Growing businesses have to maintain relationships with many suppliers and vendors, and this usually ends up making the Accounts Payable process complicated. Vendors with different invoicing standards/procedures tend to make accounts payable processes quite cumbersome.

If there are limited resources within your AP department, it becomes crucial to plan on how to scale the function to deal with greater volumes of invoices and data entry.

For many businesses, invoice data entry and payables management are not always 100% integrated into business functions, so it can often be lucrative to outsource this paperwork. Accounts payable outsourcing can help smoothen the AP process while ensuring that payments to vendors are cleared efficiently.

What is accounts payable outsourcing?

Accounts payable outsourcing is the process of hiring a specialised service provider who can take over multiple AP functions that businesses find difficult to handle in-house.

Accounts payable outsource companies are equipped with the necessary skills, tools, and technology to integrate with an organization’s existing AP processes.

Organizations dealing with sensitive financial data may be hesitant to use a third-party vendor for their AP processes. Hence they might want to consider AP Automation instead.

Looking to automate your manual AP Processes? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

Accounts payable outsourcing vs accounts payable automation

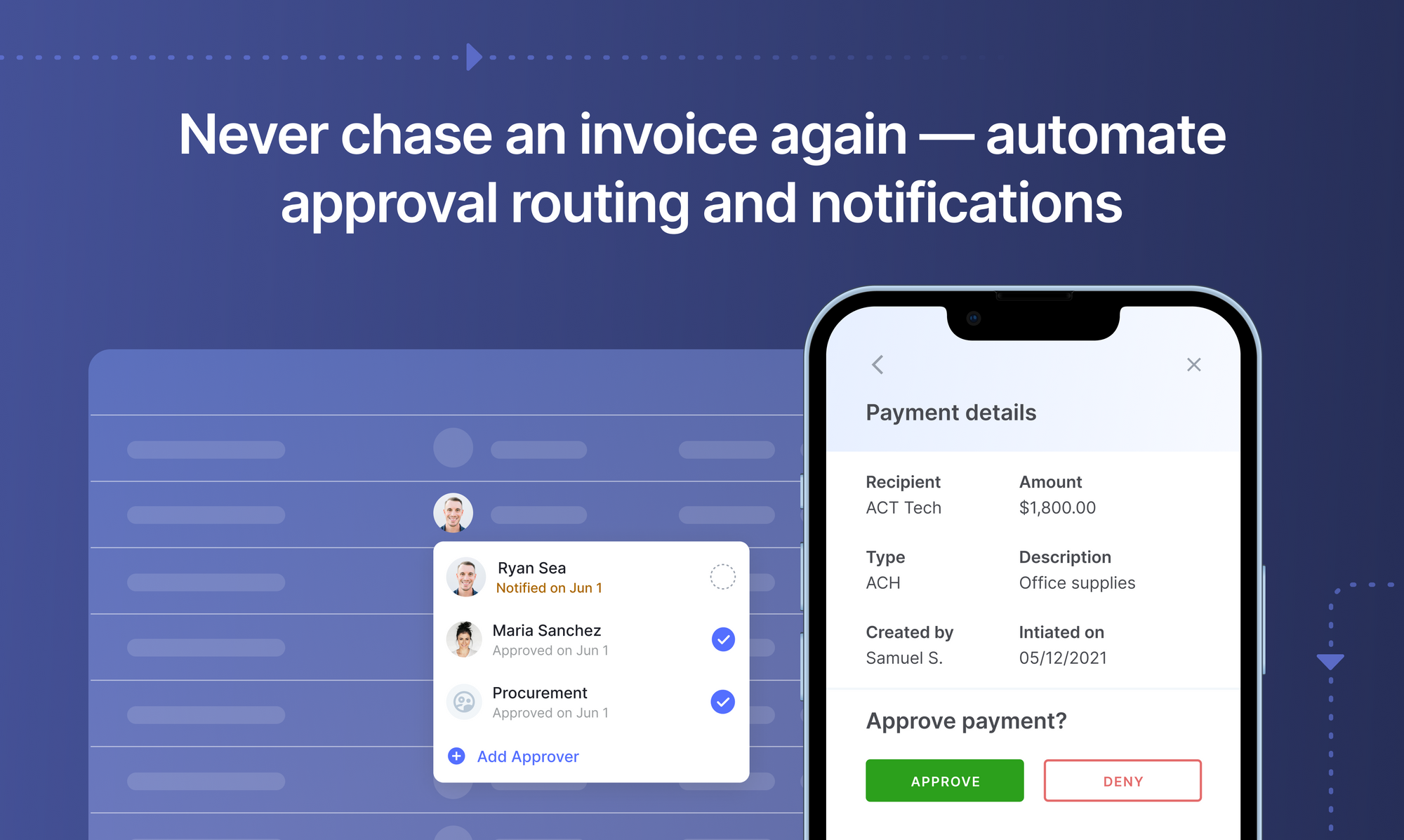

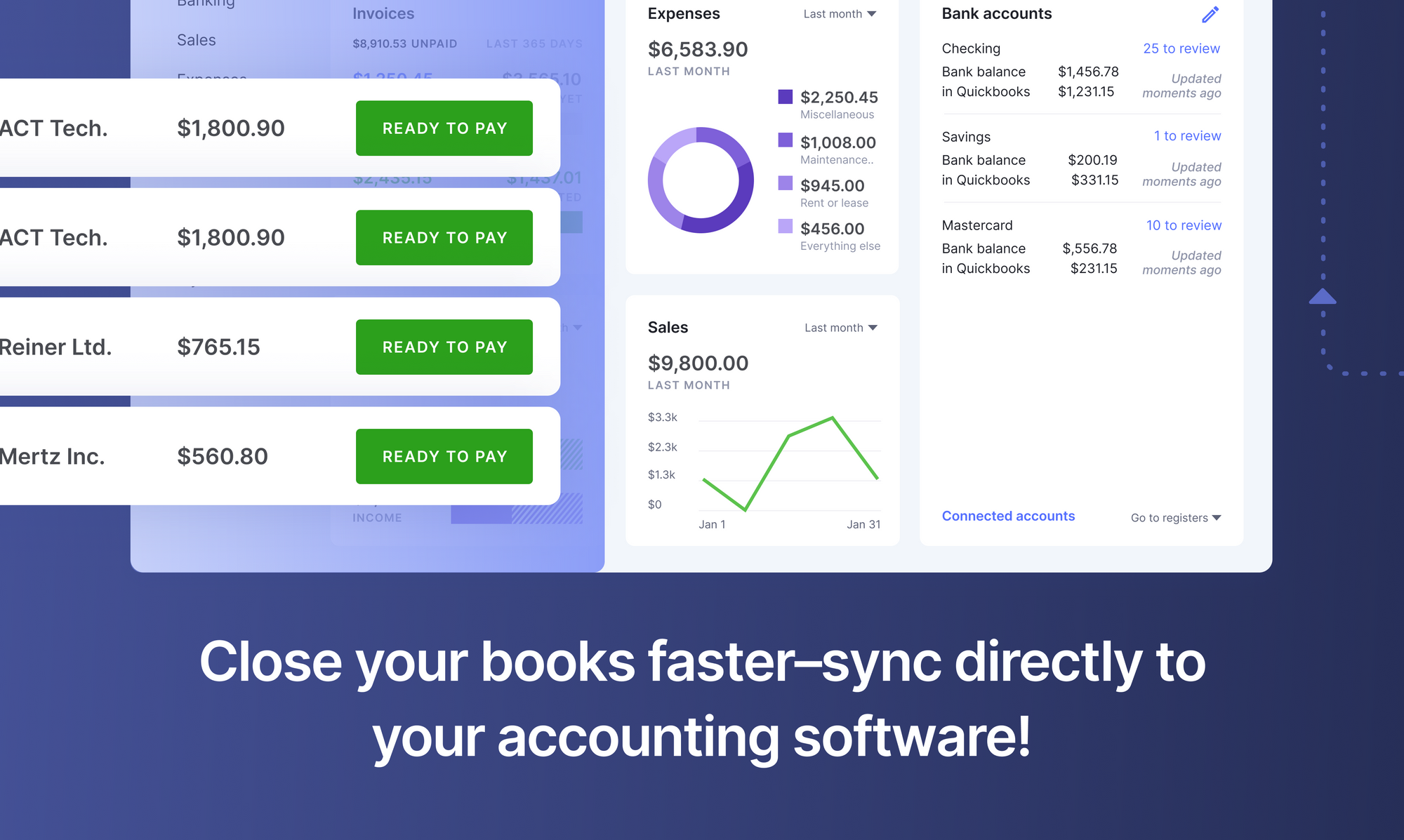

AP Outsourcing involves handing over accounts payable processes to a third-party business provider. This means that you use the accounts payable services of an external entity to perform your business transactions. AP Automation, in comparison, is the adoption/integration of an AP software to extract, validate and approve accounts payable invoice processes.

Most businesses that are looking to outsource or automate their AP function, are looking to tackle any of the following issues:

- The AP team is overwhelmed with their data entry and paper management work

- Invoices are too costly to process - usually a mix of high employee costs, poor approval process and high transaction costs

- The AP process lacks proper controls - resulting in duplicate or wrong payments (these can add up real quick)

- The cost of expanding the AP team is significant - adding a team member usually means at least $60k in expense

Outsourcing your accounts payable processes can help streamline payments and save on labor, time, and errors. Adopting an AP automation software can get you better control of invoice data capture, security, and help in better data analysis to increase business efficiency. But it involves incurring other costs such as investing in the software and allocating time for training the employees to use the software.

Choosing between accounts payable outsourcing or automation depends entirely on the size and nature of a business. While AP automation will make its in-house AP processes easier, outsourcing will be ideal for a business looking to reduce its AP workload.

For now, let’s focus on the benefits and drawbacks of accounts payable outsourcing.

Benefits of accounts payable outsourcing

Accounts payable outsourcing can be highly advantageous to a business. Skilled outsourcing providers can make a company’s AP processes more efficient; thus improving the cash flow. Suppliers and vendors can thus benefit from timely payments.

Here are a few ways by which companies can benefit from outsourcing their AP processes:

Cost reduction

Outsourcing your accounts payable processes may be cost-effective for a business. In-house AP processes require hiring people, investing in training materials, and equipment/software which can be quite expensive for a business. Outsourcing can help avoid these overheads and still turn out to be budget-friendly as you pay the provider on a per invoice basis.

Early payment discounts

Accounts payable outsourcing can increase the efficiency of your AP processes by streamlining vendor invoices and payments. This can help steer clear of missed invoices. Since everything is organized, you can also make early settlements of vendor bills to get better discounts.

Enhanced efficiency and productivity

Outsourcing your AP processes can help with faster invoice processing. Companies offering accounts payable services focus only on your AP processes; completing the work faster and more accurately. Also, with AP processes being taken care of, your employees can focus on higher value tasks with increased efficiency leading to better productivity overall.

Lower errors and better fraud mitigation

Apart from streamlining invoices, accounts payable outsourcing companies also reduce the incidence of errors in invoices. By running proper checks & validations, they can identify errors in invoices and prevent wrong payments. The use of AP experts and sophisticated technology helps them identify risks and reduce the incidence of fraud.

Skilled resources & latest technology

Accounts payable outsourcing companies use professionals familiar with the latest tools or software to optimize AP processes. This means that your business is powered by the latest technology and high-precision tools without you having to invest in them.

Constant tracking

Many accounts payable outsourcing companies work off-site but use modernized technology that can be tracked at every step. With automated tracking in place, businesses can gain real-time access and information on their account payable processes.

No shortage of workforce

AP processes, if interrupted due to employee absence, can multiply and burden the business. Outsourcing providers have an adequate workforce (and backup teams) to step in and manage your AP processes.

Set up touchless AP workflows and streamline the Accounts Payable process in seconds. Book a 30-min live demo now.

Drawbacks of accounts payable outsourcing

While outsourcing your accounts payable may seem problem-free there are some issues that a business can still face with outsourcing. Listed below are some of the disadvantages that can arise with AP outsourcing.

Error-validation

Outsourcing companies may not always be transparent in how they deal with your AP processes. Despite using modern technology, errors are still bound to occur. These errors might often go unnoticed. Also, changes in your processes may not be fully implemented by outsourcing companies handling your AP processes, resulting in more errors or rework.

Less process control

Any company dealing with accounts payable best practices in-house is bound to have greater control over its processes. Emergencies can be prioritized and handled straight away with direct approvals. With a third-party provider, you will have to play by their terms and timings. They might be located far away and the lack of transparency in processes can become a serious issue.

Issues with duplication

Many account payable outsourcing companies charge on a per-invoice basis. Hence, if your business shares duplicate invoices, you are going to have to pay for that too. If outsourcing providers do not have the facility to detect duplicate invoices, then the business ends up incurring more costs than necessary.

Less flexible

An accounts payable outsource company can have certain terms and conditions which may not make work flexible for your business. If a contract with the vendor does not cover exceptions in processing, then your business has to deal with it separately. This can result in more complexity, rework & inconvenience.

Over dependency

Being able to hand over crucial AP responsibilities may be good but it comes at a cost. The fact is you become heavily dependent on the outsourcing provider for accounts payable services that involve vital transactions. So if the provider faces challenges such as security breaches or even bankruptcy, then your company processes could come to an abrupt standstill.

Privacy and security issues

Businesses should remember that they lose privacy when they are divulging financial information and providing access to sensitive data while opting to outsource AP processes.

Usually, such third parties use internal servers and cloud storage to store sensitive data. While it serves as centralized access for both parties involved, the data is also prone to potential security breaches and hacks.

Evaluating AP outsourcing providers

How can you choose the right kind of accounts payable outsourcing service to reap the necessary benefits? Here are some guidelines you can follow to select the right account payable outsource provider:

- Research the AP Outsourcing Firm: It’s a good practice to research an AP outsourcing firm before partnering with them. Information via testimonials, user reviews, or feedback can highlight the vendor’s performance history. Looking into previous projects can provide an insight into how they handle clients, their processes, etc.

- Discuss Internally: An internal discussion with the management & staff, before handing over AP processes to an outsourcing provider, can help get clarity on the requirements to be met and challenges that could potentially arise. Efficiency increases and errors are reduced when the company, its vendors, and the outsourcing provider are all on the same page.

- Check for Privacy and Security Measures: AP outsourcing firms can even be located in another country. Before letting the outsourcing firms take over the reins of your AP processes, check for their security measures and how they maintain the privacy of your financial data. This can help assess the risk involved and the safety measures in place to prevent security breaches.

Accounts payable outsourcing services

Outsourcing accounts payable has become a popular business practice for many firms that lack the capability and means to handle their growing AP processes. Many outsourcing firms far and wide are available to offer a multitude of services.

The most common AP processes that are outsourced are purchase order or invoice matching (0r 3 way matching), invoice automation, discrepancy resolution, and AP administration. A business can opt for what it wants to outsource depending on the magnitude of work and budget involved.

Book this 30-min live demo to make this the last time that you'll ever have to manually key in data from invoices or receipts into ERP software.

Conclusion

Accounts payable outsourcing is a handy solution for companies to make their AP processes efficient & cost-effective.

More and more businesses rely on AP outsourcing firms to redesign and streamline their AP processes despite mild hiccups along the way.

Hiring, automation, or outsourcing is a choice businesses can make depending on their means, time, and capability to ensure smoother AP processes and better business efficiency.