All businesses globally require raw materials, goods or services to be able to operate. These are essential items that could either be required to manufacture the end-product or aid operations within the business, such as, other software, services, etc. There is a general process associated with purchasing or acquiring said goods and services. It is composed of important accounting steps, which record the issuance of an order for purchase, receipt of a vendor’s invoice, verification and approvals as well as final payment and reconciliation. This is the overall Accounts Payable process.

In this article, we will be exploring the Accounts Payable process, right from understanding what the process is and the documents involved to understanding the challenges involved and the significance of automating the entire AP process.

What is the Accounts Payable process?

The “Accounts Payable” process is the general term given to a set of rules or a pattern that most businesses, irrespective of their size follow when looking to acquire raw materials, goods or services. It involves the issuance of a purchase order from the procurement department, receipt of the invoice from the supplier along with a delivery note, verification and three-way matching between the purchase order, invoice and delivery note, approval and authorization of payment, and finally, recording the payment in the general ledger for auditing purposes.

This full cycle of accounts payable process is also known as the Procure-to-Pay process and Accounts Payable forms an integral part of it. Before we dive deeper into the process, it is crucial that we understand the various documents involved in the process.

Basics: Documents involved in the Accounts Payable process

The Accounts Payable process involves three key documents, including, Purchase Orders, Delivery Notes, and Invoices.

Purchase Orders are documents issued by the procurement department of an organization that contain a written record of the goods or services requested along with the vendor details. It acts as the initiator of the process, which is then sent to the vendor or the supplier.

The vendor dispatches a written record of the goods or services delivered along with the quantity which is called the Delivery Note. It ensures that no fraudulent dealings have been carried out and that the business receives the goods supplied by the vendors.

The vendor also issues another document called the Invoice, which records the contact information for both the business and the supplier, a table encapsulating the goods or services, along with their quantities and prices captured. The invoice contains the details of taxes and other charges levied along with the final amount payable and the date by which it is due. Invoices also include QR Codes for general information and verification purposes.

There is another process that takes place here, which is termed as 3-way matching. It is basically verifying that the goods delivered (Delivery Note) are in fact the same ones as were ordered (Purchase Order) and charged for (Invoice).

Now that we have a basic understanding of the documents involved, we can delve deeper into the Accounts Payable process.

AP Process: Full Cycle

In this section, we will be dissecting the full cycle Accounts Payable process to get a complete view of how AP fits within the broader expenditure and purchasing cycle.

1. Purchase Order Issuance

The need for goods or services is identified, and a purchase requisition is created, which is reviewed and approved by the appropriate personnel. A purchase order (PO) is generated based on the approved requisition detailing the items or services to be purchased, quantities, prices, and terms It is sent to the supplier or vendor, either electronically or via mail as a formal request for fulfilment.

2. Delivery of goods/services and receipt of invoice

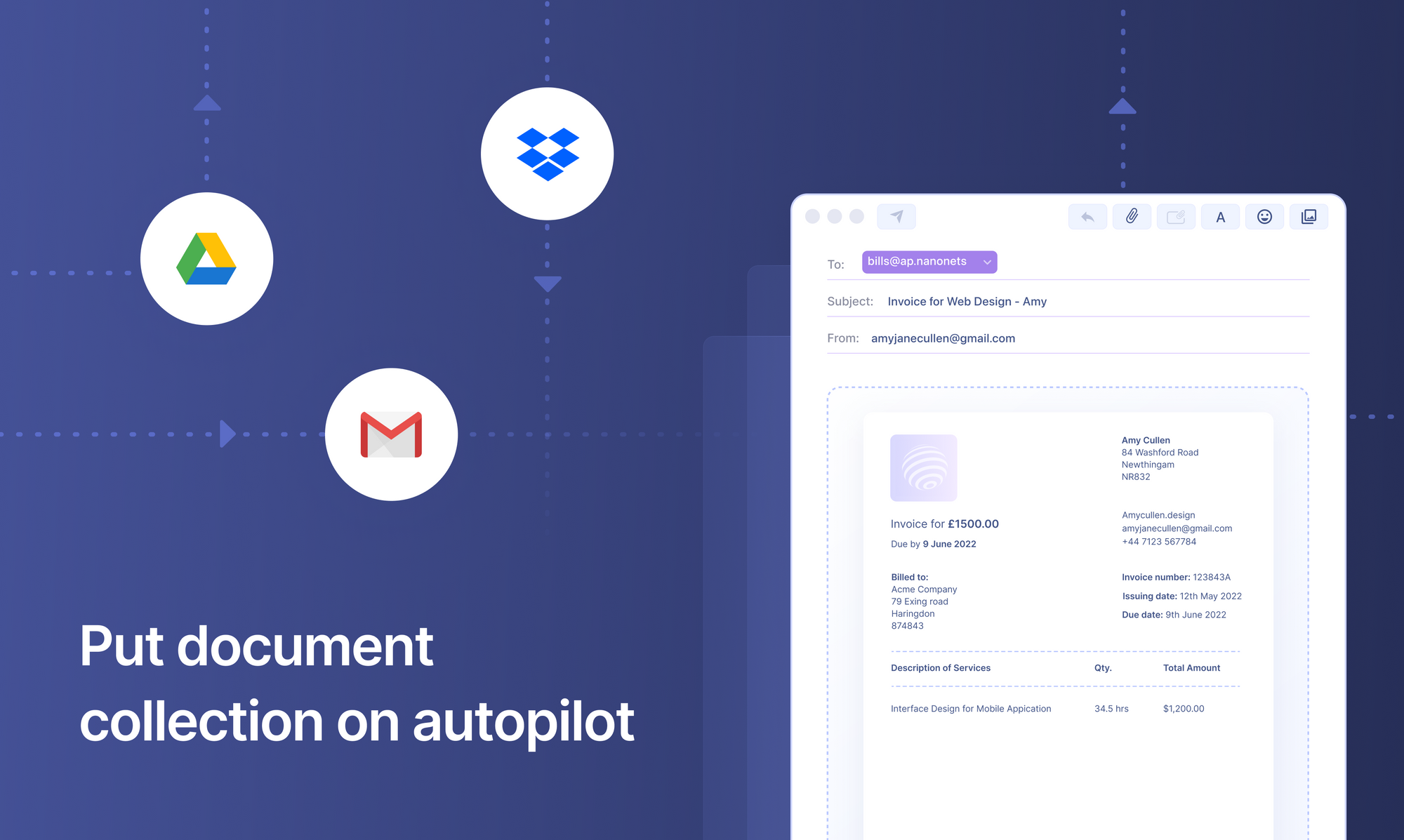

The goods or services included in the purchase order are delivered to the company along with a delivery note and an invoice. Invoices and delivery notes can be received via email, mail, or electronic invoicing systems.

3. Three-way matching

This involves ensuring the invoice details (e.g., amounts, vendor information) align with the PO and delivery note.

Read More: 3-way matching

4. Invoice coding and approval

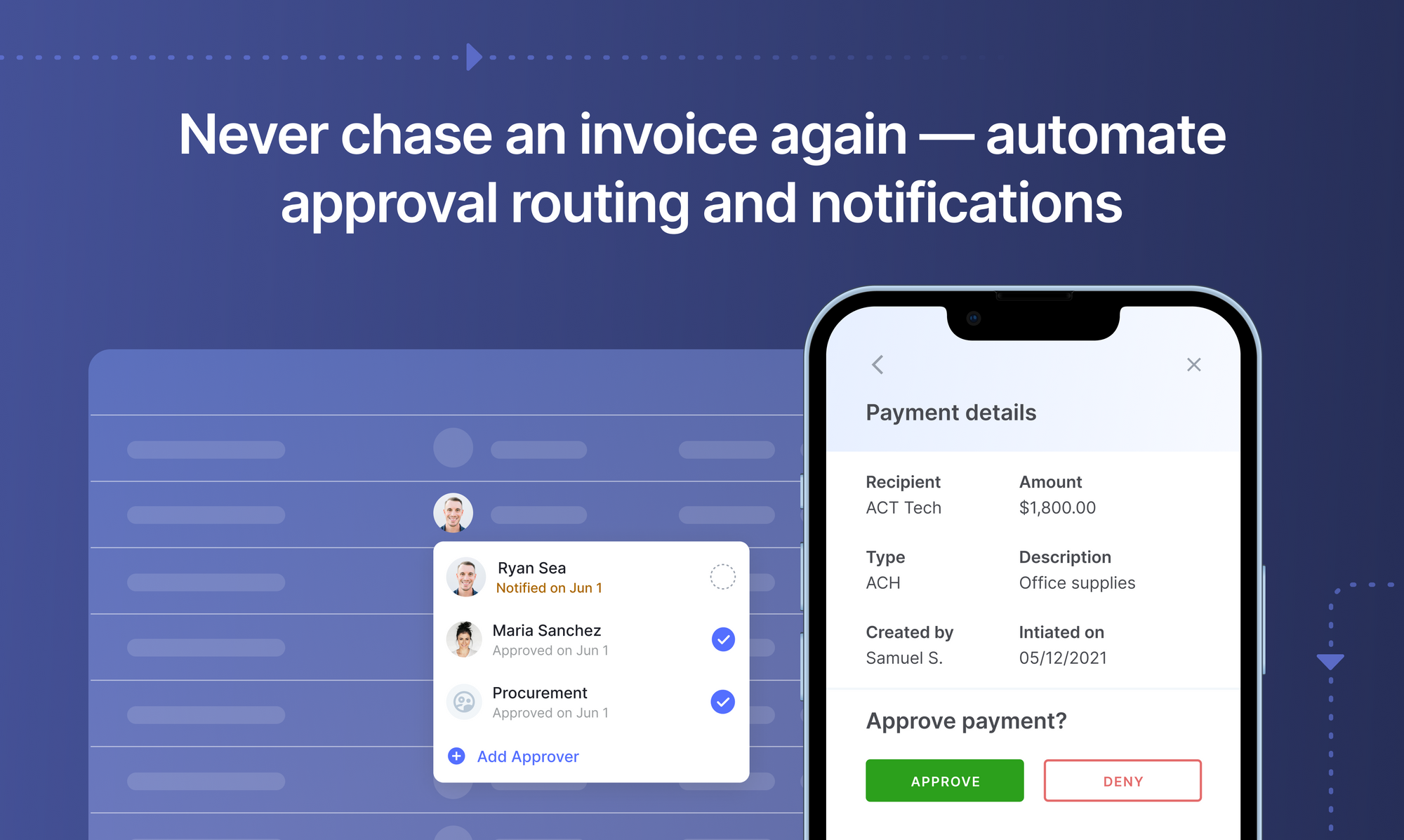

Assign appropriate general ledger codes to the invoice for accurate financial reporting, categorising expenses, and assigning costs to the correct accounts. Once completed, the invoice is routed for approval to appropriate personnel with the authorisation. This is specific to each business.

5. Payment scheduling, processing and execution

Determine the payment due date and plan the payment timing to manage cash flow and capitalise on any early payment discounts if available. Decide on the payment method (e.g., check, electronic funds transfer, ACH).

Prepare the payment according to the chosen method, including creating and issuing checks or initiating electronic transfers. Send the payment to the vendor or supplier, which involves processing through the bank or payment system for electronic payments or mailing checks.

6. Record keeping

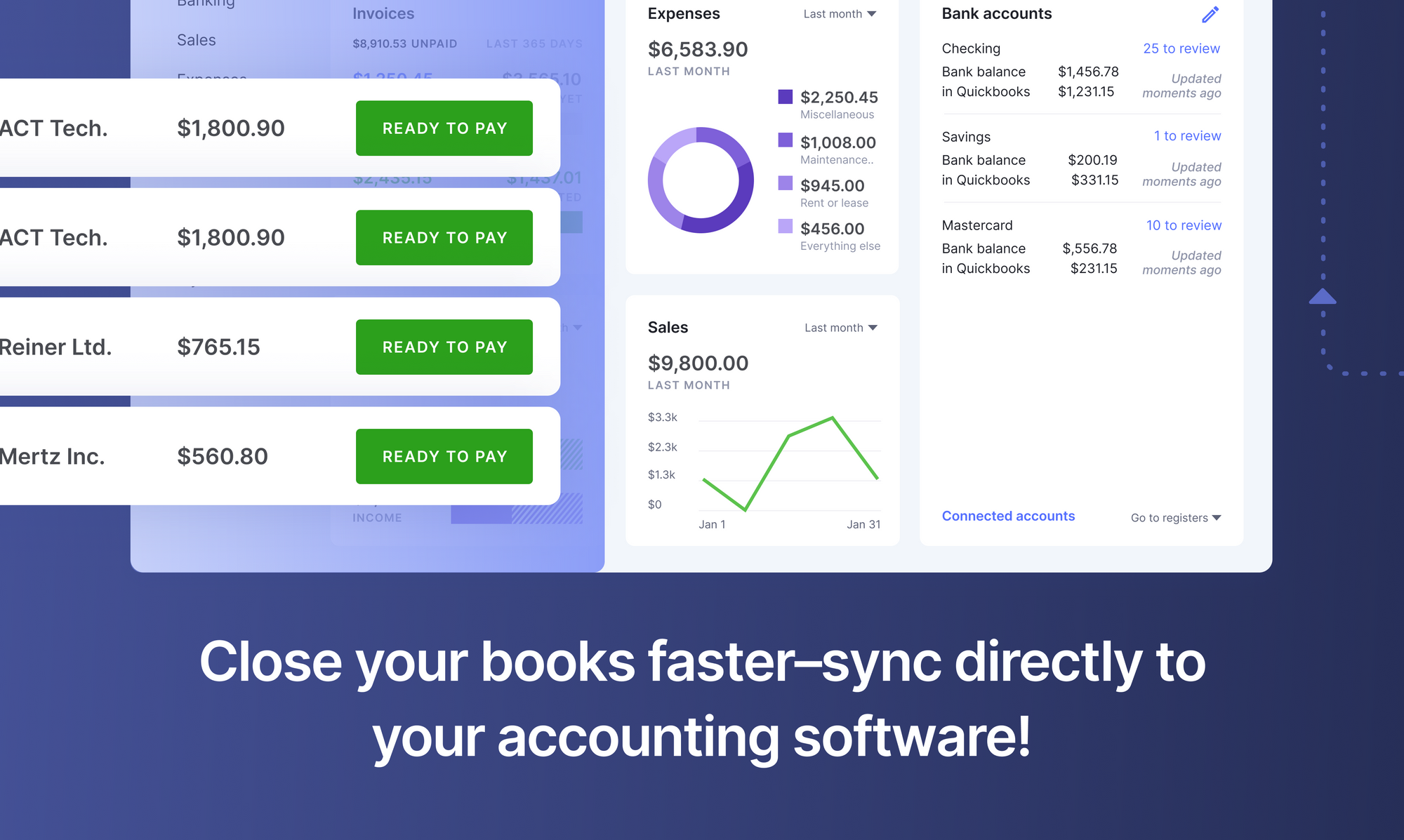

Maintain records of the payment, including copies of invoices, payment confirmations, and related correspondence. Regularly reconcile AP records with bank statements to ensure accuracy and address any discrepancies.

7. Reporting, analysis and audit

Generate reports to track outstanding payables, cash flow, and other relevant metrics as well as analyse AP data to identify trends, manage vendor relationships, and improve processes.

Implement controls to prevent fraud and ensure compliance with company policies and regulations. Conduct periodic audits of the AP process to ensure accuracy and adherence to procedures.

Challenges in the AP Process

The Accounts Payable is a fundamental process to businesses across the world. As such, it has a number of challenges associated with it. With the dwindling global economy, it is vital that vendors put measures in place to ensure the protection of their interests when entering into legally binding contracts with other businesses, such as building in late fee payments or penalties. Common challenges in AP include processing errors, missing/incorrect entries in the general ledgers, lost/misplaced/buried invoices, double entries, etc.

Let’s take a look at some of the most common challenges in this process:

1. Manual Processing Errors

Manual data entry of invoice details more often than not, results in errors. A slight discrepancy between invoices, purchase orders, and delivery dockets can lead to an interrupted workflow and unnecessary back and forth between vendors and businesses. Manual Processing is tedious, resource-intensive and time consuming and can be avoided by adoption of modern day AP automation tools.

2. Fraud and Compliance Risks

With a manual AP process, businesses run the risk of paying fraudulent or duplicate invoices. According to the Association for Financial Professionals, 0.1% to 0.5% of annual disbursements on average for any organization result in duplicate payments and while this number may seem small, it can cause significant issues on an enterprise scale. Duplicate invoices can also cause cash flow issues, compliance and auditing problems, and failure in ensuring adherence to tax laws, regulations, and internal controls.

3. Late Payments

Delays in processing and paying invoices can lead to late fee penalties. Disagreements or discrepancies with vendors regarding payments or invoice details leads to strained vendor relationships. Most vendors offer a discount on early payment of invoices from the due date. It is crucial to balance payment timing (popularly known as Days Payable Outstanding, DPO) with cash flow constraints, while optimising for discounts.

4. Scaling invoice volume and complexity

Handling a large number of invoices requires substantial time and effort. Each invoice needs to be reviewed, approved, and processed, which can lead to delays, especially when done manually. Invoices with numerous line items, varying terms, or non-standard formats require additional scrutiny. Complex invoices often necessitate more detailed data entry and validation, further extending processing time. The likelihood of volume and complexity related errors, such as, incorrect coding, misinterpretation of items, human oversight, etc. increase dramatically.

5. Approval Bottlenecks

Slow or cumbersome approval processes can cause delays in payments. They can be as harmful as complex approval hierarchies that slow down processing times. The inefficiency also disrupts cash flow management and increases operational costs as resources are tied up in managing pending approvals. Over time, persistent bottlenecks can erode trust with suppliers and impact the company's reputation. Streamlining the approval process through automation or clearer protocols can mitigate these issues and improve overall efficiency.

6. Lack of Visibility and Reporting

The AP Process is one involving multiple stakeholders. In the absence of a single system across all involved personnel, tracking and reporting on account payables can be tedious, which can hinder decision-making. Monitoring the progress of invoices, their status and payment can be challenging, especially when the process is opaque to all stakeholders at any given time. A transparent process ensures greater efficiency and reduced overall fallthrough.

7. Document Management and Integration Issues

Managing and storing physical documents can be cumbersome and prone to loss or damage.

Difficulty in accessing historical documents and records. Challenges in integrating AP systems with other financial systems (e.g., ERP systems, banking platforms). Ensuring data consistency across different systems and platforms.

Addressing these challenges typically involves implementing best practices, improving accounts payable internal controls, continuously training and supporting AP staff. There are multiple advantages to making your AP processes more efficient.

Significance of a Streamlined Accounts Payable Process

Often relegated to the background, the accounts payable (AP) function is far from a mere administrative task; it's a cornerstone of operational efficiency. The smooth execution of AP can significantly impact a company's ability to maintain an effective procure-to-pay (P2P) cycle. Why is it important to streamline your Accounts Payable Process? What are some of the advantages of doing so? All answers below:

1. Effective Financial Management

In an unpredictable economic climate, maintaining financial fluidity is crucial. Any disruption, whether from a supplier hiccup or an operational misstep, could jeopardise stability. A well-run AP department ensures that payments to business partners are processed smoothly, keeping operations on track.

2. Precise Record-Keeping

Accurate tracking of invoices, received goods, and outgoing payments is vital for operational efficiency. Incorporating AI in audits can help AP departments implement a robust, electronic record-keeping system, leading to smoother processes. Digital records reduce reliance on paper, making information retrieval easier and integrating seamlessly with other systems for comprehensive visibility.

3. Strengthening Vendor Relationships

Efficient AP processes not only streamline operations but also enhance vendor relationships. Timely payments bolster trust with suppliers, who may then offer better terms and more favourable conditions in future negotiations.

4. Avoiding Penalties and Capitalising on Discounts

A well-managed payment schedule helps avoid late fees and can enable the company to benefit from early payment discounts. This proactive approach in managing payables can contribute to overall cost savings.

5. Mitigating Fraud Risks

Fraud prevention is a significant concern in AP. Modern AP systems equipped with features like duplicate payment detection, invoice verification, and anomaly alerts help safeguard against potential fraudulent activities, ensuring a secure and reliable payment process. Focusing on these aspects of the AP process not only improves financial and operational efficiency but also strengthens overall business resilience.

Of course, all of this may sound complex and sometimes overwhelming, but the adoption of technology and leveraging automated, paperless accounts payable solutions can effectively circumvent the challenges and incorporate these advantages, saving you precious time and money.

Automating AP: A powerful solution for efficiency

Accounts payable (AP) teams are at the forefront of business transformations. Accounts payable departments are the central backbone of any organization when it comes to expenditure. Despite this, they are hindered by outdated tools, obsolete processes, and approval bottlenecks, leading to significant inefficiencies. With the advent of AI and machine learning, we can empower them with modern tools that provide one-step solutions and unlock organizational success.

A holistic, comprehensive AP process is a vital component of a company's financial health. It demands high precision and consistent accuracy which is humanly impossible. Consider a simple example, in double-entry accounting, failing to account for a vendor properly can result in discrepancies across two accounts. The cost of addressing such errors—both in terms of liabilities and corrective measures—can be substantial compared to the benefits of proactive AP automation.

Modern digital solutions enhance the AP process by automating tasks that were once labor-intensive and time-consuming. From basic spreadsheets to sophisticated AP platforms, businesses now have a variety of tools to optimize their operations. AP automation simplifies each stage of the accounts payable process, ensuring greater accuracy throughout the workflow. It reduces manual tasks, streamlines invoice approvals, guarantees timely payments, and provides valuable insights through regular reporting.

Summing up

So there we have it. A complete understanding of Accounts Payable and how it looks like in 2024. Despite being a crucial function, AP has become an undeniable drain on organisational resources, encumbered by obsolete manual processes and cumbersome frameworks. It faces multiple challenges that require optimisation if businesses want to succeed.

Modern day technologies, like, Optical Character Recognition (OCR), Natural Language Processing (NLP), Artificial Intelligence (AI) and Machine Learning offer a host of avenues for optimisation of most manual processes, including but not limited to Accounts Payable. Adoption of such tools can be an uphill task, especially considering an enterprise setup, but it offers significant advantages that make it worth it.

Flow by Nanonets can automate your Accounts Payable process end-to-end. Click on the button below and chat with us to get started!