prone to errors, and tends to stack up until we really need to get to it – compounding errors as we rush through data entry.

How small business AP software can help: AP software automates data entry and processing, reducing time spent (improving resource allocation) and cutting down on your error rate to improve compliance and reduce the risk of fines, audit, or unhappy vendors.

Challenge #3: Vendor Management

Speaking of vendors, vendor management is a common struggle for SMBs juggling multiple or complex supplier relationships. Maintaining quality vendor relationships is key to success, but managing multiple can be difficult and time intensive.

How small business AP software can help: AP software simplifies vendor management by organizing vendor information, tracking payment history and due dates, automating communications, and storing all documentation to improve vendor management efficiency.

The best accounts payable software for small businesses

Once you’ve completed this assessment, you should know what you're looking for in accounts payable software. The next step is to compare the various software options available.

Here’s a short list of some excellent accounts payable software solutions for small businesses to consider:

1. Nanonets accounts payable automation

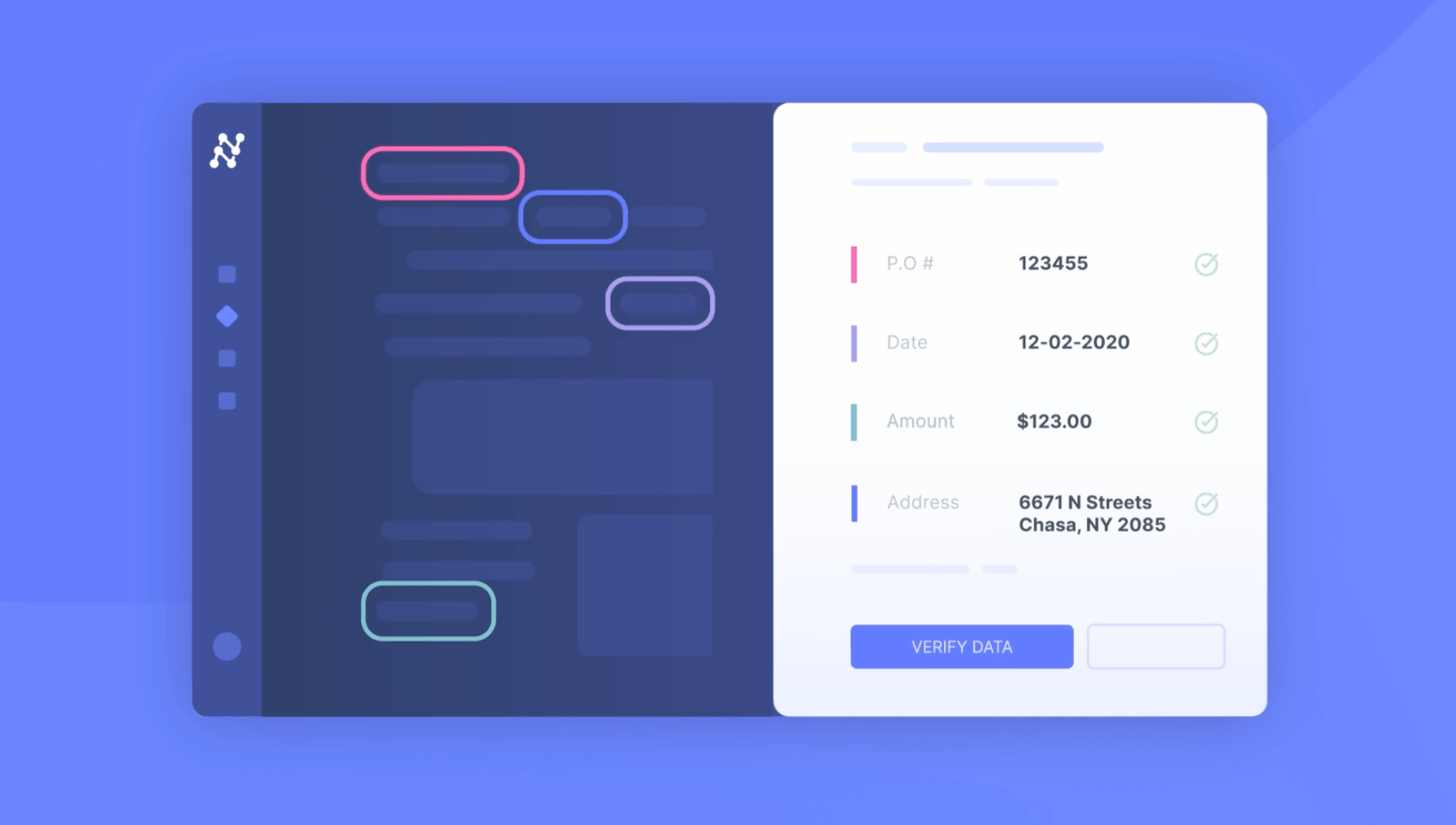

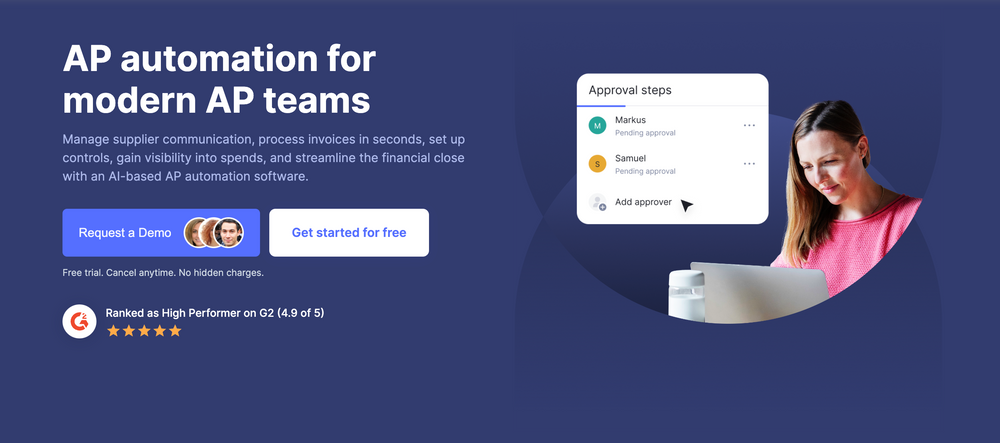

Nanonets’ integrated accounts payable automation delivers an SMB one-stop shop for invoice management, workflow creation, and bespoke integration while offering a cloud-based solution to process a wide range of invoice formats, languages, and structures, ultimately enhancing accounts payable efficiency.

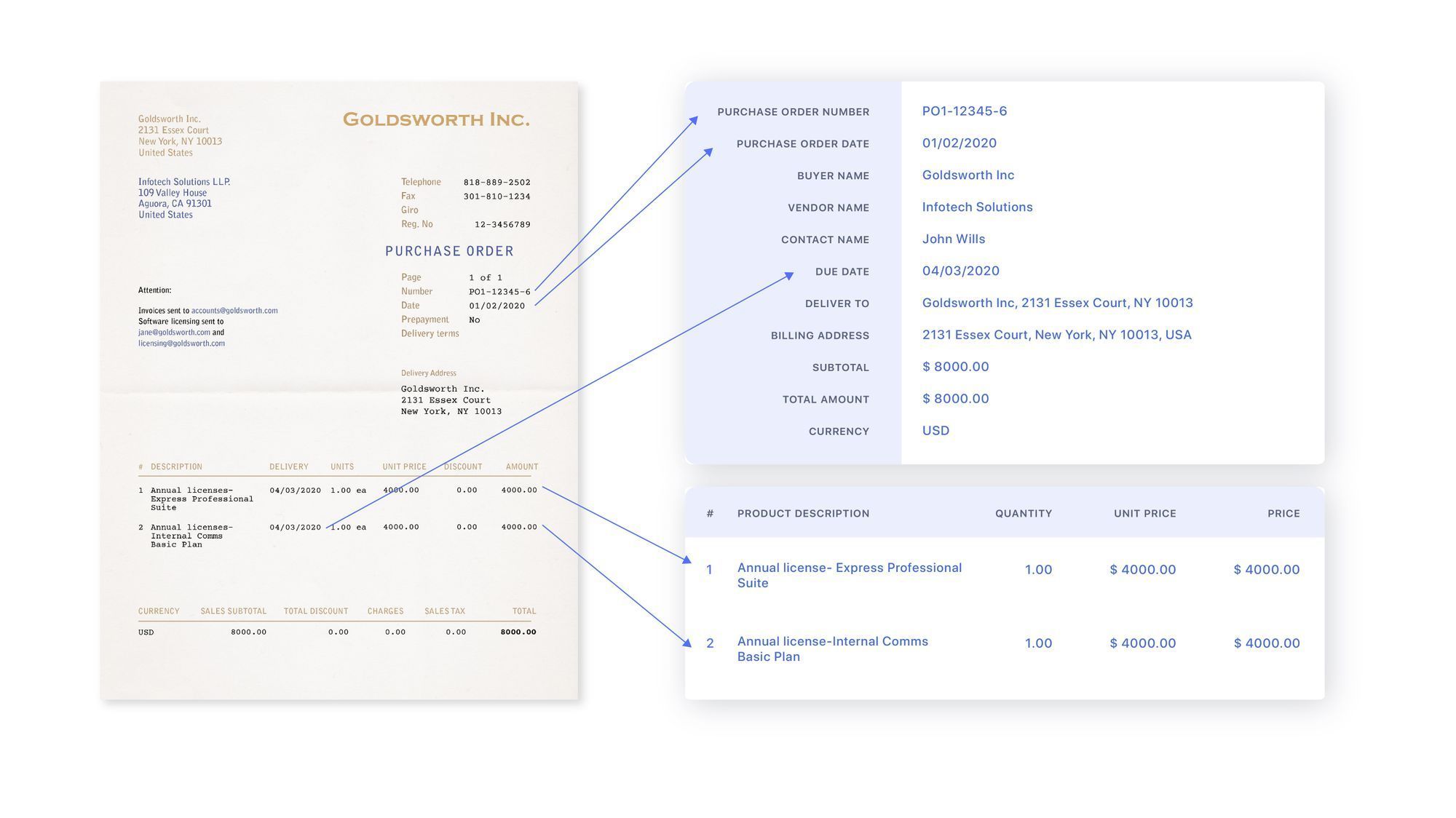

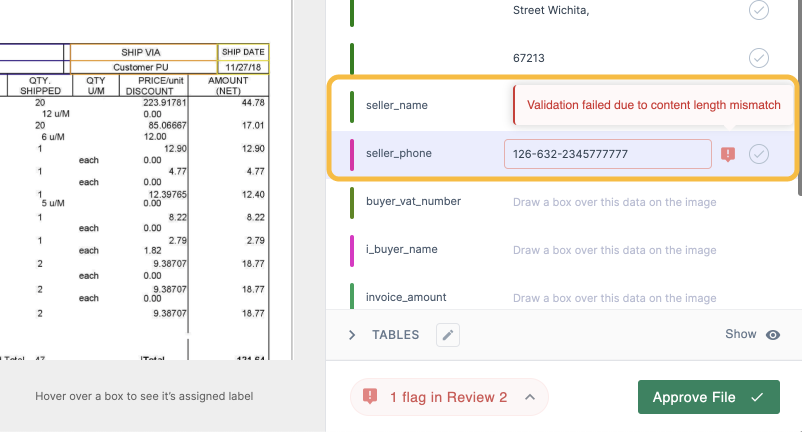

Nanonets offers small businesses tools to refine data collection and processing from invoices, receipts, and purchase orders, significantly reducing manual data entry and increasing accuracy. The platform's AI capabilities extends to data verification, aligning invoices with purchase orders, and automating the approval process, all contributing to heightened efficiency and fewer errors. With the ability to import invoices in bulk from an array of sources such as Gmail, Google Drive, SharePoint, and Dropbox—and with Zapier triggers for automatic updates—Nanonets ensures a steady and manageable influx of billing data.

Nanonets also exports processed invoices and accounts payable management across popular accounting systems, including Xero, SAP, Sage, and QuickBooks, which minimizes manual input and ensures data integrity. Automated reminders, task assignments, and follow-ups are part of the package, keeping all stakeholders informed and engaged through transparent dashboards and notifications.

Nanonets makes it easy to extract data and integrate it into various formats like CSV, JSON, and XML, streamlining data analysis. It accelerates the approval and payment process by automating workflow distribution, providing customizable approval hierarchies, and implementing auto-payment rules alongside built-in payment gateways. Compliance is also a key feature, with built-in 3-way matching for invoices, purchase orders, and delivery receipts, automatic archiving, audit trails, and role-based access controls in place.

The system is designed to automatically update SKU-level information and match supplier and general ledger codes in ERP systems, which helps reduce errors and refine overall financial management. For vendors, the process is made stress-free with automated invoice importation, status updates, and timely payments, all of which cultivate stronger vendor relationships.

For small businesses with an international footprint or ambitions to expand, Nanonets is equipped to handle multi-currency and multi-language invoicing, a crucial feature for global commerce. Stand-out qualities of this system include its adept handling of both structured and unstructured documents, multi-currency and multi-language support, advanced AI for precise data extraction and validation, and customizable workflows and approval processes, all of which combine to make Nanonets a comprehensive, future-ready accounts payable automation solution.

Pricing

You’ll be able to process 1 – 500 invoices for free, with subsequent documents costing $0.30 each. If your small business trends toward the larger side, the Pro plan offers up to 5,000 pages for just $499 monthly.

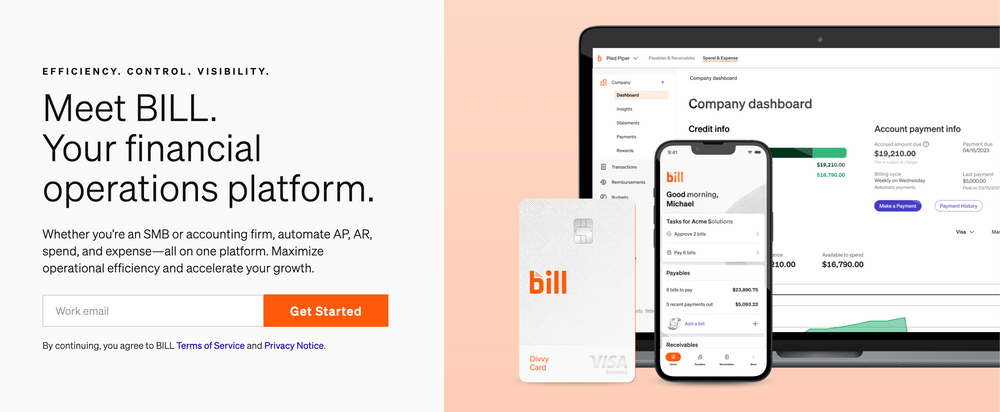

2. Bill.com

Bill assists small and medium-sized businesses with financial management by providing a cloud-based solution for accounts payable and receivable that streamlines and automates an SMB’s back-office operations. The tool lets businesses create, dispatch, receive, and oversee invoices, cutting down on manual data entry time and capital expense.

It streamlines small business’ payment processing by automating approvals and reminders, helping businesses manage their cash flow more effectively and ensure prompt transactions. Integration is a breeze with BILL, as it syncs smoothly with widely-used accounting software and ERP systems, maintaining data continuity.

Users enjoy accessible convenience through any device, granting the flexibility to manage finances on the go. The platform caters to global business needs with international payments features, simplifying transactions with overseas vendors no matter how remote.

Additionally, BILL enhances accountability and transparency by providing a detailed audit trail of invoice and payment activities. With its user-friendly interface, robust integration options, efficient invoice and payment tracking, and solid customer support, BILL stands out as an invaluable tool for financial management.

Pricing

BILL offers separate AP/AR platforms that can be bundled under a single account. AP/AR bundling is $79 per user monthly, with discrete packages of either starting at $45 per user.

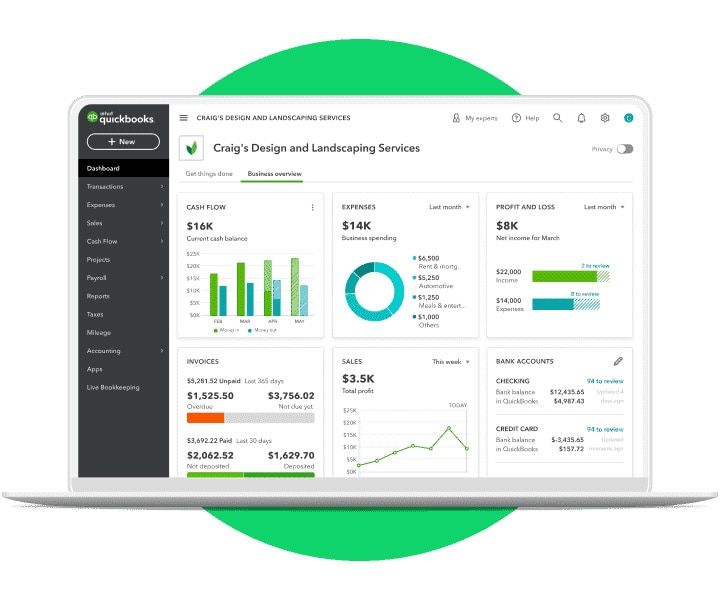

3. QuickBooks by Intuit

QuickBooks delivers a wide-ranging and popular series of accounting solutions that extend well beyond accounts payable, featuring an intuitive interface and powerful tools designed to aid small businesses in managing their finances with greater efficiency.

QuickBooks’ software lets businesses monitor income and expenses meticulously, providing a transparent view of their financial health. It comes equipped with advanced reporting tools to manage cash flow effectively. QuickBooks also offers the convenience of accepting credit card and bank transfers on the go with a complimentary GoPayment card reader, increasing timely payment rates and improving cash flow.

Likewise, running payroll becomes a swift and error-free process, whether done independently or through the Full Service Payroll upgrade. The software simplifies the tracking of employee and billable hours, fostering proactive overtime management and smooth payroll and invoicing processes.

Small businesses can also collaborate with QuickBooks Live Bookkeeping for expert, US-based support, ensuring their financial records are consistently accurate and up-to-date. Data accessibility is a breeze, with the flexibility to access information across devices at any time. QuickBooks streamlines invoice importation and accounts payable management, automating essential tasks for precision and reliability. Standout features of QuickBooks include its comprehensive approach to financial management, a straightforward and user-friendly interface, robust cash flow management and reporting tools, and the ease of tracking income, expenses, and billable hours, making it a top-tier choice for financial software.

Pricing

QuickBooks offers a range of price points designed to meet your SMB where they need you. Their Simple Start package starts at $15 per month, but most small businesses with get the most value from starting with the Plus Plat at $45 monthly.

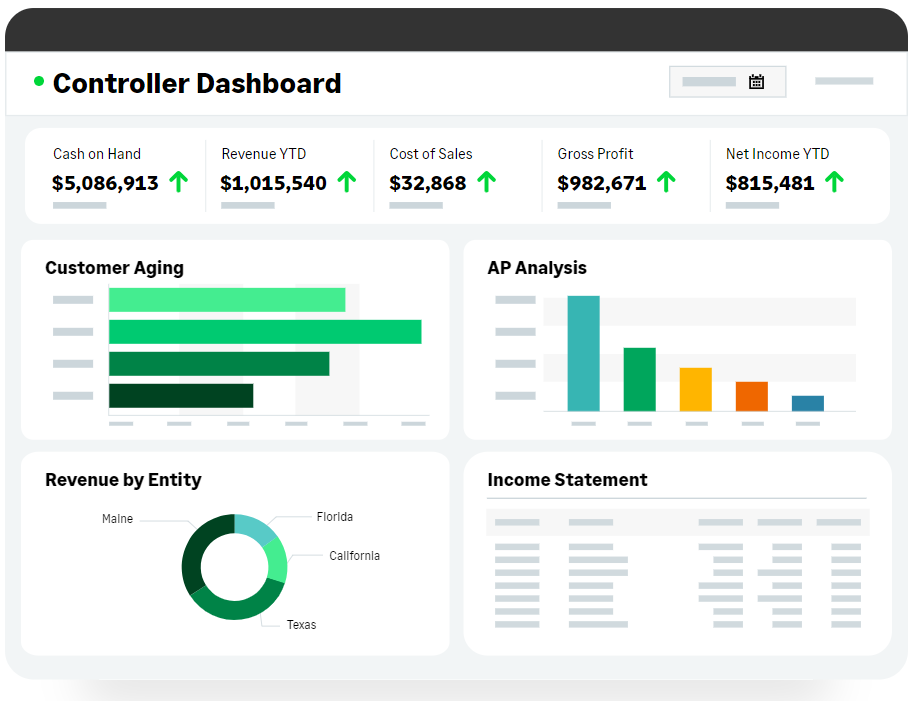

4. Sage Intacct

Sage Intacct is a robust accounting software that is well-liked for accounts payable management. A cloud-based platform, Sage Intacct offers a variety of features made for small businesses that want to streamline their financial operations. With Sage Intacct, companies can manage and tailor approval workflows to their needs, setting appropriate spending limits across various departments and exerting greater control over expenditures.

Automation is a key benefit, minimizing errors and conserving valuable time. For businesses with a global footprint, the software's ability to manage multi-currency conversions and local tax reporting is invaluable.

Beyond the basics, Sage Intacct provides advanced modules that extend into payroll, HR, planning, and analytics, thereby furnishing a well-rounded financial management toolkit.

Sage Intacct’s standout features include its broad spectrum of financial management tools, advanced modules for various financial operations, customizable accounts payable workflows offering enhanced control, capability to handle complex financial activities such as multi-currency transactions and tax reporting, and the assurance of GAAP compliance to meet regulatory demands.

Pricing

You’ll need to work with an account manager; no prices are disclosed on Sage Intacct’s public-facing page

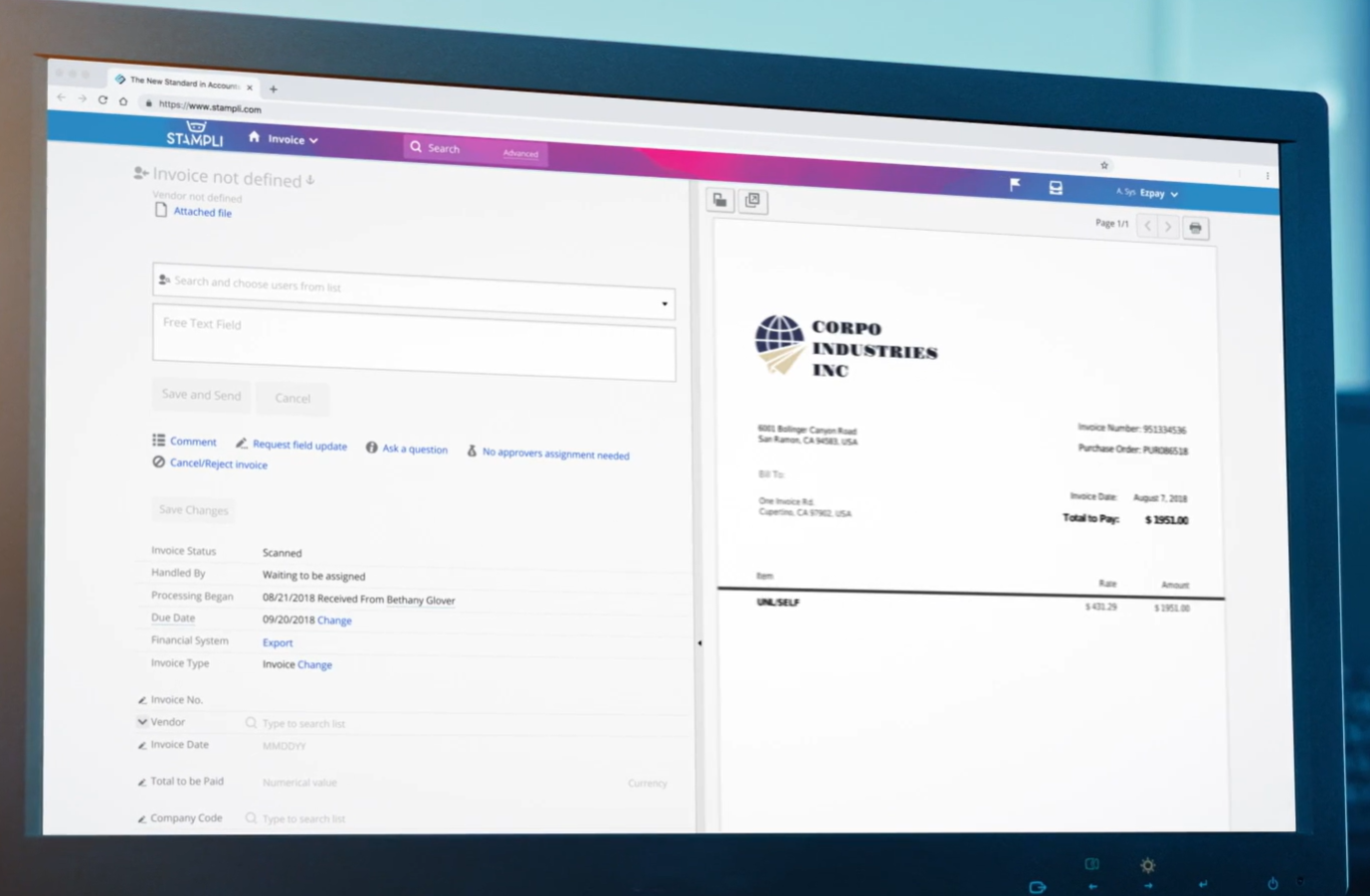

5. Stampli

Stampli is a specialized accounts payable software for of small businesses, emphasizing automated invoice processes and approval mechanisms. This system is engineered to significantly bolster the efficiency and precision of AP operations.

Employing Stampli, small businesses are equipped to automate the intricacies of invoice capture, coding, and approvals, which serves to refine the overall AP workflow. The platform consolidates invoice-related collaboration, communication, documentation, and workflows into a unified interface, simplifying interactions and tracking. Its AI technology is designed to learn and adapt to a company's specific AP procedures, taking over manual tasks to save time and reduce human error.

Additionally, Stampli simplifies purchase order management by enabling seamless 2-way and 3-way PO matches, processing of partial payments, line item adjustments, and additions within the platform itself. The comprehensive vendor management solution embedded in Stampli not only fortifies vendor relations but also ensures efficient vendor onboarding, information management, and compliance through meticulous documentation.

The software's multi-entity support is a boon for businesses that process and pay invoices across different departments, offices, companies, or geographical locations, all from a singular system. Powerful analytics and reporting tools provide immediate insights into invoices, employee performance, and the overall health of AP processes. Moreover, Stampli offers one-click access to all pertinent conversations and activities related to each invoice, thereby simplifying the audit support process and ensuring the business is perpetually prepared for audits.

Stampli distinguishes itself with an intuitive vendor management system, the capacity to support multiple business entities from a single platform, and robust analytics and reporting capabilities that together make it a formidable tool in the realm of accounts payable software.

Pricing

Stampli provides quotes upon request but does not disclose pricing on its website.

6. Airbase

Airbase offers a comprehensive accounts payable automation platform that serves as an all-encompassing solution for businesses, providing extensive capabilities for global payments, automated compliance, and immediate transparency throughout the entire procure-to-pay cycle.

Small businesses utilizing Airbase gain access to support for international currencies, enabling payments to vendors in over 200 countries using a variety of methods including ACH, checks, virtual cards, international wires, or vendor credits in more than 145 currencies. The platform's real-time synchronization with the general ledger automates compliance, ensuring precision and efficiency, which is particularly crucial during audit periods or when closing monthly accounts.

Airbase's auto-categorization feature streamlines the process of coding, tagging, and recording transactions into the general ledger, significantly easing the task of month-end bank reconciliations. It also provides a detailed banking activity report for individual transactions, simplifying the tracking and management of financials.

The collaborative nature of the Airbase platform ensures clear communication and fulfills compliance and security requirements for all stakeholders, enabling employees across different business groups to work together effectively. For complex procurement demands, Airbase's modern spend management system is well-suited for various industry needs, capturing and tracking essential data automatically for the procurement team, thus enhancing efficiency and streamlining processes.

Pricing

Airbase’s sales team is happy to assist in pricing your small business accounts payable software solution, but you’ll need to speak with them to find out – no prices are listed on its site.

7. Tipalti

Tipalti is our final look at accounts payable for small business. Tipalti is an end-to-end accounts payable automation platform designed to streamline the entire payable process for SMBs. Tipalti manages payments and handles every step including onboarding vendors and facilitating global payments, tax compliance, and reconciliation.

With Tipalti, small businesses can easily manage mass payouts across a global network of suppliers (and even influencers and unique marketing teams!), offering payment options in a multitude of currencies and methods, including ACH, wire transfers, PayPal, and more. Global payment reach is, of course, critical for small companies looking to expand their operations internationally. The software simplifies tax compliance by automating tax form collection and validation, as well as tax payment reporting, which are essential for adhering to various international tax regulations.

Tipalti's AP automation also extends to invoice processing by supporting automated invoice capture, approval workflows, and real-time payment reconciliation, which can significantly reduce the workload for accounts payable teams. The platform's integration capabilities mean that it can seamlessly connect with a multitude of ERP and accounting systems, ensuring that financial data flows smoothly and accurately across all business systems.

Pricing

Tipalti starts at $129 monthly and scales upwards based on your needs and complexity.

Which Feature Sets Should Small Businesses Prioritize When Evaluating AP Software?

Your SMB’s needs are wide-ranging, so defining a strict set of features to fit all small business accounts payable software requirements isn’t useful. Instead, we’ll look at some common core components to demand from your accounts payable automation software:

- Automated invoice and payment management: This is the bare minimum, but seek to find how accurate, timely, and trustworthy the core automation features are.

- Integration: Small business accounts payable automation software needs to work for you and with you – not the other way around. Make sure your selected software isn’t overly restrictive to your existing systems.

- Security: Cyberthreats are a real and present danger, especially when it comes to virtual finance crimes. Make sure your – and your vendors’ – information is safe.

- Overseas payment management: If you work with international vendors, you know the struggle that managing foreign transactions can be. If it applies to your business, ensuring it helps with cross-border transactions can save a ton of time and headache.

Explore: Accounts payable best practices

Which Accounts Payable Software Integrations Are Most Valuable for Smaller-Sized Businesses?

Again, integrations are business dependent. But, like we said above, your AP automation software should work within your current ecosystem, rather than forcing staff to adapt. Common integrations to validate before committing include:

- Other accounting platforms

- ERP, if applicable

- Banks and banking platforms

- Procurement/inventory management tools

- Analytics tools – some offer in-house analytics, but if you have a preference, ensure it integrates.

What benefits does accounts payable software bring to small businesses?

Managing your accounts payable as a small business owner isn’t just a waste of valuable time – it’s costing real money in terms of misallocated resources while amplifying potential for error, no matter how diligent you are. You should also expect your accounts payable software to:

1. Streamlining invoice processing: Businesses receive invoices in various formats — from paper to emails. An accounts payable software automates capturing and entering these invoices into the system, eliminating manual data entry and reducing the chances of errors.

2. Better visibility into payables: Get real-time visibility into your payables — what is the status of an invoice, when a payment is due, who approved it, mode of payment, and more. This transparency helps in better cash management and ensures timely payments.

3. Enhanced vendor relationships: Schedule and make payments on time, every time, with automated reminders and scheduling features. Accurate data extraction prevents payment amounts or details errors, ensuring no hiccups in vendor payments. This fosters trust and builds better relationships with your suppliers.

4. Improved compliance and audit trails: Detailed transaction histories, 3-way matching, and other audit trail features make it easy to maintain compliance and prepare for audits. This also helps in detecting and preventing fraudulent activities.

5. Efficient cash flow management: Features like invoice approval workflows, payment scheduling, and real-time reporting enable accounts payable software to manage cash flow efficiently. It ensures that your business has the right amount of cash in hand at the right time — no late payments, missed discounts, or duplicate transactions.

Summary

Accounts payable software is gradually bringing enterprise-level accounting solutions to small businesses. By automating the full spectrum of AP processes invoice capture, payment processing, vendor management, financial reporting, and more—these solutions are an important first step to streamlining streamlined operations. They save time and reduce human error rates while also providing insights into a business's financial health through robust analytics and AP reporting tools.

As small businesses face increasing competition and complexity in their operations, the adoption of comprehensive AP software is not just a matter of convenience but an essential requirement. It enables businesses to focus on growth and innovation while keeping reins tight on finance, ensuring that they remain cash-heavy in a restrictive economic ecosystem. Value from investing in accounts payable software are real and tangible, but the biggest benefit is time saved and put toward your real goals – growth and quality.